|

市場調查報告書

商品編碼

1644372

印度的自動化物料輸送(AMH):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Automated Material Handling (AMH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

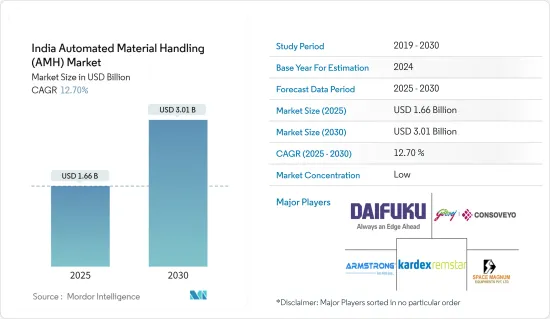

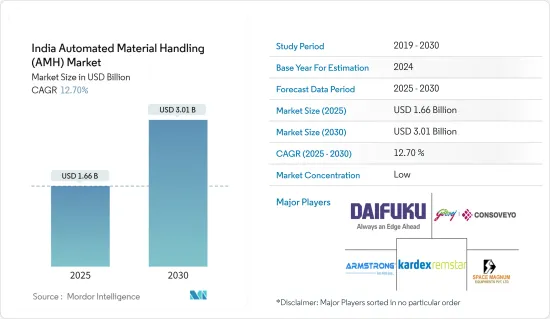

印度自動化物料輸送(AMH) 市場規模預計在 2025 年為 16.6 億美元,預計到 2030 年將達到 30.1 億美元,預測期內(2025-2030 年)的複合年成長率為 12.7%。

從物料輸送程序發展而來的一個想法是自動化物料輸送(AMH)。它使用各種機器協助製造工廠的工人將成品運送到倉庫或在組裝站之間移動組裝產品。

主要亮點

- 由於電子商務產業的成長,預測期內對自動化物料輸送(AMH) 設備的需求預計將大幅成長。隨著越來越多的人轉向網路購物,客戶期望不斷變化,以及網上零售商之間的激烈競爭,對準確、快速、高效的客戶服務以提供所購買的產品的需求日益增加。

- 由於產品選擇的增加以及關鍵產業對自動化物料輸送(AMH) 設備的需求不斷增加,整個全部區域的市場正在擴大。

- 生產商還可以採用工業 4.0 和其他數位技術(例如在零售業)來實現這一目標。印度的產品消費方式發生了重大變化。預計不斷成長的中階人口將推動對分類系統的需求,以滿足整體零售市場的擴張。

- 此外,由於許多行業的產品供應和新興企業的增加,對自動化物料輸送(AMH) 設備的需求也在增加。

- 然而,價格上漲、高資本投入、設備和系統維護成本高以及AMH設備市場的崩潰等問題可能會對公司的整體收益不利影響,因為生產會延遲整個生產過程,導致解決方案損失和工廠性能不佳,從而阻礙市場成長。

- 印度各地的新冠疫情和封鎖規定對工業活動產生了影響。封鎖造成的一些後果包括供應鏈中斷、製造所需原料短缺、勞動力短缺、價格波動可能推高生產成本並超出預算以及運輸問題。

印度自動化物料輸送(AMH) 市場趨勢

工業 4.0 投資預計將推動對自動化和物料輸送的需求,從而推動市場

- 製造業對COVID-19危機的因應將導致對工業4.0的投資增加,從而大大提升製造自動化市場的成長潛力。工業公司將擴大採用自動化組裝、即時工廠監控工具和製造資料收集系統,以便用更少的員工來管理他們的設施。

- 此外,機器人系統和其他自動化物料輸送(AMH) 設備在航空領域也被廣泛應用。由於安全需求的不斷增加和隨之而來的更嚴格標準的採用,自動行李處理系統在機場變得越來越普遍。

- 汽車產業在物料輸送方面投入了更多資金,主要包括用於點焊和相關操作的機器人等自動化設備。在食品和飲料行業,自動化系統擴大被引入製造、包裝和分銷過程中。

- 此外,Honeywell國際公司去年 11 月推出了一種新型自動儲存和搜尋系統,該系統利用人工智慧和機器學習來幫助倉庫和配送中心營運商跟上電子商務前所未有的成長。

- 另一方面,物料輸送機器人可以將工具或零件從一個位置或機器供應、運輸或卸載到另一個位置或機器。機器人技術如今在包裝領域得到更廣泛的應用,因為它們可以連續工作而不會感到疲勞。

零售/倉儲/物流中心預計將佔很大佔有率

- 電子商務預計將受到數位化的推動,這將增加對 AMH 的需求。印度都市區中超級市場和大賣場的興起以及都市區房地產價格的上漲,促使倉庫和物流中心選擇自動化,以保持競爭力並降低與長期儲存相關的成本。

- 隨著眾多新參與企業,印度零售業正在發展成為最具活力和發展最快的行業之一。它佔國內生產總值的10%以上,並提供了約8%的就業機會。印度是全球第五大零售業目的地。根據IBEF預測,到2026年印度電子商務市場規模將成長至2,000億美元。

- 印度約有 1.62 億公噸的農業倉庫、冷凍車設施、冷藏設施等。 NABARD 將對它們進行地圖繪製和地理標記工作。政府還提案按照倉庫發展監管局 (WDRA) 的規範建造倉庫。

- 此外,自動導引車 (AVG)、堆高機、揀選機、步行式堆高機和其他相關動力倉庫設備通常用於運輸各種產品。需要考慮的重要設計因素是地板的平整度和平整度、動態和地板負載。印度的物流中心對此類設備的需求很高。

印度自動化物料輸送(AMH) 產業概況

印度自動化物料輸送(AMH) 市場競爭激烈。這個市場有些分散,有一些大型參與者,例如 Godrej Consoveyo Logistics Automation Ltd、Daifuku India Private Limited、Kardex India Storage Solutions Private Limited 和 Armstrong Ltd。市場參與企業正在透過推出新產品和策略併購來擴大市場佔有率。

2022 年 8 月,Godrej Consoveyo Logistics Automation Ltd 與德國合資夥伴 Korber Supply Chain 合作,擴展其自動化供應鏈解決方案。自疫情爆發以來,工業領域自動化的應用發生了重大轉變。由於製造業的擴張、有組織的第三方物流、製藥、零售、電子商務、餐飲服務的發展以及消費模式的改變,亞洲逐漸成為供應鏈自動化的發展引擎,此外,各國政府也在投資低溫運輸和冷藏倉庫。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對產業生態系統的影響

- 印度倉儲業的發展

第5章 市場動態

- 市場促進因素

- 工業 4.0 投資推動對自動化和物料輸送的需求

- 市場挑戰

- 惡劣的工作條件和

獲得廉價勞動力

第6章 市場細分

- 解決方案類型

- 自動輸送機

- 自動儲存和搜尋系統 (AS/RS)

- 自動導引運輸車(AGV)

- 堆垛機/分類系統

- WMS/WCS解決方案

- 最終用戶

- 飛機場

- 製造業

- 零售/倉儲/物流中心

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- Daifuku India Private Limited(Incl. Vega Conveyors & Automation)

- Space Magnum Equipment Pvt. Ltd

- Godrej Consoveyo Logistics Automation Ltd(GCLA)

- Kardex India Storage Solutions Private Limited

- Armstrong Ltd.

- Falcon Autotech Private Limited

- GreyOrange Pte. Ltd.

- Addverb Technologies Inc.

- Hinditron Group

- The Hi-Tech Robotic Systemz Limited

- Bastian Solution Private Limited

第8章投資分析

第9章:未來市場展望

The India Automated Material Handling Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 3.01 billion by 2030, at a CAGR of 12.7% during the forecast period (2025-2030).

An idea that evolved from material handling procedures is automated material handling. It uses a variety of machinery to assist workers in a manufacturing facility in moving the finished product to storage facilities or moving the product assembled between assembly stations.

Key Highlights

- A substantial increase in demand for automated material handling equipment is also anticipated throughout the projection period due to the growing e-commerce sector. There is an increasing need for precise, quick, and efficient customer service to deliver the acquired product as more people turn to online shopping, customer expectations are continuously changing, and there is fierce rivalry among online retailing companies.

- The market is expanding across the region due to the expansion of product options and the increased demand for automated material-handling equipment among significant industries.

- Producers may also embrace Industry 4.0 and other digital technologies, such as retail, to accomplish this goal. The way that products are consumed in India is evolving significantly. The necessity and demand for sortation systems to meet the increased market across the retail industry are projected to be driven by the growing middle-class population.

- Additionally, the need for automated material handling equipment is being augmented by the growing number of product offerings and start-ups in numerous industries.

- However, issues similar to the rise in prices, high expenditure on capital, and high maintenance costs of equipment and systems, along with the breakdown of AMH equipment, can negatively impact the company's overall earnings as production delays the entire production process, which resolution losses and decline in plant performance which may hamper the market growth.

- The COVID-19 outbreak and lockdown restrictions across India affected industrial activities. Supply chain interruptions, a scarcity of raw materials needed for manufacture, workforce shortages, pricing fluctuations that could drive up production costs and push them beyond budget, and shipping issues are a few consequences of a lockdown.

India Automated Material Handling Market Trends

Industry 4.0 Investments Driving the Demand for Automation and Material Handling is Expected to Drive Market

- Manufacturing's response to the COVID-19 crisis has increased investments in Industry 4.0, which will significantly boost the market's growth potential for manufacturing automation. Industrial enterprises will increasingly turn to automated assembly lines, real-time plant monitoring tools, and manufacturing data collection systems to manage their facilities with fewer employees.

- Additionally, the aircraft sector extensively uses robotic systems and other automated material-handling equipment. Because of the increased requirement for security and the ensuing adoption of strict criteria for achieving it, automated baggage handling systems are becoming more common in airports.

- The automotive sector has been growing its investments in material handling, mainly consisting of automated equipment like robots used for spot welding and associated operations. Players in the food and beverage business are employing automated systems more frequently for various manufacturing, packaging, and distribution processes in the area.

- Moreover, in November last year, Honeywell International Inc. announced a new automated storage and retrieval system that uses artificial intelligence and machine learning to allow warehouse and distribution center operators to better keep up with unprecedented e-commerce growth.

- In contrast, material-handling robots can feed, transport, or detach tools and components from one place or a machine to another. Robotics now has a wider range of uses in packaging since they can work continuously without getting tired.

Retail/Warehouse/Logistics Center is Expected to Hold Significant Share

- E-commerce is predicted to be fueled by digitization, and this will increase demand for AMH. To remain competitive and reduce the expenses associated with prolonged storage, warehouses and distribution centers are choosing automation due to the rise in supermarkets and hypermarkets in Indian cities and the rising cost of real estate in urban areas.

- The Indian retail industry has developed into one of the most dynamic and fast-paced sectors due to several new players' entries. It accounts for over 10% of the country's GDP and around 8% of the employment ratio. India is the world's fifth-largest global destination in retail space. According to IBEF, the Indian e-commerce market is expected to grow to USD 200 billion by 2026.

- India has an estimated USD 162 million MT of Agri warehousing, reefer van facilities, cold storage, etc. NABARD will take exercises to map and geo-tag them. Besides, the Government proposed to create warehousing in line with the Warehouse Development and Regulatory Authority (WDRA) norms.

- Further, Automated guided vehicles (AVGs), forklifts, order pickers, walkie-rider pallet jacks, and other related powered warehouse equipment are typically used in various product movements. The critical design factors to consider are floor levelness and flatness, power, and floor loading. Such equipment has a significant demand trend in the logistics centers in India.

India Automated Material Handling Industry Overview

The India Automated Material Handling (AMH) Market is quite competitive. It is a somewhat fragmented market with large individual companies like Godrej Consoveyo Logistics Automation Ltd, Daifuku India Private Limited, Kardex India Storage Solutions Private Limited, and Armstrong Ltd. Market participants are expanding their market share by releasing new products or engaging in strategic mergers and acquisitions.

In August 2022, Godrej Consoveyo Logistics Automation Ltd scaled up its automated supply chain solutions in partnership with German-based joint venture partner Korber Supply Chain. Since the epidemic, there has been a significant shift in the industry's usage of automation. The government has been investing in cold chain and cold storage facilities on top of the fact that Asia is emerging as a development engine for supply chain automation due to the expansion of the manufacturing sector, the development of organized 3PLs, the pharmaceutical, retail, e-commerce, and food service industries, as well as changing consumption patterns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Industry Ecosystem

- 4.5 Evolution of Warehousing Industry in India

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Industry 4.0 investments driving the demand for automation and material handling

- 5.2 Market Challenges

- 5.2.1 Harsh Operating Conditions and

Availability of Cheap Labor

6 MARKET SEGMENTATION

- 6.1 Solution Type

- 6.1.1 Automated Conveyor

- 6.1.2 Automated Storage & Retrieval System (AS/RS)

- 6.1.3 Automated Guided Vehicles (AGV)

- 6.1.4 Palletizer/Sortation Systems

- 6.1.5 WMS/WCS Solutions

- 6.2 End-User

- 6.2.1 Airport

- 6.2.2 Manufacturing

- 6.2.3 Retail/Warehouse/Logistics Center

- 6.2.4 Other End-User

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daifuku India Private Limited (Incl. Vega Conveyors & Automation)

- 7.1.2 Space Magnum Equipment Pvt. Ltd

- 7.1.3 Godrej Consoveyo Logistics Automation Ltd (GCLA)

- 7.1.4 Kardex India Storage Solutions Private Limited

- 7.1.5 Armstrong Ltd.

- 7.1.6 Falcon Autotech Private Limited

- 7.1.7 GreyOrange Pte. Ltd.

- 7.1.8 Addverb Technologies Inc.

- 7.1.9 Hinditron Group

- 7.1.10 The Hi-Tech Robotic Systemz Limited

- 7.1.11 Bastian Solution Private Limited