|

市場調查報告書

商品編碼

1766255

收縮套標機市場機會、成長動力、產業趨勢分析及2025-2034年預測Shrink Sleeve Labeling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

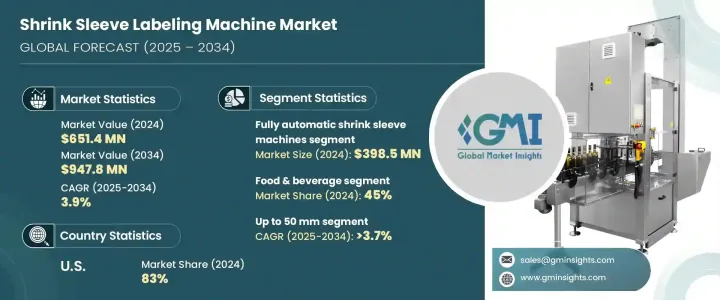

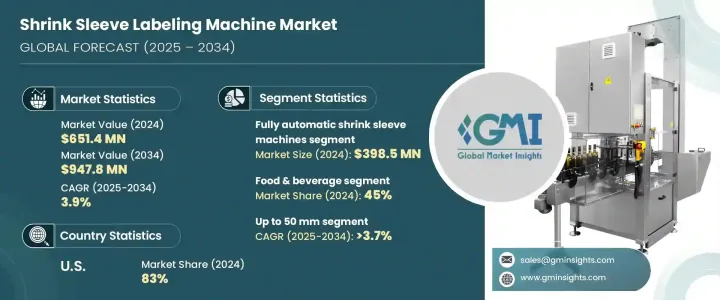

2024年,全球收縮套標機市場規模達6.514億美元,預計2034年將以3.9%的複合年成長率成長,達到9.478億美元。這一成長軌跡主要源自於對改進產品包裝日益成長的需求,以及自動化技術的持續創新。隨著各行各業擴大轉向智慧標籤系統,製造商對先進解決方案的興趣日益濃厚,這些解決方案不僅可以提高標籤準確性,還能降低營運效率。

收縮套標技術的演進大大改變了產品外觀和品牌形象,推動多個垂直產業的企業紛紛採用高速、高效且適應性強的貼標機。隨著企業注重視覺吸引力和品牌形象,這些機器在為各種容器提供無縫整體裝飾方面發揮關鍵作用。熱隧道機制和自動化框架的進步也加速了該技術的普及。此外,為了應對日益嚴格的監管和消費者對包裝安全性日益成長的需求,該行業正在進一步升級收縮套標設備。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.514億美元 |

| 預測值 | 9.478億美元 |

| 複合年成長率 | 3.9% |

2024年,全自動收縮套標機引領全球市場,營收達3.985億美元,預計預測期間內複合年成長率為4.1%。這類機器因其無需人工干預即可支援不間斷、大批量生產線而廣受歡迎。它們與智慧系統整合,可快速貼標,並內建錯誤檢測和剔除機制,有助於減少停機時間並提高效率。這類系統在速度、準確性和可重複性至關重要的大規模製造環境中尤其受歡迎。

半自動機型雖然規模較小,但仍適合中小型企業。這些機器配備了基於感測器的基本技術,可以自動將收縮標籤貼到瓶子、小瓶或容器上,無需人工精確操作。對於處理各種形狀和尺寸產品的企業來說,它們是理想之選,也為從手動貼標流程轉型的製造商提供了一個經濟高效的切入點。

手動收縮套標機繼續服務於利基市場,尤其是在需要定製或短期生產的市場。雖然它們的自動化程度有限,但它們靈活且易於操作,非常適合新創公司或小批量生產環境。

從終端用戶的角度來看,食品飲料產業在2024年佔據全球市場45%的佔有率,佔據主導地位,預計到2034年,該領域的複合年成長率將達到4.2%。該行業正經歷消費者偏好的快速變化,導致包裝食品、調味飲料和簡便食品的需求激增。因此,對能夠處理各種尺寸和形狀容器的動態貼標系統的需求正在成長。收縮套標機能夠實現360度全方位的品牌推廣,這是該領域製造商的關鍵賣點。其防竄改功能也為產品包裝增加了一層安全性和保障性,進一步推動了需求的成長。

隨著各大品牌力求在競爭激烈的零售環境中脫穎而出,化妝品和個人護理類別也呈現強勁成長。收縮套標機能夠在不規則形狀的容器上進行高解析度列印,這對於希望提升貨架吸引力的企業至關重要。隨著環保包裝日益受到重視,許多製造商也選擇使用可生物分解和可回收的套標材料,這與全球永續發展目標相契合。

製藥和化學工業正在採用這些機器來滿足嚴格的合規標準,並支援批次級識別和追蹤。尤其是對高精度、防篡改標籤解決方案的需求,正推動這些產業採用先進的收縮套標系統。

以容器直徑計算,直徑不超過50毫米的容器在2024年成為市場的最大貢獻者,預計預測期內複合年成長率將超過3.7%。小直徑容器(例如試管、西林瓶和樣品瓶)廣泛應用於個人護理、製藥和營養保健品產業。這些應用需要高速、緊湊的貼標系統,能夠精確處理易碎包裝,進而推動該領域的成長。

從地區來看,美國引領北美市場,2024年佔該地區總收入的83%,收益達1.601億美元。食品和飲料製造商的強勁存在,加上成熟的自動化包裝基礎設施,正在推動收縮套標設備的需求。技術升級和精益製造的日益成長,進一步增強了這些設備對美國企業的吸引力。

在這個市場中經營的公司正在積極投資研發並建立策略聯盟,以提升其市場影響力。技術改進和以自動化為重點的升級正在幫助企業始終領先於不斷變化的行業需求。例如,產業參與者正在將智慧功能整合到他們的機器中,從而實現更快的設定時間、預測性維護以及與現有生產線的無縫整合。這些策略不僅幫助企業滿足客戶期望,還提供可擴展的解決方案,以適應包裝和標籤領域的新興趨勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 手動收縮套標機

- 半自動收縮套標機

- 全自動收縮套標機

第6章:市場估計與預測:依貨櫃類型,2021 - 2034 年

- 主要趨勢

- 瓶子

- 罐頭

- 罐子

- 其他容器

第7章:市場估計與預測:依貨櫃直徑,2021 - 2034 年

- 主要趨勢

- 最大 50 毫米

- 50至100毫米

- 100至150毫米

- 150毫米以上

第8章:市場估計與預測:依套筒容量,2021 - 2034 年

- 主要趨勢

- 高達 300 單位/分鐘

- 300至400單位/分鐘

- 400至600單位/分鐘

- 高於600單位/分鐘

第9章:市場估計與預測:依最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 化妝品和個人護理

- 化學品和肥料

- 汽車

- 其他(營養保健品等)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Accutek Packaging Equipment

- Axon

- Bhagwati Labelling Technologies

- BW Integrated Systems

- Crown Packaging

- Dase-Sing Packaging

- Esleeve Enterprise

- Fuji Seal

- King Machine

- Magic Special Purpose Machineries

- Pack Leader USA

- PDC International

- Procus Machinery

- Quadrel

- XH Labeling Machine

The Global Shrink Sleeve Labeling Machine Market was valued at USD 651.4 million in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 947.8 million by 2034. This growth trajectory is primarily driven by the rising demand for improved product packaging, coupled with continuous innovation in automation technologies. With industries increasingly turning to smart labeling systems, manufacturers are witnessing a growing interest in advanced solutions that not only enhance labeling accuracy but also reduce operational inefficiencies.

The evolution of shrink sleeve labeling technology has significantly transformed product aesthetics and branding, pushing businesses across multiple verticals to embrace high-speed, efficient, and adaptable labeling machinery. As companies focus on visual appeal and brand identity, these machines play a pivotal role in delivering seamless full-body decoration on various types of containers. Advancements in heat tunnel mechanisms and automation frameworks are also accelerating the pace of adoption. Moreover, the industry is responding to increasing regulatory and consumer demand for packaging safety, prompting further upgrades in shrink sleeve equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $651.4 Million |

| Forecast Value | $947.8 Million |

| CAGR | 3.9% |

Fully automatic shrink sleeve labeling machines led the global market in 2024, generating revenue of USD 398.5 million and are expected to grow at a CAGR of 4.1% during the forecast period. These machines are gaining widespread acceptance due to their ability to support uninterrupted, high-volume production lines without manual intervention. Their integration with smart systems allows for rapid label application, along with built-in error detection and rejection mechanisms, contributing to reduced downtime and improved efficiency. These systems are especially popular in large-scale manufacturing environments where speed, accuracy, and repeatability are essential.

Semi-automatic variants, although more modest in scale, remain relevant for small and mid-sized enterprises. These machines are equipped with basic sensor-based technologies that can automatically apply shrink labels to bottles, vials, or containers without requiring manual precision. They are ideal for businesses handling diverse product shapes and sizes, and they offer a cost-effective entry point for manufacturers transitioning from manual labeling processes.

Manual shrink sleeve labeling machines continue to serve niche markets, particularly where customization or short-run production is necessary. Although they offer limited automation, they provide flexibility and are easy to operate, making them suitable for start-ups or low-volume production settings.

From an end-use perspective, the food and beverage industry dominated the global market with a 45% share in 2024, and the segment is projected to grow at a CAGR of 4.2% through 2034. This sector is experiencing rapid changes in consumer preferences, leading to a surge in packaged foods, flavored beverages, and convenient meal options. As a result, the need for dynamic labeling systems that can handle containers of varied sizes and shapes is increasing. Shrink sleeve labeling machines enable complete 360-degree branding, which is a key selling point for manufacturers in this space. Their ability to provide tamper-evident features also adds a layer of safety and assurance to the product packaging, further driving demand.

The cosmetics and personal care segment is also registering robust growth as brands strive to stand out in a highly competitive retail environment. Shrink sleeve machines allow for high-resolution printing on irregular container shapes, which is crucial for companies looking to enhance shelf appeal. With a growing focus on environmentally friendly packaging, many manufacturers are also opting for biodegradable and recyclable sleeve materials, which align well with global sustainability goals.

The pharmaceutical and chemical industries are adopting these machines to meet strict compliance standards and to support batch-level identification and tracking. In particular, the demand for highly precise, tamper-proof labeling solutions is spurring the adoption of advanced shrink sleeve systems in these sectors.

By container diameter, the up to 50 mm segment emerged as the top contributor to the market in 2024 and is estimated to grow at a CAGR of over 3.7% during the forecast period. Small-diameter containers such as tubes, vials, and sample bottles are extensively used in personal care, pharmaceutical, and nutraceutical industries. These applications require high-speed, compact labeling systems that can handle fragile packaging with precision, contributing to segment growth.

Regionally, the United States led the North American market, accounting for 83% of regional revenue in 2024, with earnings reaching USD 160.1 million. The strong presence of food and beverage manufacturers, combined with an established infrastructure for automated packaging, is fueling the demand for shrink sleeve labeling equipment. Technological upgrades and an increasing shift toward lean manufacturing have further enhanced the attractiveness of these machines for US-based firms.

Companies operating in this market are actively investing in R&D and forming strategic alliances to enhance their market presence. Technological improvements and automation-focused upgrades are helping firms stay ahead of changing industry requirements. For instance, industry players are integrating smart features into their machines, enabling faster setup times, predictive maintenance, and seamless integration into existing production lines. These strategies are not only helping companies meet customer expectations but also offering scalable solutions that adapt to emerging trends in packaging and labeling.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By type

- 2.2.3 By container type

- 2.2.4 By container diameter

- 2.2.5 By sleeve capacity

- 2.2.6 By end use industry

- 2.2.7 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Manual shrink sleeve machines

- 5.3 Semi-automatic shrink sleeve machines

- 5.4 Fully automatic shrink sleeve machines

Chapter 6 Market Estimates & Forecast, By Container Type, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Bottles

- 6.3 Cans

- 6.4 Jars

- 6.5 Other containers

Chapter 7 Market Estimates & Forecast, By Container Diameter, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Up to 50 mm

- 7.3 50 to 100 mm

- 7.4 100 to 150 mm

- 7.5 Above 150 mm

Chapter 8 Market Estimates & Forecast, By Sleeve Capacity, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Up to 300 units/min

- 8.3 300 to 400 units/min

- 8.4 400 to 600 units/min

- 8.5 Above 600 units/min

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 Food & beverages

- 9.3 Pharmaceuticals

- 9.4 Cosmetics & personal care

- 9.5 Chemicals and fertilizers

- 9.6 Automotive

- 9.7 Others (nutraceuticals etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Accutek Packaging Equipment

- 12.2 Axon

- 12.3 Bhagwati Labelling Technologies

- 12.4 BW Integrated Systems

- 12.5 Crown Packaging

- 12.6 Dase-Sing Packaging

- 12.7 Esleeve Enterprise

- 12.8 Fuji Seal

- 12.9 King Machine

- 12.10 Magic Special Purpose Machineries

- 12.11 Pack Leader USA

- 12.12 PDC International

- 12.13 Procus Machinery

- 12.14 Quadrel

- 12.15 XH Labeling Machine