|

市場調查報告書

商品編碼

1643140

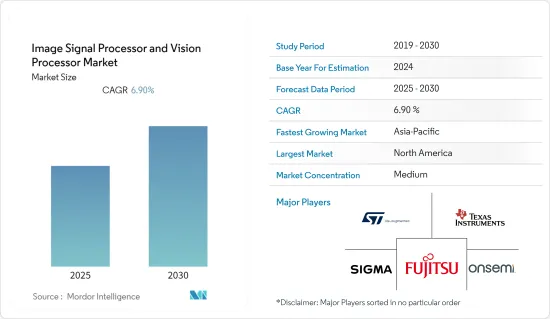

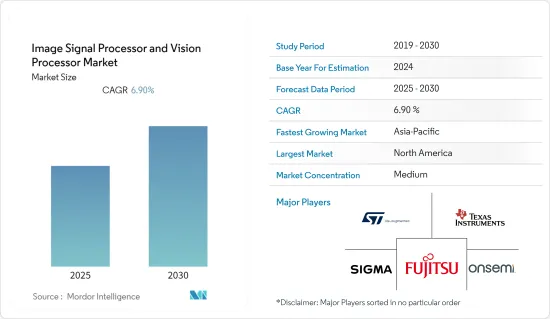

影像訊號處理器與視覺處理器:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Image Signal Processor and Vision Processor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內影像訊號處理器和視覺處理器市場複合年成長率將達到 6.9%。

主要亮點

- 智慧型手機等高級產品以及用於監控的攝影機和無人機市場具有巨大的成長潛力。此外,保全攝影機、監視錄影機、無人機(UAV)和汽車等應用領域對 VPU 的使用快速成長也推動了市場成長。

- 對高運算能力的需求不斷成長、對電腦視覺應用的需求不斷成長、人工智慧和機器學習技術的採用不斷增加以及對 ASIC 的需求不斷成長是推動市場成長的關鍵因素。

- 汽車產業成長的關鍵驅動力是配備 ADAS(高級駕駛輔助系統)和資訊娛樂系統的電動和非電動車的採用。 ADAS 系統的影像訊號處理器和視覺處理器的不斷進步和技術創新預計將推動市場成長。例如,Light 和 Cadence Design Systems Inc. 在一月宣布,Light 的 Clarity Depth Perception Platform 將包含 Cadence Tensilica Vision Q7 DSP。該平台利用業界標準攝影機實現高解析度、遠距深度感知,以輔助高級駕駛輔助系統 (ADAS)。

- 影像訊號處理器和視覺處理器功能強大,但製造成本昂貴。製造SoC需要高昂的資金,從而導致成本增加。此因素可能會增加客戶的最終價格分佈並阻礙市場成長。

- 由於全球多個地區持續採取封鎖措施,COVID-19 疫情減緩了影像訊號處理設備和影像處理設備生產設備產業多種產品的生產。封鎖措施減少了對電子設備的需求,從而影響了全球半導體產業。預計全球需求和汽車出口的持續下滑將對市場產生負面影響,從而長期減緩對半導體製造設備的需求。

影像訊號處理器與視覺處理器市場趨勢

消費性電子產品佔據市場主導地位

- VR 產品、智慧型手機、無人機等擴大採用 ISP 和 VPU,從而推動了消費性電子產品影像訊號處理器和視覺處理器市場的發展。對提供更優質產品、升級消費者體驗和更好功能的需求日益成長,推動了OEM對 ISP 和 VPU 的採用。

- 消費性電子產品不斷創新,提供先進的特性和功能,加上市場參與企業產品推出,推動了對這些處理器的需求不斷成長。例如,今年 3 月,意法半導體宣布推出適用於智慧型手機和類似設備的一系列新型高解析度飛行時間 (ToF) 感測器。 VD55H1 是 3D 感測器系列的首個成員,它透過確定 500,000 多個點之間的間距來繪製3D物體的地圖。

- 快速的處理器、連接性、出色的相機品質和應用程式使智慧型手機成為最受歡迎的家用電子電器。與當今的行動電話不同,未來的智慧型手機將利用高速連接、機器學習晶片、人工智慧功能和更強大的處理能力等創新。

- VPU 使用專用的 AI 晶片組,透過為裝置注入 AI 運算能力來增強使用者體驗。對具有更高安全性、更快運算速度、更低延遲和更少連接依賴等先進功能的高階智慧型手機的需求不斷成長,預計將推動人工智慧專用晶片的採用。

預測期內亞太地區複合年成長率最高

- 預計未來幾年亞太地區的影像訊號處理器和視覺處理器市場將面臨盈利的市場發展潛力。該地區的需求是由多家 AI 處理器新興企業的存在所推動的,這可能在不久的將來為 VPU 業務帶來巨大的發展潛力。該地區也是一線無人機生產商和智慧相機供應商的所在地,這些生產商和供應商正在將 VPU 融入其產品中。

- 影像訊號處理器和視覺處理器市場主要受到機器視覺系統和各種垂直行業(包括消費性電子和汽車)的日益普及的推動。此外,系統編程所必需的人工智慧和機器學習技術的出現也有望推動市場成長。

- 在亞太地區,由於電子產業生產能力的不斷提高,市場需求不斷增加,尤其是中國和日本等國家。例如,日本電子產業總產值2021年達到近11兆日圓。該產業包括消費性電子產品、工業電子產品以及電子元件和設備。

- 此外,日本活性化的併購、擴張和合作活動也推動了市場的成長。例如,台積電去年10月計劃與SONY合作在日本開設第一家工廠。SONY是全球最大的行動電話影像感測器製造商。總投資預計約8000億美元。

- 具有視覺功能的機器人擴大被應用於汽車和製造業,用於各種目的,包括品管、產品檢驗、協助各個生產階段,甚至安全和監控。此外,汽車,尤其是自動駕駛汽車的進步預計將對該行業產生積極影響。

影像訊號處理器與視覺處理器產業概況

影像訊號處理器和視覺處理器市場競爭適中,由幾家主要企業組成。市場的一些主要參與者包括意法半導體、德克薩斯公司、Sigma Corporation、半導體元件工業有限責任公司和富士通。這些在市場上佔有突出佔有率的關鍵市場參與者正專注於擴大不同國家的基本客群。這些公司正在利用策略合作舉措來提高市場佔有率和增加盈利。

2022年9月,影像處理技術供應商Visionary.ai宣布發布即時影片降噪器,以提高影片影像品質。這有可能改善每年生產的約 70 億個影像感測器中很大一部分的工作環境。

2022 年 2 月,義法半導體宣布推出智慧感測器處理單元 (ISPU),該單元在同一矽晶圓上整合了適合運行 AI 演算法的數位訊號處理器 (DSP) 和 MEMS 感測器。它除了具有全精度浮點計算單元外,還配備了高速四級流水線、16位元變長指令以及單週期16位元乘法器。中斷響應為四個週期。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 智慧型手機日益普及

- 對高階運算能力的需求不斷增加

- 市場限制

- 高效能 CPU 和 GPU 的可用性

- 晶片研發與製造的技術挑戰

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- COVID-19 產業影響評估

第5章 市場區隔

- 按組件

- 硬體

- 軟體

- 服務

- 按最終用戶

- 消費性電子產品

- 安全與監控

- 車

- 航太和國防

- 製造業

- 衛生保健

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- STMicroelectronics

- Texas Instruments Incorporated

- Sigma Corporation

- Semiconductor Components Industries LLC

- Fujitsu Ltd

- Toshiba Corporation

- Samsung Electronics Co. Ltd

- Analog Devices Inc.

- Broadcom Inc.

- NXP Semiconductors NV

- Google LLC

- Qualcomm Inc.

- Xilinx Inc.

- Cadence Design Systems Inc.

- HiSilicon(Shanghai)Technologies Co. Ltd

第7章投資分析

第8章 市場機會與未來趨勢

The Image Signal Processor and Vision Processor Market is expected to register a CAGR of 6.9% during the forecast period.

Key Highlights

- The market holds enormous growth potential for premium products like smartphones and the use of cameras and drones for surveillance applications. Furthermore, a surge in the usage of VPUs in security and surveillance cameras, unmanned aerial vehicles (UAVs), and automobiles, among other application areas, is driving the market's growth.

- The growing demand for high computational capability, rising demand for computer vision applications, increasing adoption of artificial intelligence and machine learning technologies, and growing need for ASICs are the principal factors that drive market growth.

- The primary determinant influencing the growth of the automotive sector is the adoption of electric and non-electric vehicles provided with advanced driver-assistance systems (ADAS) and infotainment systems. Increasing advancement and innovation in image signal processors and vision processors for ADAS systems are expected to boost market growth. For instance, in January this year, Light and Cadence Design Systems Inc. unveiled the deployment of the Cadence Tensilica Vision Q7 DSP in Light's Clarity Depth Perception Platform, which enables high-resolution long-range, depth perception utilizing industry-standard cameras to assist advanced driver-assistance systems.

- Although image signal and vision processors offer high performance, their production costs are substantial. It is related to increased cost since producing SoCs requires higher money. This factor raises the customer's ultimate price range and may impede market growth.

- The COVID-19 pandemic slowed the manufacture of several items in the image signal processor and vision processor production equipment industry owing to the continued lockdown in several global regions. Lockdown measures reduced the demand for electronic gadgets, which had a global impact on the semiconductor sector. The continued decline in worldwide demand and automobile export shipments negatively impacted the market, which is expected to slow the demand for semiconductor manufacturing equipment in the long run.

Image Signal Processor & Vision Processor Market Trends

Consumer Electronics to Hold Dominant Share of the Market

- The increasing deployment of ISPs and VPUs in VR products, smartphones, drones, etc., boost the image signal processor and vision processor market for consumer electronics. The increasing demand to bring superior products with upgraded consumer experience and excellent functionalities drive OEMs' adoption of ISPs and VPUs.

- Constant innovations in consumer electronics products, inducing advanced features and functionalities, coupled with increasing product launches by market players, add to the rising demand for these processors. For instance, in March this year, STMicroelectronics launched a new line of high-resolution Time-of-Flight (ToF) sensors for smartphones and similar devices. The VD55H1 is the first member of the 3D family, a sensor that maps three-dimensional objects by determining the separation between more than half a million points.

- Fast processors, connectivity, superior camera quality, and applications make smartphones the most thriving consumer electronic devices in terms of their adoption. Unlike current phones, future smartphones will leverage innovations such as high-speed connectivity, machine-learning chips, AI capabilities, and more powerful processing power.

- VPUs, which use dedicated AI chipsets, enhance the user experience by inducing the AI computing capacity in the devices. Growing demand for premium smartphones due to advanced characteristics, such as higher security, faster computing, low latency, and less dependence on connectivity, is expected to encourage the adoption of dedicated AI chips.

APAC to Register Highest CAGR During Forecast Period

- In subsequent years, the Asia-Pacific image signal processor and vision processor market is expected to face profitable development possibilities. This region's demand is attributed to the presence of multiple start-ups of AI processors, which are likely to give the VPU businesses with significant development possibilities soon. Besides, the region is home to primary producers of drones and intelligent camera suppliers that integrate VPUs into their goods.

- The image signal processor and vision processor market is driven principally by the expanding adoption of machine vision systems and a different range of vertical industries, including consumer electronics and automotive. Also, it is assumed that the arrival of AI and machine learning technologies required to program the systems will help market growth.

- The market demand is increasing in the Asia-Pacific due to increasing production capacities of the electronic industry in countries such as China and Japan, among others. For example, the total production value of the electronics industry in Japan reached close to JPY 11 trillion in 2021. The sector encompasses consumer electronic equipment, industrial electronic equipment, and electronic components and devices.

- Furthermore, Japan's growing merger, acquisition, expansion, and collaboration activities also assist the market's growth. For example, TSMC planned to open its first factory in Japan in October last year in collaboration with Sony. Sony is the world's largest manufacturer of image sensors used in cell phone cameras and other applications. The total investment is estimated to be around 800 billion USD.

- Several robots with vision capabilities are progressively being introduced across the automotive and manufacturing businesses for multiple purposes, including quality control, product inspection, assisting in the various production stages, and security and monitoring, among others. Besides, the growing advancement in cars, in particular autonomous vehicles, are supposed to impact the industry positively.

Image Signal Processor & Vision Processor Industry Overview

The image signal processor and vision processor market is moderately competitive and consists of several major players. Some major players operating in the market include STMicroelectronics, Texas Instruments Incorporated, Sigma Corporation, Semiconductor Components Industries LLC, and Fujitsu Ltd. These important market players with a noticeable share in the market are concentrating on expanding their customer base across different countries. They leverage strategic collaborative initiatives to improve their market share and enhance profitability.

In September 2022, Visionary.ai, an image processing technology provider, announced the release of a real-time video denoiser that enhances video picture quality. It has the potential to improve the working circumstances of the vast proportion of the nearly 7 billion image sensors produced each year.

In February 2022, STMicroelectronics' announced the launch of the Intelligent Sensor Processing Unit (ISPU), which combines a Digital Signal Processor (DSP) suited to run AI algorithms and MEMS sensors on the same silicon. A full-precision floating-point unit is included, as well as a fast four-stage pipeline, 16-bit variable-length instructions, and a single-cycle 16-bit multiplier. The interrupt response takes four cycles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Smartphones

- 4.2.2 Rising Demand for High-end Computing Capabilities

- 4.3 Market Restraints

- 4.3.1 Availability of CPUs and GPUs With High Capabilities

- 4.3.2 Technological Challenges in Chip Development and Manufacturing

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.7 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By End User

- 5.2.1 Consumer Electronics

- 5.2.2 Security and Surveillance

- 5.2.3 Automotive

- 5.2.4 Aerospace and Defense

- 5.2.5 Manufacturing

- 5.2.6 Healthcare

- 5.2.7 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 STMicroelectronics

- 6.1.2 Texas Instruments Incorporated

- 6.1.3 Sigma Corporation

- 6.1.4 Semiconductor Components Industries LLC

- 6.1.5 Fujitsu Ltd

- 6.1.6 Toshiba Corporation

- 6.1.7 Samsung Electronics Co. Ltd

- 6.1.8 Analog Devices Inc.

- 6.1.9 Broadcom Inc.

- 6.1.10 NXP Semiconductors NV

- 6.1.11 Google LLC

- 6.1.12 Qualcomm Inc.

- 6.1.13 Xilinx Inc.

- 6.1.14 Cadence Design Systems Inc.

- 6.1.15 HiSilicon(Shanghai) Technologies Co. Ltd