|

市場調查報告書

商品編碼

1644310

數位借貸:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Digital Lending - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

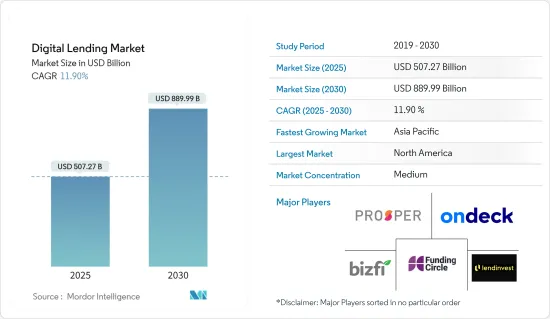

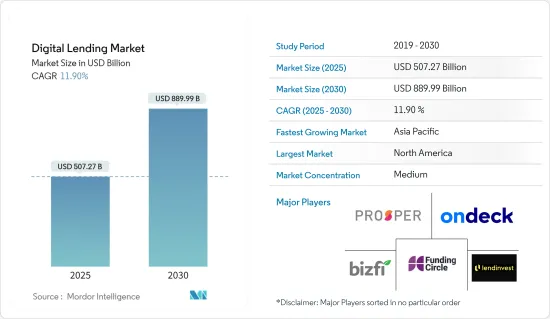

預計 2025 年數位借貸市場規模為 5,072.7 億美元,到 2030 年將達到 8,899.9 億美元,預測期內(2025-2030 年)的複合年成長率為 11.9%。

主要亮點

- 數位借貸,也稱為金融科技借貸,透過線上平台獲得貸款,使借貸流程更加有效率。借款人可以透過網路申請貸款,無需親自前往銀行。這種數位化方法消除了對銀行等傳統仲介業者的需求,並大大減輕了行政負擔。

- 隨著數位化在 BFSI 行業的快速應用,貸款格局在過去幾年發生了巨大變化。儘管傳統借貸形式在世界許多地方仍占主導地位,但數位解決方案提供商提供的優勢正日益為整個企業採用數位借貸解決方案和服務鋪平道路。

- 銀行和金融服務數位化帶來的各種好處正在改變消費者的期望和行為,這也是推動市場成長的主要因素。我們的客戶背景各異,需要融資用於各種目的,從個人貸款到小型企業融資到房屋抵押貸款。

- 此外,智慧型手機的廣泛使用等技術進步正在推動各行各業的終端用戶採用數位銀行。此外,人工智慧、機器學習和雲端處理等技術也使銀行和金融科技公司受益,因為它們可以處理大量客戶資訊。比較這些資料和資訊以獲得客戶所需的及時服務和解決方案的結果,從而有助於發展客戶關係。

- Aire、Kabbage 和 Kasisto 是一些最知名的全力投資人工智慧的金融新興企業。例如,Kabbage 使用人工智慧演算法評估向特定客戶貸款所涉及的所有風險,讓公司經理能夠在最短的時間內發放貸款。金融科技和銀行公司被要求個性化他們的客戶體驗,這進一步增加了對人工智慧的需求。

數位借貸市場的趨勢

消費領域將經歷顯著成長

- 根據全球領先的金融服務技術解決方案提供商 Fiserv Inc. 進行的最新期望與體驗消費者趨勢研究,過去兩年申請貸款的人中近三分之二是部分或全部通過在線方式申請的,與上一年相比有顯著成長。這一成長的關鍵部分是由於智慧型手機和平板電腦的使用日益增加。

- 數位借貸新興企業也開始提供教育和專業課程貸款,從個人借貸擴展到消費借貸。例如,總部位於班加羅爾的 Zest Money 正在大力投資專業教育貸款。該公司與 Upgrade、NMIMS、Great Learning、Acadgild 和 Edureka 等公司合作,為想要重新接受技能培訓的初級員工和中階管理人員提供資金。

- 千禧世代只有幾年工作經歷,沒有信用記錄(或信用記錄不佳),他們發現他們的貸款要么未獲核准,要么利率很高。此外,傳統銀行批准中小企業和大企業的貸款平均需要三到五週的時間,而平均兌現時間則接近三個月。這些挑戰正在推動客戶的數位行為轉向行動裝置來存取數位借貸應用程式。

- 政府監管也在強化消費者的數位行為。例如,2023 年 12 月,印度儲備銀行 (RBI) 宣布了監管數位貸款聚合機構並提高業務透明度的計畫。此舉凸顯了印度儲備銀行對受監管實體和相關貸款服務提供者監督的決心,以確保順利提供允許的信貸便利服務。

亞太地區成長強勁

- 信用合作社已經提供數位借貸服務很長一段時間了。但隨著新技術和消費貸款的快節奏發展,數位貸款為會員提供的不僅僅是無紙化流程,這一點比以往任何時候都更為重要。

- 2024 年 4 月,國家農業和農村發展銀行 (NABARD) 宣布與印度儲備銀行的子公司 RBIH 建立戰略合作夥伴關係,以簡化農業貸款的處理。 NABARD 計劃將其 e-KCC 貸款發放系統入口網站與儲備銀行創新中心 (RBIH) 開發的無摩擦信貸公共技術平台 (PTPFC) 結合。

- 在印度,智慧型手機的快速普及、網路的普及以及消費主義的轉變刺激了數位借貸公司的成長。目前,印度共有 338 家線上借貸新興企業,它們都試圖透過無縫流程縮小借貸雙方之間的差距。

- 此外,日本政府也推出計畫鼓勵公民採用無現金行為。政府已啟動舉措,到 2025 年將無現金付款提高到 40%。配合2019年10月1日消費稅由8%增加至10%,多項折扣制度也已實施。這些計劃為參與的商店提供補貼以安裝無現金付款終端,並為從註冊小型企業或專利權購買商品的消費者提供 2% 或 5% 的折扣。

數位借貸行業概況

數位借貸市場分散,有多家解決方案提供商,但沒有一家能夠佔多數。 Funding Circle Limited、On Deck Capital Inc.、Prosper Marketplace Inc.、LendInvest Limited 和 Bizfi LLC 等市場參與者正在進行多項創新,以改善其服務並最大限度地吸引市場。市場新興參與者正在策略性地籌集資金,以提供創新和技術整合的解決方案。市場參與者也將策略聯盟視為有利可圖的成長途徑。

- 2024年7月,領先的CRM供應商銷售團隊宣布計畫推出「面向印度的數位借貸」。該平台旨在使印度銀行和貸方能夠採用數位化方式進行消費者貸款。這樣,您可以簡化業務,降低成本,並消除管理分散、過時系統的挑戰。 「印度數位借貸」是專門針對印度市場量身定做的。此外,它還提供整合功能,讓銀行可以將財務資料與來自銷售團隊的客戶洞察相結合。

- 2024 年 5 月,PhonePe 在其應用程式內推出了一個安全的數位借貸平台。該平台為超過 5.35 億註冊用戶提供六種類別的貸款,包括共同基金、金融和汽車貸款。該貸款將與銀行、非銀行金融公司 (NBFC) 和金融科技公司網路合作提供,包括 Tata Capital、L&T Finance、Hero FinCorp 和 Muthoot Fincorp。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場趨勢

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 潛在貸款購買者的關鍵接觸點

- 新冠肺炎對數位借貸及相關市場的影響

第5章 市場動態

- 市場促進因素

- 越來越多潛在的貸款購買者正在採用數位化行為

- 市場挑戰

- 安全問題

第6章 市場細分

- 按類型

- 商業

- 商業數位借貸市場動態

- 商業數位借貸生態系統(包括新興企業和成熟企業)

- 按消費者

- 消費者數位借貸市場動態

- 消費者數位借貸模式(發薪日貸款人、P2P貸款、個人貸款、汽車貸款、學生貸款)

- 消費者數位借貸生態系統(包括新興企業和現有企業)

- 商業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Funding Circle Limited(Funding Circle Holdings PLC)

- Bizfi LLC

- On Deck Capital Inc.

- Prosper Marketplace Inc.

- LendInvest Limited

- LendingClub Corp.

- Zopa Limited

- Social Finance Inc.

- Upstart Network Inc.

- Kiva Microfunds

- Kabbage Inc.

- CAN Capital Inc.

- Lendingtree Inc.

- Kaspi Bank JSC

- Klarna Bank AB

- Ferratum Oyj

- Provident Bank(Provident Financial Services Inc.)

- International Personal Finance PLC(IPF)

- Oriente

- Faircent

- LenDenClub

- CapFloat Financial Services Private Limited

- Transactree Technologies Private Limited(LendBox)

- Monexo

- i-LEND

- Decimal Technologies Pvt. Ltd

第8章 投資分析及市場機會

The Digital Lending Market size is estimated at USD 507.27 billion in 2025, and is expected to reach USD 889.99 billion by 2030, at a CAGR of 11.9% during the forecast period (2025-2030).

Key Highlights

- Digital lending, also known as fintech lending, involves securing loans through online platforms, making the borrowing process more efficient. Rather than physically visiting a bank, borrowers can apply for loans online. This digital approach removes the need for traditional intermediaries, such as banks, and significantly reduces the burden of paperwork.

- The lending landscape has changed drastically over the years due to the rapid adoption of digitization in the BFSI industry. While the traditional form of lending still prevails in many parts of the world, the benefits provided by digital solution providers are increasingly paving the way for the adoption of digital lending solutions and services across enterprises.

- Another major factor driving the market's growth is the changing consumer expectations and behavior due to the several benefits of digitizing banking and financial services. Customers may hail from diversified backgrounds and require loans for various purposes, ranging from personal loans to SME finance and home loans.

- Furthermore, technological advancements, such as the proliferation of smartphones, have led to an increase in the adoption of digital banking across several end-user verticals. Also, technologies like artificial intelligence, machine learning, and cloud computing benefit banks and fintech as they can process vast amounts of customer information. This data and information are then compared to obtain results about timely services/solutions that customers want, which has aided in developing customer relations.

- Aire, Kabbage, and Kasisto are some of the most prominent financial industry startups that are fully investing in AI. For instance, Kabbage uses AI algorithms that assess all risks of lending money to a particular customer, allowing company managers to give loans in minimal time. The demand for personalization of their needs among consumers in fintech and banking companies has further strengthened the demand for AI.

Digital Lending Market Trends

The Consumer Segment to Witness Significant Growth

- According to the latest Expectations & Experiences consumer trends survey from Fiserv Inc., a leading global provider of financial services technology solutions, almost two-thirds of people who have applied for loans in the past two years do so either partially or fully online, representing a significant increase from the previous year. A central portion of this growth is due to the increasing usage of smartphones and tablets.

- Digital lending startups have also started giving out loans for education and professional courses, expanding from mainly focusing on personal loans to consumer lending space. For instance, Bengaluru-based Zest Money is betting big on lending for professional education purposes. The company partnered with players like Upgrade, NMIMS, Great Learning, Acadgild, and Edureka to provide funds to entry-level- or mid-level executives wanting to acquire new skill sets.

- Millennials with a few years of work experience and no credit history (or the new-to-credit segment) find their loans either unapproved or at high interest rates. Moreover, in traditional banks, the time to decide for small businesses and corporate lending averages between three and five weeks, and the average time to cash is nearly three months. Such challenges are driving customers' digital behavior to mobile devices to access digital lending applications.

- Government regulations also augment digital behavior among consumers. For instance, in December 2023, the Reserve Bank of India (RBI) announced plans to subject digital loan aggregators to a regulatory framework to enhance transparency in operations. This move underscores the RBI's commitment to overseeing its regulated entities and the lending service providers it collaborates with, ensuring the smooth provision of permissible credit facilitation services.

Asia-Pacific to Register Major Growth

- Digital lending has been available to credit unions for quite some time. However, with emerging technologies and the fast-paced nature of consumer lending, it is more important than ever that digital lending offers members more than a paperless process.

- In April 2024, the National Bank for Agriculture and Rural Development (NABARD) announced a strategic partnership with the Reserve Bank's subsidiary, RBIH, to streamline the processing of agricultural loans. NABARD is projected to merge its e-KCC loan origination system portal with the Public Tech Platform for Frictionless Credit (PTPFC) developed by the Reserve Bank Innovation Hub (RBIH).

- The rapid adoption of smartphones, internet access, and a shift toward consumerism in India helped fuel the growth of digital lending enterprises. Currently, there are 338 online lending start-ups in India that are trying to reduce the gap between lenders and creditors through a seamless process.

- Moreover, the Government of Japan is launching programs to inculcate cashless behaviors in citizens. The government launched an initiative to increase cashless payments to 40% by 2025. With the consumption tax increase from 8% to 10% on October 1, 2019, several discount schemes were implemented. These schemes subsidized the installation of cashless payment terminals for merchants and provided 2% or 5% discounts for consumers when purchasing from registered SMEs or franchise stores.

Digital Lending Industry Overview

The digital lending market is fragmented owing to the presence of several solution providers, none of which holds a majority share. Market players, such as Funding Circle Limited, On Deck Capital Inc., Prosper Marketplace Inc., LendInvest Limited, and Bizfi LLCare, are making several innovations to improve their offerings and gain maximum market traction. The emerging players in the market are strategically raising funds to provide innovative and technologically integrated solutions. The market players also view strategic collaborations as a lucrative path toward growth.

- July 2024: Salesforce, a leading CRM provider, unveiled its plans to launch 'Digital Lending for India.' This platform is designed to enable banks and lenders in India to adopt digital approaches to consumer lending. By doing so, they can streamline operations, reduce costs, and eliminate the challenges of managing outdated, disparate systems. 'Digital Lending for India' is tailored exclusively for the Indian market. Furthermore, it offers integration capabilities, allowing banks to merge their financial data with Salesforce's customer insights.

- May 2024: PhonePe launched its secure digital lending platform within its app. This platform allows over 535 million registered users to access loans across six categories, including mutual fund, gold, and car loans. The loans are provided in partnership with a network of banks, non-banking financial companies (NBFCs), and other fintech companies, including Tata Capital, L&T Finance, Hero FinCorp, and Muthoot Fincorp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKETDYNAMICS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Important Touchpoints of Potential Loan Purchasers

- 4.5 Impact of COVID-19 on the Digital Lending and Allied Markets

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Potential Loan Purchasers with Digital Behavior

- 5.2 Market Challenges

- 5.2.1 Security concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Business

- 6.1.1.1 Business Digital Lending Market Dynamics

- 6.1.1.2 Business Digital Lending Ecosystem (Including both Startups and Incumbents)

- 6.1.2 By Consumer

- 6.1.2.1 Consumer Digital Lending Market Dynamics

- 6.1.2.2 Consumer Digital Lending Models (Payday Lenders, Peer-to-Peer Loans, Personal Loans, Auto Loans, and Student Loans)

- 6.1.2.3 Consumer Digital Lending Ecosystem (Including both Startups and Incumbents)

- 6.1.1 Business

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Funding Circle Limited (Funding Circle Holdings PLC)

- 7.1.2 Bizfi LLC

- 7.1.3 On Deck Capital Inc.

- 7.1.4 Prosper Marketplace Inc.

- 7.1.5 LendInvest Limited

- 7.1.6 LendingClub Corp.

- 7.1.7 Zopa Limited

- 7.1.8 Social Finance Inc.

- 7.1.9 Upstart Network Inc.

- 7.1.10 Kiva Microfunds

- 7.1.11 Kabbage Inc.

- 7.1.12 CAN Capital Inc.

- 7.1.13 Lendingtree Inc.

- 7.1.14 Kaspi Bank JSC

- 7.1.15 Klarna Bank AB

- 7.1.16 Ferratum Oyj

- 7.1.17 Provident Bank (Provident Financial Services Inc.)

- 7.1.18 International Personal Finance PLC (IPF)

- 7.1.19 Oriente

- 7.1.20 Faircent

- 7.1.21 LenDenClub

- 7.1.22 CapFloat Financial Services Private Limited

- 7.1.23 Transactree Technologies Private Limited (LendBox)

- 7.1.24 Monexo

- 7.1.25 i-LEND

- 7.1.26 Decimal Technologies Pvt. Ltd