|

市場調查報告書

商品編碼

1641962

客戶分析:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Customer Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

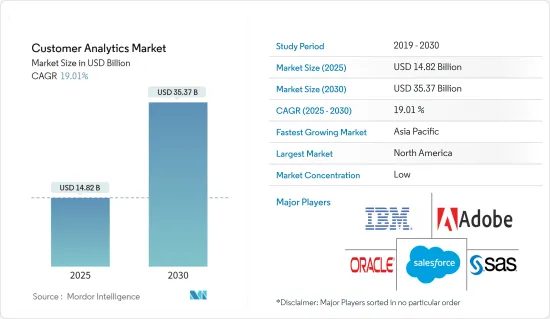

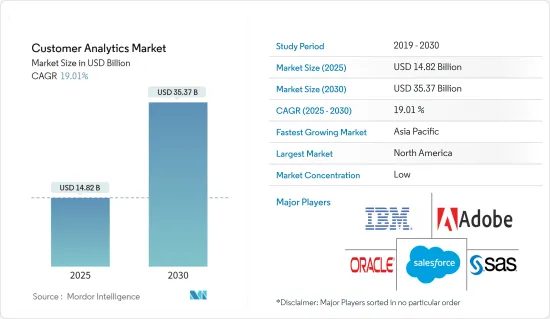

預計 2025 年客戶分析市場規模為 148.2 億美元,到 2030 年將達到 353.7 億美元,預測期內(2025-2030 年)的複合年成長率為 19.01%。

由於市場上已經出現了各種雲端基礎的解決方案,預計將有更多的企業轉向雲端。公司還可以了解如何釋放雲端分析的潛力,大多數元件都託管在雲端分析中:客戶資料來源、資料模型、處理應用程式、運算能力、分析模型和資料儲存。這可能使您能夠將智慧嵌入到現有程式中,以改善業務決策。

主要亮點

- 推動客戶分析市場成長的其他因素包括人工智慧(AI)簡化行銷流程、了解客戶購買行為以提供更個人化的客戶體驗的需求、機器學習(ML)和業務流程等技術進步自動化。

- 由於對提高顧客滿意度的需求不斷成長,該行業正在迅速發展。在零售業中,客戶分析用於制定客製化的溝通和行銷策略。了解哪些消費者購買什麼,並根據購物者資料為他們量身定做行銷策略,可以提高客戶體驗和忠誠度。根據 ACSI 零售和消費者研究,消費者滿意度在過去一年中保持相對穩定,這得益於重複購買、客戶忠誠度、客戶推薦、收益和參與度帶來的良好購物體驗,這讓零售商感到寬慰。

- 推動該行業發展的另一個因素是社交媒體意識的不斷增強。社群媒體分析可以增加品牌曝光、提升品牌價值、將產品清單與電子商務網站聯繫起來,並透過社群媒體平台擴大消費者覆蓋範圍,幫助監控人員並發展聯繫。的優勢。亞馬遜和沃爾瑪使用 Facebook、Instagram、YouTube 和 Twitter 等社群媒體網站來促銷他們的產品。社群平台是連結客戶和營業單位的現代店面。

- 近年來,安全和隱私侵犯行為不斷增加。因此,客戶對隱私和安全變得更加關注。這對客戶分析領域的擴展構成了重大障礙。由於資料遺失的威脅,保護消費者分析中的關鍵資料架構變得更加重要。

客戶分析市場趨勢

零售業成長推動市場成長

- 在零售領域,消費者重視並要求個人化的全通路體驗。因此,許多零售商開始採用顧客分析等技術來更了解消費者的需求。

- 隨著零售額的成長,客戶分析擴大被用於進行個人化的溝通和行銷宣傳活動。了解消費者的購買模式並調整行銷策略可以提高客戶體驗和忠誠度。

- 隨著網路應用的增加,網上購物變得越來越普遍。電子商務已成為零售和流通產業的重要平台。 2021年訂單數量與前一年同期比較增加15%,拉動了跨境電商的發展。來自不同國家的線上購物者更有可能進行大筆購買。光是亞馬遜一家就佔了美國銷售額的約40%和線上銷售成長的80%。

- 預測分析是商業情報解決方案的熱門趨勢,它使公司能夠準確預測未來客戶的購買趨勢。許多預測分析模型的發展主要是為了更好地服務現有客戶、減少客戶流失和建立更緊密的聯繫。

- 如果商家能夠分析消費者行為(流量、時間、停留等),就能獲得重要的洞見。 Motionlogic 是 T-Systems 推出的工具,它可以捕捉和分析運動,幫助實體零售商了解顧客的動作和動機。這些交通模式可以與特定的觸發器相聯繫,以指示有吸引力的區域或目的地,從而有可能幫助零售商了解即時客戶資料。

北美占主要佔有率

- 由於北美市場影響力強大,預計將佔據最大的市場佔有率。為了改善客戶體驗,對巨量資料計劃的需求不斷增加,這也改變了該地區組織對資料消費、收集和分析的看法。

- 美國公司可能會維持或增加其行銷支出,導致該地區的成長率低於其他地區。

- 為了提供客戶的單一視圖,美國銀行建立了一個分析系統,整合了來自美國線上和實體管道的資料。該銀行將其潛在客戶轉換率提高了 100% 以上,並透過客服中心提供更多相關潛在客戶和提案,提供了更個人化的體驗。

客戶分析行業概覽

消費者分析市場高度分散,現有企業和新興市場之間的競爭非常激烈。這些公司投資研發和收購,試圖透過新產品開發獲得相對於競爭對手的優勢。 Adobe Systems Inc.、IBM Corporation 和 Oracle Corporation 是該行業中的一些重要參與者。

- 2022 年 3 月-Adobe 為 Adobe Experience Cloud 推出新的客戶旅程分析。 Adobe 宣布推出一款用於體驗分析的新實驗工具。這使得企業能夠測試真實場景並評估結果,以了解微小的變化如何影響不同產品的客戶體驗。 Adobe 客戶資料平台 (CDP) 和客戶旅程分析也已整合,提高了 Adobe 發現客戶細分的能力。

- 2022 年 6 月銷售團隊推出新的 Customer 360 技術,將行銷、商業和服務資料整合到一個平台上。

- 2022 年 12 月 - 開放數位體驗供應商 Acquia 宣布對其客戶資料平台 (CDP) 進行更改,以擴大對商業行銷團隊的支援。這項附加功能擴展了行銷人員和資料科學家與 Acquia CDP 管理的資訊互動的方式,加強了該產品在可組合客戶資料舉措中的關鍵地位。 Acquia CDP 是 Acquia 數位體驗平台 (DXP) 的一個組成部分,該平台是業界第一個結合內容和資料來創造世界一流數位消費者體驗的開放平台。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 提高客戶滿意度的需求不斷增加

- 更加關注社群媒體以跟上客戶行為

- 市場限制

- 資料安全和隱私問題

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 技術藍圖

第6章 市場細分

- 依部署類型

- 本地

- 雲端基礎

- 按解決方案

- 社群媒體分析工具

- 網路分析工具

- 儀表板和報告工具

- 顧客之聲 (VOC)

- ETL(提取、轉換、載入)

- 分析模組/工具

- 按組織規模

- 中小企業

- 大型企業

- 按服務

- 託管服務

- 專業服務

- 按最終用戶產業

- 資訊科技/通訊

- 旅遊與飯店

- 零售

- BFSI

- 媒體與娛樂

- 衛生保健

- 運輸和物流

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Adobe

- Alteryx

- Angoss Software Corporation

- Axtria

- Bridgei2i Analytics Solution(Accenture)

- IBM

- Manthan Software Services Pvt. Ltd

- Microsoft

- NGDATA NV

- Oracle

- Pitney Bowes Inc.

- Salesforce Inc.

- SAS Institute Inc.

- Teoco Corporation

- Aruba Networks Inc.(Hewlett Packard Enterprise Development LP)

第8章投資分析

第9章 市場機會與未來趨勢

The Customer Analytics Market size is estimated at USD 14.82 billion in 2025, and is expected to reach USD 35.37 billion by 2030, at a CAGR of 19.01% during the forecast period (2025-2030).

Due to the variety of cloud-based solutions already on the market, more businesses are expected to migrate to the cloud. Companies might also learn how to exploit the potential of cloud analytics, where the bulk of the components, such as customer data sources, data models, processing apps, computing capacity, analytic models, and data storage, are hosted. This might assist in incorporating intelligence into existing procedures and improve operational decision-making.

Key Highlights

- Other factors driving the growth of the customer analytics market include the need to understand customer purchasing behavior to provide a more personalized customer experience, in addition to the advancement of technology such as artificial intelligence (AI), machine learning (ML), and business process automation to streamline marketing processes.

- The industry under consideration is rapidly developing due to the rising need for greater customer pleasure. Customer analytics are used in retail to produce tailored communications and marketing strategies. They know which consumers buy what, and tailoring marketing to them based on shopper data may increase customer experience and loyalty. According to the ACSI Retail and Consumer Study, retailers may sigh relief as consumer satisfaction remains relatively stable in the previous year due to a great shopping experience via repeat purchases, customer loyalty, customer referrals, revenues, and participation.

- Another element propelling the industry is the rise in social media awareness. Social media analytics enhances the benefits of social networking by increasing brand exposure, increasing brand value, and expanding consumer reach through social media platforms by linking their product list with e-commerce sites, which assists in monitoring people and connection development. Amazon and Walmart have utilized social media sites such as Facebook, Instagram, YouTube, and Twitter to promote their items. Social platforms are modern-day shops that act as a conduit between customers and entities.

- In recent years, there has been a rise in security and privacy breaches. As a result, customers began to worry more about their privacy and security. This has been a critical impediment to the expansion of the customer analytics sector. Significant data architecture in consumer analytics may become increasingly crucial to safeguard, threatening data loss.

Customer Analytics Market Trends

Growing Retail Sector to Drive Market Growth

- In the retail sector, consumers value and demand a personalized omnichannel experience. As a result, many retailers are turning to technology like customer analytics to understand better what their consumers want and need.

- As retail sales grow, customer analytics is increasingly used to create personalized communications and marketing campaigns. Knowing consumers' purchase patterns and adaptable marketing strategies improve customer experience and loyalty.

- Online purchasing has increasingly developed as Internet usage has increased. E-commerce has emerged as a critical platform in the retail and distribution industries. The number of orders climbed by 15% in 2021 compared to the previous year, fueling development in cross-border commerce. Online buyers from different nations are more likely to make significant purchases. Amazon alone accounts for around 40% of US sales and 80% of the increase in online sales.

- Predictive analytics is a popular trend in business intelligence solutions, allowing organizations to accurately forecast future customer purchasing preferences. Many predictive analytic models are developed primarily to give better service to existing customers, reduce churn, and build stronger connections.

- When merchants can analyze consumer activity, including flows, timing, and stops, they may draw significant insights. Motionlogic, a T-Systems tool, captures and analyzes motions to help brick-and-mortar retailers understand customers' journeys and motives. These traffic patterns may be linked to specific triggers to indicate attractive areas and destinations, which may aid retailers in comprehending real-time customer data.

North America Accounts for Major Share

- North America is expected to have the largest market share due to its robust presence. As the demand for big data projects to improve customer experience grows in this area, organizations' perspectives on data consumption, collecting, and analysis are changing.

- Corporations in the United States are likely to maintain or increase their marketing expenditures, resulting in a low growth rate for the region compared to other locations.

- To provide a single customer view, United States Bank established an analytics system incorporating data from online and physical channels in the United States. The bank raised its lead conversion rate by more than 100% and created more personalized experiences by providing relevant leads and suggestions to the contact center.

Customer Analytics Industry Overview

The market for consumer analytics is highly fragmented, with fierce competition from established and developing businesses. By spending on R&D and player acquisitions, these players hope to acquire an advantage over their competitors through new product development. Adobe Systems Inc., IBM Corporation, and Oracle Corporation are critical participants in the industry under consideration.

- March 2022 - Adobe introduced a new Customer Journey Analytics for Adobe's Experience Cloud. Adobe launched a new experimentation tool in experience analytics that allows organizations to test real-world scenarios and evaluate the results to understand how little changes can affect the overall customer experience across their various products. Adobe Customer Data Platform (CDP) and Customer Journey Analytics have also been combined to improve Adobe's capacity to uncover customer segments.

- June 2022 - Salesforce introduced new Customer 360 technologies that combine marketing, commerce, and service data on a single platform, allowing businesses to connect, automate, and customize every encounter and develop trusted relationships at scale.

- December 2022 - Acquia, the open digital experience provider, announced changes to its customer data platform (CDP) that expand support for business marketing teams. The additional features broaden how marketers and data scientists can engage with information managed by Acquia CDP and reinforce the product's important position in composable customer data initiatives. Acquia CDP is a component of Acquia Digital Experience Platform (DXP), the industry's first open platform for combining content and data to create world-class digital consumer experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Demand for Improved Customer Satisfaction

- 4.3.2 Increase in Social Media Concern to Address Customer Behavior

- 4.4 Market Restraints

- 4.4.1 Data Security and Privacy Concerns

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 TECHNOLOGY ROADMAP

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Solution

- 6.2.1 Social Media Analytical Tools

- 6.2.2 Web Analytical Tools

- 6.2.3 Dashboard and Reporting Tools

- 6.2.4 Voice of Customer (VOC)

- 6.2.5 ETL (Extract, Transform, and Load)

- 6.2.6 Analytical Modules/Tools

- 6.3 By Organization Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By Service

- 6.4.1 Managed Service

- 6.4.2 Professional Service

- 6.5 By End-user Industry

- 6.5.1 Telecommunications and IT

- 6.5.2 Travel and Hospitality

- 6.5.3 Retail

- 6.5.4 BFSI

- 6.5.5 Media and Entertainment

- 6.5.6 Healthcare

- 6.5.7 Transportation and Logistics

- 6.5.8 Manufacturing

- 6.5.9 Other End-user Industries

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia

- 6.6.4 Australia and New Zealand

- 6.6.5 Latin America

- 6.6.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adobe

- 7.1.2 Alteryx

- 7.1.3 Angoss Software Corporation

- 7.1.4 Axtria

- 7.1.5 Bridgei2i Analytics Solution (Accenture)

- 7.1.6 IBM

- 7.1.7 Manthan Software Services Pvt. Ltd

- 7.1.8 Microsoft

- 7.1.9 NGDATA NV

- 7.1.10 Oracle

- 7.1.11 Pitney Bowes Inc.

- 7.1.12 Salesforce Inc.

- 7.1.13 SAS Institute Inc.

- 7.1.14 Teoco Corporation

- 7.1.15 Aruba Networks Inc. (Hewlett Packard Enterprise Development LP)