|

市場調查報告書

商品編碼

1693596

GRC覆層:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)GRC Cladding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

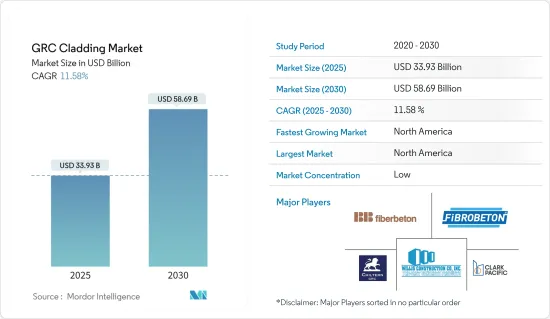

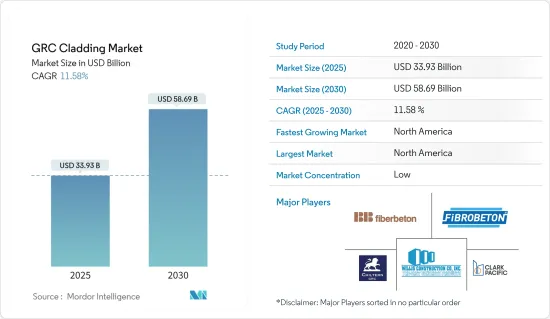

預計 2025 年 GRC覆層市場規模為 339.3 億美元,到 2030 年將達到 586.9 億美元,預測期間(2025-2030 年)的複合年成長率為 11.58%。

主要亮點

- 玻璃纖維增強混凝土(GRC) 是一種輕質覆層層板,主要用作建築結構中的支撐板。纖維增強混凝土通常被認為比標準混凝土更有利於環境。

- GRC覆層市場受到對綠建築(LEED 評級)日益重視的推動,卓越的機械性能有望推動市場成長。在美國,建築規範要求牆板和覆層材料不得成為火勢蔓延的媒介。

- 美國和英國對水泥混合物是否有火災隱患有嚴格的指導方針。這導致了對更耐火的外牆材料的需求。

- GRC 具有良好的耐火性和不燃性,因為它是由特殊的聚合物和纖維混合而成,具有不透水、耐候和阻燃的特性。

- GRC 與其他材料相比具有許多優勢。 GRC 是一種真正出色的水泥替代品,它更輕、更堅固、更靈活、更耐用且更耐火。

- 由於其特性,當使用岩絨時,GRC 可提供隔熱、防水和隔音功能。這項特性可能會增加極端天氣地區的需求。

- 較大的 GRC 產品(例如覆層層板)採用噴塗方法生產。噴射混凝土 GRC 通常比預混合料振鑄 GRC 更堅固。

- 為了應對迅速出現的氣候緊急情況,並提高住宅建築的抗震能力,加拿大國家研究委員會在《國家建築規範》(2025 年)中引入了氣候適應性建築指南,以抵禦極端天氣事件。

GRC覆層市場趨勢

商業空間需求激增推動市場

根據最近的一項研究,到2024年底,辦公空間的需求將增加12-18%。預計成長將受到本會計年度辦公室租戶逐步回歸和宏觀經濟環境改善的推動。

最近的銀行業危機為商業房地產蒙上了一層陰影。由於不受「系統重要性」同業的限制,美國地區性銀行一直積極向商業房地產發放貸款。這引發了人們對「惡性循環」情景的擔憂,即房地產困境和銀行倒閉相互加劇。這看起來似乎有點牽強,因為大部分房地產市場的表現仍然很出色。但這是因為雙方都無法崩壞對方。關於替代貸款機構和私募股權的討論很多,但考慮到未來幾年需要償還的巨額債務,減少銀行貸款(銀行貸款仍佔商業房地產貸款總額的 50% 至 60%)並不是一個好主意。再融資已經很困難了,而且隨著信貸標準的收緊,可能會變得更加困難。

儘管美國市場面臨許多週期性和結構性挑戰,但仍有許多理由對其他地區的辦公室運轉率感到樂觀。例如,在歐洲,預計到 2022 年,平均辦公室運轉率將從 43% 恢復至 55%,周中運轉率將接近新冠疫情之前的平均值(70%)。在許多亞太市場(例如首爾、東京),辦公室運轉率幾乎已恢復到疫情前的水平。在整個亞太地區,優質建築的供應有限,導致空置率較低,租金上漲。

在印度,儘管 2023 年第一季供應量年減 23%,但預計商業空間供應量將回升,到 2023 年第三季達到約 4,700 萬至 4,900 萬平方英尺。根據淨吸收量,預計 2023 年的供應量將超過疫情前 2017-2019 年的平均值。預計到 2024 年供應量將以每年 22% 的速度成長,達到 5,800 萬至 6,000 萬平方英尺。追求高品質將導致機構業主和現有開發人員建築之間的需求兩極化。

北美預計將主導市場

倉儲和配送業是最受歡迎的商業領域之一,近年來已占美國商業投資的一半以上。

隨著辦公大樓市場的持續繁榮,未來的租賃活動可能會集中在最受歡迎的子市場和甲級建築中的較小空間。大型商店正在整合空間並投資電子商務和基礎設施。

受醫院大規模擴建以及門診病人和醫療辦公室需求復甦的推動,醫療保健建設支出將在 2023 年之前保持高位。這個大型計劃的推動因素包括近期的人口變化、容量、維護需求以及影響醫療服務的新技術(如穿戴式裝置和遠端醫療)。

大型新建設施預計將擴大使用預製和模組化來簡化計劃進度和預算。相較之下,專業醫療和護理設施(SCH)仍然受到嚴重資源限制,限制了建設活動。

教堂關閉的速度超過了開放的速度,為重建和再利用創造了新的機會。在一些競爭最激烈的市場中,基礎設施和交通的投資可能會支持休閒和休閒建設的支出。

GRC覆層產業概況

該報告介紹了 GRC覆層市場的主要國際參與者。市場高度分散,大公司佔據市場佔有率。主要企業正在透過合作、創新、擴張、獎勵和認可以及其他策略來改進其產品並保持競爭力。

GRC 覆層市場的主要企業包括 UltraTech Cement Ltd、Clark Pacific、BB Fiberbeton、Asahi Building-wall、Willis Construction Co. Inc.、Loveld、Fibrobeton、GB Architectural Cladding Products Ltd、Ibstock Telling 和 BCM GRC Limited。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概覽

- 市場促進因素

- 住宅領域需求不斷成長推動市場

- 都市化加速推動市場

- 市場限制

- 租金上漲阻礙市場成長

- 市場機會

- 建設產業成長推動市場

- 深入了解供應鏈/價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 政府法規和舉措

- 科技趨勢

- COVID-19 市場影響

第5章市場區隔

- 按應用

- 商業建築

- 住宅建築

- 基礎設施建設

- 按地區

- 亞太地區

- 北美洲

- 歐洲

- 南美洲

- 中東和非洲

第6章競爭格局

- 市場集中度概覽

- 公司簡介

- UltraTech Cement Ltd

- Clark Pacific

- BB Fiberbeton

- ASAHI BUILDING-WALL CO. LTD

- Willis Construction Co. Inc.

- Loveld

- Fibrobeton

- GB Architectural Cladding Products Ltd

- Ibstock Telling

- BCM GRC Limited

- 其他公司

第7章:市場的未來

第 8 章 附錄

The GRC Cladding Market size is estimated at USD 33.93 billion in 2025, and is expected to reach USD 58.69 billion by 2030, at a CAGR of 11.58% during the forecast period (2025-2030).

Key Highlights

- Glass-reinforced concrete cladding (GRC) is a lightweight cladding panel primarily used as fascia panels in building structures. Concrete, reinforced with fibers, is often presented as an environmental improvement compared to typical concrete.

- The GRC cladding market is driven by the increased emphasis on green buildings (LEED ratings), and superior mechanical characteristics are expected to drive the market's growth. In the United Kingdom, building regulations state that the materials used for external wall construction or wall cladding should not be a medium for spreading fire.

- The United States and the United Kingdom have stringent guidelines on whether cement formulations can run the risk of combustion. This increased the need for a more fire-resistant material for wall cladding.

- GRC is effective at fire resistance and incombustibility because the mix's special blend of polymers and fibers makes it impermeable, weather-resistant, and fire-retardant.

- GRC has many different advantages that come with its use over other materials. It is a genuinely amazing cement alternative that is lighter, stronger, more flexible, more durable, and fire-resistant.

- Due to its nature, GRC, water, and sound insulation provide thermal insulation by applying rock wool. This property may lead to increased demand in regions with extreme weather conditions.

- Larger GRC products, like cladding panels, are manufactured using a spray. Sprayed GRC is generally stronger than premix vibration-cast GRC.

- In the wake of the rapidly emerging climate change emergency and to help improve resiliency in residential buildings, the National Research Council, Canada, has introduced guidelines in the National Building Code (2025) for climate-resilient construction to withstand extreme weather events.

GRC Cladding Market Trends

The Surge in the Demand for Commercial Spaces is Driving the Market

According to a recent study, the demand for office space will increase by 12-18% by the end of 2024. The growth is expected to be driven by the current fiscal year, the gradual return of office tenants, and the improving macroeconomic environment.

The recent banking crisis has cast a long shadow on commercial real estate. Unburdened by the regulations of their larger 'systemically important' peers, US regional banks have been aggressively lending against commercial property. This raises the specter of a 'doom-loop' scenario, where real estate woes and banking failures reinforce each other. This may seem far-fetched, as much of the real estate market continues to outperform. However, this is because neither can bring the other down. For all the talk of alternative lenders and private equity, a pullback on bank lending (which continues to account for 50% to 60% of total commercial real estate lending) is ill-advised, given the massive amounts of debt that will need to be repaid over the next several years. Refinancing has already been challenging, and it is only likely to become more so as credit standards tighten.

While there are many challenges to the US market in terms of cyclicality and structural issues, there are many reasons to be optimistic about office occupancies in other regions. For example, in Europe, average office occupancies recovered to 55% compared to 43% in 2022, and midweek rates are now close to the pre-COVID-19 average (70%). In many Asia-Pacific markets (Seoul, Tokyo, etc.), office attendance is almost back to where it was before the pandemic. In Asia-Pacific, a limited supply of high-quality buildings keeps vacancy low and pushes up rents.

In India, despite a year-over-year decline of 23% in supply in Q1 2023, the supply of commercial spaces was projected to pick up and reach around 47-49 million square feet by Q3 2023. Based on net absorption, the 2023 supply was projected to be above the average of 2017-2019 before the pandemic. In 2024, supply is projected to grow by 22% yearly to 58-60 million square feet. A flight to quality drives demand polarization toward institutional owners and established developer buildings.

North America is Expected to Dominate the Market

Warehouse and distribution, a commercial segment, is in high demand and has increased in recent years to account for more than half of US commercial investment.

As the office market continues to boom, future leasing activity will likely focus on smaller spaces in the most sought-after submarkets and class-A buildings. Big-box stores are consolidating their space and investing in e-commerce offerings and infrastructure.

Healthcare construction spending remained high through 2023, driven by large-scale hospital expansions and outpatient and medical office demand recovery. Large-scale projects were supported by recent changes in demographics, capacity, maintenance needs, and new technologies that affect health services (such as wearables and telehealth).

Large-scale new facilities are expected to increasingly use prefabrication and modularization to streamline project schedules and budgets. In contrast, specialty care and nursing home (SCH) facilities remain heavily constrained by resources, limiting construction activity.

Churches are closing at a faster rate than they are opening, which is creating new opportunities for renovation or repurposing. Investments in infrastructure and transportation will support spending on the construction of amusement and recreational facilities in some of the most competitive markets.

GRC Cladding Industry Overview

The report covers major international players operating in the GRC cladding market. The market is highly fragmented, with large companies claiming significant market share. Key players engage in collaborations, innovations, business expansion, awards and recognition, and other strategies to improve their offerings and remain competitive.

Some of the key players in the GRC cladding market are UltraTech Cement Ltd, Clark Pacific, BB Fiberbeton, Asahi Building-wall Co. Ltd, Willis Construction Co. Inc., Loveld, Fibrobeton, GB Architectural Cladding Products Ltd, Ibstock Telling, BCM GRC Limited, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand in the Residential Segment Driving the Market

- 4.2.2 Increasing Urbanization Driving the Market

- 4.3 Market Restraints

- 4.3.1 Increasing Rents Hindering the Growth of the Market

- 4.4 Market Opportunities

- 4.4.1 Growing Construction Industry Driving the Market

- 4.5 Insights into Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Regulations and Initiatives

- 4.8 Technological Trends

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Commercial Construction

- 5.1.2 Residential Construction

- 5.1.3 Infrastructure Construction

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.2 North America

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 UltraTech Cement Ltd

- 6.2.2 Clark Pacific

- 6.2.3 BB Fiberbeton

- 6.2.4 ASAHI BUILDING-WALL CO. LTD

- 6.2.5 Willis Construction Co. Inc.

- 6.2.6 Loveld

- 6.2.7 Fibrobeton

- 6.2.8 GB Architectural Cladding Products Ltd

- 6.2.9 Ibstock Telling

- 6.2.10 BCM GRC Limited*

- 6.3 Other Companies