|

市場調查報告書

商品編碼

1644462

美國數位借貸:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States Digital Lending - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

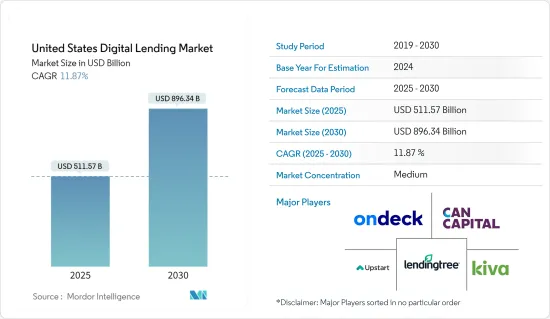

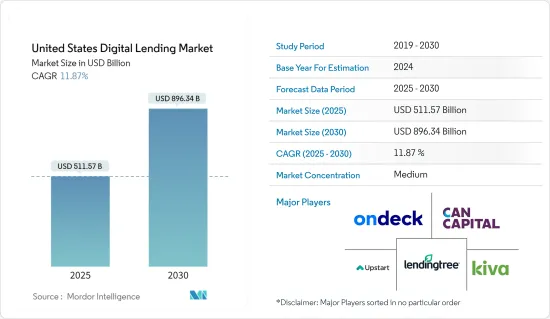

2025年美國數位借貸市場規模預估為5,115.7億美元,預估至2030年將達8,963.4億美元,預測期間(2025-2030年)複合年成長率為11.87%。

預計市場擴張將受到數位借貸平台帶來的好處的推動,例如改進貸款最佳化貸款流程、加快決策速度、遵守法規和規範以及提高業務效率。傳統借貸平台要求每一步都進行身體接觸和人機交互,從而延長了處理時間並增加了人為錯誤的可能性。然而,數位借貸平台使銀行能夠實現貸款流程自動化並提高消費者滿意度。

關鍵亮點

- 美國是全球最大、最先進的數位借貸市場之一,也是各領域數位化的早期採用者。此外,蓬勃發展的經濟、知名解決方案提供商的強大影響力以及政府和私人組織對開發和發展研發活動的大力投資等因素都將推動該地區對數位借貸的需求。

- 資金籌措是數位借貸經營模式的關鍵組成部分。數位貸款機構採用的資金籌措模式主要有三種:市場貸款人、資產負債表貸款人和銀行通路貸款人。一些數位貸款機構在發展過程中採用多種資金籌措模式。

- 此外,銀行具有根本的競爭優勢。最重要的是,他們可以獲得保險存款,從而獲得低成本資本。儘管監管問題似乎阻礙了銀行採用新技術,但它們正擴大尋找進入金融科技領域的切入點。預計將有許多銀行與現有的金融科技公司合作,將他們的技術力與自身的成本優勢結合。

- 將銀行的低資本成本與技術專長結合,可以使銀行以更低的費用提供更有效率的客戶體驗,從而開拓以前尚未開發的客戶群。此外,在美國,從事信用發放的平台可能需要遵守國家許可要求。為此,許多平台與銀行合作,執行網路約定的貸款。

- 新冠疫情導致該地區的小型企業在危機期間面臨繼續營運的資金籌措挑戰。預計數位借貸將迎來許多成長和應用機會,尤其是在中小型企業中。此外,在 COVID-19 疫情期間,政府致力於支持其公民。此外,鑑於大規模失業、工資削減和嚴重的流動性短缺,隨著新冠肺炎疫情對貸款行業的影響不斷顯現,銀行和金融機構(FI)的信貸成本和不良資產率預計將上升。貸款人可以透過使用科技受益匪淺,以幫助他們適應新常態。

美國數位借貸市場趨勢

越來越多潛在的貸款購買者正在採用數位化行為

- 根據美國小型企業管理局統計,美國未償還的100萬美元以下小型企業貸款餘額為4,100億美元,未償還的小型企業消費貸款餘額為4兆美元。美國聯邦儲備銀行估計,由於銀行不願發放小額貸款,約有 1,000 億美元的信貸需求未得到滿足。為了滿足這一未滿足的需求,利用科技與銀行合作的數位貸款機構正在受到關注。

- 此外,信貸平台鼓勵投資者分散風險。投資者可以選擇在各種貸款中進行多元化投資,通常會根據他們選擇的風險類別和條款自動獲得貸款組合的投資機會。美國超過 95% 的點對點消費者平台使用自動選擇流程。在信用便利方面,金融科技平台可以提供與銀行等傳統信貸提供者類似的監控和定序能力。

- 大多數消費者使用金融科技提供者來再融資或合併現有債務,但有些消費者也使用它們來為更大的購買資金籌措資金(例如汽車或房地產)。在美國,學生借貸來資助高等教育的現象十分突出。

- 在商業方面,各類微企業尋求營運資金和投資計劃融資的情況很常見。資金也可以透過發票交易的形式籌集,投資者根據公司的發票(應收帳款)購買折價應收帳款。小型企業對大多數地區的經濟做出了重大貢獻。以下統計數據支持上述說法:根據美國小型企業管理局 (SBA) 的數據,超過 50% 的美國擁有或經營小型企業。

消費者數位借貸預計將大幅成長

- 尤其是專注於消費貸款的GreenSky Inc.的IPO,引發了人們對銀行通路貸款的關注。該公司已獲得超過110億美元的銀行承諾。小型企業貸款機構 OnDeck 宣布擴展其 OnDeck-as-a-Service 平台,將其技術授權給銀行。該公司增加了 PNC 銀行作為客戶,並推出了新的子公司 ODX,以處理未來基於銀行管道的業務。 Avant推出了個人借貸銀行合作平台 Amount。

- 為了繼續發展,數位貸款機構正在抓住機會擴大其覆蓋範圍,包括資金籌措和產品供應。例如,SoFi 最初是一家學生貸款再融資公司,現在提供個人貸款和房屋抵押貸款。 Lending Club 專門提供個人貸款,同時也提供商業貸款產品。雖然 Square 和 Paypal 等一些公司已經從相鄰的金融科技領域進入數位借貸領域,但其他貸款機構正尋求透過提供貸款以外的服務來朝這個方向發展。 SoFi 在這方面最為活躍,提供資產管理服務並接受其高收益儲蓄帳戶產品 SoFi Money 的申請。

- 隨著該地區繼續面臨學生貸款債務危機,學生貸款新興企業正在尋找新的投資和新的客戶。美國聯邦估計美國學生貸款債務為1.7兆美元。平均而言,學生畢業時背負 29,000 美元的私人和聯邦貸款債務,其中 15% 拖欠貸款。

- 該部門提供的產品包括學生貸款再融資、直接學生貸款、個人貸款以及資產管理和房屋抵押貸款產品。

- 雲端可以被視為數位借貸領域最重要的趨勢之一,因為它能夠協助金融機構進行線上服務交付、文件管理、資訊儲存、資料處理等。據埃森哲稱,目前超過 90% 的銀行在雲端運行至少相當一部分工作負載。

美國數位借貸產業概況

隨著各類全球公司進入美國數位借貸市場,投資和併購活動預計將增加,市場預計將呈現半固定化趨勢。供應商正在透過提供一系列優惠來增加支出以吸引消費群。此外,這些投資在我們的競爭策略中發揮強大的作用。獲得分銷管道、現有的業務關係、更好的供應鏈知識和自有平台使進入市場的現有科技巨頭比新競爭對手更具優勢。

2023年10月,美國軟體公司Blend Labs與金融機構和消費者研究組織的軟體供應商MeridianLink Inc.宣佈建立合作夥伴關係。 Blend 表示,使用 MeridianLink 消費者貸款發放軟體 (LOS) 的金融機構可以透過利用 Blend 的統一平台和消費者銀行發放軟體,享受更快的銀行、信用卡和貸款產品的入職和申請流程。

2023 年 9 月,富國銀行支持的抵押房屋抵押貸款金融科技公司 Maxwell 宣布將收購數位借貸平台 Revvin(前身為 MortgageHippo),以改善其銷售點技術。該公司專注於 Revvin 更快的貸款發放流程,並相信 Maxwell 將使房屋抵押貸款市場的貸方受益,該市場繼續面臨利率上升、貸款量限制和貸款成本增加的挑戰。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 監管狀態

- 美國個人貸款借款人的關鍵指標

- 美國借款人貸款與負債比率

- 超級總理

- 優質加值

- 主要的

- 接近黃金地段

- 次級貸款

- 美國借款人平均餘額

- 超級總理

- 優質加值

- 主要的

- 接近黃金地段

- 次級貸款

- 美國借款人拖欠率

- 超級總理

- 優質加值

- 主要的

- 接近黃金地段

- 次級貸款

- 美國借款人貸款與負債比率

- 數位貸款機構發放量分析

- 個人貸款

- 小型企業貸款

- 美國次級抵押貸款分析

- 狀態分佈

- 年齡結構

- 次級抵押貸款類別整體萎縮

第5章 市場動態

- 市場促進因素

- 更多具有「數位行為」的潛在貸款購買者

- 可支配所得增加

- 市場限制

- 數字借貸的安全問題

第6章 市場細分

- 按類型

- 商業

- 商業數位借貸市場動態

- 商業數位借貸生態系統(包括新興企業和成熟企業)

- 市場估計和預測

- 消費者

- 消費者數位借貸市場動態

- 消費者導向的數位借貸模式(發薪日貸款、P2P借貸、個人貸款、汽車貸款、學生貸款)

- 消費者數位借貸生態系統(包括新興企業和現有企業)

- 市場估計和預測

- 商業

第7章 競爭格局

- 公司簡介

- Bizfi, LLC.

- OnDeck Capital Inc.

- Prosper Marketplace Inc.

- LendingClub Corp.

- Social Finance Inc.(SoFi)

- Upstart Network Inc.

- Kiva Microfunds

- Kabbage Inc.

- Lendingtree Inc.

- CAN Capital Inc.

第8章投資分析

第9章 市場機會及未來展望

The United States Digital Lending Market size is estimated at USD 511.57 billion in 2025, and is expected to reach USD 896.34 billion by 2030, at a CAGR of 11.87% during the forecast period (2025-2030).

Market expansion is anticipated to be fueled by the advantages provided by digital lending platforms, such as improved loan optimization loan process, quicker decision-making, compliance with regulations and norms, and improved corporate efficiency. Traditional lending platforms required physical contact and human engagement at every stage, which prolonged processing times and raised the possibility of human error. However, digital lending platforms allow banks to automate the loan process, improving consumer satisfaction.

Key Highlights

- The United States is one of the largest and most advanced markets for digital lending globally due to its early adoption of digitization in various sectors. Also, factors such as the strong economy and robust presence of prominent solution providers, coupled with strong investment by government and private organizations for the development and growth of research & development activities, are poised to drive the demand for digital lending in the region.

- Funding is a crucial element of the digital lending business model. There are three major funding models used by digital lenders: Marketplace lenders, Balance sheet lenders, and bank channel lenders. Several digital lenders have been tapping multiple funding models as they grow.

- Further, banking institutions retain certain fundamental competitive advantages. Arguably the most important is their access to insured deposits, which affords them low-cost capital. Regulatory concerns have likely caused banks to hesitate when adopting new technologies, but banks are increasingly looking for points of entry to the fintech space. It is expected that many banks will partner with existing fintech companies to have their cost advantages with the fintech's technological capabilities.

- By combining their technological expertise with banks' lower cost of capital, these partnerships could enable banks to provide more efficient customer experiences at lower rates and open them up to previously untapped customer segments. Also, in the United States, platforms engaging in credit origination can be subjected to licensing requirements in each state. For this reason, many platforms partner with the banks to originate loans agreed online.

- Owing to the COVID-19 pandemic, SMEs in the region faced challenges in raising funds during the crisis to keep their businesses operating. Digital Lending is expected to find several opportunities, especially among SMEs, for growth and adoption. Further, during the COVID-19 pandemic, the government aimed to support the people. Moreover, given widespread job losses, wage reductions, and a severe liquidity shortage, banks and financial institutions (FIs) anticipates to experience an increase in credit costs and non-performing assets ratio as the effects of COVID-19 on the lending industry develop. Lenders can benefit significantly from the use of technology to assist them in adjusting to the new normal.

United States Digital Lending Market Trends

Increasing Number of Potential Loan Purchasers with Digital Behavior

- According to the U.S. Small Business Administration, there are USD 410 billion in sub-USD 1 million loans to small firms and USD 4 trillion in outstanding consumer loans for small enterprises in the US. In addition, the US Federal Reserve Bank of NY calculates an approximate USD 100 billion unmet credit demand due to banks' resistance to making small-dollar loans. To address the unmet demand, technology-driven digital lenders are attracting attention in their capacity to collaborate with banks.

- Moreover, credit platforms majorly encourage investors to spread the risks. Investors can choose to spread the investments across various multiple loans and often can automatically gain exposure to a portfolio of loans based on the risk category and terms they select. Among P2P (peer-to-peer) consumer platforms, more than 95% of the United States use an auto-selection process. In facilitating credit, fintech platforms can provide monitoring and servicing functions that are similar to those of traditional credit providers such as banks.

- Most consumers use fintech providers to refinish or consolidate existing debts, but some use them to finance their major purchases (such as vehicles or real estate). Borrowing by students to fund higher education is prominent in the United States.

- On the business side, various small and micro enterprises typically seek funds for working capital or investment projects. Financing can also be in the form of invoice trading, whereby investors purchase discounted claims on a firm's invoices (receivables). SMEs are contributing to the economy significantly for most regions. The following statistics validate the above statement: According to the US Small Business Administration (SBA), more than 50% of Americans either own or work for a small business.

Consumer Digital Lending is Expected to Grow Significantly

- Bank channel-based lending drew particular attention, especially with the IPO of consumer loan-focused GreenSky Inc. The company has secured more than USD 11 billion in bank commitments. Small business-focused lender OnDeck announced an expansion of its OnDeck-as-a-Service platform through which it licenses its technology to banks. The company added PNC Bank as a customer and launched a new subsidiary, ODX, to handle future bank channel-based business. Avant launched a bank partnership platform for personal lending called Amount.

- In order to keep growing, digital lenders are taking advantage of opportunities to expand the scope of their activities, both in terms of funding and product offerings. For example, SoFi, which began as a student loan refinancing company, now offers personal loans and mortgages. Personal loan-focused LendingClub also offers a business loan product. While some the companies, such as Square and PayPal, entered digital lending from adjacent fintech segments, some lenders are moving in the other direction by offering nonlending services. SoFi has been the most aggressive on this front, offering wealth management services and accepting applicants for its high-yield deposit account product, SoFi Money.

- Student-focused lenders remain the most diversified platforms in the digital lending sector as Student loan startups are witnessing new investments and new customers as the region faces a continued student loan debt crisis. The Federal Reserve estimates USD 1.7 trillion in U.S. student loan debt. Students, on average, graduate with USD 29,000 of private and federal loan debt and default on their loans at a rate of 15%.

- Product offerings in this segment include student loan refinance, direct student loans, personal loans, and even wealth management and mortgage products.

- Due to its capacity to assist financial institutions with service delivery, document management, information storage, and data processing online, the cloud can be regarded as one of the most important trends in digital lending. It's understandable why, according to Accenture, more than 90% of banks currently have at least a significant level of workloads operating in the cloud.

United States Digital Lending Industry Overview

The United States digital lending market is expected to be semi-consolidated, observing an increase in the number of investments and M&A activities by various global enterprises to gain access to the market. Vendors are increasingly spending on gaining a consumer base by offering numerous benefits. In addition, such investments are a strong part of their competitive strategy. Access to the distribution channel, already present business relations, better supply chain knowledge, and the self-owned platform give the established tech giants entering the market an advantage over the new competitors.

In October 2023, Blend Labs, a United States-based software company, and MeridianLink Inc., a software provider for financial institutions and consumer reporting agencies, announced a partnership. Blend stated that lenders utilizing MeridianLink Consumer loan origination software (LOS) can use Blend's unified platform and consumer banking origination software for a quick onboarding and application procedure for banking, credit card, and loan products.

In September 2023, the digital lending platform Revvin, formerly MortgageHippo, was announced to be acquired by Maxwell, a mortgage fintech sponsored by Wells Fargo, to improve its point-of-sale technology. The company focuses on Revvin's faster loan origination process, which Maxwell thinks would benefit lenders as the mortgage market continues to be challenged by rising interest rates, limited loan volume, and increasing lending expenses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Regulatory Landscape

- 4.3 Key Indicators for Personal Loan Borrowers in the United States

- 4.3.1 Percentage of Loan Debt in United States Held By Borrowers

- 4.3.1.1 Super Prime

- 4.3.1.2 Prime Plus

- 4.3.1.3 Prime

- 4.3.1.4 Near Prime

- 4.3.1.5 Sub Prime

- 4.3.2 Average Outstanding Balances in United States Held By Borrowers

- 4.3.2.1 Super Prime

- 4.3.2.2 Prime Plus

- 4.3.2.3 Prime

- 4.3.2.4 Near Prime

- 4.3.2.5 Sub Prime

- 4.3.3 Delinquency Rates of Borrowers in United States

- 4.3.3.1 Super Prime

- 4.3.3.2 Prime Plus

- 4.3.3.3 Prime

- 4.3.3.4 Near Prime

- 4.3.3.5 Sub Prime

- 4.3.1 Percentage of Loan Debt in United States Held By Borrowers

- 4.4 Analysis of Origination Volumes of Digital Lenders

- 4.4.1 Personal Loans

- 4.4.2 SME Loans

- 4.5 Analysis of Subprime Borrowers in the United States

- 4.5.1 Distribution by States

- 4.5.2 Demographic Breakdown by Age

- 4.5.3 Overall Shrinking of Subprime Population in the Country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Uptick of Potential Loan Purchasers with 'Digital Behavior'

- 5.1.2 Increasing Disposable Income

- 5.2 Market Restraints

- 5.2.1 Security Concerns involved in Digital Lending

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Business

- 6.1.1.1 Business Digital Lending Market Dynamics

- 6.1.1.2 Business Digital Lending Ecosystem (including both Startups and Incumbents)

- 6.1.1.3 Market Size Estimates and Forecasts

- 6.1.2 Consumer

- 6.1.2.1 Consumer Digital Lending Market Dynamics

- 6.1.2.2 Consumer Digital Lending Models (Payday Lenders, Peer-to-peer Loans, Personal Loans, Auto Loans, and Student Loans)

- 6.1.2.3 Consumer Digital Lending Ecosystem (including both Startups and Incumbents)

- 6.1.2.4 Market Size Estimates and Forecasts

- 6.1.1 Business

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bizfi, LLC.

- 7.1.2 OnDeck Capital Inc.

- 7.1.3 Prosper Marketplace Inc.

- 7.1.4 LendingClub Corp.

- 7.1.5 Social Finance Inc. (SoFi)

- 7.1.6 Upstart Network Inc.

- 7.1.7 Kiva Microfunds

- 7.1.8 Kabbage Inc.

- 7.1.9 Lendingtree Inc.

- 7.1.10 CAN Capital Inc.