|

市場調查報告書

商品編碼

1643047

覆層:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Cladding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

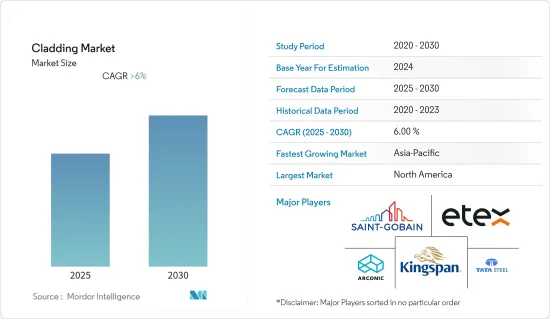

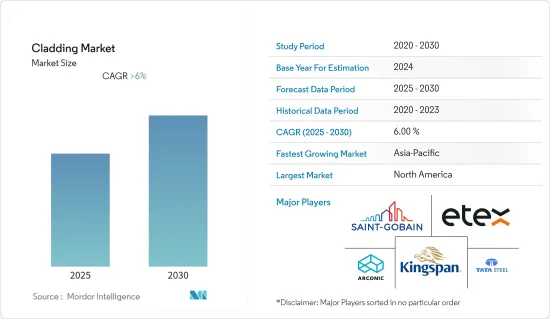

預計預測期內覆層市場複合年成長率將超過 6%。

在材料創新、節能解決方案需求激增以及嚴格的安全標準的推動下,覆層系統市場正在經歷強勁成長。這一勢頭明顯體現在廣泛採用尖端覆層材料和技術,支持永續性並提高從住宅到商業等各個領域建築的性能。

鋁複合板(ACP)是一種複合材料,由於其耐用性、重量輕和成本效益而越來越受歡迎。領先製造商 Stakbond 報告稱,ACP 的需求激增,尤其是在通風立建築幕牆。這些建築幕牆現已成為永續建築的主要內容,預計到 2024 年 11 月將能源消耗減少高達 30%,提高效率並有助於獲得 LEED 等綠色認證。 ACP 的日益普及也反映了其設計的多功能性,使建築師和建築商能夠實現功能和美學目標。此外,整合智慧覆層系統的趨勢也日益成長。

2024 年 7 月,Sto SE & Co. 推出了一款採用奈米技術的自清潔建築幕牆。建築幕牆的設計旨在防塵並降低維護成本,符合當代建築的永續性和美學訴求。這項技術創新不僅降低了營運成本,還延長了覆層系統的使用壽命,使其成為長期投資的理想選擇。

人們對消防安全的日益關注推動了對先進覆層系統的需求,特別是在高層住宅維修中。英國格蘭菲爾大樓 (Grenfell Tower) 2024 年的維修凸顯了防火覆層的迫切需求。這樣的維修不僅符合嚴格的消防規定,也滿足了都市區對不燃材料的需求。市場正在轉向礦物板和防火鋁複合材料等材料,這些材料在不犧牲設計靈活性的情況下提供了更高的安全性。

同時,亞太地區的快速都市化正在推動對經濟實惠且耐用的包層材料的需求。作為印度2024年11月宣布的「智慧城市使命」的一部分,新城市發展將採用節能的包層材料,旨在減少能源消耗並增強不斷擴張的城市的永續性。該舉措強調,人們越來越重視將先進的覆層系統納入城市規劃,以實現能源效率和環境責任的雙重目標。

包層市場趨勢

覆層市場對扁平軋延碳鋼的需求不斷增加

永續性、基礎設施擴張和對高性能建築材料的需求推動了覆層系統中扁鋼的需求不斷成長。在越來越多的全球建築項目中,扁軋延碳鋼因其耐用性、成本效益和美觀性而受到重視。

在新興市場,尤其是中國,快速的都市化和基礎設施發展正在推動需求。在中國,建築業對鋼鐵的強勁需求凸顯了扁軋延產品作為覆層系統關鍵組成部分的地位。公共基礎設施和住宅開發的持續投資正推動對扁平材的需求大幅成長。根據2024年產業報告,作為鋼材主要消費產業的建築業對扁鋼的使用量正在穩步成長。這一成長符合中國雄心勃勃的建設目標,包括大型基礎設施計劃和城市住宅開發,進一步推動了對扁平材產品的需求。

鋼鐵製造商正在增加扁鋼等高強度鋼材的產量,以滿足以耐用性為優先考慮的建築計劃的需求。為了滿足激增的需求,新日鐵正在推出包括 ZAM(R)-EX 在內的專用產品。這種高強度鋼專為覆層應用而設計,其耐腐蝕性使其非常適合以長壽命為優先考慮的戶外使用。新日鐵 ZAM®-EX 將於 2023 年首次亮相,彰顯出該產業將轉向用於現代覆層系統(尤其是建築領域)的優質鋼鐵產品。

此外,鋼鐵生產技術的進步正在推動對碳鋼平板的需求。該行業向永續方法的轉變,特別是電弧爐(EAF)的採用,正在加速。與傳統製造方法相比,電弧爐技術可以生產出更高品質的鋼材,而且對環境的影響更小。這一趨勢在覆層系統市場尤為明顯,對永續和耐用材料的需求日益增加。根據2024年產業報告,鋼鐵製造商擴大採用EAF製程來遵守監管要求並滿足對環保建築材料日益成長的需求。

配音偏好的興起

在全球範圍內,對耐用且有彈性的外部包層材料的需求正在增加,尤其是在住宅建築領域。這種成長是由環境問題和對能夠承受極端天氣、只需極少維護並支持永續建築實踐的材料的需求所推動的。因此,建築和材料領域的主要企業正在進行創新,以滿足人們對更持久、低維護的覆層系統日益成長的偏好。

對永續建築解決方案的需求不斷增加,促使 James Hardie 等行業領導者開發旨在減少碳足跡的產品。例如,James Hardie 在24會計年度在北美推出了低碳水泥技術。此外,該公司的 Hardie(R) Artisan Lap Siding 於 2024 年 4 月被 Green Builder 評為 2024 年度永續產品,突顯了其氣候適應力和耐用性。這些措施符合更廣泛的產業趨勢,即將永續材料納入住宅建築,解決環境問題,同時也滿足消費者對更環保住宅的期望。

除了永續性之外,纖維水泥包層也因其強度和防火性而越來越受歡迎。 James Hardie 纖維水泥牆板產品在野火多發地區的應用越來越廣泛。例如,根據 2024 年 8 月報道,科羅拉多的 Panorama Home計劃使用纖維水泥包層來降低發生野火的風險。此外,Ashgrove Cement 正在與 James Hardie 合作試行包層生產的回收解決方案,以減少廢棄物並提高產品的永續性。材料科學的這些進步使住宅建築業能夠滿足對耐用、易於維護和環保的建築解決方案日益成長的需求。

覆層行業概況

覆層市場是一個競爭激烈的市場,有多個區域參與者。在全球範圍內存在的公司非常少。覆層市場的主要企業包括 Arconic Corporation、Tata Steel Corporation、Etex Group、Compagnie de Saint-Gobain SA 和 Kingspan Group。企業正在開發新型塗層材料以滿足市場的各種需求。例如,聖戈班公司正在利用平板玻璃和高性能材料對覆層部分進行創新。室內解決方案包括隔熱材料和石膏產品,而室外解決方案包括管道、工業砂漿和外部產品。公司正在採取併購策略來增加市場佔有率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 市場促進因素

- 節能建築解決方案的激增

- 自清潔建築幕牆系統的需求

- 市場限制

- 先進複合材料的初始成本較高

- 滿足法規遵循和消防安全標準的挑戰

- 市場機會

- 光伏(PV)系統整合

- 價值鏈/供應鏈分析

- 波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 深入了解建築和覆層市場的趨勢

- 洞察市場技術顛覆

- 深入了解市場中的政府監管

- 深入了解地緣政治和疫情對市場的影響

第5章 市場區隔

- 按材質

- 金屬

- 紅陶

- 纖維水泥

- 混凝土的

- 陶瓷製品

- 木頭

- 乙烯基塑膠

- 其他材料

- 按組件類型

- 牆

- 屋頂

- 門窗

- 其他組件類型

- 按應用

- 住宅

- 非住宅

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 韓國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 市場集中度概覽

- M&A

- 公司簡介

- Arconic

- Tata Steel Ltd

- Compagnie de Saint Gobain SA

- Etex Group

- Kingspan Group

- James Hardie Industries PLC

- Boral Limited

- CSR Building Products

- Nichiha Corporation

- Cembrit Holding AS

- DowDuPont

- 其他公司

第7章 市場機會與未來趨勢

第 8 章 附錄

The Cladding Market is expected to register a CAGR of greater than 6% during the forecast period.

The cladding systems market is witnessing robust growth, fueled by material innovations, a surge in demand for energy-efficient solutions, and stricter safety standards. This momentum is evident in the broad embrace of cutting-edge cladding materials and technologies, championing sustainability and bolstering building performance across sectors, from residential to commercial.

Aluminum composite panels (ACPs), a type of composite material, are gaining traction for their durability, lightweight nature, and cost efficiency. Leading manufacturer STACBOND reports a surge in demand for its ACPs, particularly in ventilated facades. These facades, now a staple in sustainable construction, promise up to a 30% reduction in energy consumption, boosting efficiency and aiding in green certifications like LEED as of November 2024. The increasing adoption of ACPs is also attributed to their versatility in design, allowing architects and builders to achieve both functional and aesthetic objectives. Furthermore, there's a growing trend towards integrating smart cladding systems.

In July 2024, Sto SE & Co. unveiled a nanotechnology-driven self-cleaning facade, designed to repel dirt and slash maintenance costs, aligning with modern buildings' sustainability and aesthetic aspirations. This innovation not only reduces operational expenses but also enhances the lifespan of the cladding system, making it a preferred choice for long-term investments.

Heightened fire safety concerns are propelling the demand for advanced cladding systems, especially in retrofitting high-rise residential buildings. The 2024 renovation of the Grenfell Tower in the UK highlights the critical need for fire-resistant cladding. Such upgrades not only adhere to stringent fire safety regulations but also address the urban demand for non-combustible materials. The market is witnessing a shift towards materials like mineral-based panels and fire-rated aluminum composites, which offer enhanced safety without compromising on design flexibility.

Meanwhile, in the Asia-Pacific, swift urbanization is spurring a quest for affordable, durable cladding. As part of India's Smart Cities Mission, unveiled in November 2024, new urban developments will feature energy-efficient cladding, targeting reduced energy consumption and bolstered sustainability in expanding cities. This initiative underscores the growing emphasis on integrating advanced cladding systems into urban planning to meet the dual objectives of energy efficiency and environmental responsibility.

Cladding Market Trends

Rising Demand for Flat-Rolled Carbon Steel in the Cladding Market

The rising demand for flat-rolled carbon steel in cladding systems is driven by sustainability, infrastructure expansion, and the need for high-performance construction materials. As global construction grows, flat-rolled carbon steel is valued for its durability, cost-effectiveness, and aesthetics.

Emerging markets, especially China, are fueling demand due to rapid urbanization and infrastructure development. In China, the construction sector's strong steel demand highlights flat-rolled products as key components in cladding systems. Ongoing investments in public infrastructure and residential developments are fueling a significant surge in demand for flat steel. Industry reports from 2024 indicates that the construction sector, a major consumer of steel, is witnessing a steady increase in the use of flat-rolled carbon steel. This growth aligns with China's ambitious construction goals, which include large-scale infrastructure projects and urban housing developments, further driving the demand for flat steel products.

Steelmakers are ramping up their production of high-strength steel products, like flat-rolled carbon steel, to cater to construction projects that prioritize durability. Responding to this surge in demand, Nippon Steel has rolled out specialized offerings, notably ZAM(R)-EX. This high-strength steel, tailored for cladding applications, boasts enhanced corrosion resistance, making it a top choice for outdoor settings where longevity is paramount. Nippon Steel's 2023 debut of ZAM(R)-EX underscores the industry's pivot towards premium steel products, especially for modern cladding systems in construction.

Furthermore, advancements in steel production technology are driving the demand for flat-rolled carbon steel. The industry's transition to sustainable methods, particularly the adoption of electric arc furnaces (EAF), is accelerating. EAF technology enables the production of high-quality steel while reducing environmental impact compared to traditional methods. This trend is particularly significant in the cladding systems market, where demand for sustainable and durable materials is on the rise. As per 2024 industry reports, steel producers are increasingly adopting EAF processes to comply with regulatory requirements and address the growing demand for eco-friendly building materials.

Growing Preferences for Durb

Globally, the demand for durable and resilient wall cladding materials is increasing, particularly in residential construction. This growth is driven by environmental concerns and the need for materials that can withstand extreme weather, require minimal maintenance, and support sustainable building practices. Consequently, major players in the construction and materials sector are innovating to meet the rising preference for long-lasting, low-maintenance cladding systems.

In response to the growing demand for sustainable building solutions, industry leaders like James Hardie are developing products aimed at reducing carbon footprints. For instance, James Hardie introduced its low-carbon cement technology across North America in FY24. Additionally, their Hardie(R) Artisan Lap Siding was named Green Builder's 2024 Sustainable Product of the Year in April 2024, highlighting its climate resilience and durability. These efforts align with a broader industry trend toward incorporating sustainable materials in residential construction, addressing environmental concerns while meeting consumer expectations for eco-friendly housing solutions.

In addition to sustainability, fiber cement cladding is gaining popularity due to its strength and fire resistance. James Hardie's fiber cement siding products have seen increased adoption in wildfire-prone regions. For instance, in FY24, the Panorama Home project in Colorado utilized fiber cement cladding to mitigate wildfire risks, as reported in August 2024. Furthermore, Ash Grove Cement, in collaboration with James Hardie, is piloting recycling solutions for cladding production to reduce waste and enhance product sustainability. These advancements in material science are enabling the residential construction sector to address the growing demand for durable, low-maintenance, and environmentally responsible building solutions.

Cladding Industry Overview

The cladding market is competitive in nature, with various regional players present in the market. Very few companies are present at the global level. Some of the major players in the cladding market are Arconic Inc., Tata Steel Ltd., Etex Group, Compagnie de Saint-Gobain SA., and Kingspan Group, among others. Players are innovating new cladding materials in order to meet the different demands in the market. For instance, Saint-Gobain S.A. is innovating in the cladding material segment with flat glass and high-performance materials. The interior solutions comprise insulation and gypsum products, whereas the exterior solutions consist of pipes, industrial mortars, and exterior products. Companies are adopting acquisition and merger strategies to gain market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge for Energy-Efficient Building Solutions

- 4.2.2 Demand for Self-Cleaning Facade Systems

- 4.3 Market Restraints

- 4.3.1 High Upfront Costs of Advanced Cladding Materials

- 4.3.2 Challenges in Meeting Regulatory Compliance and Fire Safety Standards

- 4.4 Market Opportunities

- 4.4.1 Integration of Photovoltanic (PV) Systems

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Trends in the Construction and Cladding Market

- 4.8 Insights on Technological Disruptions in the Market

- 4.9 Insights on Government Regulations in the Market

- 4.10 Insights on Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Metal

- 5.1.2 Terracotta

- 5.1.3 Fiber Cement

- 5.1.4 Concrete

- 5.1.5 Ceramics

- 5.1.6 Wood

- 5.1.7 Vinyl

- 5.1.8 Other Materials

- 5.2 By Component Type

- 5.2.1 Wall

- 5.2.2 Roofs

- 5.2.3 Windows and Doors

- 5.2.4 Other Component Types

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 South Korea

- 5.4.3.4 Japan

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of the Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Megers and Acquisitions

- 6.3 Company Profiles

- 6.3.1 Arconic

- 6.3.2 Tata Steel Ltd

- 6.3.3 Compagnie de Saint Gobain SA

- 6.3.4 Etex Group

- 6.3.5 Kingspan Group

- 6.3.6 James Hardie Industries PLC

- 6.3.7 Boral Limited

- 6.3.8 CSR Building Products

- 6.3.9 Nichiha Corporation

- 6.3.10 Cembrit Holding AS

- 6.3.11 DowDuPont*

- 6.4 Other Companies