|

市場調查報告書

商品編碼

1645147

農業包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Agricultural Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

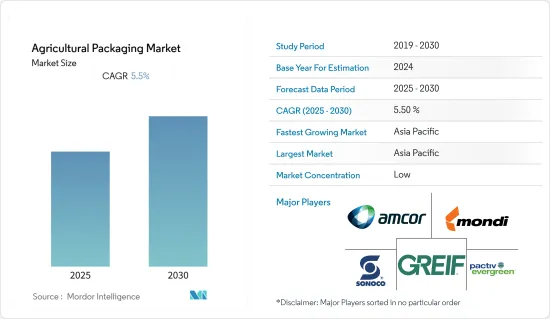

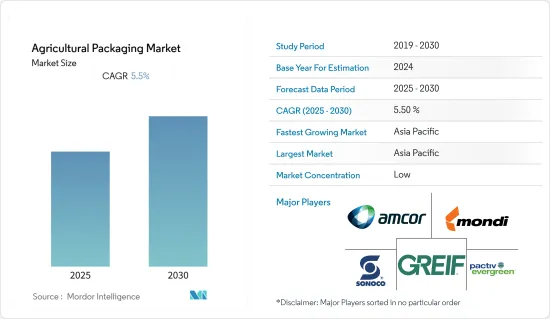

預測期內農業包裝市場預計複合年成長率為 5.5%

關鍵亮點

- 在新冠疫情期間,許多國家宣布向農業部門提供剩餘資金,以加強農業部門的倉儲和供應鏈,包括包裝。例如,印度政府宣佈為農業基礎設施提供1兆印度盧比(約135億美元)的特別盈餘。所有這些都有可能在疫情過後推動市場成長。此外,俄烏戰爭正在影響整個包裝生態系統。

- 害蟲侵襲的增加推動了對農藥和化肥等作物保護化學品的需求。因此,需要先進的包裝來降低處理、儲存和運輸這些農藥的風險,從而推動對農藥包裝解決方案的需求,以延長其保存期限。

- 根據《環境科學與技術》雜誌發表的一篇論文,食物平均運輸距離為 4,200 英里。這就產生了對創新包裝解決方案的需求,以滿足農民和加工商向全球和國內市場銷售產品的需求。此外,農業包裝解決方案正在經歷一種橫向整合的方式,將印刷功能、簡易包裝解決方案和增值包裝解決方案更貼近包裝解決方案提供者。

- 此外,技術進步、永續性問題和誘人的經濟效益正在推動對創新包裝解決方案的需求。最近,對配備可以追蹤任何產品的品質和調節溫度的監控設備的農業包裝的需求日益成長。

- 此外,袋裝和盒中袋等先進的包裝方式正在推動軟包裝與硬包裝形式的結合使用。據軟包裝協會稱,軟包裝主要用於食品,佔整個市場的60%以上。此外,由於全球電子商務產業的整合,預計軟包裝將成為預測期內成長最快的包裝方法之一。

農業包裝市場趨勢

塑膠包裝佔據主要市場佔有率

- 由於消費者更喜歡軟包裝,對軟包裝的需求不斷增加,因此塑膠包裝正在影響市場的成長。例如,根據軟包裝協會的統計,超過 60% 的北美消費者願意為功能性包裝帶來的好處買單,例如產品保護、供應鏈效率和運輸便利性。

- 聚乙烯是最便宜的包裝薄膜。阻隔膜使用的聚乙烯材料包括HDPE、LDPE、LLDPE。聚乙烯易於加工,可與聚醯胺和 EVOH 等氣體/香氣阻隔材料結合用於各種應用。其中,入門級材料是線型低密度聚乙烯(LLDPE)。這是一種廣泛用於食品包裝的高密度薄膜。

- 此外,塑膠也以剛性或軟性形式用作肥料和農藥的包裝材料。重量輕、耐用、製造成本低,這些都是塑膠在市場上越來越受歡迎的原因之一。

- 塑膠也推動了包裝設計的創新。例如,調氣包裝透過將低氧空氣困在塑膠包裝內來幫助保持食物新鮮。該技術使農民、加工商和經銷商受益,向全球和國內市場銷售產品,透過減緩細菌的生長來延長產品的保存期限。

亞太地區將經歷最高成長

- 亞太地區正在經歷大量投資和技術進步,包括農業領域的人工智慧技術。亞太地區的新興經濟體正在農業領域迅速採用智慧技術。該地區採用精密農業的因素有很多,包括技術的不斷進步、設備價格的下降、社交媒體和線上出版物的使用有助於提高人們的認知。

- 中國電子商務巨頭阿里巴巴最近將人工智慧引入其農業領域,幫助農民提高作物產量並同時降低成本。透過阿里巴巴的智慧型手機,農民可以存取數位記錄的資訊,並監控水果是否可以採摘,或者作物是否沒有病蟲害。

- 該地區還廣泛採用農產品的永續包裝解決方案,為全球品牌進一步投資該地區創造了機會。預測期內,農作物產量的提高以及種子、農業化學品/肥料等許多終端行業的加速成長預計將擴大亞太地區的農業包裝市場規模。

- 市場參與企業擴大向亞太地區投資以擴大其製造能力。例如,2023 年 1 月,安姆科宣布將在中國惠州啟動先進的製造工廠。該工廠佔地 59 萬平方英尺,是中國產能最大的軟包裝工廠,投資額約 1 億美元,進一步增強了 Amcor 滿足亞太地區日益成長的客戶需求的能力。

農業包裝產業概況

農業包裝市場中等細分,市場上有 C Packaging International BV、Greif Inc.、Mondi Group、NNZ Group、Sonoco Products Company、BAG Corporation、Proampac LLC、Flexpack FIBC 和 Amcor plc 等供應商。市場競爭對手在設計、技術和應用上不斷創新,以獲得永續的競爭優勢。此外,它還採用聯盟、合併和收購等競爭策略。

- 2022 年 11 月-有機垂直農業公司 Upward Farms 為其經美國農業部認證的有機微型菜苗開發了一種新的可重新密封的包裝設計。與傳統的蛤殼式托盤相比,Upward Farm 的新型密封塑膠托盤可堆疊且更易於打開和關閉,有助於延長微型菜苗的保存期限。這種可重新密封的設計比典型的綠色蛤殼減少了 38% 的塑膠用量,並且由消費後回收的塑膠製成。它為顧客列出了更多環保的選擇。

- 2022 年 4 月-Yara Brasil 與 Packem SA 簽署了生產環保大袋的協議。用於儲存和運輸肥料等農業投入品的容器是大袋子。在尋找聚丙烯(一種用於製造袋子的材料,在回收和再加工方面存在局限性)的替代品時,他們發現 PET/PCR(一種消費後塑膠)是理想的替代品,從而創造了巴西農業行業第一個可回收和完全可回收的塑膠包裝。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估新冠肺炎對農業包裝的影響

- 目前對農產品和零售包裝的需求

- 產業相關人員分析(材料供應商、包裝製造商、經銷商、最終用戶等)

第5章 市場動態

- 市場促進因素

- 農業化學品領域的需求不斷成長

- 基於材料的創新可延長產品保存期限並持續體現包裝的永續性主題

- 市場問題

- 監管和定價挑戰

- 利潤率下降仍然是小型製造商面臨的問題

- 市場機會

- 散裝包裝材料創新,重點關注 PP 和散裝袋的使用

第6章 市場細分

- 依材料類型

- 塑膠

- 金屬

- 紙和紙板

- 複合材料

- 其他

- 按應用

- 農藥

- 肥料

- 種子

- 其他

- 依產品類型

- 袋子和麻袋(塑膠和紙質)

- 散裝容器(桶和 IBC)

- 小袋

- 容器(金屬/塑膠)

- 其他產品(盒子、瓶蓋、蓋子等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 法國

- 德國

- 英國

- 荷蘭

- 亞洲

- 中國

- 印度

- 印尼

- 澳洲和紐西蘭

- 中東和非洲

- 拉丁美洲

- 北美洲

第7章 競爭格局

- 公司簡介

- LC Packaging International BV

- Greif Inc.

- Mondi Group

- NNZ Group

- Sonoco Products Company

- BAG Corporation

- Proampac LLC

- Flexpack FIBC

- Amcor plc

- Anderson Packaging Inc.

- Pactiv LLC

- Western Packaging

第8章投資分析

第9章:市場的未來

The Agricultural Packaging Market is expected to register a CAGR of 5.5% during the forecast period.

Key Highlights

- During the COVID-19 pandemic, many countries announced a surplus for the agricultural sector to strengthen the sector's storage and supply chain, including packaging. For instance, the Indian Government announced INR 1 lakh crore (nearly USD 13.5 billion) exceptional package surplus for agricultural infrastructure. All these will boost the market growth post-pandemic. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

- The increasing pest attacks drive the demand for crop protection chemicals, such as pesticides and fertilizers, which are toxic. Hence, they need advanced packaging to reduce the risk while handling, storing, and transporting these agrochemicals, which escalates the demand for agricultural packaging solutions for agrochemicals to increase their shelf life.

- According to an article published in the Environmental Science and Technology journal, food travels an average of 4,200 miles. This creates demand for innovative packaging solutions to cater to farmers' requirements and processors distributors who sell in the global and national markets. Moreover, agricultural packaging solutions are experiencing horizontal integration approaches that bring printing capabilities, easy packaging solutions, and additional value-adding solutions to packaging closer to the packaging solution providers.

- Furthermore, technological innovation, sustainability trepidations, and attractive economics drive the demand for innovative packaging solutions. Nowadays, there is a growing demand for agricultural packages equipped with monitoring equipment, which can track the quality of any product and adjust the temperature.

- Also, the advanced packaging styles, such as pouches and bag-in-box, raise the usage of flexible packaging in combination with rigid packaging formats. According to the Flexible Packaging Association, flexible packaging is mainly used for food, contributing to more than 60% of the total market. Additionally, globally, the e-commerce sector's consolidation is anticipated to make flexible packaging one of the quickly growing packaging approaches over the forecast period.

Agricultural Packaging Market Trends

Plastic Packaging to Hold a Significant Market Share

- Plastic packaging is influencing market growth due to the rising demand for flexible packaging, as consumers prefer these solutions. For instance, according to the Flexible Packaging Association, more than 60% of North American consumers are ready to pay for functional packaging benefits, such as product protection, supply chain efficacy, and shipping friendly.

- Polyethylene is the cheapest packaging film. The polyethylene materials used for barrier film include HDPE, LDPE, and LLDPE. Polyethylene is easy to process and is combined with gas/aroma barriers, such as Polyamide and EVOH, for their use in various applications. Among these, the elementary-grade material is linear low-density polyethylene (LLDPE). It is a high-clarity film that is widely used for food packaging.

- Moreover, plastics are used in either rigid or flexible forms as packaging material for fertilizers and pesticides. The factors such as lightweight, durable, and economical to manufacture are the reasons behind the growing adoption of plastic in the market.

- Plastics also drive innovation in packaging design. For instance, modified atmosphere packaging helps preserve food freshness by capturing a reduced-oxygen air mixture in a plastic package. This technique can benefit farmers, processors, and distributors that sell in global and national markets and extend the product's shelf life by slowing the growth of bacteria.

Asia-Pacific to Witness the Highest Growth

- Asia-Pacific is experiencing many investments and technological advancements, such as AI-based technologies in agriculture. The emerging countries of the Asia-Pacific region are rapidly adopting smart technologies across the agriculture space.The adoption of precision farming in the region is fueled by various factors, like continuous advancements in technology, a reduced price of equipment, social media use, and online publications that help create awareness.

- Chinese e-commerce giant Alibaba recently got into the farming sector by deploying artificial intelligence in agriculture to assist farmers in increasing crop yield, simultaneously reducing costs. In their smartphones, Alibaba's digitally-recorded information was accessed by farmers, enabling them to monitor whether fruits are ready to be harvested or any pest attack on their standing crops.

- The region is also witnessing higher adoption of sustainable packaging solutions for agricultural products, creating opportunities for global brands to invest in the region further.The rise in the farm yield along with accelerated growth witnessed in a plethora of end-use industries such as seed and pesticides & fertilizers is expected to boost Asia Pacific agricultural packaging market size during the forecast period.

- Market players are increasingly investing in Asia-Pacific region for expanding their manufacturing capacities. For instance, in January 2023, Amcor made an announcement about the launch of its advanced manufacturing facility in Huizhou, China. The 590,000 square foot plant, the largest flexible packaging plant in China by production capacity, represents an investment of approximately USD 100 million, further enhancing Amcor's capacity to satisfy rising client demand throughout Asia Pacific.

Agricultural Packaging Industry Overview

The Agricultural Packaging Market is moderately fragmented, with vendors such as C Packaging International BV, Greif Inc., Mondi Group, NNZ Group, Sonoco Products Company, BAG Corporation, Proampac LLC, Flexpack FIBC, and Amcor plc, among others operating in the market. Players in the market are innovating their designs, technology, and applications to achieve sustainable competitive advantage. Moreover, they are adopting competitive strategies such as partnerships, mergers, and acquisitions.

- November 2022 - Upward Farms, an organic vertical farming company, developed a new resealable packaging design for its USDA-certified organic microgreens. Compared to conventional clamshells, Upward Farms' new sealed plastic trays are stackable and more straightforward to open and close, extending the shelf life of microgreens. The resealable design uses 38% less plastic than the typical greens clamshell form and is constructed from post-consumer recycled plastic. It provides customers with a more environmentally friendly option.

- April 2022 - An agreement for producing big eco-friendly bags was signed between Yara Brasil and Packem SA. The containers used to store and transport agricultural inputs, such as fertilizer, are big bags. When searching for a replacement for polypropylene, a material used to make bags but currently subject to restrictions in terms of recycling and reprocessing, they discovered PET/PCR, the plastic processed after consumption, as the ideal replacement, giving rise to the first recycled and entirely recyclable plastic packaging in Brazilian agriculture.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Agricultural Packaging

- 4.4 Current Demand for Produce and Retail-based Packaging

- 4.5 Industry Stakeholder Analysis (Material Suppliers, Packaging Manufacturers, Distributors, End Users, etc.)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from the Agro-chemical Segment

- 5.1.2 Material-based Innovations to Enhance Shelf Life of Products and Ongoing Theme of Sustainability in Packaging

- 5.2 Market Challenges

- 5.2.1 Regulatory & Price-related Challenges

- 5.2.2 Diminishing Profit Margins Remains a Concern for Smaller Manufacturers

- 5.3 Market Opportunities

- 5.3.1 Material Innovations in Bulk Packaging Focused on the Use of PP and Bulk Bags

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Metal

- 6.1.3 Paper and Paperboard

- 6.1.4 Composite Materials

- 6.1.5 Other Materials

- 6.2 By Application Type

- 6.2.1 Pesticides

- 6.2.2 Fertilizers

- 6.2.3 Seeds

- 6.2.4 Other Types

- 6.3 By Product Type

- 6.3.1 Bags & Sacks (Plastic & Paper)

- 6.3.2 Bulk Containers (Drums & IBC)

- 6.3.3 Pouches

- 6.3.4 Containers (Metal & Plastic)

- 6.3.5 Other Products (Boxes, Caps & Lids, etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 France

- 6.4.2.2 Germany

- 6.4.2.3 United Kingdom

- 6.4.2.4 Netherlands

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Indonesia

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Middle East and Africa

- 6.4.5 Latin America

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 LC Packaging International BV

- 7.1.2 Greif Inc.

- 7.1.3 Mondi Group

- 7.1.4 NNZ Group

- 7.1.5 Sonoco Products Company

- 7.1.6 BAG Corporation

- 7.1.7 Proampac LLC

- 7.1.8 Flexpack FIBC

- 7.1.9 Amcor plc

- 7.1.10 Anderson Packaging Inc.

- 7.1.11 Pactiv LLC

- 7.1.12 Western Packaging