|

市場調查報告書

商品編碼

1644625

北美倉庫自動化:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Warehouse Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

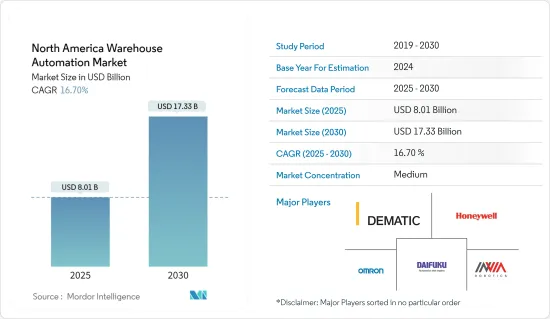

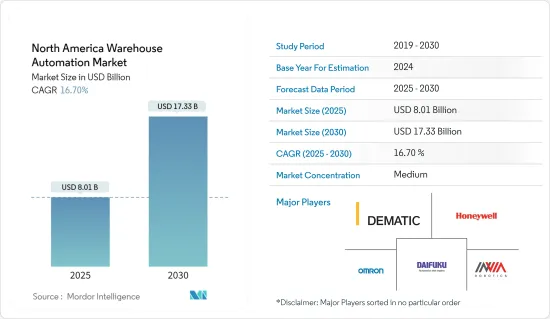

北美倉庫自動化市場規模預計在 2025 年為 80.1 億美元,預計到 2030 年將達到 173.3 億美元,預測期內(2025-2030 年)的複合年成長率為 16.7%。

倉庫自動化是指使用機器、控制系統、軟體和最少的人工協助來移動倉庫內的庫存,以提高業務效率。自動化的好處包括改善客戶服務、可擴展性和速度、組織控制以及減少錯誤。

關鍵亮點

- 據美國銀行稱,到 2025 年,45% 的製造業將由機器人完成。為了應對這一趨勢,雷蒙有限公司(一家印度紡織公司)和富士康科技(一家三星等科技巨頭的中國供應商)等大公司正在透過在其工廠中實施自動化技術來取代工人。

- 據 Generix Group 稱,任何自動化舉措都應從倉庫管理系統 (WMS) 的最佳化實施開始。只需實施 WMS,您就可以將生產力提高 20%,而成本僅為建立倉庫的 10 倍。接下來,根據公司的需求,可以引入機器人技術,例如安裝自動卸垛/碼垛系統。機器人從不同的托盤上拾取特定的包裹並創建該托盤。

- 此外,還有多種因素直接影響倉庫機器人的採用率的提高。倉庫數量的增加和倉庫自動化投資的增加,再加上全球人事費用的上升和可擴展技術解決方案的可用性,正在推動全部區域倉庫機器人市場的發展。

- 隨著市場供應商在自動化技術的快速提升,這些產品系列和軟體功能的新變化也越來越頻繁地出現。結果,現有技術很快就會過時,而且需要定期修改和升級,從而導致高昂的成本。

- COVID-19 疫情促使倉庫業者考慮加快實施自動化和機器人技術的時間表。如果成功實施,它可以幫助創造更安全的就業機會,並透過提高生產力並減少工人的互動來滿足日益成長的電子商務需求。近幾個月來,電子商務的興起導致數千家實體店關閉。然而,疫情的爆發和全球停工影響了倉庫和工業活動,尤其是在美國等國家。

北美倉庫自動化市場趨勢

倉庫中機器人的日益普及將推動市場

- 越來越多的自動駕駛機器在倉庫過道中推著服飾和體育用品,從高高的堆放處拉出一箱箱食品、化妝品和工業零件,並將物品交給工人,以便更快地交付訂單。一些物流業者正在試用遙控堆高機,以便勞動市場緊張的雇主能夠挖掘出更廣泛的地理勞動力資源。

- 根據Ware2Go的一項調查,67%的美國人在家工作。這意味著他們可以輕鬆進行網路購物。由於新冠疫情改變了美國人的購物方式,人們對電子商務的依賴變得比以往任何時候都更加強烈。因此,超過一半的美國公司正在增加對自動化的投資,以跟上不斷變化的市場條件。 2020 年,霍尼韋爾智慧自動化投資調查發現,電子商務雜貨(66%)、食品和飲料(59%)和物流(55%)產業最有可能投資自動化。

- 由於冠狀病毒疫情期間需求激增,一些公司正在投資開發消毒機器人。例如,2020年4月,Ocado宣布將推出北美首個機器人自動化倉庫。這是 2020 年在國際上開設的第二家 Ocado 客戶履約中心。

- 市場也看到了在物流領域部署自動化解決方案的各種夥伴關係。例如,2021年5月,ABB機器人公司與Cam Industrial和Remtech Systems合作,在亞伯達和不列顛哥倫比亞省部署物流和供應鏈自動化解決方案,以滿足消費者需求推動的履約中心對靈活性、速度和精確度日益成長的需求。

- 現今的智慧機器人適合全通路供應鏈的複雜需求。例如,自主移動機器人 (AMR) 具有更好的導航能力,可以使用內建感測器和雷射掃描器在整個倉庫中導航以拾取產品並將其運送給工人。隨著美國勞動力不斷在這些新勞動力隊伍中工作,自動化將幫助企業充分利用這些電子商務機會,並確保社會擁有繁榮昌盛所需的一切。

電子商務行業的成長和SKU的激增。

- 永遠線上電子商務和更快的回應時間,以及無錯誤管理大量庫存單位 (SKU) 的需求,正在推動倉庫、履約中心和智慧高效標準的擴張。降低成本、簡化營運和提高效率的迫切需求正在推動機器人技術的創新。此外,由於該地區電子商務零售市場的競爭日益激烈,經濟成長和自動化需求的不斷成長也推動了市場的成長。

- 技術進步和市場變化(例如全通路物流的興起)迫使企業在其目錄中添加新產品。公司有時會銷售更多的 SKU(庫存單位)來擴大其客戶組合。 SKU 激增是一種透過儲存更多商品來增加銷售的策略,使企業能夠服務更多客戶,從而獲得更多銷售。

- 2021 年 4 月,雲端基礎倉庫管理系統 (WMS) 領導者之一 3PL Central 收購了領先的庫存管理系統和電子商務營運平台 Skubana。透過此次收購,3PL Central 擴展了其供應鏈技術產品範圍,包括智慧訂單路由和庫存管理,並提供了從購物車到倉庫的整合履約解決方案。

- 同樣,2020 年 9 月,Chewy 宣布計劃在未來兩年內透過新的倉庫位置和現有設施的整修來提高履約網路的自動化程度。 Chewy 在第二季開設了第二家自動化履約中心,並在第三季開設了「有限目錄設施」。 Chewy 還在大都會圈開設了第一個有限 SKU 倉庫,以滿足激增的貨物量並避免高昂的運輸成本和分批裝運。

- 此外,根據《物料管理與分銷報告》,即時訂購、直接面對消費者的運輸以及零售商與批發商關係的變化正在減少大型托盤訂單的數量。小批量、多 SKU 訂單的增加迫使倉庫自動化。在這些情況下,可以利用技術,減少重新設計整個設施所需的時間和成本,並使其更容易實施。

北美倉庫自動化產業概況

北美倉庫自動化市場的競爭模式包括德馬泰克集團、大福株式會社、Swisslog Holding AG、Honeywell智慧等。產品發布、收購和夥伴關係是倉庫自動化產業市場參與企業採用的關鍵策略。

- 2021 年 6 月-Invia Robotics, Inc. 宣布與 10 多家目前提供倉庫技術解決方案的公司達成協議。該協議是全面通路合作夥伴計畫的一部分,旨在透過新管道補充 Invia 的直銷舉措。由於倉庫被迫自動化以滿足日益成長的需求,該公司將擴展其能力,向電子商務履約中心提供其人工智慧主導的最佳化軟體和自主移動機器人。

- 2021年10月-ABB有限公司白皮書專注於機器人和自動化,以應對電子商務帶來的挑戰和機遇,包括勞動力短缺、全通路分銷和電子商務的成長。 ABB 提供了四種關鍵的自動化解決方案,透過靈活的自動化使物流業務更具彈性。這些包括物品挑選、碼垛、機器人儲存和搜尋系統以及分類。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 宏觀經濟因素對倉庫自動化市場的影響

- COVID-19 對國內付款市場的影響

第5章 市場動態

- 市場促進因素

- 電子商務行業的成長和SKU的激增。

- 提高技術創新和可用性

- 市場問題

- 產品製造資本投入高

第6章 市場細分

- 按組件

- 硬體

- 移動機器人(AGV、AMR)

- 自動儲存和搜尋系統 (AS/RS)

- 自動輸送機及分類系統

- 卸垛/碼垛系統

- 自動識別與資料採集

- 拾料機器人

- 軟體(倉庫管理系統、倉庫執行系統)

- 服務(附加價值服務、維護等)

- 硬體

- 按最終用戶產業

- 飲食

- 郵政和小包裹

- 食物

- 通用產品

- 服飾

- 製造業

- 其他

第7章 競爭格局

- 公司簡介

- Dematic Group

- Daifuku Co., Ltd

- Honeywell Intelligrated(Honeywell International Inc.)

- Omron Adept Technologies

- Invia Robotics Inc

- KUKA AG

- Oracle Corporation

- One Network Enterprises Inc.

- Locus Robotics

- Fetch Robotics Inc.

第8章投資分析

第9章:未來展望

The North America Warehouse Automation Market size is estimated at USD 8.01 billion in 2025, and is expected to reach USD 17.33 billion by 2030, at a CAGR of 16.7% during the forecast period (2025-2030).

The use of machines, control systems, and software to increase operational efficiency by using minimal human assistance in the warehouses for inventory movement is known as warehouse automation. The benefits of automating include improved customer service, scalability & speed, organizational management, and error reduction.

Key Highlights

- By 2025, according to the Bank of America, 45% of all manufacturing will be carried out using robotic technology. Following this trend, large companies such as Raymond Limited (an Indian textile company) and Foxconn Technology (a China-based supplier to major tech makers like Samsung) have replaced workers by incorporating automatic technology in their factories.

- According to the Generix Group, automation initiatives should start with a well-optimized implementation of the Warehouse Management System (WMS). WMS alone can increase productivity by 20% at ten times the cost of installing a warehouse. Then, depending on the company's needs, there are ways to introduce robotization, for example, by setting up an automatic de-palletizing/palletizing system. The robot picks up a specific package from different palettes and creates its palette.

- Moreover, various factors have directly impacted the increasing adoption of warehouse robotics. The rising number of warehouses and increasing investments in warehouse automation, coupled with the global rise in labor costs and availability of scalable technological solutions, have driven the market for warehouse robots across the region.

- Rapid enhancement in automation technology by market vendors has led to new variations in these product ranges or software functionalities occurring more frequently. This has been causing existing technologies to become outdated quickly, and the need to be changed or upgraded regularly accounts for high costs.

- The COVID-19 pandemic has led warehouse operators to consider accelerating their schedules to adopt automation and robotics. Successful deployments create safer jobs by reducing worker interaction while increasing productivity to meet growing e-commerce demands. With the rise of e-commerce in recent months, thousands of physical stores have closed. However, the pandemic outbreak and the lockdown worldwide have affected the warehousing and industrial activities, especially in countries such as the United States.

North America Warehouse Automation Market Trends

Increased Adoption of Robotics In The Warehouses Is Driving The Market

- A growing number of self-driving machines are shuttling clothing and sports equipment down warehouse aisles, pulling bins of groceries, cosmetics, and industrial parts from high stacks, and handing off goods to workers to help deliver orders faster. Some logistics operators are testing forklifts that can be operated remotely, allowing employers in tight labor markets to draw from a geographically broader pool of workers.

- According to a Ware2Go survey, 67% of Americans work from home. This means they have easy access to online shopping. E-commerce is more dependent than ever as the COVID-19 pandemic has changed how Americans shop. As a result, over half of U.S. companies are increasingly willing to invest in automation to respond to changing market conditions. The 2020 Honeywell Intelligrated Automation Investment study found that the e-commerce grocery(66%), food and beverage (59%), and logistics (55%) industries are most likely to invest more in automation.

- Some players are investing in developing disinfection robots due to the sudden increase In demand during the coronavirus pandemic. For instance, in April 2020, Ocado announced the launch of its first robotic automated warehouse in North America, which the Empire company would use to begin testing orders in Ontario, Canada. It is the second Ocado customer fulfillment center to be opened internationally in 2020.

- The market is also witnessing various partnerships to deploy automated solutions in the logistics sector. For instance, in May 2021, ABB robotics collaborated with Cam Industrial and Remtech Systems to introduce automation solutions for logistics and supply chains in Alberta and British Columbia to address the growing need for flexibility, speed, and accuracy in fulfillment centers based on consumer demand.

- Today's intelligent robots are well suited for the complex demands of omnichannel supply chains. For example, autonomous mobile robots (AMRs) have more agile navigation capabilities that allow them to navigate anywhere in the warehouse using built-in sensors and laser scanners to retrieve goods and deliver them to workers. As the U.S. workforce continues to work inside and outside this new workforce, automation will help businesses maximize these e-commerce opportunities and ensure that society has what it needs to thrive and prosper.

Growth In The E-commerce Industry and SKUs Proliferation.

- With the advent of always-on e-commerce and faster response times, the need to manage large numbers of error-free stock-keeping units (SKUs) are expanding warehouses, fulfillment centers, and intelligent and efficient standards. The urgent need to reduce costs, streamline operations and increase efficiency drives robot innovation. In addition, the economy is growing, and the demand for automation due to intensified competition in the retail e-commerce market in the region is driving the market's growth.

- Technological advances and market changes, such as the rise of omnichannel logistics, have required companies to add new items to their catalogs. Companies may increase the number of SKUs (Stock Keeping Units) sold to expand their customer portfolio. SKU spikes are a strategy aimed at increasing sales by stocking more products, and companies can serve more customers and, as a result, earn more sales.

- In April 2021, 3PL Central, one of the leaders in cloud-based Warehouse Management Systems (WMS), acquired Skubana, a leading inventory management system and e-commerce operations platform. With this acquisition, 3PL Central expanded its supply chain technology offering to include intelligent order routing and inventory management to provide an integrated fulfillment solution from the shopping cart to the warehouse.

- Similarly, in September 2020, Chewy company plans to drive automation of its entire fulfillment network over the next two years through new warehouse locations and remodeling existing facilities. Chewy opened a second automated fulfillment center in the second quarter and a "limited catalog facility" in the third quarter. Also, Chewy opened its first Limited SKU warehouse in the metropolitan area of Kansas City, Missouri, to respond to spikes in volume and avoid rapid transportation costs and split transportation.

- Also, as per the Materials Management & Distribution Report, just-in-time ordering, direct-to-consumer distribution, and shifting retailer-wholesaler relationships reduce the number of large-pallet orders. The growth of small, multiple SKU orders is forcing warehouses to automate. The availability of technology, in such cases, has led to an ease of deployment by decreasing the time and cost of re-designing the whole facility.

North America Warehouse Automation Industry Overview

The North American warehouse automation market's competitive environment shows the market's fragmentation with major global players, including Dematic Group, Daifuku Co. Limited, Swisslog Holding AG, and Honeywell Intelligrated. Product launches, acquisitions, and partnerships are key strategies market players adopt in the warehousing automation industry.

- June 2021 - Invia Robotics, Inc. announced agreements with more than ten companies currently providing warehouse technology solutions. The contracts are part of a comprehensive channel partner program designed to supplement inVia's direct selling initiatives through new channels. It expands the company's capacity to provide its AI-driven optimization software and autonomous mobile robots to e-commerce fulfillment centers when warehouses are pressured to automate to keep up with the growing demand.

- October 2021 - The ABB Limited's White Paper focuses on robotics and automation in addressing the challenges and opportunities accelerated by COVID-19, such as labor shortages, omnichannel distribution, and e-commerce growth. ABB offered four critical automation solutions that increase the resiliency of logistics operations through flexible automation. Item picking, palletizing, robotic storage and retrieval systems, and sorting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness-Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macro-economic Factors on the Warehouse Automation Market

- 4.5 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in the e-commerce industry and SKUs proliferation.

- 5.1.2 Increase in technology innovations and availbility

- 5.2 Market Challenges

- 5.2.1 High capital investments for manufacturing products

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Mobile Robots (AGV, AMR)

- 6.1.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.1.3 Automated Conveyor & Sorting Systems

- 6.1.1.4 De-palletizing/Palletizing Systems

- 6.1.1.5 Automatic Identification and Data Collection

- 6.1.1.6 Piece Picking Robots

- 6.1.2 Software (Warehouse Management System, Warehouse Execution System)

- 6.1.3 Services (Value Added Services, Maintenance, etc.)

- 6.1.1 Hardware

- 6.2 By End-user Industry

- 6.2.1 Food and Beverage

- 6.2.2 Post and Parcel

- 6.2.3 Groceries

- 6.2.4 General Merchandise

- 6.2.5 Apparel

- 6.2.6 Manufacturing

- 6.2.7 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dematic Group

- 7.1.2 Daifuku Co., Ltd

- 7.1.3 Honeywell Intelligrated (Honeywell International Inc.)

- 7.1.4 Omron Adept Technologies

- 7.1.5 Invia Robotics Inc

- 7.1.6 KUKA AG

- 7.1.7 Oracle Corporation

- 7.1.8 One Network Enterprises Inc.

- 7.1.9 Locus Robotics

- 7.1.10 Fetch Robotics Inc.