|

市場調查報告書

商品編碼

1640417

控制閥:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Control Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

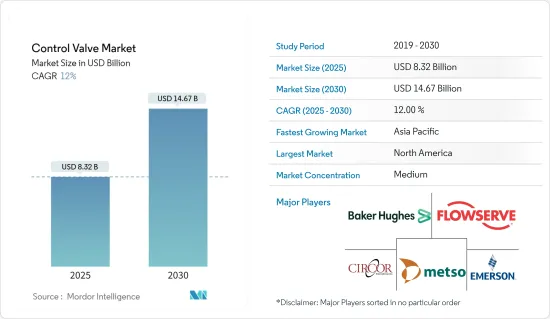

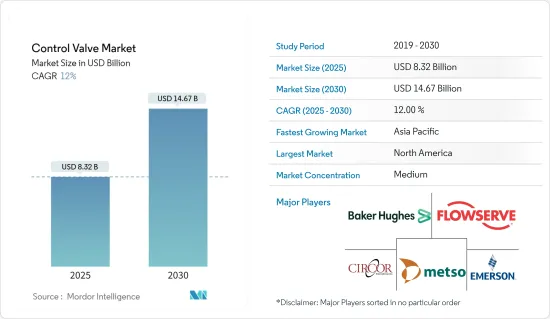

控制閥市場規模預計在 2025 年為 83.2 億美元,預計到 2030 年將達到 146.7 億美元,預測期內(2025-2030 年)的複合年成長率為 12%。

在預計預測期內,管道和基礎設施擴建投資的增加以及多個行業自動化程度的提高將推動對控制閥的需求。

主要亮點

- 控制閥是一種根據控制器的訊號調節流道大小來調節流體流量的裝置。這有助於精確的流量控制和隨後的壓力、溫度和液位等製程變數的調節,這對於石油和天然氣、水資源管理、發電、食品和飲料以及汽車等行業至關重要。一般來說,各行業都採用線性和旋轉兩種類型的控制閥來提供卓越的效率和安全性。

- 控制閥可以透過電動、氣動或液壓方式操作。它接收來自控制器(例如可程式邏輯控制器 (PLC))的訊號來啟動運動,從而改變流量。控制器(無論是 PLC 或分散式控制系統 (DCS))都會將目前流速與所需設定值進行比較。然後,控制器調節閥門產生輸出,以實現所需的流速。

- 技術進步在形成創新解決方案方面發揮了關鍵作用,透過簡化操作來提高加工廠的效率。隨著產業需求的不斷發展,控制閥和閥門自動化解決方案的供應商需要開發產品和流程來應對這些新的挑戰。由於各個製程工業的自動化程度不斷提高、石油和天然氣行業的投資不斷增加以及高功率需求,控制閥市場預計在未來幾年將會成長。

- 控制閥市場的成長受到多種因素的推動,例如對用於監控各個工廠設備的無線基礎設施的需求不斷增加、對自動化的日益關注以及製程工業中機構數量的不斷增加。為了滿足市場需求,我們開發了能夠承受多次循環和高溫的控制閥。此外,對替代能源,特別是可再生能源的投資日益重視,為控制閥創造了新的機會和潛在的應用。例如,國際能源總署預測全球70%的能源投資將流向可再生能源。

- 預計預測期內,工業自動化的普及和智慧控制閥的使用增加將進一步推動市場成長。控制閥的需求是由全球發電廠數量的不斷成長以及新興經濟體對能源和電力的不斷成長的需求所推動的。這些閥門也用於核能發電廠,特別是在化學處理、給水、冷卻水和蒸氣渦輪控制系統中。

- 原物料價格波動是控制閥市場成長的一大障礙。原料成本在決定控制閥的價格時起著關鍵作用,原料價格上漲對供應商構成了重大挑戰,因為它會降低他們的利潤率。銅、不銹鋼、鑄鐵、鋁、黃銅和青銅是製造控制閥的主要原料。預計缺乏標準化認證和政府政策將抑制市場成長。

控制閥市場趨勢

石油和天然氣板塊可望引領市場

- 在石油和天然氣工業中,閥門發揮著至關重要的作用,因為它們是管道系統的重要組成部分。閥門的主要作用包括隔離和保護設備、控制流量、引導和指揮原油精製過程。這些閥門旨在透過控制器的電、液壓和氣動訊號調節流量、溫度和壓力。其自主操作允許遠端操作,無需操作員不斷監控和調整。

- 控制閥因其調節流量、壓力和溫度的能力而在石油和天然氣行業越來越受歡迎。這些閥門根據液壓、氣動或電氣控制器的訊號調整流路大小,從而實現遠端操作。此外,對流體處理技術的投資不斷增加,特別是在石油和天然氣領域,對控制閥市場的成長做出了重大貢獻。

- 石油和天然氣行業數位化和自動化的日益發展趨勢推動了對控制閥的需求。因此,控制閥製造商正在致力於研發和改進他們的產品,以滿足最終用戶產業的需求。中東和非洲、中國和北美等地區的石油和天然氣探勘活動的增加預計將顯著增強市場成長。

- 2023年6月,挪威宣布核准在挪威大陸棚進行19項石油和天然氣作業,總投資超過190億美元。這些計劃包括對新開發、現有礦區的擴建以及現有礦區的擴建計劃的投資。由於先前依賴俄羅斯的歐洲國家開始尋求替代能源,烏克蘭衝突增加了挪威的收益。因此,歐盟為使石油和天然氣產業更加自力更生而進行的大規模投資將擴大控制閥的商機。

- 石油和天然氣行業依賴控制閥,並且是其使用至關重要的行業。新的石油和天然氣探勘計劃、輸送管道計劃和維護作業使得控制閥在世界範圍內的需求量很大。

- 根據國際能源總署(IEA)預測,到2030年,全球對石油、天然氣和煤炭等石化燃料的需求將達到前所未有的高峰。天然氣需求激增的原因是全球能源政策的不斷演變、太陽能電池板和電動車等乾淨科技的快速發展、熱泵的日益普及以及俄羅斯入侵烏克蘭後歐洲被迫放棄天然氣。此外,該領域不斷發展的自動化技術預計將顯著推動市場成長。

- 隨著石油和天然氣運輸量的增加,預計陸上應用控制閥的需求將會增加。例如,根據美國能源資訊署的數據,預計到2025年,全球原油產量的28%將來自海上,其餘72%將來自陸上。

- 截至 2024 年 2 月,該地區共有 296 個陸上鑽機,另有 95 個陸上鑽機、53 個中東海上鑽井平台和 16 個非洲海上鑽井平台。這些值得關注的能力以及石油和天然氣行業的預期成長無疑對市場有利。

預計北美將佔據較大的市場佔有率

- 北美是世界上最重要的控制閥市場之一。在美國和加拿大,各行業都有巨大的需求,包括石油和天然氣、電力、食品和包裝以及化學品。隨著工業自動化的快速發展,該地區預計將成為控制閥需求的前沿。

- 這些國家的快速工業化和交通運輸業的成長預計將增加對石油和天然氣的需求。此外,向不斷成長的人口提供飲用水的需求導致了海水淡化廠的安裝,進一步增加了對控制閥的需求。廢棄物和污水管理也是預計推動未來需求的關鍵領域。

- 與加拿大相比,美國在增加該地區的需求方面發揮關鍵作用。幾乎所有終端用戶領域的需求都在增加,尤其是石油和天然氣、精製和發電領域。該國的重點產業,包括石油和天然氣、可再生能源以及水和用水和污水處理,正在轉向具有嵌入式處理器和網路功能的閥門技術,以便與透過中央控制站協調的先進監控技術配合使用。

- 美國石油產量正在大幅擴大。美國最大的石油生產商埃克森美孚公司宣布,計劃提高西德克薩斯州州二疊紀盆地的石油產量,目標是到 2024 年實現日產超過 100 萬桶油當量的目標。與目前的生產能力相比,這增加了約 80%。雪佛龍預測,到 2020 年淨生產量將增加至 60 萬桶/天,到 2023 年將增加至 90 萬桶/天。

- 北美頁岩油的繁榮帶來了對流體處理設備和組件,尤其是控制閥的巨大需求。這些閥門對於規範頁岩油探勘生產過程,確保頁岩油通過管道的順利輸送起著至關重要的作用。新的上游油氣探勘計劃的啟動預計將推動石油和天然氣產業對控制閥的需求。

- 在美國,開發新的頁岩油計劃需要建造額外的管道來輸送頁岩油。貝克休斯稱,北美目前擁有世界上最多的石油和天然氣鑽機。截至 2023 年 5 月,該地區總合776 個陸上鑽井鑽機,另有 22 個海上鑽機。隨著俄羅斯出口制裁逐漸生效以及北美探勘活動的活性化,2022 年下半年石油和天然氣鑽機數量激增。

- 隨著該地區對可再生能源計畫的重視,太陽能熱能裝置的數量急劇增加,控制閥的使用也隨之激增。該地區擁有豐富的風能、太陽能、地熱能、水力和生質能資源。豐富的資金籌措機會和高技能勞動力推動了可再生能源計劃的需求。

- 由於有關水處理和清潔度的規定日益嚴格,用水和污水產業是流體處理技術的重要消費者。預計該地區對用水和污水行業的投資增加將提供巨大的市場成長機會。

控制閥產業概況

控制閥市場高度分散,既有全球參與者,也有中小型企業。市場的主要參與者包括艾默生電氣公司、福斯公司、貝克休斯公司、美卓公司和 CIRCOR 國際公司。市場參與者正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024年2月,艾默生向全球發布了一項創新解決方案,將改變閥門在工業應用中的安裝方式以及與最終用戶的互動方式。最終用戶需要了解控制閥的性能、解決問題、減少維護並提高整體閥門的性能。 Fisher(TM) FieldView(TM) DVC7K 數位閥門控制器透過建立最佳化操作的路徑解決了這些問題以及更多問題。

- 2023年10月,安德里茲與福斯簽署協議,收購NAF AB閥門業務。交付的生產裝置和設備已配備NAF控制閥多年。此次收購進一步擴大並加強了安德里茨在製程控制領域的產品和服務組合。

- 2023 年 5 月,艾默生推出 ASCO 系列 209 比例流量控制閥,該閥採用專門設計的節省空間的結構,具有無與倫比的精度、壓力等級、流量特性和能源效率。該閥門的最佳尺寸和出色性能使其能夠在需要精確度的各種應用中實現精確的流體流量調節,包括醫療設備、食品和飲料以及暖通空調行業。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場動態

- 產業供應鏈分析

- 市場促進因素

- 更關注新興市場的電力和用水和污水

- 最終用戶關注環境問題和老化基礎設施維修以保持競爭力

- 市場挑戰

- 為了保持競爭力,最終用戶關注環境問題和老化基礎設施的維修

- 預計油價的動態波動將影響整體計劃支出。

- 市場機會

第6章 市場細分

- 按類型

- 手套

- 球

- 蝴蝶

- 插頭

- 隔膜

- 其他閥門

- 按最終用戶產業

- 石油和天然氣

- 化工、石化、化肥

- 能源和電力

- 用水和污水處理

- 金屬與礦業

- 其他最終用戶產業(食品和飲料、製藥、紙漿和造紙等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Emerson Electric Co.

- Flowserve Corporation

- Baker Hughes Company

- Metso Corporation

- CIRCOR International Inc.

- IMI PLC

- Christian Burkert GmbH & Co. KG

- GEA Group Aktiengesellschaft

- Neway Valve(Suzhou)Co. Ltd

第8章投資分析

第 9 章:未來趨勢

The Control Valve Market size is estimated at USD 8.32 billion in 2025, and is expected to reach USD 14.67 billion by 2030, at a CAGR of 12% during the forecast period (2025-2030).

Over the forecast period, increasing investments in pipeline and infrastructure expansion and the increasing adoption of automation across several industries are expected to boost the demand for control valves.

Key Highlights

- A control valve is a device utilized to regulate fluid flow by adjusting the size of the flow passage in response to a signal from a controller. This facilitates the precise flow rate management and subsequent regulation of process variables such as pressure, temperature, and liquid level, which are crucial in industries such as oil and gas, water management, power generation, food and beverages, and automotive. Typically, two control valves, linear and rotary, are employed in various industries, offering superior efficiency and safety.

- A control valve can be operated through electrical, pneumatic, or hydraulic means. It receives a signal from a controller, such as a Programmable Logic Controller (PLC), to initiate movement and consequently alter the flow. Whether a PLC or a Distributed Control System (DCS), the controller compares the current flow rate with the desired setpoint value. Subsequently, the controller generates an output to adjust the valve and achieve the desired flow rate.

- Technological advancements have played a key role in shaping innovative solutions that enhance the efficiency of process plants by streamlining their operations. As industry requirements continue to evolve, suppliers of control valves and valve automation solutions are expected to develop products and processes that address these new challenges. The control valves market is anticipated to grow in the coming years, driven by increasing automation in various process industries, rising investment in the oil and gas sector, and high-power requirements.

- The growth of the control valve market is being propelled by several factors, including the escalating requirement for wireless infrastructure to monitor equipment in diverse plants, an increased emphasis on automation, and a rising number of process industry establishments. In response to market demand, control valves with many cycles and the ability to withstand high temperatures have been developed. Additionally, the growing emphasis on investing in alternative energy sources, particularly renewable energy, has created new opportunities and potential uses for control valves. For example, the IEA forecasts that 70% of all global energy investment will be directed toward renewable energy.

- Market growth is expected to be further boosted over the forecast period due to the increasing adoption of industrial automation, which will drive the use of smart control valves. The demand for control valves is driven by the growing number of power generation plants worldwide and the increasing need for energy and power from developing economies. These valves are also utilized in nuclear power plants, particularly in chemical treatment, feed water, cooling water, and steam turbine control systems.

- Fluctuations significantly hinder the control valve market's growth in terms of raw material prices. The costs of raw materials play a crucial role in determining the prices of control valves, and an increase in raw material prices poses a significant challenge for vendors as it can diminish their profit margin. Copper, stainless steel, cast iron, aluminum, brass, and bronze are the primary raw materials used to produce control valves. The absence of standardized certifications and government policies is anticipated to serve as restraints to market growth.

Control Valve Market Trends

The Oil and Gas Segment is Expected to Drive the Market

- Valves play a crucial role in the oil and gas sector as they are vital to any piping system. Their primary functions include equipment isolation and protection, flow rate control, and guidance and direction of the crude oil refining process. These valves are designed to regulate flow rate, temperature, and pressure through a controller's electrical, hydraulic, or pneumatic signals. Their automatic operation allows for remote operation, eliminating an operator's need for constant monitoring and adjustment.

- Control valves are gaining popularity in the oil and gas sector owing to their ability to regulate flow rate, pressure, and temperature. These valves adjust the flow passage size based on signals from a hydraulic, pneumatic, or electrical controller, enabling remote operation. Furthermore, increased investments in fluid handling technology, particularly in the oil and gas sector, are significantly contributing to the growth of the control valve market.

- The increasing inclination toward digitalization and automation within the oil and gas sector is increasing the need for control valves. Consequently, manufacturers of control valves are consistently involved in research and development endeavors to create and enhance their offerings in accordance with the demands of end-user industries. The escalating number of oil and gas exploration ventures in regions like the Middle East, Africa, China, and North America is projected to bolster the market's growth significantly.

- In June 2023, Norway declared its endorsement of 19 oil and gas ventures on the Norwegian continental shelf, with a total investment value exceeding USD 19 billion. These projects encompass novel developments, expanding existing fields, and investing in projects to augment extraction at existing areas. The Ukraine conflict augmented Norway's revenues as European nations previously dependent on Russia sought alternative energy sources. Consequently, significant investments in the European Union to enhance self-reliance in the oil and gas sector will amplify opportunities for control valves.

- The oil and gas sector relies on control valves, making it a pivotal sector for their utilization. Control valves are in high demand globally due to new oil and gas exploration projects, transportation pipeline initiatives, and maintenance operations.

- As per the International Energy Agency (IEA), the global demand for fossil fuels such as oil, gas, and coal is projected to reach an unprecedented peak by 2030. This surge can be attributed to evolving energy policies worldwide, the rapid advancement of clean technologies like solar panels and electric vehicles, the growing adoption of heat pumps, and the compelled transition from gas in Europe following Russia's invasion of Ukraine. Furthermore, the sector's escalating automation technologies are anticipated to propel the market growth significantly.

- The demand for control valves across onshore applications is expected to rise with the increasing distribution of oil and gas. For instance, according to EIA, in 2025, it is projected that 28% of the world's crude oil production will be derived from offshore sources, with the remaining 72% being extracted onshore.

- As of February 2024, there were 296 land rigs in that region, with a further 53 rigs located offshore in the Middle East and 95 land rigs in that region, with 16 rigs located offshore in Africa. These notable capabilities and the anticipated growth in the oil and gas industry will undoubtedly generate substantial prospects for the market.

North America is Expected to Hold a Significant Market Share

- North America is one of the world's most significant markets for control valves. There is immense demand from various industries in the United States and Canada, including oil and gas, electricity, food and packaging, and chemicals. With rapid industrial automation, the region is expected to spearhead the need for control valves.

- Rapid industrialization and the growing transportation sector in these nations are expected to increase the demand for oil and gas. The need to provide potable water to the ever-increasing population also leads to the setting up of desalination plants, further resulting in the demand for control valves. Waste and wastewater management is also a considerable segment that is expected to drive future demand.

- The United States plays a critical role in increasing the demand from the region compared to Canada. The demand from almost all the end-user segments is increasing, especially from the oil and gas, refining, and power generation segments. Major industries in the country, such as oil and gas, renewable energy, and water and wastewater treatment, are moving toward valve technology with embedded processors and networking capability to work alongside sophisticated monitoring technology coordinated through a central control station.

- The United States is experiencing a significant expansion in oil production. ExxonMobil, a prominent oil producer in the country, announced its intention to augment production activity in the Permian Basin of West Texas, with a target of producing over 1 million barrels per day (bpd) of oil equivalent by 2024. This represents an increase of almost 80% compared to the current production capacity. Chevron was projected to increase its net oil-equivalent production to 600,000 bpd by 2020 and 900,000 bpd by 2023.

- The shale oil boom in North America generated a significant need for fluid handling equipment and components, particularly control valves. These valves play a crucial role in regulating the shale oil exploration and production process and ensuring the smooth transportation of shale oil through pipelines. The initiation of new upstream oil and gas exploration projects is anticipated to fuel the demand for control valves in the oil and gas industry.

- In the United States, developing new shale oil projects necessitates the construction of additional pipelines for the transportation of shale oil. According to Baker Hughes, North America currently boasts the highest number of oil and gas rigs worldwide. As of May 2023, the region had a total of 776 land rigs, with an additional 22 rigs situated offshore. The number of oil and gas rigs experienced a surge in late 2022 due to the gradual impact of sanctions on Russian exports, resulting in increased exploration activities in North America.

- The region has experienced a surge in the utilization of control valves due to the heightened emphasis on renewable energy initiatives, resulting in a rapid rise in the number of solar thermal energy facilities. The region boasts an abundance of wind, solar, geothermal, hydro, and biomass resources. The demand for renewable energy projects is fueled by ample financing opportunities and a highly skilled workforce.

- The water and wastewater industry is a significant consumer of fluid handling technology due to increasingly stringent regulations regarding the treatment and cleanliness of water. The increasing investments in the region's water and wastewater industry are expected to offer significant market growth opportunities.

Control Valve Indsutry Overview

The control valve market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Emerson Electric Co., Flowserve Corporation, Baker Hughes Company, Metso Corporation, and CIRCOR International Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024: Emerson released innovative solutions that transform valves installed in industrial applications and interact with end users globally. End users need to know how their control valves are performing, address any issues, and improve valve performance in general, for instance, by reducing maintenance. The Fisher(TM) FIELDVUE(TM) DVC7K digital valve controller addresses these and other issues by creating an optimized path to action.

- October 2023: Andritz signed an agreement with Flowserve Corporation to acquire its NAF AB valve business. The production plant and equipment deliveries have been equipped with NAF control valves for many years. This acquisition further extended and strengthened Andritz's product and service portfolio in process control.

- May 2023: Emerson unveiled the ASCO Series 209 proportional flow control valves, which boast unparalleled precision, pressure ratings, flow characteristics, and energy efficiency within a specially designed, space-saving structure. These valves, with their optimal size and exceptional performance, enable users to accurately regulate fluid flow in various devices demanding meticulous performance, such as those utilized in medical equipment, food and beverage, and HVAC industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Industry Supply Chain Analysis

- 5.2 Market Drivers

- 5.2.1 Growing emphasis on Power and Water and Wastewater in Emerging Markets

- 5.2.2 Focus of End Users on Environmental Issues and Refurbishment of Aging Infrastructure to Stay Competitive

- 5.3 Market Challenges

- 5.3.1 Focus of End Users on Environmental Issues and Refurbishment of Aging Infrastructure to Stay Competitive

- 5.3.2 Dynamic Change in Oil Prices is Expected to Influence the Overall Spending on the Projects

- 5.4 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Globe

- 6.1.2 Ball

- 6.1.3 Butterfly

- 6.1.4 Plug

- 6.1.5 Diaphragm

- 6.1.6 Other Types of Valves

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical, Petrochemical, and Fertilizer

- 6.2.3 Energy and Power

- 6.2.4 Water and Wastewater Treatment

- 6.2.5 Metal and Mining

- 6.2.6 Other End-user Industries (Food and Beverage, Pharmaceutical, Pulp and Paper, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Flowserve Corporation

- 7.1.3 Baker Hughes Company

- 7.1.4 Metso Corporation

- 7.1.5 CIRCOR International Inc.

- 7.1.6 IMI PLC

- 7.1.7 Christian Burkert GmbH & Co. KG

- 7.1.8 GEA Group Aktiengesellschaft

- 7.1.9 Neway Valve (Suzhou) Co. Ltd