|

市場調查報告書

商品編碼

1644410

半導體和電子製造:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Semiconductor and Electronic Parts Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

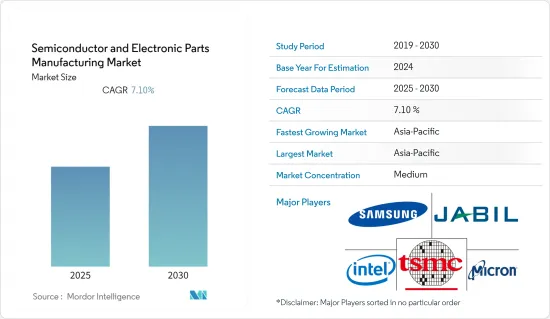

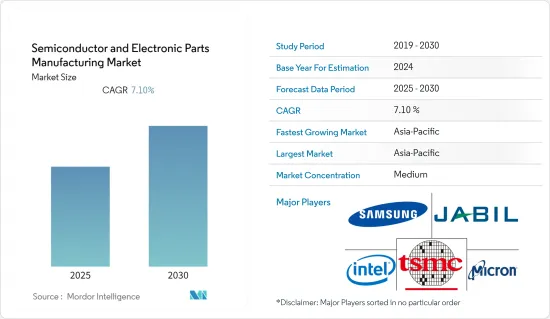

預測期內半導體和電子元件製造市場預計複合年成長率為 7.1%

關鍵亮點

- 半導體和電子製造包括電子和半導體元件以及印刷基板(PCB)組件的設計、工程、組裝、製造和測試服務。對於目的地設備製造商來說,它簡化了對自動化組裝設備的投資。在目前的市場情況下,IC、PCB 和其他封裝幾乎用於所有電子設備,如筆記型電腦、智慧型手機、電腦等,因此對製造的需求增加

- 物聯網 (IoT) 設備的興起預計將迫使半導體產業增加對半導體和電子元件製造的投資,以滿足對這些產品日益成長的需求。半導體公司(包括代工廠和OEM)在半導體設備上投入的大量資金就證明了這一點。例如,根據SEMI的數據,預計2022年全球半導體製造設備總銷售額將達到1,175億美元,較2021年創下的1,025億美元的產業高點成長14.7%。

- 由於良好的生態系統和政府法規支持市場成長,亞洲預計將繼續主導半導體製造市場。此外,亞太地區各國政府正採取舉措促進區域半導體製造市場的發展。例如,2021年,印度政府宣布了一項7,600億印度盧比的一攬子計劃,以促進該國半導體製造業的發展。

- 然而,由於半導體與電子元件微型化等因素,其製造流程變得越來越複雜,對半導體與電子元件製造供應商提出了重大挑戰。

- COVID-19 疫情衝擊了半導體和電子元件製造業,由於大面積工廠封鎖和勞動力有限,嚴重影響了供應商的製造能力。不過,隨著大多數國家所有半導體製造地都已恢復正常營運,受市場需求增加的推動,預計受調查市場也將呈現上升的成長趨勢。

半導體和電子元件製造市場趨勢

消費性電子產品佔很大佔有率

- 消費性電子是半導體和電子元件需求不斷成長的主要產業之一。網路和其他數位科技的普及率不斷提高,以及科技進步使得這些設備變得更實惠,是推動消費性電子產品需求的關鍵因素之一。

- 這一領域的趨勢是各種設備中電池壽命延長的採用率日益提高。製造商正在增加設備的電池容量,對更快充電時間的需求正在推動該行業的市場成長。智慧型手機是該領域半導體和電子元件的主要消費者。近年來,智慧型手機市場競爭異常激烈。製造商越來越注重為設備添加附加功能和特性,從而推動了對半導體和電子元件的需求。

- 此外,隨著 5G 連接的日益普及以及消費者對數位技術的日益採用,智慧型手機的普及率預計將大幅成長,為研究市場的參與企業創造新的機會。例如,根據 GSMA 的數據,智慧型手機普及率佔總行動連線的比例預計將從 2021 年的 75% 成長到 2025 年的 84%。

- 這一趨勢在個人電腦和穿戴式裝置中也有所體現。製造商希望他們的客戶減少插電時間。三星、Oppo 和摩托羅拉等製造商都提供開箱即用的快速充電適配器,使快速充電成為其行銷策略的重要組成部分。電源供應器在更高的電壓和電流下工作,這意味著需要使用更多的半導體和電子元件。

- 此外,功能升級、性能改進的設備也定期推向市場。這種對增強功能的需求意味著將數千個電子元件裝入這些機器有限的空間內,這進一步增加了對半導體和電子元件製造服務的需求。

亞太地區將經歷最高成長

- 亞太地區是全球半導體和電子元件製造的主要市場之一,在家用電子電器、半導體以及其他 IT 和通訊和設備製造業佔有重要地位。此外,家用電子電器、汽車等半導體和電子元件主要終端用戶產業的龐大消費群也是支持受調查市場成長的主要因素。

- 中國是全球半導體和電子元件製造的關鍵市場之一,得益於其在家用電子電器、半導體和其他通訊設備及裝置製造業的強勢地位。根據半導體產業協會(SIA)統計,2021年中國仍為半導體最大與前一年同期比較市場,銷售額達1,925億美元,年增27.1%。

- 國內半導體公司正在進行大量投資以維持現有的市場地位,包括擴大生產能力以及遷移技術節點和晶圓尺寸。此外,國內電子製造公司在軟性PCB和剛撓結合PCB等技術開發方面也取得了長足進展。隨著PCB製造技術的不斷升級,中國的產品結構正在穩定最佳化。此外,人工智慧、巨量資料、雲端運算等一系列新興策略性產業屬於先進製造業,對產品設計開發的依賴增強。

- 亞太其他主要國家也出現了類似的趨勢。例如,為了使印度在電子製造業中實現自力更生,印度政府宣布了多項基於績效的獎勵,並做出了多項監管改革。預計這些系統將為該國研究市場的成長做出重大貢獻。

半導體和電子元件製造業概況

由於參與企業和新參與企業的混合,半導體和電子元件製造市場呈現中等程度的細分。市場上的供應商正在推出創新解決方案、建立夥伴關係並進行合併,以增加市場佔有率並擴大其地理影響力。主要市場參與企業包括 Jabil Inc.、英特爾公司、三星電子和台積電。

- 2022 年 9 月-印度礦業投資公司 Vedanta 與印度古吉拉突邦簽署了兩份合作備忘錄,以建立半導體製造廠。在韋丹塔和中國科技公司富士康同意在印度成立合資公司後,該公司決定在古吉拉突邦設立計劃。

- 2022 年 9 月——半導體巨頭、唯一一家美國記憶體製造商美光科技公司宣布,計劃在未來十年投資約 150 億美元在愛達荷州博伊西建造一座新工廠,用於製造先進的記憶體。該製造部門將專注於滿足國內資料中心、汽車和其他細分市場所需的尖端記憶體的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19影響評估

第5章 市場動態

- 市場促進因素

- 小型化進展

- 採用工業物聯網、區塊鏈和增強通訊等新技術

- 市場問題

- 競爭日益激烈,政府及環境法規日益嚴格

- 智慧財產權侵權

第6章 半導體及電子元件產品展望

- 邏輯半導體

- 模擬半導體

- 記憶體半導體

- 電子連接器和感應器

- 裸印刷電路基板

- 其他

第7章 市場區隔

- 按組件

- 裝置

- 前端設備(微影、晶圓表面製備、晶圓清洗、薄膜沉積)

- 後端設備(組裝與封裝、切割、計量、鍵結、晶圓測試)

- 軟體

- 服務

- 電子設計與工程

- 電子組裝

- 電子製造業

- 其他

- 裝置

- 按應用

- 通訊及網路設備

- 運輸

- 家用電子電器

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 義大利

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 其他

- 北美洲

第8章 競爭格局

- 公司簡介

- Jabil Inc.

- Intel Corporation

- Samsung Electronics Co. Ltd

- Taiwan Semiconductor Manufacturing Company Limited

- SK Hynix Inc.

- Micron Technology Inc.

- Qualcomm Technologies Inc.

- Broadcom Inc.

- Texas Instruments Inc.

- Sumitronics Corporation

- SIIX Corporation

- Flex Ltd

- Nortech Systems Incorporated

第9章投資分析

第10章:投資分析市場未來展望

簡介目錄

Product Code: 71615

The Semiconductor and Electronic Parts Manufacturing Market is expected to register a CAGR of 7.1% during the forecast period.

Key Highlights

- The manufacturing of semiconductor and electronic parts entails design and engineering, assembly, manufacturing, and testing services for electronic and semiconductor components and printed circuit board (PCB) assemblies. Aimed at original equipment manufacturers, it simplifies investment in automated assembly equipment. In the current market scenario, as almost all electronic devices, including laptops, smartphones, and computers, use ICs, PCBs, and other packages, the demand for manufacturing is rising.

- The increasing number of Internet of Things (IoT) devices is expected to force the semiconductor industry to increase its investment in semiconductor and electronic parts manufacturing to fulfill the growing demand for these products. This is evident from the fact that semiconductor companies (including foundries and OEMs) are spending considerable amounts on semiconductor equipment. For instance, according to SEMI, the global sales of total semiconductor manufacturing equipment are forecast to reach USD 117.5 billion in 2022, rising 14.7% from the previous industry high of USD 102.5 billion in 2021.

- Asia is expected to continue dominating the semiconductor manufacturing market as the favorable ecosystem and government regulations support the market's growth. Additionally, governments across various countries of the Asia Pacific region are taking initiatives to boost the local semiconductor manufacturing markets. For instance, in 2021, the government of India unveiled an INR 76,000 crore package to facilitate the country's semiconductor manufacturing industry.

- However, the factors such as the miniaturization of semiconductors and electronic components are further increasing the complexity of the manufacturing processes, which is among the significant challenges looming over the vendors involved in the manufacturing of semiconductors and electronic parts.

- The COVID-19 outbreak impacted the semiconductor and electronic part manufacturing industry, as the widespread lockdown and restriction on the utilization of the workforce in factories significantly impacted the manufacturing capabilities of the vendors. However, with most countries restoring their normal operations at all their semiconductor manufacturing sites, the studied market is also expected to witness an upward growth trend driven by increasing market demand.

Semiconductor & Electronic Parts Manufacturing Market Trends

Consumer Electronics to Hold a Significant Share

- Consumer electronics is among the leading industries wherein the demand for semiconductors and electronic parts is increasing. The increasing penetration of the internet and other digital technologies, along with technological advancements making these devices affordable, are among the key factors driving the demand for consumer electronic products.

- This segment's trend has been to increase the adoption of various devices with an extended battery life of the device. Manufacturers are extending the battery capacity of their devices, and the demand for shorter charging is driving the market growth in this industry. The smartphone is this segment's major consumer of semiconductors and electronic parts in this segment. The smartphone has been a very competitive market in recent years; the manufacturers are increasingly focusing on including additional features and functionalities in the devices, driving the demand for semiconductor and electronic components.

- Furthermore, with the adoption of smartphones expected to witness significant growth, owing to the growing availability of 5G connectivity and increasing penetration of digital technologies among consumers, new opportunities are on the horizon for the players operating in the studied market. For instance, according to GSMA, smartphone penetration, as a percentage of total mobile connections, is expected to grow from 75% in 2021 to 84% in 2025.

- The trend has been the same for PC and wearable devices. The manufacturers want their customers to spend less time plugged in. The manufacturers like Samsung, Oppo, and Motorola, provide these fast charge adapters out of the box, and fast charging is the key to their marketing strategy. As the power adapters operate at a much higher voltage and current increased number of semiconductor and electronic components are used.

- Moreover, devices with upgraded functionalities and increased performance are entering the market at regular intervals. The requirement for such enhanced functionalities has led to the inclusion of thousands of electronic components in a limited amount of space inside these devices, which is further increasing the demand for semiconductor and electronic parts manufacturing services.

Asia-Pacific to Witness Highest Growth

- The Asia-Pacific region is one of the world's significant markets for semiconductors and electronic parts manufacturing, owing to its strong position in consumer electronics, semiconductors, and other telecommunications and equipment manufacturing industries. Furthermore, a large consumer base of major end-user industries of semiconductor and electronic parts, such as consumer electronics and automotive, etc., is another major factor supporting the growth of the studied market.

- China is one of the significant global markets for semiconductor and electronic parts manufacturing, owing to its strong position in the consumer electronics, semiconductor, and other telecommunications devices and equipment manufacturing industries. According to the Semiconductor Industry Association (SIA), in 2021, China remained the largest individual market for semiconductors, with sales totaling USD 192.5 billion, an increase of 27.1% compared to the previous year.

- Domestic semiconductor companies have been spending significant amounts to maintain their current market position in terms of increasing their capacity and transitioning between technology nodes and wafer sizes. Moreover, the electronic manufacturing companies in the country made achievements in developing technologies, such as Flex PCB and Flex rigid PCB. With the continuous upgrades of PCB manufacturing technology, China experiences a stable and optimized product structure. Furthermore, a series of newly established strategic industries in the field of AI, Big Data, and cloud computing belong to advanced manufacturing, thus, leading to the dependence on product design developments.

- A similar trend has been observed across other major countries of the Asia Pacific region. For instance, to make India self-reliant in electronic manufacturing, the government of India has announced several performance-linked incentives and has made several regulatory changes. These schemes are expected to contribute considerably towards the growth of the studied market in the country.

Semiconductor & Electronic Parts Manufacturing Industry Overview

The Semiconductor and Electronic Parts Manufacturing Market is moderately fragmented due to a mixed presence of established and new players. The vendors operating in the market are launching innovative solutions, forming partnerships, and mergers to increase their market share and expand their geographical presence. Some major market players include Jabil Inc., Intel Corporation, Samsung Electronics Co. Ltd, and TSMC.

- September 2022 - Vedanta, an Indian mining investment company, signed two memoranda of understanding with the Indian state of Gujarat to set up a semiconductor fabrication plant. The decision to set up the project in Gujarat came after Vedanta and Foxconn, a Chinese technology company, agreed to form a joint venture (JV) company in India.

- September 2022 - Micron Technology Inc., a leading semiconductor company and the only U.S.-based memory manufacturer, announced plans to invest approximately USD 15 billion through the decade's end to construct a new fab for leading-edge memory manufacturing in Boise, Idaho. The manufacturing unit will focus on fulfilling the domestic demand for leading-edge memory required for market segments like data-center, automotive, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment on the impact due to COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Miniaturization

- 5.1.2 Adoption of Emerging Technologies in IIoT, Blockchain, and Enhanced Communication

- 5.2 Market Challenges

- 5.2.1 Intensifying Competition and Rigorous Government and Environmental Regulations

- 5.2.2 Intellectual Property Rights Infringements

6 SEMICONDUCTOR AND ELECTRONIC PARTS PRODUCT LANDSCAPE

- 6.1 Logic Semiconductor

- 6.2 Analog Semiconductor

- 6.3 Memory Semiconductor

- 6.4 Electronic Connectors and Inductors

- 6.5 Bare Printed Circuit Boards

- 6.6 Other Product Types

7 MARKET SEGMENTATION

- 7.1 By Component

- 7.1.1 Equipment

- 7.1.1.1 Front-End Equipment (Lithography, Wafer Surface Conditioning, Wafer Cleaning, and Deposition)

- 7.1.1.2 Back-End Equipment (Assembly and Packaging, Dicing, Metrology, Bonding, and Wafer Testing)

- 7.1.2 Software

- 7.1.3 Services

- 7.1.3.1 Electronics Design and Engineering

- 7.1.3.2 Electronics Assembly

- 7.1.3.3 Electronics Manufacturing

- 7.1.3.4 Other Service Types

- 7.1.1 Equipment

- 7.2 By Application

- 7.2.1 Communications and Network Equipment

- 7.2.2 Transportation

- 7.2.3 Consumer Electronics

- 7.2.4 Other Applications

- 7.3 By Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 United Kingdom

- 7.3.2.2 Italy

- 7.3.2.3 Germany

- 7.3.2.4 France

- 7.3.2.5 Rest of Europe

- 7.3.3 Asia-Pacific

- 7.3.3.1 China

- 7.3.3.2 Japan

- 7.3.3.3 South Korea

- 7.3.3.4 India

- 7.3.3.5 Rest of Asia-Pacific

- 7.3.4 Rest of the World

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Jabil Inc.

- 8.1.2 Intel Corporation

- 8.1.3 Samsung Electronics Co. Ltd

- 8.1.4 Taiwan Semiconductor Manufacturing Company Limited

- 8.1.5 SK Hynix Inc.

- 8.1.6 Micron Technology Inc.

- 8.1.7 Qualcomm Technologies Inc.

- 8.1.8 Broadcom Inc.

- 8.1.9 Texas Instruments Inc.

- 8.1.10 Sumitronics Corporation

- 8.1.11 SIIX Corporation

- 8.1.12 Flex Ltd

- 8.1.13 Nortech Systems Incorporated

9 INVESTMENT ANALYSIS

10 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219