|

市場調查報告書

商品編碼

1822637

光學分選機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Optical Sorter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

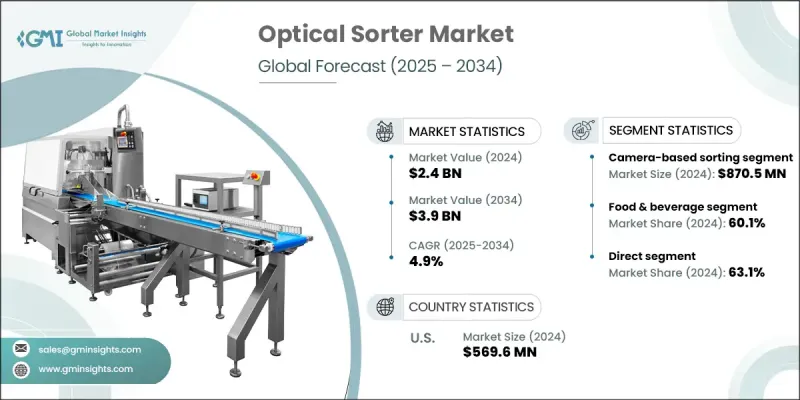

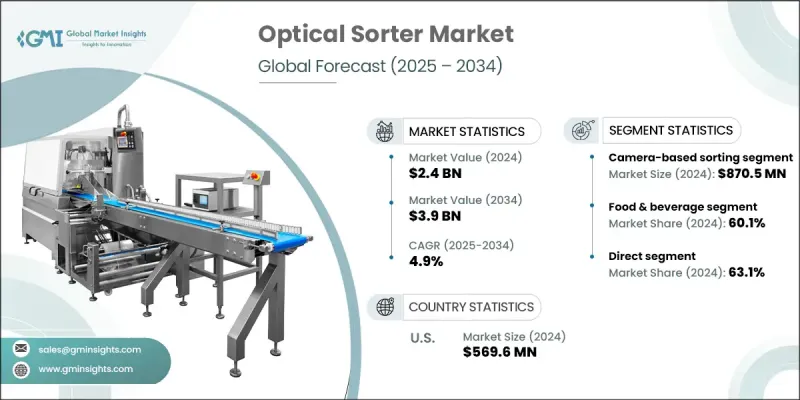

2024 年全球光學分選機市場價值為 24 億美元,預計到 2034 年將以 4.9% 的複合年成長率成長至 39 億美元。

蓬勃發展的包裝食品產業推動了自動化分類解決方案需求的不斷成長,尤其是在快速成長的經濟體中。隨著加工食品消費量的激增,製造商面臨越來越大的滿足衛生、安全和品質標準的壓力。隨著全球人口預測的成長,企業現在面臨著高效擴大食品生產規模的巨大壓力,這使得光學分類技術成為創新和合規的重中之重。這些系統不再是可有可無的升級,而是在人工檢測無法滿足需求的高產量設施中不可或缺的。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 39億美元 |

| 複合年成長率 | 4.9% |

光學分選技術能夠高速、非接觸式地偵測並剔除瑕疵產品、污染物和不合格品。這些解決方案不僅符合嚴格的食品安全法規,還能提高營運吞吐量。不斷發展的永續發展目標也影響著產業成長,因為光學分選機在循環經濟(包括減少廢棄物和資源回收)中發揮關鍵作用。如今,先進的機器整合了近紅外線、高光譜感測器、X光視覺和人工智慧成像技術,能夠根據結構、形狀、顏色和化學成分對材料進行精確分選。這些創新正在食品、回收和製藥等各行各業中不斷增強其重要性。

基於攝影機的分選機在2024年創造了8.705億美元的市場規模,預計到2034年將以4.6%的複合年成長率成長。由於其成本效益、易於整合和技術靈活性,該細分市場正在迅速擴張。這些系統使用高影格速率的RGB和單色鏡頭,可以檢測產品特徵的細微變化。它們能夠處理從新鮮農產品到工業零件的各種產品,使其具有高度的適應性。解析度、邊緣運算和板載AI的最新進展正在提高檢測率、提高即時準確性並最大限度地減少誤判。

食品飲料產業在2024年佔了60.1%的市場佔有率,預計在2025年至2034年期間的複合年成長率將達到4.7%。消費者對品質、清潔度和透明度的期望不斷提高,促使加工商投資高效的光學分選機。監管機構日益嚴格的審查,加上消費者對食品安全和可追溯性的要求,使得這些系統變得至關重要。即時缺陷檢測和精準剔除有助於生產商保持一致的產品質量,最大限度地減少召回,並建立品牌信任。

2024年,美國光學分選機市場規模達5.696億美元,預計2034年將以5.2%的複合年成長率成長。食品加工、回收和製藥業的強勁成長推動了這一成長。各機構嚴格的監管標準要求技術能夠提供一流的衛生、精度和可追溯性。隨著人們對永續性、減少浪費和自動化的認知不斷提高,美國各工業領域對尖端分選設備的需求也不斷成長。

影響全球光學分選機市場的關鍵公司包括 Buhler、Raytec Vision、TOMRA、STEINERT、SATAKE、Allgaier、CP Manufacturing、Cimbria Heid、Angelon、SORTEX、Pellenc ST、GREEFA、NEWTEC、Sesotec 和 NRT (National Recovery Technologies)。光學分選機市場的領導者正在大力投資人工智慧技術和智慧感測器,以提高分選精度並減少處理錯誤。許多公司正在整合高光譜成像和深度學習演算法來處理各種材料的複雜分選需求。各公司正在擴展其產品組合,以提供可同時滿足食品和非食品行業的多應用系統。與自動化供應商的合作有助於簡化工廠運作並增強機器互通性。關鍵公司也透過合資企業和服務夥伴關係擴大其在高成長地區的業務。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 食品飲料業的擴張

- 回收和廢棄物管理需求不斷成長

- 技術進步

- 產業陷阱與挑戰

- 資本投資成本高

- 在成本敏感的市場中採用有限

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 基於攝影機的分類

- 雷射分選

- NIR(近紅外線)分選

- 高光譜成像

- X光分選

- 組合/混合系統

第6章:市場估計與預測:依平台,2021 - 2034

- 主要趨勢

- 自由落體

- 腰帶

- 車道

- 混合

- ADR 系統

- 機械平地機

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 食品和飲料

- 回收利用

- 製藥

- 其他

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- Allgaier

- Buhler

- Cimbria Heid

- CP Manufacturing

- GREEFA

- NRT (National Recovery Technologies)

- NEWTEC

- Pellenc ST

- Raytec Vision

- SATAKE

- Sesotec

- SORTEX

- STEINERT

- TOMRA

- Angelon

The Global Optical Sorter Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 3.9 billion by 2034.

The accelerating demand for automated sorting solutions, especially in fast-growing economies, is driven by a booming packaged goods sector. As consumption of processed food surges, manufacturers are under mounting pressure to meet hygiene, safety, and quality standards. With rising global population projections, organizations now face intense pressure to scale food production efficiently, placing optical sorting at the forefront of innovation and compliance. These systems are no longer an optional upgrade-they're a necessity in high-output facilities where manual inspection fails to meet demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 4.9% |

Optical sorting technology enables high-speed, contactless detection and removal of defective products, contaminants, and non-conforming items. These solutions support rigorous food safety regulations while increasing operational throughput. Evolving sustainability goals are also influencing growth, as optical sorters play a key role in circular economy efforts, including waste reduction and resource recovery. Advanced machines now integrate near-infrared, hyperspectral sensors, X-ray vision, and AI-powered imaging to accurately sort materials by structure, shape, color, and chemical composition. These innovations are reinforcing their relevance across a diverse range of industries-from food to recycling to pharmaceuticals.

The camera-based sorters generated USD 870.5 million in 2024 and are projected to grow at a CAGR of 4.6% through 2034. This segment is expanding rapidly due to its cost-efficiency, ease of integration, and technological flexibility. Using RGB and monochrome cameras at high frame rates, these systems can detect minute variations in product features. Their ability to process everything from fresh produce to industrial parts makes them highly adaptable. Recent improvements in resolution, edge computing, and onboard AI are sharpening detection rates, improving real-time accuracy, and minimizing false rejects.

The food & beverage industry segment held a 60.1% share in 2024 and is forecast to grow at a CAGR of 4.7% between 2025 and 2034. Rising consumer expectations for quality, cleanliness, and transparency are pushing processors to invest in high-efficiency optical sorters. Increasing scrutiny from regulatory bodies, combined with consumer demands for food safety and traceability, has made these systems essential. Real-time defect detection and precision removal help producers maintain consistent product quality, minimize recalls, and build brand trust.

United States Optical Sorter Market was valued at USD 569.6 million in 2024 and is expected to grow at a CAGR of 5.2% through 2034. Strong growth in food processing, recycling, and pharmaceutical manufacturing is driving this expansion. High regulatory standards from agencies require technologies to deliver top-tier hygiene, precision, and traceability. Growing awareness of sustainability, waste reduction, and automation is accelerating the demand for cutting-edge sorting equipment across the country's industrial sectors.

Key companies shaping the Global Optical Sorter Market include Buhler, Raytec Vision, TOMRA, STEINERT, SATAKE, Allgaier, CP Manufacturing, Cimbria Heid, Angelon, SORTEX, Pellenc ST, GREEFA, NEWTEC, Sesotec, and NRT (National Recovery Technologies). Leading players in the optical sorter market are investing heavily in AI-driven technologies and smart sensors to boost sorting accuracy and reduce processing errors. Many are integrating hyperspectral imaging and deep learning algorithms to handle complex sorting needs across various materials. Companies are expanding their portfolios to offer multi-application systems that cater to both food and non-food sectors. Collaborations with automation providers help streamline plant operations and enhance machine interoperability. Key firms are also scaling their presence in high-growth regions through joint ventures and service partnerships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Platform

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of the food & beverage industry

- 3.2.1.2 Raising demand in recycling & waste management

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment costs

- 3.2.2.2 Limited adoption in cost-sensitive markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Camera-based sorting

- 5.3 Laser-based sorting

- 5.4 NIR (near-infrared) sorting

- 5.5 Hyperspectral imaging

- 5.6 X-ray sorting

- 5.7 Combined/Hybrid systems

Chapter 6 Market Estimates & Forecast, By Platform, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Freefall

- 6.3 Belt

- 6.4 Lane

- 6.5 Hybrid

- 6.6 ADR systems

- 6.7 Mechanical graders

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Recycling

- 7.4 Pharmaceuticals

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Allgaier

- 10.2 Buhler

- 10.3 Cimbria Heid

- 10.4 CP Manufacturing

- 10.5 GREEFA

- 10.6 NRT (National Recovery Technologies)

- 10.7 NEWTEC

- 10.8 Pellenc ST

- 10.9 Raytec Vision

- 10.10 SATAKE

- 10.11 Sesotec

- 10.12 SORTEX

- 10.13 STEINERT

- 10.14 TOMRA

- 10.15 Angelon