|

市場調查報告書

商品編碼

1644621

全球收縮套管貼標機市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Shrink Sleeve Applicator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

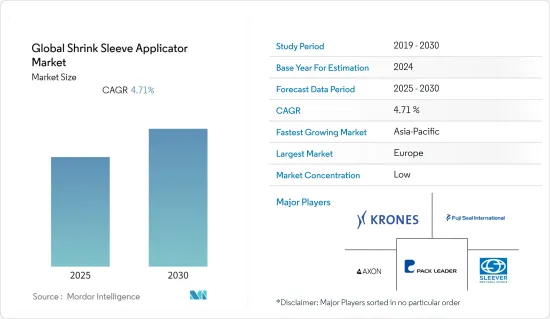

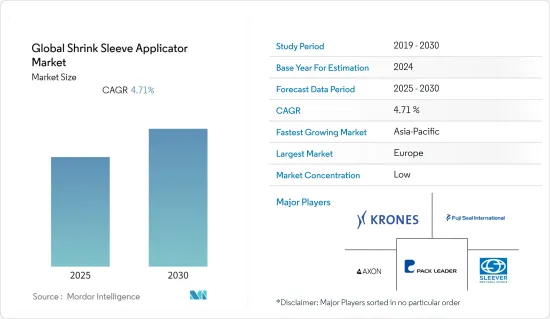

預測期內,全球收縮套管塗抹器市場預計將以 4.71% 的複合年成長率成長。

收縮套管塗抹器用於實現平穩、快速、高效的操作輸出。收縮套管塗抹器非常省時,並利用技術來確保最低的成本和高品質的輸出,從而提供高性能的產品系列。與包裝器材相關的技術進步是推動市場對收縮套筒標籤機需求的關鍵因素之一。

製造商宣傳並打造其品牌產品,其產品採用優質、有吸引力的標籤進行包裝。這一趨勢將導致對能夠高效實現這一目標的包裝器材的需求激增。收縮套管塗抹器是製造商實現這一目標的最佳選擇之一。

對能夠消除浪費的全機械化和自動化設備的需求不斷成長以及其在處理玻璃和塑膠容器方面的多功能性是推動未來市場發展的一些因素。

COVID-19疫情對標籤包裝產業供應鏈造成嚴重擾亂,影響了需求和供應鏈。不過,世界各國政府都認為食品和製藥業務對於抵消 COVID-19 對市場帶來的影響至關重要。出於衛生原因而對包裝食品進行改造的趨勢預計將在預測期內增加對收縮套管塗抹機的需求。

由於製造設備中使用了諸如PLC、SCADA、HMI等自動化最尖端科技,收縮套管貼標機市場正面臨著諸如機器安裝成本上升和新技術創新等挑戰,而環保標籤的日益流行可能很快就會抵消供應商市場的衝擊。

收縮套標機市場趨勢

食品包裝佔據主要市場佔有率

收縮套管塗抹機在食品包裝中的應用主要是為了封閉或包裹食品,以防止其受到化學、物理和生物來源的篡改和污染,並反映製造商的詳細資訊,新法律強制要求在包裝上壓印主要成分,所有這些都可以通過收縮套管塗抹機高效快速地完成。

隨著人口不斷成長至90多億,包裝行業的製造商需要自動化和設備來高效完成任務同時保持品質。收縮套標機可幫助您製作美觀且高品質的包裝。未來食品包裝的品質和數量都需要大幅提升。

食品包裝產業正在經歷一場具有突破性的新技術的變革:鑄造標籤。在使用收縮貼標機為產品貼標時,該設備現在能夠將 3 到 4 種套標機整合為一體。透過簡單更換模組,即可實現多種類型、多種品種的鑄造標籤。

2004年,《食品過敏標籤和消費者保護法》獲得通過,1906年,美國頒布了《食品和藥品法》,禁止州際貿易中貼錯標籤和摻假的食品、飲料和藥品。由於食品對包裝和標籤的品質要求,這些法規正在推動收縮套管貼標機市場的發展。

食品包裝的進步在維護食品供應安全方面發揮著重要作用,而根據海關規定,保持標籤完好至關重要。收縮套標貼機設備可維持標準標籤,使食品能夠從原產地安全地遠距運輸,確保包裝品質和標籤完美無缺。

歐洲佔大部分市場

根據歐盟委員會發布的報告,2022年1月,歐盟農產品貿易總額達283億歐元,較2021年成長25%。出口額達158億歐元,進口額達125億歐元,分別成長16%和38%。

歐盟成功推行開放、進入貿易政策,推動了歐盟農業貿易的成功。使用收縮套標設備包裝的產品標籤體現了產品的永續生產、安全、營養和高品質的良好聲譽,推動了該地區市場的發展。

瑞士、中國、中東和北非是歐盟農產品出口主要成長地區。歐盟出口降幅最大的國家是土耳其、美國、日本和新加坡。海關對進出口的要求迫使製造商遵守食品標籤監管法。否則,將導致整批產品被拒收,並使製造商蒙受損失。收縮套管貼標機的創新使得各種產品的貼標變得簡單而有效率。

2022 年 1 月,即俄羅斯入侵之前,從烏克蘭的進口額達到 10 億歐元,比去年同期成長 88%,其中穀物進口額成長 2.58 億歐元(136%)。其中,從美國的進口成長了16%,從中國的進口成長了67%。穀物運輸有包裝破裂和產品損壞的風險,使用 PVC 薄膜收縮套標機進行集體包裝可以避免這些風險(資料來源:歐盟委員會)。

出口增幅最大的是英國、美國和中國,佔歐盟農產品出口總額的40%。在去年大幅下滑之後,對英國的出口增加了 8.94 億歐元(成長 36%),達到 2020 年的水準。隨著蔬菜、雞蛋、啤酒和其他飲料等出口的不斷增加,加工和貼標此類產品需要能夠以極高的速度處理貼標的技術,同時還要保持收縮套管貼標機可以輕鬆實現的品質一致性。

收縮套標機產業概況

收縮套筒標籤市場競爭激烈,同時被主要企業分割。為了保持領先地位,這些行業參與企業正在採取合作、合資和新產品發布的策略來滿足日益成長的客戶需求。

2022 年 5 月-Tripack LLC 宣布將在佛羅裡達州開設一家製造工廠,以滿足飲料業對裝飾鋁罐日益成長的需求。 Tri-Pack 計劃在佛羅裡達州萊克蘭開設第三家製造工廠,該工廠佔地超過 30,000 平方英尺,可容納多條包裝生產線。

2021 年 5 月-為政府機構、全球企業、消費者和中小型企業提供專業標籤、安全和包裝解決方案的供應商 CCL Industries Inc. 宣布收購新加坡的 Lux Global Label Asia Pte Ltd.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 自動貼標機的使用有助於減少套筒標籤消費量,這在很大程度上受到近期減薄趨勢的推動。

- 醫藥和食品領域的需求不斷擴大,目前這兩個領域佔需求的大部分

- 市場限制

- 關於標籤清晰度的嚴格監管限制對整個供應鏈帶來了挑戰。

- 收縮套管塗抹器的演變和最近的技術進步。

第6章 市場細分

- 依設備類型

- 半自動和手動

- 自動化

- 按最終用戶產業

- 硬體維修

- 軟調頻

- 按最終用戶

- 食物

- 飲料

- 藥品

- 個人護理及化妝品

- 工業(化工、汽車)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 其他

第7章 競爭格局

- 公司簡介

- Krones AG

- Fujiseal International

- Finpac Group

- Pack Leader Machinery Inc.

- Sleever International

- Tripack Group

- Axon Corporation

- USLUGA SHPK

- Label-Aire Corporation

- Benison Group

第 8 章 相對定位分析-根據預定義標準對頂級供應商進行排名

第9章 市場展望

The Global Shrink Sleeve Applicator Market is expected to register a CAGR of 4.71% during the forecast period.

Shrink Sleeve Applicator is used for smooth, high speed, and efficient operations output. Shrink Sleeve applicators are very time efficient, giving a high-performance product range ensuring minimal cost with high-quality output using technology. Technological advancement related to packaging machinery is one of the crucial factors that propel the demand for shrink sleeve label applicators in the market.

Manufacturers promote and brand the packaged product with high quality and attractive labeling. This trend leads to an upsurge in demand for packaging machinery, which can efficiently achieve this goal. The shrink sleeve applicators are one of the best options to achieve this goal of manufacturers.

The rising demand for fully mechanized and automated equipment that can eliminate wastage and the versatility of handling glass and plastic containers are among the key drivers to propel the market in the future.

The COVID-19 outbreak caused significant disruption in the supply chain in the labeling and packaging industry and has affected the demand and supply chain. However, governments worldwide have deemed food and pharma-related businesses essential to offset the effects of covid 19 on the market. Changing trends to adapt packaged food because of hygiene will increase the demand for shrink sleeve applicators in the forecast period.

The shrink sleeve applicator market has been facing challenges like higher installation costs of machinery and new technological innovation with the use of cutting edge technologies in automation like plc, SCADA, and HMI in manufacturing units, and increasing trends towards eco-friendly labels soon may offset the market for the vendors.

Shrink Sleeve Applicator Market Trends

Food Packaging Accounted to Hold the Major Market Share

The use of shrink sleeve applicators in food packaging is mainly to enclose or wrap food products to protect them from tampering or contamination from chemical, physical, and biological sources, reflecting the manufacturer details the new laws made it mandatory to emboss the main ingredient on the packaging all these can be done efficiently and at a fast pace with Shrink Sleeve applicators.

With the increase in the population of over 9 billion, the manufacturers in the packaging industry require automation and equipment to achieve the task efficiently while maintaining quality. All these can be delivered by using shrink sleeve applicators with attractive and quality packaging. The quality and quantity of food packaging will have to increase considerably.

The food packaging industry is going through a transformation with the traditional breakthrough technology of casting labels. When it comes to labeling the product using shrink label applicators, the equipment now can integrate three to four trapping label machine varieties into one. It only needs to change the modules to realize the casting label of different types and varieties.

In 2004, the Food Allergy Labeling and Consumer Protection Act was passed, and In 1906, Food and Drugs Act (prohibited interstate commerce in misbranded and adulterated foods, drinks, and drugs.) in the United States. These regulations drive the shrink sleeve applicator market for the requirement of quality packaging and labeling of food products.

Advances in food packaging play a primary role in keeping the food supply safe, and keeping the label intact is very important because of customs regulations. Shrink sleeve applicator equipment ensures quality Packaging with perfect labeling maintaining standard labeling enabling food products to travel safely for long distances from their point of origin.

Europe Accounts to Hold the Major Share of the Market

As per the report published by the European Commission, the total EU agri-food trade reached a value of EUR 28.3 billion in January 2022, a 25% increase compared to 2021. Exports reached EUR 15.8 billion, while imports were valued at EUR 12.5 billion, representing an increase of 16% and 38%, respectively.

The successful promotion of the European union's open and accessible trade policy drives the success of European Union agricultural trade. The excellent reputation of products as sustainably produced, safe, nutritious, and of high quality reflected on the labels of the packaging products using the shrink sleeve applicators equipment is driving the market in the region.

Switzerland, China, the Middle East, and North Africa were the major growth regions for EU agri-food exports. The value of EU exports fell most to Turkey, the United States, Japan, and Singapore. The custom requirement for exports and imports requires the manufacturer to follow the regulatory laws regarding labeling the food products. Failing short may result in the rejection of the entire batch causing loss to the manufacturer. The shrink sleeve applicators' technological innovation labeling of various products becomes easy and efficient.

Before the Russian invasion, imports from Ukraine had grown by 88% YOY in January 2022 to reach a value of EUR 1 billion, primarily driven by cereals imports, which grew by EUR 258 million (136%). Elsewhere, imports from the US grew by 16%, while imports from China increased by 67%. Cereal shipping includes chances of rupturing the packages and spoilage of the product but can be avoided by using group packaging with a shrink sleeve aaplicator using PVC film (source: European Commission).

The largest export increase was noted to the United Kingdom, the United States, and China, for 40% of all EU agri-food exports. Exports to the UK grew by EUR 894 million (+36%) to 2020 levels after a sharp decline last year. The primarily increase in exports of vegetables, poultry & eggs, beer, and other beverages, processing and labeling of products at this level need technology, which can process the labeling at a very high rate maintaining the uniformity in quality which shrink sleeve applicators can achieve in no time.

Shrink Sleeve Applicator Industry Overview

The shrink sleeve labels market is competitive and simultaneously fragmented because of different domestic and international key players. These industry players have incorporated strategies to remain at the forefront and satisfy customers' increasing demand with collaborations, joint ventures, and new product launches.

May 2022 - Tripack LLC announced opening a manufacturing facility in Florida to fulfill the growing demand for decorated aluminum cans in the beverage industry. Tripack plans to open a third manufacturing facility in Lakeland, Florida with over 30,000 sq ft and space for multiple packaging lines.

May 2021 - CCL Industries Inc., a specialty label, security, and packaging solutions provider for government institutions, global corporations, consumers, and small businesses, announced the acquisition of Lux Global Label Asia Pte Ltd, based in Singapore.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recent trend of downgauging has been a major driver for the use of automated applicator machines as they contribute to lower consumption of sleeve label

- 5.1.2 Growing demand from Pharmaceutical and food sectors which currently account for a large share of the demand

- 5.2 Market Restraints

- 5.2.1 Stringent regulatory constraints pertaining to the visibility of labels remains a challenge across the supply chain

- 5.3 Evolution of Shrink Sleeve Applicators and recent advancements in technology

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Semi-automated & Manual

- 6.1.2 Automated

- 6.2 By End-user Vertical

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-User

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical

- 6.3.4 Personal care & Cosmetics

- 6.3.5 Industrial (Chemicals & Automotive)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Middle-East and Africa

- 6.4.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Krones AG

- 7.1.2 Fujiseal International

- 7.1.3 Finpac Group

- 7.1.4 Pack Leader Machinery Inc.

- 7.1.5 Sleever International

- 7.1.6 Tripack Group

- 7.1.7 Axon Corporation

- 7.1.8 USLUGA SHPK

- 7.1.9 Label-Aire Corporation

- 7.1.10 Benison Group