|

市場調查報告書

商品編碼

1644910

歐洲精製石油產品 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Refined Petroleum Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

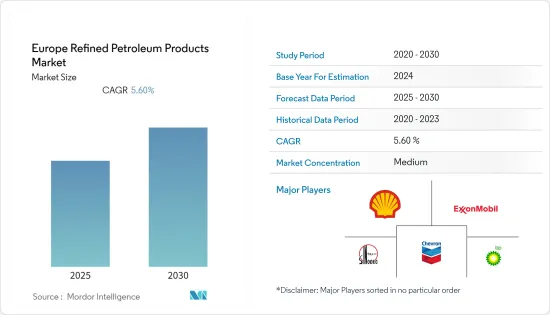

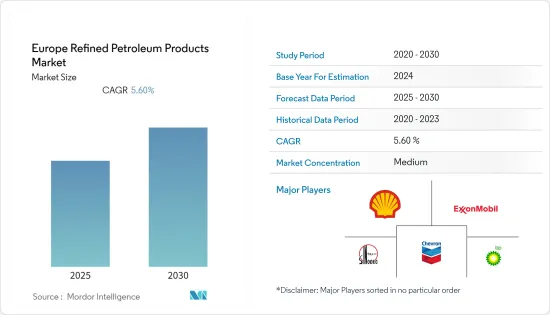

預計預測期內歐洲精製石油產品市場複合年成長率將達到 5.6%。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 從長遠來看,英國、德國、義大利等歐洲國家極高的電力需求(這些國家的燃料主導電力產業可以輕鬆滿足這些需求)和航運業的穩定成長(從而帶來對船用燃料的需求)等因素預計將推動市場的發展。

- 另一方面,可再生能源的日益普及是阻礙市場成長的一個主要因素。

- 對於低收入家庭能源來說,向更清潔的燃料和液化石油氣的轉變至關重要。因此,預計市場研究將會出現大量機會。

- 由於英國精製石油產品消費量的不斷成長,預計英國將佔據市場主導地位。

歐洲精製石油產品市場趨勢

航空燃油消耗大幅增加

- 歐洲國家的航空客運量正大幅成長。需要航空燃料來滿足未來的需求。歐盟航空業也致力於實現航空運輸脫碳,並加速努力使歐洲在2050年成為世界上第一個二氧化碳中和大陸。

- 航空燃料約佔英國軍隊所用燃料的三分之二。由於永續航空燃料的採用日益發展,英國國防航空部門可能會出現可觀的成長。

- 據美國能源資訊署稱,2021 年英國的噴射機燃料消費量預計將達到約 101,000 桶/日,相對低於 2020 年的 107,300 桶/日。

- 然而,2021 年 12 月,西班牙國防部訂購了 36 架空中巴士 H135 直升機,軍用飛機庫存增加。預計這將在預測期內促進航空燃料的銷售。

- 此外,2022 年 2 月,國際航空運輸協會遊說西班牙政府拒絕西班牙機場和航運公司 (AENA)提案的提高機場費用的提議。該提案是為了挽回疫情造成的 25.2 億美元經濟損失。預計這些決定將鼓勵更多的航空旅客出行,從而促進該地區石油產品市場的成長。

- 鑑於上述情況,預計預測期內航空燃料使用量的增加將促進歐洲石油產品市場的成長。

英國可望主導市場

- 英國是歐盟主要使用精製石油產品的國家之一。航空運輸是該國經濟的關鍵部門,到 2021 年將佔該國 GDP 的一小部分,但卻很重要。 2020年,新冠疫情迫使各國政府實施多項航空限制措施,導致噴射機燃料消費量下降。

- 根據英國石油工業協會(UKPIA)的數據,汽油是英國產量最大的精製石油產品。 2012年至2021年,汽油產量佔石油產品總量的27%。其次是柴油(柴油引擎車輛燃料 - DERV),佔 22%。

- 此外,截至 2021 年,英國共有 8,378 個加油站。英國是歐洲加油站數量最多的十個國家之一,而義大利則以超過 20,000 個加油站的數量位居第一。

- 過去幾天,該國住宅和商業場所對液化石油氣的需求增加。預測期內,液化石油氣需求的增加可能會導致該國精製石油產品的需求成長。

- 此外,2022 年 10 月,英國領先的液化石油氣 (LPG) 供應商之一 Flogas Britain 獲得規劃許可,將建造一條從布里斯托爾港到位於埃文茅斯的英國最大的地上液化石油氣儲存終端的天然氣管道。此倉儲設施由國家電網所有,之前僅能儲存液化天然氣。然而,Flogas 將把它改造成一個容量為 34,564 噸的液化石油氣和綠色氣體倉儲設施。

- 此外,2022年2月,北海六個新的油氣天然氣田即將獲得英國政府的核准。財政部已敦促上級部門加快頒發六個能源區塊的建設許可證。這反過來將有利於全國的石油和天然氣生產活動,並促進精製石油產品市場的成長。

- 鑑於上述情況,預計英國將在預測期內主導歐洲精製石油產品市場。

歐洲精製石油產品產業概況

歐洲精製石油產品市場中等分散。市場的主要企業包括(不分先後順序):荷蘭皇家殼牌、埃克森美孚、中國石油化學股份有限公司、英國石油公司和雪佛龍公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 至 2027 年歐洲精製石油產品市場(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 最新趨勢和發展

- 市場動態

- 驅動程式

- 限制因素

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章 市場區隔

- 類型

- 汽車燃料

- 船用燃料

- 航空燃料

- 液化石油氣(LPG)

- 其他燃料

- 地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Royal Dutch Shell

- Exxon Mobil Corporation

- China Petroleum & Chemical Corporation

- BP PLC

- Chevron Corporation

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 92857

The Europe Refined Petroleum Products Market is expected to register a CAGR of 5.6% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as extremely high power demand in various European countries such as the United Kingdom, Germany, and Italy, which can be immediately met by the fuel-driven power sector, and demand for marine fuels due to the steadily growing shipping industry are expected to drive the market.

- On the other hand, the growing adoption of renewable power sources is a major restraint hindering the market growth.

- Nevertheless, the transition to cleaner fuels and LPG becomes critical to household energy in low-income communities. Therefore it is expected to create ample opportunities for the market studied.

- The United Kingdom is expected to dominate the market due to the growing consumption of refined petroleum products across the country.

Europe Refined Petroleum Products Market Trends

Aviation Fuel Usage to Grow Significantly

- Air transportation of passengers in European countries is increasing considerably. There is a need for aviation to meet the upcoming demand. Also, the EU aviation sector is committed to decarbonizing air transport and accelerating its efforts to make Europe the world's first CO2-neutral continent by 2050.

- Aviation fuel consumes around two-thirds of the fuel used by the British military. The British defense aviation sector is likely to witness considerable growth due to increasing developments concerning adopting sustainable aviation fuel.

- According to the United States Energy Information Administration, jet fuel consumption in the United Kingdom has reported around 101 thousand barrels per day in 2021, which is comparatively lower than 107.3 thousand barrels per day recorded in 2020.

- However, in December 2021, the Spanish Ministry of Defense ordered 36 Airbus H135 helicopters, adding to the military aircraft inventory. This is expected to boost aviation fuel sales during the forecast period.

- Furthermore, in February 2022, IATA encouraged the Spanish government to reject the proposal of increasing the airport charges from Aeropuertos Espanoles y Navegacion Aerea (AENA). The proposal was made to recover economic losses worth USD 2.52 billion during the pandemic. Such decisions are likely to encourage more air passengers to travel, which is expected to culminate in the growth of the region's refined petroleum products market.

- Owing to the above points, the growing usage of aviation fuel is expected to contribute to the growth of the European refined petroleum products market during the forecast period.

United Kingdom is Expected to Dominate the Market

- The United Kingdom is one of the major countries in the European Union utilizing refined petroleum products. Air transport is a critical sector in the Kingdom's economy, accounting for a small but significant percentage of the country's GDP in 2021. In 2020, the outbreak of COVID-19 compelled the government to put several air travel restrictions in place, leading to a decline in jet fuel consumption.

- According to United Kingdom Petroleum Industries Association (UKPIA), petrol is the most produced refined petroleum product in the United Kingdom. Between 2012 and 2021, petrol accounted for 27% of the total petroleum products production. This was followed by diesel (diesel engine road vehicle fuel - DERV) at 22%.

- Also, the United Kingdom has 8,378 operational petrol stations as of 2021. The country is among the leading ten European countries by the number of petrol stations, while Italy ranks first with over 20,000 service stations.

- In recent days the country has witnessed increasing demand for LPG in residential and commercial spaces. The growing demand for LPG may, in turn, culminate in the growth of the country's refined petroleum products during the forecast period.

- Moreover, in October 2022, Flogas Britain, one of the UK's leading liquefied petroleum gas (LPG) suppliers, was granted planning permission to construct a gas pipeline from Bristol Port into the UK's largest aboveground LPG storage terminal at Avonmouth. The storage facility, formerly owned by National Grid, was previously only able to store LNG. However, Flogas is converting it into an LPG and green gas storage facility, with the capacity to store 34,564 tonnes.

- Furthermore, in February 2022, six new oil and gas fields in the North Sea almost confirmed the approval from the UK government. The finance department pushed the senior authorities to fast-track the licenses for constructing the six energy areas. This, in turn, benefits oil and gas production activities across the country and further culminates in the growth of the refined petroleum products market.

- Owing to the above points, the United Kingdom is expected to dominate the European refined petroleum products market during the forecast period.

Europe Refined Petroleum Products Industry Overview

The European refined petroleum products market is moderately fragmented in nature. Some of the key players in the market include (in no particular order) Royal Dutch Shell, Exxon Mobil Corporation, China Petroleum & Chemical Corporation, BP PLC, and Chevron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Europe Refined Petroleum Products Market in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Automotive Fuels

- 5.1.2 Marine Fuels

- 5.1.3 Aviation Fuels

- 5.1.4 Liquefied Petroleum Gas (LPG)

- 5.1.5 Other Fuel Types

- 5.2 Geography

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 France

- 5.2.4 Italy

- 5.2.5 Spain

- 5.2.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Royal Dutch Shell

- 6.3.2 Exxon Mobil Corporation

- 6.3.3 China Petroleum & Chemical Corporation

- 6.3.4 BP PLC

- 6.3.5 Chevron Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219