|

市場調查報告書

商品編碼

1642190

光學分類機-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Optical Sorter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

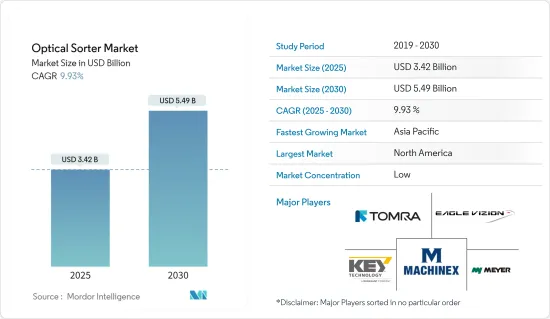

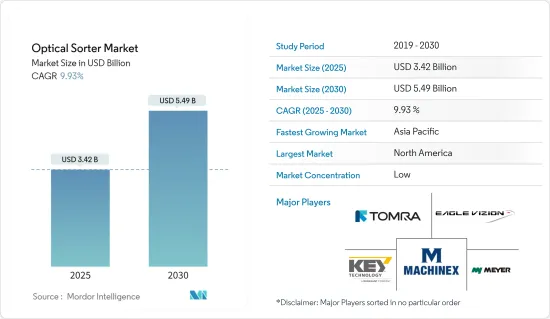

光學分類機市場在 2025 年的估值為 34.2 億美元,預計到 2030 年將達到 54.9 億美元,在市場估計和預測期(2025-2030 年)內,複合年成長率為 9.93%。

光學分選是使用攝影機和感測器(單獨或組合)自動對固態產品進行分選的過程。根據所使用的感測器類型和部署的影像處理系統的有效性,光學分類機可以識別物體的顏色、大小、形狀、結構特性和化學成分。光學分類機是一種自動化過程,使用攝影機和/或雷射與感測器和軟體驅動的影像處理系統協同工作來分離固態材料。

關鍵亮點

- 光學分選系統用於識別生產線上的缺陷產品並根據可接受/定義的標準將其移除,以及從生產線上移除異物。它也用於製造使用不同等級和類型的材料的產品。光學分選系統的實施提高了產品質量,最大限度地提高了產量,增加了產量比率,同時降低了人事費用。

- 自動化可以減少錯誤並提高生產力,從而提高業務績效。越來越多的行業採用自動化來加快流程並維持產品品質。這項策略減少了體力勞動,改善了衛生狀況並加快了操作速度。食品、回收和採礦等關鍵產業是光學分分類機的主要市場,這些產業的自動化程度不斷提高,預示著市場呈現積極的成長。

- 增強食品加工既改善了產品的口感,也延長了保存期限。加工食品包括經過不同程度加工的食品,從中度加工到高度加工。加工技術的不斷創新和對加工食品的需求不斷增加預計將推動食品和飲料加工設備市場的發展。

- 光學分類機所需的高額初始投資是市場成長的一大障礙。這些系統通常比其他傳統解決方案更昂貴,這可能會阻止潛在買家,尤其是中小型企業。此外,維護這些系統的難度進一步增加了它們的整體成本,影響了銷售和市場滲透。

- 國際貨幣基金組織曾預測,已開發經濟體的成長將出現特別急劇的放緩,從 2022 年的 2.7% 降至 2023 年的 1.3%。北美是採用先進解決方案的主要市場之一,但也面臨經濟不穩定的問題,多家金融機構倒閉。許多經濟學家認為,歐洲和中國的利率上升、高通膨和經濟放緩將進一步影響該地區 2024 年的成長前景。

光學分類機的市場趨勢

食品業佔有較大市場佔有率

- 回收部門包括對各種技術的研究,例如X光傳輸、攝影機解決方案、雷射和近紅外線感測器,這些技術用於全球回收行業的高效分類過程。本研究涵蓋的回收領域包括金屬和廢料回收、城市廢棄物回收、電子廢棄物回收、不同類型的塑膠廢棄物回收、紡織廢棄物回收等。

- 光學廢棄物分類是一種現代的、對環境負責的回收技術,它利用先進的攝影系統、感測器和機器學習演算法。這些技術可以快速且準確地識別不同類型的廢棄物並對其進行分類,以便進行最佳處理或回收。該流程非常方便用戶,並且對每種可回收材料使用顏色編碼的袋子。使用者只需將這些袋子放入普通垃圾桶或投放區即可。然後,分揀廠根據顏色對袋子進行分類,並將其放入單獨的容器中。

- 光學分類機提高了廢棄物管理流程的效率、準確性和整體效益,徹底改變了回收業。它採用先進的攝影系統、感測器和機器學習演算法來高效、準確地識別和分類各種廢棄物。這些系統能夠檢測不同材料的獨特頻譜特徵,從而實現精確的識別和分離。該技術對於分類包含塑膠、玻璃、紙張和金屬的消費後廢棄物特別有用。

- 光學分選系統可以與自動廢棄物收集系統結合使用,也可以添加到傳統廢棄物收集方法中並進行現代化改造。例如,Envac 與斯德哥爾摩 Valla Torg 的 Grow Smarter計劃合作,將家庭產生的城市廢棄物減少了 65%。這項成果是該公司重新思考其傳統回收方法的結果。

- 新安裝的系統可以追蹤每種物品的重量,監控使用者分類物品的效率並評估他們處理可回收物品的方式。利用這些資料,Envac 能夠超越先前的標準來最佳化其系統。技術的進步意味著可以精確設定系統容量和收集間隔,從而提高回收率並使系統永續且智慧化。

- 隨著世界各國政府和國際組織採取重大措施減少塑膠廢棄物,安裝光學分類機的需求強勁。例如,2023年,聯合國環境規劃署(UNEP)發布藍圖,提案2040年將全球塑膠污染減少80%的措施。只要各國和各企業接受重大政策和市場變化,並利用現有的技術,這個目標是可以實現的。

- 經合組織預測,到2060年,全球塑膠廢棄物產生量將增加兩倍,達到10億噸以上。造成這種激增的主要原因是人口快速成長和經濟擴張。

- 公司正在開發創新解決方案,以在技術先進的市場中保持競爭力並滿足客戶的多樣化需求。例如,總部位於丹麥的Cimbria公司於2024年7月宣布推出一款新型光學分類機,該分選機可對塑膠進行先進的分選和精確的材料分離,使分選後的塑膠精製高達99.99%。

亞太地區實現強勁成長

- 由於人們越來越重視食品安全和廢棄物管理,亞太地區對光分類機的需求顯著增加。這一趨勢在中國、印度和日本等國家尤為明顯,這些國家對高效分類解決方案的需求日益增加。

- 人工智慧、機器學習和高光譜遙測影像等先進技術的融合,大大提高了光學分類機的功能。這些創新可以更準確地對各種材料(包括食品、塑膠和金屬)進行分類,這對於尋求提高效率和減少廢棄物的行業至關重要。

- 消費者對食品安全的意識不斷增強,推動了亞太食品加工產業採用光學分選技術。這些系統可有效去除加工過程中的任何缺陷或污染物,確保只有高品質的產品才能到達消費者手中。這對於農業部門規模龐大的國家尤其重要,因為維持品質對於國內消費和出口都至關重要。

- 韓國食品和飲料市場對國際參與企業和品牌來說具有巨大潛力。韓國作為世界第十大經濟體,人均GDP較高,為市場提供了豐厚的機會。在韓國,GS25(GS Holdings Corp.)、CU(BFG Retail)、7-Eleven(包括樂天集團的 Ministop)等主要企業在全國經營超過 48,000 家便利商店(CVS)。因此,預計該國食品和飲料行業的成長將為所研究的市場提供豐厚的成長機會。

- 此外,印度的食品生態系統提供了巨大的投資機會,令人鼓舞的經濟刺激措施和有吸引力的財政激勵措施刺激了食品零售業的成長。印度政府透過食品加工工業部(MoFPI)採取一切必要措施鼓勵對印度食品加工產業的投資。例如,PMKSY(Pradhan Mantri Kisan Sampada Yojana)旨在發展現代化食品加工基礎設施。

- 此外,受城市人口比重增加、飲食習慣改變等因素影響,日本食品飲料產業也蓬勃發展。例如,根據《全球有機貿易指南》,日本包裝有機食品消費量預計將在 2025 年達到 4.271 億美元,而 2018 年為 4.014 億美元。

光學分類機產業概況

光學分類機市場高度細分,既有全球參與企業,也有中小型企業。市場的主要企業包括TOMRA Systems ASA、Eagle Vizion Inc.、Key Technology Inc.(Duravant LLC 旗下子公司)、合肥美亞光電科技有限公司和Machinex Industries Inc.市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 7 月-TOMRA 的 GAINnext 分選機專為 UBC 設計。新型包裝分類分類機利用深度學習技術(人工智慧和機器學習的一部分)來區分輸送機上的不同容器。 GAINnext 目前已在北美上市。 Tomra 相信該技術為從 UBC 中回收鋁提供了一種高通量解決方案,無需人工分類即可保證純度超過 98%。

- 2024 年 1 月-Duravant 食品分類與處理解決方案部門旗下的 Key Technology 推出了一款專為蛋白質加工產品設計的光學分類機。這些產品包括冷凍雞塊、雞柳、魚條和植物性肉類替代品。光學分類機,特別是 COMPASS 和 VERYX 型號,旨在快速去除廢品和異物(FM)。這樣做可以提高產品品質、增加產量比率並減少勞動力需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 新冠疫情後遺症及其他宏觀經濟趨勢對市場的影響

第5章 市場動態

- 市場促進因素

- 更加重視自動化以提高各行業的生產力

- 更重視食品安全,對加工食品的需求不斷成長

- 市場限制

- 設備的初始成本和維護成本高

第6章 市場細分

- 依技術分類

- X光透射

- 相機解決方案

- 近紅外線感測器

- 其他技術(高光譜遙測、雷射等)

- 按最終用戶產業

- 食品加工

- 回收利用

- 礦業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- TOMRA Systems ASA

- Eagle Vizion Inc.

- Key Technology Inc.(A Duravant LLC)

- Hefei Meyer Optoelectronic Technology Inc.

- Machinex Industries Inc.

- Raytec Vision SPA

- Cimbria Inc.(AGCO Corporation)

- Satake Corporation

- Sesotec GmbH

- Buhler Group

第8章 市場展望

The Optical Sorter Market size is estimated at USD 3.42 billion in 2025, and is expected to reach USD 5.49 billion by 2030, at a CAGR of 9.93% during the forecast period (2025-2030).

Optical sorting is the process of automating the sorting of solid products by using cameras and sensors individually or in conjunction with each other. Optical sorters can recognize an object's color, size, shape, structural properties, and chemical composition, subject to the type of sensors used and the effectiveness of the image processing system deployed. The optical sorter is an automated process that enables the user to sort solid products using cameras or, lasers, or both working in conjunction with sensors and software-driven image processing systems.

Key Highlights

- Optical sorting systems are deployed to identify and remove defective objects from production lines based on accepted/defined criteria and to remove foreign material from the production line. They are also used to make products of different grades or types of materials. The deployment of optical sorting systems improves product quality, maximizes throughput, and increases yields while simultaneously reducing labor costs.

- Automation enables businesses to enhance performance by minimizing errors and increasing productivity. Several industries are increasingly adopting automation to accelerate processes and maintain product quality. This strategy reduces manual labor, improves hygiene, and speeds up operations. The rising automation in key industries such as food, recycling, and mining, primary markets for optical sorters, indicates positive market growth.

- Enhancements in food processing have improved both the taste and shelf life of products. Processed foods, which include items that undergo varying degrees of processing, range from moderately to highly processed. Continuous innovations in processing technology and the growing demand for processed foods are projected to fuel the development of the food and beverage processing equipment market.

- The high initial investment required for optical sorters is a significant barrier to the market's growth. These systems are often more expensive than other traditional solutions, which can deter potential buyers, especially small and medium-sized enterprises. The difficulty in maintaining these systems further adds to the overall cost, affecting their sales and market penetration.

- IMF had predicted advanced economies would see an especially harsh growth slowdown, from 2.7% in 2022 to 1.3% in 2023. The North American region, which is among the leading markets in adopting advanced solutions, is also facing economic instability, with multiple financial institutions collapsing. Many economic experts believe that a combination of steep rises in interest rates, high inflation, and slowdowns in Europe and China will further impact the growth prospects across geographies in 2024.

Optical Sorter Market Trends

Food Industry to Hold Significant Market Share

- The recycling segment includes the study of various technologies, such as X-ray transmission, camera solutions, laser, and NIR sensors, used in the recycling industry for efficient sorting processes worldwide. The recycling segment covered as a part of the study includes metal and scrap recycling, municipal waste recycling, electronic waste recycling, different types of plastic waste recycling, and textile waste recycling.

- Optical waste sorting is a contemporary and environmentally conscious recycling technique that leverages advanced camera systems, sensors, and machine learning algorithms. These technologies swiftly and precisely identify and categorize various waste materials for optimal disposal or recycling. The process is user-friendly, employing color-coded bags tailored to different recyclable materials. Users simply deposit these bags into a common waste bin or inlet. Subsequently, at the sorting plant, the bags are segregated by color and directed to their respective containers.

- Optical sorters have revolutionized the recycling industry by enhancing waste management processes' efficiency, accuracy, and overall effectiveness. They employ advanced camera systems, sensors, and machine learning algorithms to efficiently and accurately identify and sort various waste materials. These systems can detect the unique spectral signatures of different materials, allowing for precise identification and separation. This technology is particularly useful for sorting post-consumer waste, including plastics, glass, paper, and metal.

- An optical sorting system can be used with the automated waste collection system or can be added to traditional methods of waste collection to modernize them. For instance, Envac has, in collaboration with the Grow Smarter project at Valla Torg, Stockholm, achieved a significant 65% reduction in household general waste. This achievement followed the company's overhaul of traditional recycling methods.

- The newly implemented system tracks weight per fraction, monitors user sorting efficiency, and assesses the disposal methods of recyclables. By leveraging this data, Envac has optimized the system, surpassing conventional standards. Technological advancements allow precise configuration of the system's capacity and collection intervals, enhancing recycling rates and establishing the system as both sustainable and intelligent.

- Governments and international organizations worldwide are taking significant measures to reduce plastic waste, which is creating a significant demand for the implementation of optical sorters. For instance, in 2023, the UN Environment Program (UNEP) unveiled a roadmap, proposing measures to reduce global plastic pollution by 80% by 2040. This target is achievable and contingent on nations and corporations embracing substantial policy and market changes and leveraging technologies already at their disposal.

- The OECD forecasts a tripling of global plastic waste generation by 2060, surpassing a staggering one billion metric tons. This surge is primarily attributed to burgeoning populations and economic expansion.

- Companies are developing innovative solutions to remain competitive in the technologically advanced market and cater to customers' varying needs. For instance, in July 2024, Cimbria, a Denmark-based company, released new optical sorters that provide advanced sorting of plastics with precise material separation to enable the purification of up to 99.99% of the sorted plastic.

Asia Pacific to Register Major Growth

- Optical sorters are significantly witnessing increasing demand in the Asia-Pacific due to a growing emphasis on food safety and waste management. This trend is particularly evident in countries like China, India, and Japan, where the demand for efficient sorting solutions is on the rise.

- The integration of advanced technologies such as AI, machine learning, and hyperspectral imaging has significantly enhanced optical sorters' capabilities. These innovations allow for more precise sorting of various materials, including food products, plastics, and metals, which is crucial for industries looking to improve efficiency and reduce waste.

- With rising consumer awareness regarding food safety, the food processing industry in Asia-Pacific is increasingly adopting optical sorting technologies. These systems ensure that only high-quality products reach consumers by effectively removing defective items and containments during processing. This is particularly important in countries with large agricultural sectors, where maintaining quality is essential for both domestic consumption and export.

- South Korea's food and beverage market offers tremendous potential for international players and brands. As the 10th largest economy with a high per-capita GDP, South Korea presents a lucrative opportunity for the market. The country has over 48,000 convenience stores (CVS) across the country with major players, including GS25 (GS Holdings Corp.), CU (BFG Retail), and 7-Eleven (including Ministop, Lotte Group). Thus, the growing food & beverage industry in the country is expected to add lucrative growth opportunities for the market studied.

- Moreover, India's food ecosystem offers immense investment opportunities by stimulating growth in the food retail sector, promoting economic policies, and attractive fiscal incentives. The Government of India has taken all necessary measures to encourage investments in the Indian food processing industry through the Ministry of Food Processing Industries (MoFPI). For example, Pradhan Mantri Kisan Sampada Yojana (PMKSY) aims to develop a modern food processing infrastructure.

- Moreover, the food and beverage industry in Japan is also prospering owing to factors such as a higher share of the urban population and changing food consumption habits, among others. For instance, according to the Global Organic Trade Guide, the consumption of packaged organic food in Japan is anticipated to reach a value of USD 427.1 million by 2025, compared to USD 401.4 million in 2018.

Optical Sorter Industry Overview

The Optical Sorter Market is highly fragmented, with the presence of global players and small and medium-sized enterprises. Some of the major players in the market include TOMRA Systems ASA, Eagle Vizion Inc., Key Technology Inc. (A Duravant LLC), Hefei Meyer Optoelectronic Technology Inc., and Machinex Industries Inc. Market players are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- July 2024 - TOMRA's GAINnext sorting device was specifically designed for UBCs. This new packaging sorter leverages deep learning technology, a branch of AI and machine learning, to distinguish various containers on a conveyor belt. Currently, GAINnext is being rolled out in North America. Tomra boasts that this technology provides a high-throughput solution for aluminum recovery from UBCs, ensuring 98% or above purity without manual sorting.

- January 2024 - Key Technology, part of Duravant's Food Sorting and Handling Solutions division, introduced optical sorters designed for processed protein products. These products range from frozen chicken nuggets and tenders to fish sticks and plant-based meat alternatives. The optical sorters, notably the COMPASS and VERYX models, are designed to eliminate defects and foreign materials (FM) swiftly. By doing so, they enhance product quality, boost yields, and cut labor requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Focus on Automation for Increasing Productivity in Various Industries

- 5.1.2 Growing Emphasis on Food Safety and Rising Demand for Processed Foods

- 5.2 Market Restraints

- 5.2.1 High Initial and Maintenance Cost of the Equipment

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 X-ray Transmission

- 6.1.2 Camera Solutions

- 6.1.3 NIR-Sensors

- 6.1.4 Other Technologies (Hyperspectral, Laser, etc.)

- 6.2 By End-user Industries

- 6.2.1 Food Processing

- 6.2.2 Recycling

- 6.2.3 Mining

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TOMRA Systems ASA

- 7.1.2 Eagle Vizion Inc.

- 7.1.3 Key Technology Inc. (A Duravant LLC)

- 7.1.4 Hefei Meyer Optoelectronic Technology Inc.

- 7.1.5 Machinex Industries Inc.

- 7.1.6 Raytec Vision SPA

- 7.1.7 Cimbria Inc. (AGCO Corporation)

- 7.1.8 Satake Corporation

- 7.1.9 Sesotec GmbH

- 7.1.10 Buhler Group