|

市場調查報告書

商品編碼

1641961

企業協作:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Enterprise Collaboration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

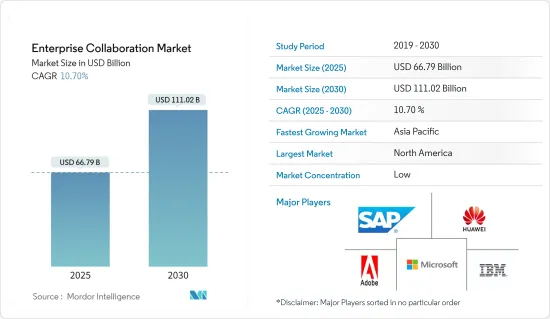

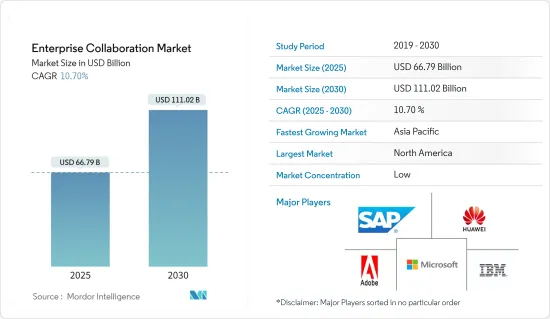

預計 2025 年企業協作市場規模為 667.9 億美元,到 2030 年將達到 1,110.2 億美元,預測期內(2025-2030 年)的複合年成長率為 10.7%。

企業正在利用虛擬實境、機器人流程自動化和人工智慧機器人等先進工具來提高內部生產力並促進更好的員工互動。據高盛稱,到 2025 年,虛擬實境和擴增實境市場的企業和公共部門部分預計將達到約 161 億美元。 RealSense 和 DORA 等虛擬實境公司正在為負責人提供身臨其境型體驗。

關鍵亮點

- 企業協作工具透過提供員工之間的無縫溝通並提高業務效率和生產力來幫助公司實現業務目標。企業協作工具提供組織之間的資料同步和協作解決方案,包括官方電子郵件、行事曆和聯絡人檢查等功能。此外,視訊會議可以幫助員工更積極地交流和共用想法。

- 人工智慧、物聯網和機器學習等先進技術正在企業協作工具中實施,以增強協作能力。基於人工智慧的企業協作工具可以追蹤員工的行為和共用的內容,提供生產力查核點,如消費行為、員工保留、辦公室利用率和績效最佳化。 關聯視覺化分析用於為員工提供預測性業務洞察,幫助他們實現業務完成得更快。

- 預計雲端基礎的工作負載部署將主要由生成的資料的持續成長推動。各個終端用戶產業都會產生大量的資料。資料中心適合那些為了企業協作而必須運行許多應用程式和複雜工作負載的組織。透過所有應用工具可以存取即時資料,您可以提高工作效率。

- 例如,2022 年 8 月,微軟宣佈在卡達推出一個新的資料中心區域,這表明微軟作為該國提供企業級服務的領先超大規模雲端供應商具有巨大潛力。最新的雲端資料區域與 Microsoft Azure 和 Microsoft 365 一起推出,讓企業能夠存取數百種可擴展、高可用性和彈性的雲端服務。

- 擴大使用行動裝置來操作眾多社交網路平台正在推動企業協作市場的成長。很少有人透過電腦造訪社交網站;大多數人透過智慧型手機造訪。例如在美國,目前超過50%的網路流量來自於行動設備,最新資料預測2026年美國行動網路用戶數將達3億人。

- 此外,由於智慧型手機的普及,中國、印度等新興經濟體也出現了類似的趨勢。這些優勢正在推動企業協作市場的成長。愛立信預計,2022年全球智慧型手機行動網路用戶數將達到約66億,到2028年將超過78億人。印度、中國和美國的智慧型手機行動網路訂閱用戶數量最多。

- 資料隱私問題是企業協作市場成長的關鍵挑戰之一。儘管許多公司都注重防範惡意資料駭客攻擊和竊取,但資料外洩往往是由於資料安全性的缺乏或意外的誤操作所造成的。此外,隨著公司走向更具協作性的環境,內部和與外部公司之間的資料交換將會增加。隨著企業和員工之間的資料交換增加,越來越需要解決在協作活動期間保護共用資料的挑戰。這些挑戰在一定程度上阻礙了市場的成長。

企業協作市場趨勢

雲端基礎的部署推動市場成長

預計基於雲端基礎的工作負載的擴展將主要受到所產生資料的持續成長的推動。許多行業都需要處理大量資料。資料中心適合運行各種應用程式和複雜工作負載以進行企業協作的組織。所有應用工具都可以存取即時資料,從而提高資料中心的生產力。

如今,企業社交協作 (ESC) 解決方案正在將世界各地的人們聯繫在一起。社交應用受到科技的限制,在一個部門行之有效的方法在另一個部門可能就行不通了。隨著雲端運算的出現,整合社交協作解決方案變得更加容易。許多中小型企業正在採用雲端運算。採用雲端運算可以幫助中小型企業降低硬體、軟體、儲存和技術人員的成本。它也有利於協作市場的資料可擴展性。

雲端基礎的平台提供更多功能和特性,因此企業不需要整合、實施和管理多個獨立系統。與內部部署相比,雲端基礎的部署具有這些優勢,預計將推動市場成長。據 Flexera Software 稱,到 2023 年,47% 的受訪者將在 Amazon Web Services (AWS) 上運行大量工作負載。

全球組織的擴張、生產力的提高以及自帶設備(BYOD)和物聯網的成長趨勢是預計推動雲端基礎的企業協作市場成長的關鍵因素。雲端基礎的企業協作解決方案的開發,包括語音通訊、音訊會議和社交協作軟體,使企業能夠高效、快速地協作,維持良好的客戶關係,並立即回應詢問,從而促進市場成長。

根據印度公司事務部的數據,截至 2022 年 6 月,印度這個南亞國家約有 148 萬家註冊公司。根據 BetterCloud 的數據,到 2022 年,全球組織將平均使用 130 個雲端基礎的軟體即服務 (SaaS) 應用程式。自 2015 年以來,企業使用的 SaaS 應用程式數量一直在增加,這可能會進一步推動市場成長。

公共雲端雲和私有雲端應用程式的混合環境需要使用正確的工具進行同質雲整合。例如,總部位於德國的 T-Systems 在高度安全的私有雲端上運行其動態協作服務,完全符合該國嚴格的資料隱私法。

這推動了新興國家各領域對應用程式的需求,使得雲端安全解決方案更加可行。隨著該地區大多數企業採用這些技術服務,雲端協作市場的應用範圍正在擴大,從而推動了整體市場的成長。

北美市場將實現顯著成長

由於 Facebook Inc.、Microsoft Corporation、Google LLC 和 Slack Technologies Inc. 等市場參與企業的存在,北美佔據了企業協作市場的大部分佔有率。這些公司向小型、中型和大型企業提供技術先進的解決方案和產品,透過促進內部和外部溝通來提高生產力。該地區擁有先進的基礎設施,這對市場來說是重要的收益驅動力。預計這些因素將在未來幾年進一步促進該地區的市場成長。

該地區的公司正在超越公共雲端,進入混合 IT 的新時代,即公共雲端、私有雲端和傳統 IT 的結合。透過採用混合雲端策略,這些公司正在改善其協作業務的運作方式。

2022 年 6 月,Google Cloud推出了自己的以美國為重點的「Google Public Sector」子公司。該部門向聯邦、州和地方政府以及教育機構銷售產品。這個最新部門將作為 Google LLC 的子公司營運,並將專注於向美國公共部門客戶提供 Google Cloud 技術,包括 Google Cloud Platform 和 Google Workspace。

在當前情況下,資訊透過行動電話、視訊會議、即時通訊等方式共用,並在規定的時間範圍內傳遞。協作溝通顯著減少了擁塞並提高了聯繫的便利性。為了更好地溝通,企業正在盡一切努力利用雲端和協作技術進行互通,這推動了企業協作市場的成長。

據Oberlo稱,北美擁有2,250億社群媒體用戶和3,730億行動用戶。這使得企業能夠處理筆記、培訓資源並共用與其行業相關的最新消息。企業協作解決方案和服務正在該地區廣泛採用,尤其是美國是社交、行動、分析和雲端 (SMAC) 技術的早期採用者之一。

美國聯合部隊司令部、美國以及許多地方和州機構等組織開始使用協作技術來建立內部和外部知識庫。本公司客製其產品以保持市場競爭力。總部位於美國的Dropbox於2022年8月公佈了其企業軟體入口網站的最新版本。您可以使用捷徑啟動應用程式,或使用內建的 Slack訊息和 Zoom 視訊通話。

企業協作產業概覽

企業協作市場細分狀況良好。雖然主要企業都覬覦較大的佔有率,但一些較小的參與者也覬覦相當大的市場佔有率。結果就是企業間競爭敵意激烈。市場參與企業包括微軟、華為技術有限公司和 Adobe Systems Inc.近期市場走勢如下:

2022 年 7 月:微軟宣布推出 Microsoft Cloud for Sovereignty,這是一款主要針對歐洲公共部門客戶的獨特解決方案。微軟雲端主權的加入使企業能夠更好地控制資料,並擴大雲端操作和管治程序的透明度。

2022 年 1 月:塔塔諮詢服務公司 (TCS) 現已成為新推出的 Microsoft Cloud for Retail 的合作夥伴,並擴大了與超大規模企業的合作。 TCS 將結合其與全球領先零售商合作所獲得的深厚行業知識及其多視野雲轉型框架,幫助零售商利用 Microsoft Cloud for Retail 加速其成長和轉型之旅。 Microsoft Cloud for Retail 是一種行業特定的安全雲,它結合了由標準資料模型連結的多種 Microsoft 技術,將端到端購物者旅程中的體驗與整合的智慧功能連接起來。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 企業的競爭

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- API 整合以提高效率

- 擴大使用行動裝置進行時間管理

- 市場問題

- 有關資料共享的安全性問題

第6章 市場細分

- 依實施類型

- 本地

- 雲端基礎

- 按應用

- 通訊工具

- 會議工具

- 調整工具

- 按最終用戶產業

- 通訊和 IT

- 旅遊與飯店

- BFSI

- 零售和消費品

- 教育

- 運輸和物流

- 醫療

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Microsoft Corporation

- Huawei Technologies Co. Ltd.

- Adobe Systems Inc.

- SAP SE

- IBM Corporation

- Atlassian Corporation PLC

- Slack Technologies Inc.

- TIBCO Software Inc.

- Polycom Inc.

- Salesforce.Com Inc.

- Mitel LLC

- Cisco System Inc.

- Zoho Corporation Pvt. Ltd.

- Jive Software

- Axero Solutions LLC

第8章投資分析

第9章:市場的未來

The Enterprise Collaboration Market size is estimated at USD 66.79 billion in 2025, and is expected to reach USD 111.02 billion by 2030, at a CAGR of 10.7% during the forecast period (2025-2030).

Enterprises utilize advanced tools like virtual reality, robotic process automation, and artificial intelligence bots to augment internal productivity and promote better employee communication. According to Goldman Sachs, the virtual and augmented reality market's enterprise and public sector segments are expected to account for around USD 16.1 billion by 2025. Virtual reality companies, such as RealSense and DORA, offer immersive experiences for the boardroom.

Key Highlights

- Enterprise collaboration tools help firms by providing seamless communication between employees and improving their operational efficiency and productivity, helping them meet their business goals. Enterprise collaboration tools provide data synchronization and collaboration solutions across organizations and include features such as checking official emails, calendars, and contacts. Furthermore, video conferencing helps to give the employees more engaging communication and sharing of ideas.

- Advanced technologies such as AI, IoT, and ML are being implemented into enterprise collaboration tools to enhance collaborative capabilities. AI-based enterprise collaboration tools can track the activities of employees and the contents being shared and are used to deliver anticipated business insights to the employees and help get the work done quicker by correlating visual analytics with production checkpoints such as consumer behavior, employee retention, office utilization, and performance optimization.

- The cloud-based deployment of workloads is anticipated to be primarily driven by the consistent growth in the generated data. Various end-user industries are dealing with a massive volume of data being generated. The data centers are more suited for an organization that has to run many applications and complex workloads for enterprise collaboration. It also enables high productivity, with access to real-time data with all application tools.

- For instance, in August 2022, Microsoft announced the launch of its new data center region in Qatar, marking a significant possibility for Microsoft as the most significant hyperscale cloud provider to offer enterprise-grade services in the country. The latest cloud data center region launches with Microsoft Azure and Microsoft 365, giving organizations access to hundreds of scalable, highly available, and resilient cloud services.

- The growing usage of mobile devices to operate numerous social networking platforms boosts the enterprise collaboration market growth. It is observed that few people access social networking sites via computers, while most people use smartphones to access these websites. For instance, recently, more than 50% of web traffic in the United States originated from mobile devices, and according to the latest data, mobile internet users in the United States are forecast to reach 300 million by 2026.

- Furthermore, emerging economizing, such as China and India, are also experiencing a similar trend, owing to the increasing usage of smartphones due to their easy accessibility. These advantages are propelling the growth of the enterprise collaboration market. According to Ericsson, smartphone mobile network subscriptions worldwide reached almost 6.6 billion in 2022 and are forecast to exceed 7.8 billion by 2028. India, China, and the U.S. have the highest smartphone mobile network subscriptions.

- Data privacy concern is one of the significant challenges for the growth of the enterprise collaboration market. While many enterprises focus on preventing malicious data hacking and theft, data breaches are most commonly caused due to lack of data security or accidental mishandling. Furthermore, as enterprises step toward a more collaborative environment, the exchange of data increases, both within the company and with external enterprises. With the increasing data exchange among enterprises and employees, there is a growing need to address the challenges of safeguarding shared data during collaboration activities. Such challenges are hampering the market growth at a certain level.

Enterprise Collaboration Market Trends

Cloud-based Deployment to Increase the Market Growth

Cloud-based deployment to workload is expected to be primarily driven by the consistent growth in the data generated. Several industry verticals are dealing with a massive volume of data. A data center is better suited for an organization that runs many kinds of applications and complex workloads for enterprise collaboration. It enables high productivity, with access to real-time data with all application tools.

Enterprise social collaboration (ESC) solutions have connected people worldwide in recent years. Social applications have been limited by technology and may work fine for one department but not for another. The advent of the cloud makes integrating social collaboration solutions more effortless. Most SMEs (small and medium enterprises) are adopting cloud deployment, as these solutions help SMEs avoid hardware, software, storage, and technical staff costs. It also helps in the scalability of data in the collaboration market.

The market players deliver cloud-based platforms with more features and functionality, avoiding organizations needing to integrate, implement, and manage several standalone systems. Such advantages of cloud-based deployment over on-premises are expected to boost the market growth. According to Flexera Software, in 2023, 47% of respondents are already running significant workloads on Amazon Web Services (AWS).

The expansion of organizations globally, increased productivity, and growth in the trend of bringing devices (BYOD) and the IoT are some significant factors expected to boost the growth of the cloud-based enterprise collaboration market. With the development of cloud-based Enterprise collaboration solutions, including telephony, teleconferences, and social collaboration software, enterprises collaborate efficiently and rapidly, maintain good relationships with clients, and immediately respond to queries, allowing market growth.

According to the Ministry of Corporate Affairs (India), as of June 2022, there were around 1.48 million registered companies in the South Asian country of India. In addition, According to BetterCloud, In 2022, organizations worldwide were using an average amount of 130 cloud-based software as a service (SaaS) applications. Since 2015, the number of SaaS apps enterprises use has constantly increased, which may further drive market growth.

Hybrid landscapes of public and private cloud applications require integration in a homogeneous cloud coordinated with the right tools. For instance, a German-based company, T-Systems, operates dynamic services for collaboration in the high-security private cloud, fully compliant with the country's strict data privacy and protection laws.

Therefore, the growing demand for applications across various sectors in emerging economies also boosts viability, providing relevant cloud security solutions. As most enterprises across regions engage in these technology services, the usage of the cloud collaboration market expands and drives the growth of the overall market.

North America to Experience Significant Market Growth

North America significantly holds the market share in the enterprise collaboration market due to the presence of market players such as Facebook Inc., Microsoft Corporation, Google LLC, and Slack Technologies Inc. These organizations provide technologically advanced solutions and products to small- and large-scale companies to boost their productivity by facilitating enhanced internal and external communications. This region has an advanced infrastructure capability, which has led it to become a significant revenue generator for the market. Such factors would further augment regional market growth in the coming years.

Companies in the region are moving beyond the public cloud and stepping into a new era of hybrid IT, which combines public cloud, private cloud, and traditional IT. These organizations have implemented a hybrid cloud strategy as it helps improve how they run their collaboration business.

In June 2022, Google Cloud launched a unique 'Google Public Sector' subsidiary focusing on the United States. The division will sell to national, state, and local governments and educational associations. This latest division will serve as a subsidiary of Google LLC and will specialize in bringing Google Cloud technologies, including Google Cloud Platform and Google Workspace, to US public sector customers.

In the current scenario, information is shared using mobile phones, video conferencing, instant messenger, and others that deliver information within a stipulated time. With collaborative communication, the congestion overload is reduced significantly, thus providing ease of contact. For better communication, firms are making every effort to have cloud and collaboration technology mutually available, which drives the growth of the Enterprise Collaboration Market.

According to Oberlo, North America has 225 billion social media users and 373 billion mobile subscriptions. This will enable enterprises to process memos and training resources and share industry-relevant news updates. Enterprise collaboration solutions and services have gained wide adoption in the region, particularly in the US, as the nation has been one of the earliest adopters of Social, Mobile, Analytics, and Cloud (SMAC) technologies.

Organizations such as the US Joint Forces Command, the US Department of Defense, and many local and state agencies have started to use collaborative technologies to build internal and external knowledge repositories. Companies are customizing their offerings to stay competitive in the market. US-based Dropbox announced its more recent version in August 2022, an enterprise software portal. It allows users to launch apps with shortcuts and use built-in Slack message-sending and Zoom video calls.

Enterprise Collaboration Industry Overview

The enterprise collaboration market is favorably fragmented. The top players aim for a large share of the market, while the numerous smaller players aim for a substantial pie of the market. This results in intense rivalry and competition. Key participants in the market are Microsoft Corporation, Huawei Technologies Co. Ltd, Adobe Systems Inc., etc. Some of the recent developments in the market are -

July 2022: Microsoft introduced the launch of the Microsoft Cloud for Sovereignty, a unique solution for public sector customers, mainly in Europe. With the addition of Microsoft Cloud for Sovereignty, companies will have greater control over their data and expanded transparency to the operational and governance procedures of the cloud.

January 2022: Tata Consultancy Services (TCS) is currently a partner for the newly-launched Microsoft Cloud for Retail, expanding its collaboration with the hyper-scale. TCS will combine its deep industry knowledge from working with significant retailers worldwide and its multi-horizon cloud transformation framework to assist retail clients in accelerating their growth and transformation journeys using Microsoft Cloud for Retail. Microsoft Cloud for Retail is a secure industry-specific cloud that combines various Microsoft technologies linked by a standard data model to connect experiences across the end-to-end shopper journey with integrated and intelligent capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 API Integration for Greater Efficiency

- 5.1.2 Increase in Usage of Mobile Devices for Time Management

- 5.2 Market Challenges

- 5.2.1 Security Concerns in Data Collaboration

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Application

- 6.2.1 Communication Tools

- 6.2.2 Conferencing Tools

- 6.2.3 Coordination Tools

- 6.3 By End-user Industry

- 6.3.1 Telecommunications and IT

- 6.3.2 Travel and Hospitality

- 6.3.3 BFSI

- 6.3.4 Retail and Consumer Goods

- 6.3.5 Education

- 6.3.6 Transportation and Logistics

- 6.3.7 Healthcare

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Huawei Technologies Co. Ltd.

- 7.1.3 Adobe Systems Inc.

- 7.1.4 SAP SE

- 7.1.5 IBM Corporation

- 7.1.6 Atlassian Corporation PLC

- 7.1.7 Slack Technologies Inc.

- 7.1.8 TIBCO Software Inc.

- 7.1.9 Polycom Inc.

- 7.1.10 Salesforce.Com Inc.

- 7.1.11 Mitel LLC

- 7.1.12 Cisco System Inc.

- 7.1.13 Zoho Corporation Pvt. Ltd.

- 7.1.14 Jive Software

- 7.1.15 Axero Solutions LLC