|

市場調查報告書

商品編碼

1716561

汽車通風口市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Vents Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

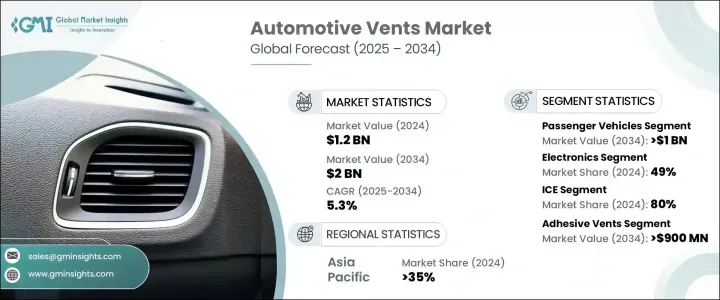

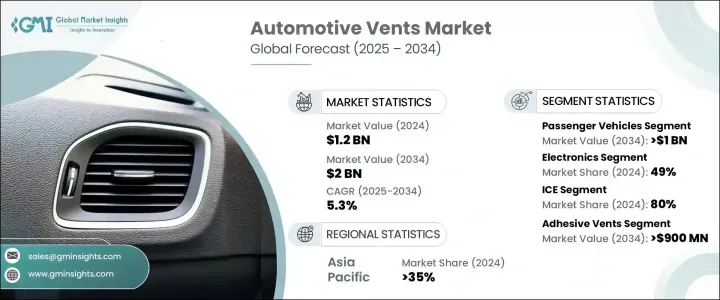

2024 年全球汽車通風口市場規模達到 12 億美元,預計 2025 年至 2034 年的複合年成長率為 5.3%。這一成長主要得益於電動車 (EV) 的激增,電動車需要專門的通風解決方案來提高高壓電池和複雜電子設備的安全性和性能。由於電動車電池會產生大量熱量,因此有效通風以保持壓力平衡、防止濕氣侵入和降低熱問題風險的需求比以往任何時候都更加重要。隨著電動車的興起,汽車電子設備日益複雜,尤其是連網和自動駕駛汽車技術的出現,促進了市場的擴張。現代車輛現在配備了眾多感測器、高級駕駛輔助系統 (ADAS) 和高性能資訊娛樂系統。所有這些組件都需要高效的通風才能可靠運行,因為它們需要免受濕氣、灰塵和溫度波動等環境因素的影響,從而延長其使用壽命並確保最佳功能。

此外,對無縫座艙體驗的需求不斷成長,促使製造商不斷創新並提供通風解決方案,以提高舒適度和整體座艙空氣品質。這些發展符合消費者對改善車輛環境和更嚴格的排放和能源效率法規日益成長的期望。製造商正在透過推進通風技術來滿足汽車行業不斷變化的需求。對可靠耐用的通風解決方案的需求不斷增加,也是自動化和連接性在車輛中的作用不斷擴大的直接結果,這進一步擴大了對支持高科技汽車系統的有效通風系統的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 20億美元 |

| 複合年成長率 | 5.3% |

市場按車輛類型細分為乘用車和商用車,其中乘用車到 2024 年將佔 75% 的佔有率。該細分市場的成長主要歸因於全球個人交通需求的不斷成長以及汽車技術的不斷進步。同時,就推進類型而言,市場分為內燃機 (ICE) 汽車和電動車。雖然 2024 年內燃機汽車佔據了 80% 的市場佔有率,但預計未來幾年電動車領域將經歷更快的成長。儘管內燃機汽車憑藉其完善的基礎設施、更長的行駛里程以及更熟悉的加油流程佔據主導地位,但電動車憑藉其不斷擴展的技術功能繼續吸引消費者的興趣。

2024 年,亞太汽車通風口市場佔有 35% 的佔有率,其中中國憑藉其巨大的生產能力和全球最大汽車消費國的地位發揮主導作用。中國政府透過各種獎勵措施、補貼和擴大充電基礎設施等方式大力支持電動車,讓電動車更加普及且價格更實惠。此外,電池技術的進步進一步加強了中國在全球電動車市場的領導地位,為該地區汽車通風解決方案的發展奠定了堅實的基礎。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 通風口提供者

- 經銷商

- 最終用途

- 利潤率分析

- 價格趨勢

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 電動車的普及率不斷提高

- 車輛電子和資訊娛樂系統日益複雜

- 對增強座艙舒適度和氣候控制的需求

- 更嚴格的排放法規和燃油效率標準

- 產業陷阱與挑戰

- 先進透氣材料和技術成本高昂

- 不斷發展的車輛設計帶來複雜的整合要求

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 聚四氟乙烯(PTFE)

- 聚丙烯(PP)

- 聚乙烯(PE)

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 蓋子通風口

- 過濾器通風口

- 黏性透氣膜

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車(LCV)

- 重型商用車(HCV)

第8章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電動車

- 純電動車(BEV)

- 插電式混合動力電動車(PHEV)

- 混合動力電動車(HEV)

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 動力總成部件

- 電子產品

- 燈光

- 內部和外部組件

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Ascencione

- Berghof

- CREHERIT

- Donaldson

- Hangzhou IPRO

- Interstate Specialty Products

- ITW Automotive

- LTI Atlanta

- Mann Hummel

- Mutares SE

- Nifco

- Nitto Denko

- Novares

- Parker Hannifin

- Porex

- Porvent

- Shenzhen Milvent Technology

- Toyoda Gosei

- WL Gore & Associates

- Weber

The Global Automotive Vents Market reached USD 1.2 billion in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2034. This growth is primarily fueled by the surging adoption of electric vehicles (EVs), which require specialized venting solutions to enhance the safety and performance of high-voltage batteries and intricate electronics. As EV batteries generate significant heat, the need for effective venting to maintain pressure balance, prevent moisture intrusion, and reduce the risk of thermal issues is more critical than ever. Alongside the rise of EVs, the increasing complexity of automotive electronics, especially with the emergence of connected and autonomous vehicle technology, is contributing to the market's expansion. Modern vehicles now feature numerous sensors, advanced driver-assistance systems (ADAS), and high-performance infotainment systems. All these components require efficient ventilation to operate reliably, as they need protection from environmental factors like moisture, dust, and temperature fluctuations, thereby extending their lifespan and ensuring optimal functionality.

Additionally, the growing demand for seamless in-cabin experiences is driving manufacturers to innovate and provide venting solutions that enhance comfort and overall cabin air quality. These developments are in line with rising consumer expectations for enhanced vehicle environments and stricter emissions and energy efficiency regulations. Manufacturers are responding by advancing venting technology to meet the evolving needs of the automotive sector. This increasing demand for reliable and durable venting solutions is also a direct result of the expanding role of automation and connectivity in vehicles, which further amplifies the need for effective ventilation systems to support high-tech automotive systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2 Billion |

| CAGR | 5.3% |

The market is segmented by vehicle type into passenger and commercial vehicles, with passenger vehicles accounting for 75% of the share in 2024. The growth in this segment is largely attributed to the rising global demand for personal transportation and the ongoing advancements in automotive technology. Meanwhile, in terms of propulsion types, the market is divided between internal combustion engine (ICE) vehicles and electric vehicles. While ICE vehicles held 80% of the market share in 2024, the EV segment is expected to experience faster growth in the coming years. Despite ICE vehicles' dominance due to their established infrastructure, longer driving ranges, and more familiar refueling processes, EVs continue to capture the interest of consumers with their expanding technological features.

The Asia Pacific Automotive Vents Market held a significant 35% share in 2024, with China playing a leading role due to its enormous production capacity and position as the world's largest automotive consumer. The Chinese government's robust support for EVs, through various incentives, subsidies, and the expansion of charging infrastructure, has made EVs more accessible and affordable. Moreover, advancements in battery technology have further strengthened China's leadership in the global EV market, setting a solid foundation for the growth of automotive venting solutions in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material providers

- 3.2.2 Vent providers

- 3.2.3 Distributors

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Price trends

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing adoption of EVs

- 3.8.1.2 Growing complexity of vehicle electronics and infotainment system

- 3.8.1.3 Demand for enhanced cabin comfort and climate control

- 3.8.1.4 Stricter emission regulations and fuel efficiency standards

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High cost of advanced venting materials and technologies

- 3.8.2.2 Complex integration requirements with evolving vehicle designs

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Polytetrafluoroethylene (PTFE)

- 5.3 Polypropylene (PP)

- 5.4 Polyethylene (PE)

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Cap vents

- 6.3 Filter vents

- 6.4 Adhesive vents

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Electric vehicles

- 8.3.1 Battery Electric Vehicles (BEV)

- 8.3.2 Plug-in Hybrid Electric Vehicles (PHEV)

- 8.3.3 Hybrid Electric Vehicles (HEV)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Powertrain components

- 9.3 Electronics

- 9.4 Lighting

- 9.5 Interior and exterior components

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Ascencione

- 11.2 Berghof

- 11.3 CREHERIT

- 11.4 Donaldson

- 11.5 Hangzhou IPRO

- 11.6 Interstate Specialty Products

- 11.7 ITW Automotive

- 11.8 LTI Atlanta

- 11.9 Mann Hummel

- 11.10 Mutares SE

- 11.11 Nifco

- 11.12 Nitto Denko

- 11.13 Novares

- 11.14 Parker Hannifin

- 11.15 Porex

- 11.16 Porvent

- 11.17 Shenzhen Milvent Technology

- 11.18 Toyoda Gosei

- 11.19 W. L. Gore & Associates

- 11.20 Weber