|

市場調查報告書

商品編碼

1687259

亞太地區 AMH:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)APAC AMH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

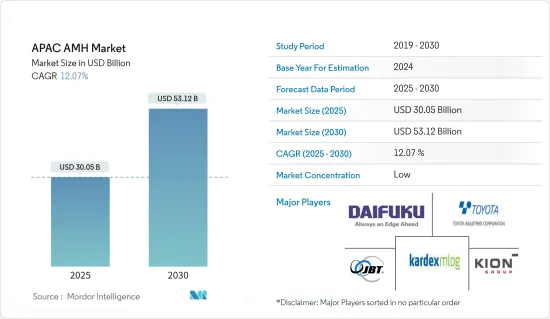

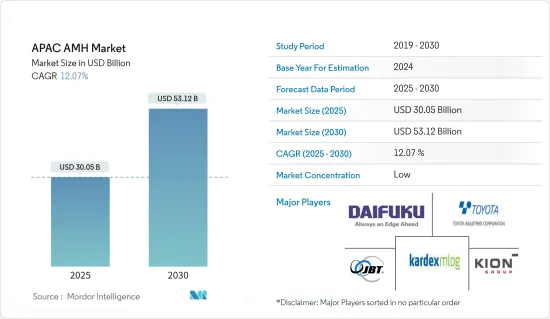

預計 2025 年亞太地區 AMH 市場規模為 300.5 億美元,預計到 2030 年將達到 531.2 億美元,預測期內(2025-2030 年)的複合年成長率為 12.07%。

亞太地區自動化物料輸送市場正日益以中國為核心,推動其強勁的經濟成長。製造業等產業推動了大部分經濟活動,供應鏈也變得越來越複雜。

主要亮點

- 一些亞太國家的倉庫空間變得越來越有限。預計這些地區將會出現更多的多層設施和走道狹窄的高層倉庫。這些趨勢預計將推動對物料輸送系統的需求。

- 印度等新興亞洲國家正大力投資物料輸送設備。據威斯康辛州經濟發展局稱,印度物料輸送設備(MHE)市場約佔該國施工機械行業13%的市場佔有率,近期呈現顯著成長趨勢。

- 亞太地區已成為全球最大的電子商務中心之一。受中國、印度和印尼中產階級人口不斷成長以及行動小工具普及的推動,該地區零售電子商務迅速成長。光是中國就佔全球零售電子商務銷售額的40%。

- 在食品和飲料行業,由於對自動化的需求不斷成長,自動化的引入正在增加。自動化技術使這些公司能夠以相對較少的時間和精力進行業務。例如,可口可樂在新加坡開設了一個價值約 5700 萬美元的倉庫,並安裝了自動儲存和搜尋系統。

- 印度等新興亞洲國家正大力投資物料輸送設備。據威斯康辛州經濟發展局稱,印度物料輸送設備(MHE)市場約佔該國施工機械行業13%的市場佔有率,近期呈現顯著成長趨勢。

- 新冠疫情重創了中國、日本和印度等主要國家,由於幾乎所有生產、物流和倉儲都處於封鎖狀態,預計將影響整個 2022 年的市場成長。標準操作程序已經發生了變化,帶來了社交距離和非接觸式操作的獨特挑戰。組織被迫限制勞動力以應對日益成長的需求。

亞太地區自動化物料輸送(AMH) 市場趨勢

機場佔據最大的市場佔有率

- 許多國家已經意識到投資機場的重要性,因為乘客更有可能在舒適、無壓力的環境中度過他們的時間和金錢。大型和小型機場使用輸送機和分類系統有效地減少了從報到登機過程中的許多不便。這確保客戶擁有無憂的體驗。

- 印度和中國由於人均GDP的不斷成長和國內航空連通性的不斷提高,成為該地區航空業發展的主要貢獻者。例如,根據國際民航組織的數據,亞太地區國內交通運輸佔有率為70%。

- 預計未來幾年中國航空市場將經歷顯著成長,因為中國三大航空公司——中國國際航空、中國南方航空和中國東方航空——均制定了雄心勃勃的機隊計劃,將使它們躋身全球最大航空公司之列。中國上海和北京等主要機場也正在進行大規模擴建計畫。

- 根據中國旅遊出境研究所預測,到2030年終,中國遊客出境旅遊人數預計將達到約4億人次,光是中國遊客就將佔到國際觀光的四分之一。為了全面支持這一成長,機場需要先進的系統。預計這將對預測期內的市場成長產生積極影響。

中國佔很大市場佔有率

- 中國是亞太地區 AMH 市場成長的主要貢獻者。製造業、汽車業和電子商務等行業對 AMH 產品的需求不斷增加,積極推動了市場成長。

- 中國人口眾多,推行產業政策。以PPP(購買力平價)計算,中國是世界最大經濟體和出口大國。中國目前正在從製造業和建設業主導的經濟轉型為消費主導的經濟。

- 該十年規劃於2015年5月訂定,是中國政府為推動產業向全球價值鏈中高階轉移和培育若干先進製造業叢集製定的一項競標。

- 透過引入自動化製造,中國預計2025年將生產成本降低30%。技術純熟勞工的短缺,加上獨生子女政策和勞動力老化,要求企業適度減少工作活動以維持職場的生產效率。

亞太地區自動化物料輸送(AMH) 產業概況

亞太地區自動化物料輸送市場分散且競爭激烈。推出產品、高額研發支出、夥伴關係和收購是國內公司為維持激烈競爭所採取的主要成長策略。

- 2022 年 1 月 - Wise Robotics 與 VisionNav Robotics 合作,為英國倉庫帶來進一步創新。透過此次合作,VisionNavi 的創新技術將成為 Wise Robotics 產品組合的一部分。這有望幫助英國企業降低營運面臨供應鏈挑戰的倉庫的持續成本並提高其訂單履行能力。

- 2021 年 12 月-凱傲集團宣佈在中國開設新的堆高機工廠,進軍亞太地區。此次擴建屬於直接資金籌措活動,預計中期將為濟南創造1,000多個新的就業機會。 Geek 平衡重型卡車工廠和附近的供應鏈解決方案附加工廠以及研發和技術中心總價值約為 1.4 億歐元。就業機會的創造和直接投資表明該地區研究市場的經濟正在健康成長。

- 2021 年 11 月-永恆力集團 (Jungheinrich AG) 收購了位於慕尼黑的自主移動機器人 (AMR) 開發商 arculus GmbH,收購金額未公開。 Arclas 設計和製造用於行動自動化的 AMR、模組化製造平台和軟體解決方案。透過此次收購,永恆力為其自動化系統產品組合添加了針對快速成長的 AMR 領域的硬體和軟體解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 技術進步不斷推動市場成長

- 工業 4.0 投資推動對自動化和物料輸送的需求

- 電子商務快速成長

- 市場挑戰/限制

- 初期成本高

- 技術純熟勞工短缺

第6章 市場細分

- 依產品類型

- 硬體

- 軟體

- 服務

- 依設備類型

- 移動機器人

- 自動導引運輸車(AGV)

- 自動堆高機

- 汽車牽引車/曳引機/拖曳船

- 單元貨載

- 組裝

- 特殊用途

- 自主移動機器人(AMR)

- 雷射導引車

- 自動儲存和搜尋系統 (ASRS)

- 固定巷道(堆垛機高機+穿梭車系統)

- 旋轉木馬(水平旋轉木馬+垂直旋轉木馬)

- 垂直升降模組

- 自動輸送機

- 腰帶

- 滾筒

- 調色盤

- 開賣

- 堆垛機

- 常規型(高電位+低電位)

- 機器人

- 分類系統

- 移動機器人

- 按最終用戶產業

- 飛機場

- 車

- 飲食

- 零售/倉儲/配送中心/物流中心

- 一般製造業

- 藥品

- 郵政和小包裹

- 其他最終用戶

- 按國家

- 中國

- 日本

- 印尼

- 印度

- 澳洲

- 泰國

- 韓國

- 新加坡

- 馬來西亞

- 台灣

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- DAIFUKU Co. Ltd.

- Kardex Group

- KION Group

- JBT Corporation

- Jungheinrich AG

- SSI Schaefer AG

- VisionNav Robotics

- System Logistics

- BEUMER Group GmbH & Co. KG

- Interroll Group

- Witron Logistik

- Kuka AG

- Honeywell Intelligrated Inc.

- Murata Machinery Ltd

- Toyota Industries Corporation

第8章投資分析

第9章:市場的未來

The APAC AMH Market size is estimated at USD 30.05 billion in 2025, and is expected to reach USD 53.12 billion by 2030, at a CAGR of 12.07% during the forecast period (2025-2030).

The automated material handling market in the Asia Pacific region is becoming increasingly integrated, with China as the core, bolstering its strong economic growth. Sectors, such as manufacturing, have driven much of this economic activity and have increasingly made supply chains complex.

Key Highlights

- In some Asia Pacific countries, the land for warehousing is becoming increasingly limited. In these areas, warehouses are expected to increase, with multi-story facilities and taller, narrower aisles. These trends are expected to drive the demand for material handling systems.

- Developing countries in Asia, such as India, significantly invest in material handling equipment. According to the Wisconsin Economic Development Corporation, the Indian market for materials handling equipment (MHE), accounting for about 13% of the market share of the country's construction equipment industry, witnessed significant growth in the recent past.

- The Asia Pacific emerged as one of the world's largest e-commerce hubs. The region witnessed a rapid growth in retail e-commerce, owing to the rising middle-class population in China, India, and Indonesia, along with the popularity of mobile gadgets. China alone accounts for 40% of the world's retail e-commerce sales.

- The food & beverage industry is witnessing high adoption of equipment due to the rising demand for automation. The automated technologies will allow these companies to perform their tasks in comparatively less time and effort. For instance, the Coca-Cola company has opened warehouses in Singapore valued at around USD 57 million to have automated storage and retrieval systems.

- Developing countries in Asia, such as India, significantly invest in material handling equipment. According to the Wisconsin Economic Development Corporation, the Indian market for materials handling equipment (MHE), accounting for about 13% of the market share of the country's construction equipment industry, witnessed significant growth in the recent past.

- The COVID-19 pandemic, which hit major countries like China, Japan, and India severely, is expected to influence the market's growth during 2022, as almost all production, logistics, and warehouses are under lockdown. Bringing unique challenges of social distancing and contactless operation has changed the standard operating procedure. Organizations were forced to limit the workforce and deal with the increasing demand.

APAC Automated Material Handling (AMH) Market Trends

Airports to Hold a Dominant Market Share

- Several countries realize the importance of investing in airports, as passengers are more likely to spend time and money in a pleasant and stress-free ambiance. The use of conveyors and sortation systems in major and small airports effectively reduces several inconveniences, from check-in to onboarding. This provides customers with a hassle-free experience.

- India and China are major contributors to the aviation industry developments in the region, owing to increasing per capita GDP and domestic air connectivity. For instance, according to the ICAO, Asia Pacific recorded 70% of the domestic traffic share.

- The Chinese aviation market is expected to witness significant growth over the next few years, as its three largest airlines, such as Air China, China Southern, and China Eastern, have ambitious fleet plans that will put their sizes at the top of airlines globally. China's major airports in Shanghai and Beijing are also undergoing major expansion plans.

- According to the Chinese Tourism Outbound Research Institute, by the end of 2030, the number of outbound trips made by Chinese travelers is expected to reach approximately 400 million, and Chinese tourists alone are likely to account for a quarter of international tourism. To ensure adequate support for such growth, airports need to have advanced systems. This is expected to impact the market's growth positively over the forecast period.

China to Hold Significant Market Share

- China has been a prominent contributor to the growth of the AMH market in the Asia Pacific region. The increasing demand for AMH products across industries, such as manufacturing, automotive, and e-commerce, is positively boosting the market's growth.

- China has a vast population and pursues an industrial policy. Measured on the PPP basis, the country became the world's largest economy and exporter, and trader during the current decade. The country is currently passing through the transition state of being manufacturing- and construction-led economy to a consumer-led economy.

- The ten-year plan, introduced in May 2015, is the government's bid to shift the industries up to the medium-high end of the global value chain and foster several advanced manufacturing clusters.

- With the adoption of automation in manufacturing, China is expected to cut manufacturing costs by 30% by 2025. The dearth of skilled labor, complicated by the one-child policy and an aging workforce, requires job activities to be eased to maintain productivity at work.

APAC Automated Material Handling (AMH) Industry Overview

The Asia Pacific automated material handling market is fragmented and highly competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- January 2022 - Wise Robotics partnered VisionNavRobotics to bring greater innovation to UK warehouses. The collaboration means VisionNav'sinnovative technology is expected to be available as part of the Wise Robotics range. This is expected to help UK operators increase order fulfillment and reduce the ongoing costs related to running a warehouse in the face of well-documented supply chain challenges.

- December 2021- KION Group announced the expansion in its Asia Pacific operations by opening a new forklift plant in China. Such expansion indicates direct funding activities and is expected to create more than 1,000 new jobs in Jinan in the medium term. The total volume for the Geek's counterbalance truck plant and an additional plant for supply chain solutions in the immediate vicinity, plus an R&D center and a technology center, comes to around EUR 140 million. Alongside the direct investment, the creation of jobs indicates the growth of a healthy economy surrounding the studied market in the region.

- November 2021 - Jungheinrich AG acquired arculus GmbH, a Munich-based autonomous mobile robot (AMR) developer, for an undisclosed amount. Arculus designs and manufactures AMRs, modular production platforms, and software solutions for mobile automation. Through this acquisition, Jungheinrich added hardware and software solutions in the rapidly-growing AMR sector to its portfolio of automation systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Advancments Aiding Market Growth

- 5.1.2 Industry 4.0 Investments Driving The Demand For Automation And Material Handling

- 5.1.3 Rapid Growth In E-commerce

- 5.2 Market Challenges/restraints

- 5.2.1 High Initial Costs

- 5.2.2 Unavailability Of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Equipment Type

- 6.2.1 Mobile Robots

- 6.2.1.1 Automated Guided Vehicle (AGV)

- 6.2.1.1.1 Automated Forklift

- 6.2.1.1.2 Automated Tow/Tractor/Tug

- 6.2.1.1.3 Unit Load

- 6.2.1.1.4 Assembly Line

- 6.2.1.1.5 Special Purpose

- 6.2.1.2 Autonomous Mobile Robots (AMR)

- 6.2.1.3 Laser Guided Vehicle

- 6.2.2 Automated Storage and Retrieval System (ASRS)

- 6.2.2.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 6.2.2.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.2.2.3 Vertical Lift Module

- 6.2.3 Automated Conveyor

- 6.2.3.1 Belt

- 6.2.3.2 Roller

- 6.2.3.3 Pallet

- 6.2.3.4 Overhead

- 6.2.4 Palletizer

- 6.2.4.1 Conventional (High Level + Low Level)

- 6.2.4.2 Robotic

- 6.2.5 Sortation System

- 6.2.1 Mobile Robots

- 6.3 By End-user Vertical

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food and Beverage

- 6.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Other End-Users

- 6.4 By Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 Indonesia

- 6.4.4 India

- 6.4.5 Australia

- 6.4.6 Thailand

- 6.4.7 South Korea

- 6.4.8 Singapore

- 6.4.9 Malaysia

- 6.4.10 Taiwan

- 6.4.11 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DAIFUKU Co. Ltd.

- 7.1.2 Kardex Group

- 7.1.3 KION Group

- 7.1.4 JBT Corporation

- 7.1.5 Jungheinrich AG

- 7.1.6 SSI Schaefer AG

- 7.1.7 VisionNav Robotics

- 7.1.8 System Logistics

- 7.1.9 BEUMER Group GmbH & Co. KG

- 7.1.10 Interroll Group

- 7.1.11 Witron Logistik

- 7.1.12 Kuka AG

- 7.1.13 Honeywell Intelligrated Inc.

- 7.1.14 Murata Machinery Ltd

- 7.1.15 Toyota Industries Corporation