|

市場調查報告書

商品編碼

1640427

硝基苯 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Nitrobenzene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

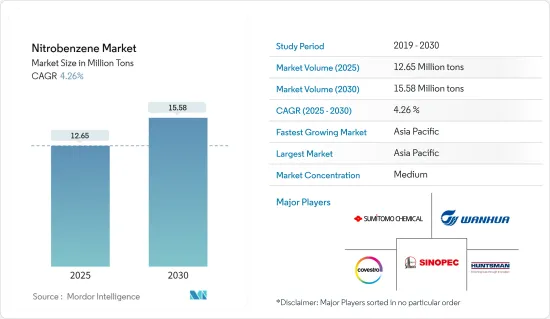

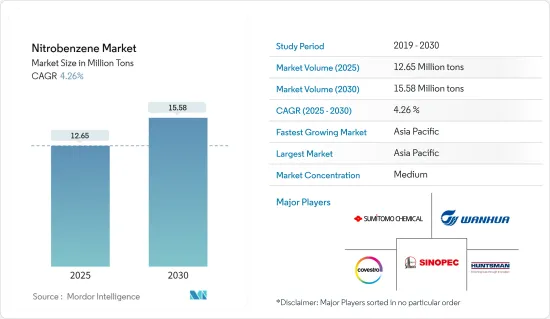

預計2025年硝基苯市場規模為1,265萬噸,預計2030年將達到1,558萬噸,預測期(2025-2030年)複合年成長率為4.26%。

2020 年,硝基苯市場受到了 COVID-19 的負面影響。考慮到大流行的情況,各種硝基苯衍生物產品的需求下降對市場需求產生了負面影響。但硝基苯衍生物苯胺衍生的對乙醯胺酚酚需求增加,刺激硝基苯市場需求。儘管如此,市場在疫情後時代已開始加快步伐,並預計未來將遵循相同的軌跡。

主要亮點

- 從中期來看,推動需求強勁的因素,例如生產苯胺的硝基苯需求增加、生產原料的容易取得以及亞太地區建設活動的活性化,預計將推動市場成長。

- 相反,對生物基化學品的需求不斷成長可能會阻礙市場成長。

- 世界各地建築業的各種投資可能為所研究的市場帶來機會。

- 亞太地區主導全球市場,消費量最高的國家是中國和印度等。

硝基苯市場趨勢

苯胺生產需求增加

- 苯胺製造用途佔硝基苯用途的最大佔有率,佔超過90%。主要生產硝基苯催化加氫。

- 印度是最大的苯胺生產和出口國之一。根據印度化學和化學肥料部統計,2022-2023年國內苯胺產量為39,660噸,較2021-2022年成長約18.28%。

- 苯胺衍生的二苯基甲烷二異氰酸酯(MDI) 是各種最終用途行業(包括建築和汽車領域)聚合物的重要前體。

- 根據國際汽車製造組織(OICA)的數據,2022年全球汽車產量成長約6%,達到85.01輛。這將減少對基於MDI的合成橡膠和聚氨酯等聚合物的需求,這些聚合物用於製造各種汽車零件,如轉向部件、安全氣囊蓋、防水地板和保險桿。

- 此外,MDI也用於生產聚氨酯泡棉,聚氨酯泡沫主要用作建築物的隔熱材料。

- 英國土木工程師學會估計,到 2025 年,中國、印度和美國這三大國家將佔全球建築業成長的近 60%。

- 根據美國人口普查局統計,2023年美國建設業年度總額為19,787億美元,較2022年成長約7.03%。

- 製藥業是全球成長最快的市場之一,尤其是在美國、印度和德國。對乙醯胺酚(乙醯胺酚)是一種由苯胺製成的流行止痛藥。世界上最受歡迎的學名藥是乙醯胺酚。它以錠劑、錠劑和糖漿的形式出售,適合所有年齡層。

- 中國、印度、美國、德國是全球最大的製藥工業國。據估計,中國製造商約佔全球使用的原料藥的 40%。此外,美國進口的原料藥75% 至 80% 來自中國和印度。對降低成本和不太嚴格的環境法規的渴望正在推動中國和印度的製藥業發展。

- 根據IQVIA預測,2023年全球醫藥市場規模為16,070億美元,成長約8.34%。

- 因此,所有上述因素預計將對未來幾年的市場成長產生重大影響。

亞太地區主導市場

- 就消費和生產而言,亞太地區是硝基苯最大的市場,預計在預測期內的調查市場中也將出現最高的成長。由於該地區基礎設施不足和人事費用不足,多家外國公司已將其生產設施遷至該地區。硝基苯的生產和消費也受到主要苯胺和二苯基甲烷二異氰酸酯(MDI)生產企業擴大產能的顯著影響。

- 由於對黏合劑、密封劑、合成橡膠和聚氨酯等各種基於 MDI 的產品的需求不斷增加,建築業已成為硝基苯最重要的最終用戶市場。此外,它還用作木材和家具的粘合劑。為了這些用途,建築業消耗了全球生產的硝基苯的 48% 以上,其中大部分發生在亞太地區。

- 中國、印度和越南等亞太國家的建設活動強勁成長,預計將在預測期內推動該地區苯胺衍生物的消費。

- 根據美國國際貿易管理局的數據,中國是世界上最大的建築市場,預計到2030年將以年均8.6%的速度成長。據國家發展和改革委員會(NDRC)稱,到2025年,中國已在重大建設計劃上投資1.43兆美元。

- 根據中國國家統計局的數據,2023年中國建築業總產值成長1.99%,達到712,847.2億元人民幣(108,677.8億美元)。

- 根據住宅及城鄉建設部預測,2025年中國建築業預計將維持GDP的6%。基於這些預測,2022年1月,中國政府宣布了五年計劃,透過品質主導發展提高建築業的永續性。

- 印度的住宅產業也在成長,政府的支持和措施進一步刺激了需求。在2022-2023年預算中,住房與城市發展部(MoHUA)已撥款約98.5億美元用於住宅建設並籌集資金以完成停滯的計劃。

- 因此,所有上述因素預計將對未來幾年的市場成長產生重大影響。

硝基苯產業概況

硝基苯市場部分整合。主要參與企業包括(排名不分先後)科思創股份公司、亨斯邁國際有限責任公司、住友化學、萬華化學和中國石化集團公司(中石化)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 苯胺需求增加

- 輕鬆取得原料

- 亞太地區建設活動的成長

- 抑制因素

- 對生物基化學品的需求增加

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 監理政策分析

第5章市場區隔(市場規模(基於數量))

- 目的

- 苯胺生產

- 染料/顏料

- 殺蟲劑

- 醫藥中間體

- 其他用途(溶劑、火藥等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Aarti Industries Ltd.

- Aromsyn Co.,Ltd.

- Bann Quimica Ltda.

- Chemieorganics Chemical India Pvt.Ltd.

- China Petrochemical Corporation(Sinopec)

- Covestro AG

- Huntsman International LLC.

- Sadhana Nitro Chem Ltd.

- SP Chemicals Pte Ltd.

- Sumitomo Chemical Co., Ltd.

- Wanhua

第7章 市場機會及未來趨勢

- 建築業的各類投資

- 其他機會

The Nitrobenzene Market size is estimated at 12.65 million tons in 2025, and is expected to reach 15.58 million tons by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

The nitrobenzene market was negatively impacted by COVID-19 in 2020. Considering the pandemic scenario, the decrease in demand for various nitrobenzene derivative-based products negatively impacted the market demand. However, the demand for paracetamol derived from the nitrobenzene derivative aniline increased, stimulating the demand for the nitrobenzene market. Nevertheless, the market started to gain pace in the post-pandemic era and was expected to continue the same trajectory.

Key Highlights

- Over the medium term, factors such as the increasing demand for nitrobenzene to produce aniline, the easy availability of raw materials used for production, and the growing construction activities in the Asia-Pacific region, which are contributing to significant demand, are expected to drive the market's growth.

- On the contrary, the growing demand for bio-based chemicals will likely hinder the market's growth.

- Various investments in the construction industry across the globe are likely to act as opportunities for the market studied.

- Asia-Pacific dominated the global market, with the largest consumption from countries such as China, India, etc.

Nitrobenzene Market Trends

Increasing Demand for Aniline Production

- Aniline production applications account for the largest share of nitrobenzene applications, with a share of more than 90%. The catalytic hydrogenation of nitrobenzene majorly produces it.

- India is one of the largest manufacturers and exporters of aniline. According to the Ministry of Chemicals and Fertilizers of India, In FY 2022-2023, aniline production in the country was valued at 39.66 thousand metric tons, which is an increase of about 18.28% as compared to FY 2021-2022.

- The aniline-derived methylene diphenyl diisocyanate (MDI) is a crucial precursor for polymers in various end-use industries, including the building and automotive sectors.

- According to the Organization Internationale des Constructeurs d'Automobiles (OICA), global automotive production in 2022 increased by about 6% and was valued at 85.01 units. This will result in a decline in the demand for MDI-based elastomers and polymers like polyurethane, which are used to make various automotive parts, including steering components, airbag covers, waterproof floor materials, bumpers, and others.

- Furthermore, MDI is used for the production of polyurethane foams, mainly used in various building insulation applications, and acts as one of the significant components in construction, both in their flexible and rigid form.

- As per the estimates of the Institution of Civil Engineers, the top three countries, i.e., China, India, and the United States, will account for almost 60% of all growth in the global construction industry by 2025.

- According to the US Census Bureau, the annual value for construction in the United States accounted for USD 1,978.7 billion in 2023, which is an increase of about 7.03% compared to that of 2022.

- The pharmaceutical sector is one of the global markets with the highest growth, particularly in the United States, India, and Germany. Acetaminophen, or paracetamol, is a popular painkiller produced from aniline. The most popular generic medicine worldwide is paracetamol. For people of all ages, it is commercially offered in tablet, pill, and syrup formulations.

- China, India, the United States, and Germany are the largest pharmaceutical industries in the world. Chinese manufacturers are estimated to make up around 40% of all the APIs used worldwide. Additionally, China and India source 75% to 80% of the APIs imported to the United States. The desire for cost savings and less stringent environmental regulations has driven the pharmaceutical industries in China and India.

- According to IQVIA, the global pharmaceutical market in 2023 was valued at USD 1,607 billion, which is an increase of about 8.34%.

- Therefore, all the abovementioned factors are expected to impact the market's growth significantly in the coming years.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is the largest market for nitrobenzene in terms of consumption and production and is also expected to have the highest growth during the forecast period in the market studied. Various foreign corporations have relocated their manufacturing facilities in the area due to the region's inadequate infrastructure and labor expenses. Production and consumption of nitrobenzene have also been significantly influenced by major aniline and methylene diphenyl diisocyanate (MDI) manufacturing companies expanding their production capacities.

- Due to the increased need for various MDI-based products such as adhesives, sealants, elastomers, and polyurethanes, the construction sector is the most important end-user market for nitrobenzene. Moreover, it is used as a binding agent for wood and furniture. Due to these uses, the construction industry consumes over 48% of the nitrobenzene produced globally, with a significant portion of this consumption occurring in the Asia-Pacific area.

- Asia-Pacific countries, such as China, India, and Vietnam, are registering strong growth in construction activities, which will drive the consumption of these aniline-based derivatives in the region over the forecast period.

- As per the U.S. International Trade Administration, China is the largest market for construction globally and is expected to grow at an annual average rate of 8.6% till 2030. According to the National Development and Reform Commission (NDRC), China is investing USD 1.43 trillion in significant construction projects till 2025.

- According to the National Bureau of Statistics of China, the gross output value of the construction industry in China in 2023 increased by 1.99% and was CNY 71,284.72 billion (USD 10,086.78 billion).

- According to the Ministry of Housing and Urban Rural Development's forecast, China's construction sector is projected to remain at 6 % of its GDP in 2025. In view of these forecasts, in January 202, the Chinese government announced a five-year plan to improve sustainability in the construction industry through quality and driven development.

- In addition, the residential sector in India is growing, and government support and initiatives are further boosting demand. In the budget of 2022-2023, the Ministry of Housing and Urban Development (MoHUA) allocated about USD 9.85 billion to construct houses and create funds to complete the halted projects.

- Therefore, all the abovementioned factors are expected to impact the growth of the market in the coming years significantly.

Nitrobenzene Industry Overview

The Nitrobenzene Market is partially consolidated in nature. Some major players include (not in any particular order) Covestro AG, Huntsman International LLC., Sumitomo Chemical Co., Ltd., Wanhua, and China Petrochemical Corporation (Sinopec), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Aniline

- 4.1.2 Easy Availability of Raw Materials

- 4.1.3 Growing Construction Activities in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 Growing Demand for Bio-based Chemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Aniline Production

- 5.1.2 Dyes and Pigments

- 5.1.3 Pesticides

- 5.1.4 Intermediate in Pharmaceuticals

- 5.1.5 Other Applications (including Solvent, Explosives, etc.)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 NORDIC

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Nigeria

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 United Arab Emirates

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aarti Industries Ltd.

- 6.4.2 Aromsyn Co.,Ltd.

- 6.4.3 Bann Quimica Ltda.

- 6.4.4 Chemieorganics Chemical India Pvt.Ltd.

- 6.4.5 China Petrochemical Corporation (Sinopec)

- 6.4.6 Covestro AG

- 6.4.7 Huntsman International LLC.

- 6.4.8 Sadhana Nitro Chem Ltd.

- 6.4.9 SP Chemicals Pte Ltd.

- 6.4.10 Sumitomo Chemical Co., Ltd.

- 6.4.11 Wanhua

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Various Investments in Construction Industry

- 7.2 Other Opportunities