|

市場調查報告書

商品編碼

1640387

化學感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Chemical Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

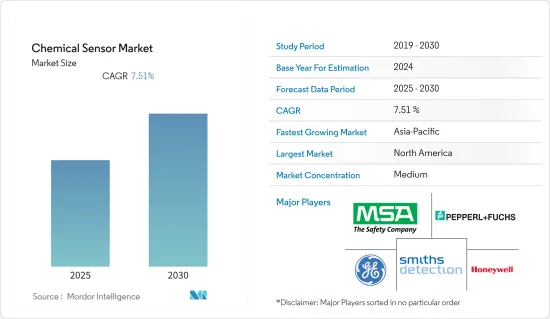

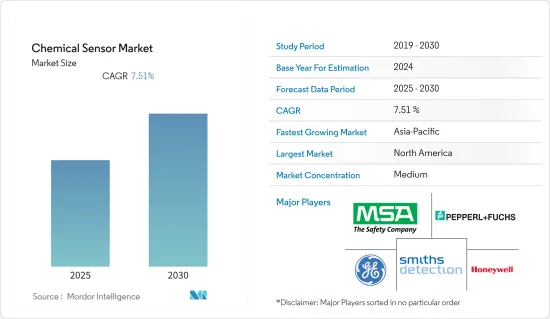

預計預測期內化學感測器市場複合年成長率為 7.51%。

主要亮點

- 化學感測器的採用是由於感測器在分析各種樣品的化學成分方面的應用越來越廣泛。高階正交感測器等化學感測器的低成本和可攜式是全球市場的關鍵趨勢,預計將推動市場成長。

- 化學感測器的主要優點是其能夠抵抗惡劣的環境因素(例如電磁干擾、高溫、高 pH 值)並且無需與樣品進行任何電氣連接即可運作。這些特性促成了大量用於臨床、環境和工業應用分析目的的光纖化學感測器的開發。

- 除了環境問題之外,市場還在整合化學工業製程中分析物的化學感測器的使用。感測器用於尖端設備並推動醫療保健、研究實驗室和國防工業的市場發展。

- 光學感測器依賴分析物與換能器相互作用引起的光學分析(光強度或波長)的變化。這種互動會改變您周圍的光照水平。為了確定分析物是否存在,需要測量光的物理量並將其轉換成電訊號。

- 傳統感測器也難以在石油和天然氣行業使用,因為它們維護成本高,需要空調庇護室,需要頻繁重新校準,並且會受到其他化學物質的影響。

- 儘管化學感測器的銷售量很高且需求依然強勁,但價格波動預計將減緩全球市場的成長。

- COVID-19 疫情對全球化學感測器市場產生了重大影響。世界各國政府都已實施封鎖措施作為預防措施。這導致汽車行業的所有運作暫時停止。供應鏈中斷導致製造汽車所需的原料和零件短缺。這限制了化學感測器的生產需求,而化學感測器在汽車工業中有許多應用。因此,疫情導致全球化學感測器市場溫和擴張。

化學感測器的市場趨勢

醫療業占主要佔有率

- 由於對快速、緊湊、準確和攜帶式診斷感測設備的需求不斷增加,醫療保健和生物醫學領域已成為化學感測器的主要市場。此外,奈米技術在市場上越來越普遍,並極大地改變了化學感測器的工作方式。體外診斷感測器正在不斷進步,不久的將來將會有多種產品面世。化學奈米感測器還提供照護現場診斷。

- 隨著人口老化和疾病易感性的增加,疾病盛行率預計會呈指數級成長。因此,許多臨床環境中都需要化學感測器來測量血糖值、血氣和其他類似用途。

- 植入和穿戴式裝置中對下一代臨床診斷、測量和監測感測器的需求日益成長,為其帶來了指數級成長的機會。隨著原料變得越來越便宜以及奈米和微製造技術在工業製造過程中的應用,醫療保健領域可供銷售的化學感測器的數量大幅增加。

- 此外,隨著糖尿病患者比例的增加,世界各地的政府機構都在投資開發有效的診斷技術,這推動了化學感測器在醫療保健領域的應用。

- 癌症、糖尿病和神經系統疾病均已利用電化學感測器成功診斷。這些感測器可在家中或醫生辦公室輕鬆使用。電化學感測器的未來進步有可能成為醫療機構過程分析的重要分析工具。

預計亞太地區將出現強勁成長

- 中國、印度和其他亞太國家的污染程度正在推動對化學感測器的需求。低成本、靈活的應用和快速的技術採用正在推動亞太市場對化學感測器的需求。

- 預計整個預測期內亞太地區將出現成長。亞太國家是石油和天然氣產業的頻繁投資者。正在建造新工廠以滿足印度、孟加拉和台灣等國家的能源需求。新工廠的建設將推動石油和天然氣行業對化學感測器的需求,這些感測器用於洩漏檢測、密閉空間監測等。因此,預計預測期內亞太地區將見證全球化學感測器市場的成長。

- 由於化學感測器在工業安全操作和環境監測專案中的應用越來越多,因此化學感測器的市場預測前景看好。此外,國防工業迫切需要感測器來提供預警並強制防禦潛在的化學和生物(C/B)攻擊。亞洲軍事強國繼續在軍事上投入巨資,這是全球國防費用不斷增加的大趨勢的一部分。

- 新的石油和天然氣工廠的投資不斷增加推動了市場的發展。由於近年來石油業的快速發展,對環境危害的準確監測已成為重中之重。過去15年來,東協十國的能源需求成長了60%。到 2040 年,該地區的能源需求預計將增加三分之二(資料來源:IEA)。電化學感測器由於能夠準確識別特定的氣體類型甚至最小的洩漏,因此擴大被許多石油和天然氣公司所採用。

- 此外,我國還正在建置全球最大的奈米技術多功能研究平台。位於江蘇蘇州的真空互聯奈米X研究設施在單一超高真空環境中整合了材料生長、裝置製造和測試的最先進的能力。預計國防和安全領域的奈米化學感測器市場將在不久的將來支持市場擴張。

化學感測器產業概況

由於全球化學感測器公司的數量不斷增加,化學感測器市場競爭激烈。這些感測器製造成本低廉,吸引了新參與企業的注意。與人工智慧(AI)相關的創新是化學感測器市場的新前沿。市場的主要參與者包括 Smiths Detection Inc.、通用電氣公司、Hans Turck GmbH &Co.KG、霍尼韋爾國際公司和 MSA Safety。這些參與者不斷提供和升級創新產品以滿足日益成長的市場需求。

2022年8月,霍尼韋爾國際公司與英維思公司宣布已達成協議,霍尼韋爾自動化與控制解決方案公司(ACS)將以4.15億美元現金收購英維思感測器系統公司。英維思感測器系統是醫療、辦公室自動化、航太、暖通空調、汽車和家電行業中使用的感測器和控制設備的領先供應商,將成為ACS自動化和控制產品部門的一部分。

2022年9月,ABB宣布將收購荷蘭電訊號分析(ESA)技術供應商Samotix 10%的股份,並與該公司建立長期策略夥伴關係關係,以提供更全面的狀態監控服務。 Thermotix 的技術與 ABB動力傳動系統,該服務是一種基於感測器的解決方案,可分析旋轉設備的健康和性能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 微型化、攜帶式電化學感測器的拓展開發

- 汽車和醫療保健行業的招聘增加

- 市場挑戰

- 儘管化學感測器廣泛可用,但價格不穩定

- 先進感測器應用的嚴格性能要求

第6章 市場細分

- 依產品類型

- 電化學

- 光學的

- Pellistor

- 其他類型

- 按最終用戶應用

- 工業

- 衛生保健

- 環境監測

- 防禦

- 石油和天然氣

- 國防安全保障

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Smiths Detection Inc.

- General Electric Co.

- Honeywell International Inc.

- MSA Safety Incorporated

- Pepperl+Fuchs Group

- AirTest Technologies Inc.

- Siemens AG

- ABB Ltd

- Halma plc.,

- Delphi Automotive PLC.

- Alpha MOS

- Yokogawa Electric Corporation.

- Denso Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Chemical Sensor Market is expected to register a CAGR of 7.51% during the forecast period.

Key Highlights

- The adoption of chemical sensors is attributed to the increasing applications of these sensors in analyzing the chemical composition of different samples. The low cost and portable nature of chemical sensors, such as higher-order orthogonal sensors, are significant trends in the global market and are expected to fuel the growth of the market studied.

- The primary benefit of chemical sensors is their resistance to challenging environmental factors (such as electromagnetic interference, high temperatures, and high pH levels) and their ability to operate without an electrical connection to the sample. These characteristics have led to the creation of many fibre-optic chemical sensors for analytical purposes in the clinical, environmental, and industrial domains.

- In addition to environmental issues, the market is integrating the use of chemical sensors for analytes in the chemical industrial process. Sensors are being used as cutting-edge equipment in the healthcare, research labs, and defense industries, driving the market.

- Optical sensors rely on variations in optical analysis (light intensity or wavelength) due to analyte-transducer interaction. The interaction causes changes in the ambient light levels. To determine whether an analyte was present, the physical quantity of light was measured and transformed into electrical signals.

- Also, traditional sensors are less accurate at measuring low-concentration chemicals in the oil and gas industries because they are hard to maintain, need shelter rooms with air conditioning, need to be recalibrated often, and can be affected by other chemicals.

- Even though sales of chemical sensors will be high and demand will remain steady, the growth of the global market is expected to be slowed by their fluctuating prices.

- The COVID-19 epidemic significantly impacted the worldwide market for chemical sensors. Lockdowns were implemented by governments all over the world as a preventative measure. Due to this, all businesses in the automobile industry were temporarily suspended. There was a lack of the raw materials and components needed for manufacturing automobiles as a result of disrupted supply chain operations. This limited the demand for the production of chemical sensors, which have numerous uses in the automobile industry. As a result, the pandemic saw moderate expansion in the global chemical sensor market.

Chemical Sensor Market Trends

Medical Industry to Hold the Major Share

- Due to the rising demand for quick, small, precise, and portable diagnostic sensing equipment, the healthcare and biomedical sectors are a significant market for chemical sensors. Additionally, nanotechnology is becoming increasingly popular on the market and has significantly altered how chemical sensors operate. In vitro sensors for diagnostics have advanced, and a few items are about to be released in the near future. Chemical nanosensors also provide point-of-care diagnostics.

- The prevalence of diseases is anticipated to rise sharply as the population ages and becomes more susceptible to illness. Because of this, there is a need for chemical sensors, which are used in many clinical settings to do things like measure blood glucose or blood gasses.

- Opportunities with exponential growth potential have been established due to the growing need for the next generation of clinical diagnostic, measuring, and monitoring sensors in implanted and wearable devices. Due to cheaper raw materials and the use of nano- and microfabrication techniques in the industrial manufacturing process, the number of chemical sensors used in healthcare that are sold to the public has grown by a lot.

- Moreover, with the increasing rates of patients suffering from diabetes, government bodies in various countries are investing in developing effective diagnostic techniques, which is stimulating the adoption of chemical sensors in the healthcare sector.

- Cancer, diabetes, and neurological illnesses have all been successfully diagnosed using electrochemical sensors. These sensors are simple to use at home or at a doctor's office. Future advancements in electrochemical sensors could make them significant analytical tools for process analysis in healthcare facilities.

Asia-Pacific is Expected to Grow Significantly

- The concerning pollution levels in China, India, and other Asia-Pacific countries are driving the demand for chemical sensors. Low prices, flexible applications, and speedy technological implementations are fueling the need for chemical sensors in the Asia-Pacific market.

- Throughout the forecast period, growth is anticipated in the Asia Pacific area. Asia-Pacific nations frequently make investments in the oil and gas industry. New plants are being built to address the energy needs of countries like India, Bangladesh, Taiwan, and others. Chemical sensors are needed in the oil and gas industry to detect leaks and monitor confined spaces, among other things; thus, the building of new plants will raise demand for them. As a result, the Asia Pacific region is anticipated to experience growth in the worldwide chemical sensor market over the forecast period.

- The chemical sensors market forecast appears promising, owing to the increasing usage of chemical sensors in industrial safety operations and environmental monitoring programs. In addition, the defense industry urgently needs the development of sensors for early warning and protection of military troops against potential chemical and biological (C/B) attacks. Asia's military superpowers keep spending a lot on their military, which is part of a larger trend of growing defense spending around the world.

- The market is driven by rising investments in new oil and gas plants. The fast development of the oil sector in recent years has made accurate monitoring of environmental toxins a top priority. Energy demand has increased by 60% in the 10 ASEAN (Association of Southeast Asian Nations) nations over the previous 15 years. By 2040, the region's energy demand is anticipated to increase by two-thirds (source: IEA). Since electrochemical sensors can accurately identify a specific type of gas and even the smallest leak, many oil and gas corporations promote their use.

- Moreover, the greatest multifunctional research platform for nanotechnology is being constructed in China. In Suzhou, Jiangsu Province, the Vacuum Interconnected Nano-X Research Facility combines cutting-edge capabilities for material growth, device fabrication, and testing in a single ultra-high vacuum environment. The market for nano chemical sensors in defense and security is anticipated to support market expansion in the near future.

Chemical Sensor Industry Overview

The Chemical Sensor Market is highly competitive due to the rise in chemical sensor companies across the world. The manufacturing cost of the sensor is low, which is drawing the attention of new players in the market. Innovations pertaining to artificial intelligence (AI) are the new unexplored space for the chemical sensor market. Some of the key players in the market are Smiths Detection Inc., General Electric Co., Hans Turck GmbH & Co. KG, Honeywell International Inc., and MSA Safety. These players are constantly innovating and upgrading their product offerings to cater to increasing market demand.

In August 2022, Honeywell International Inc. and Invensys plc announced that Honeywell Automation and Control Solutions (ACS) had signed an agreement to acquire Invensys Sensor Systems for USD 415.0 million in cash. Invensys Sensor Systems, a leading supplier of sensors and controls used in the medical, office automation, aerospace, HVAC, automotive, and consumer appliance industries, will become part of the Automation and Control Products unit of ACS.

In September 2022, ABB announced that it is acquiring a 10% stake in Samotics, the Dutch electrical signature analysis (ESA) technology provider, and has entered into a long-term strategic partnership with the company to offer enhanced condition monitoring services. The technology from Samotics works well with the ABB Ability Condition Monitoring service for powertrains, which is a sensor-based solution that analyzes the health and performance of rotating equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Developments in Miniaturised and Portable Electrochemical Sensors

- 5.1.2 Increased Adoption from Automotive and Healthcare Sector

- 5.2 Market Challenges

- 5.2.1 The fluctuating price of chemical sensors despite extensive sales

- 5.2.2 Stringent Performance Requirements for Advanced Sensor Application

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Electrochemical

- 6.1.2 Optical

- 6.1.3 Pellister/Catalytic Bead

- 6.1.4 Other Types

- 6.2 By End-user Application

- 6.2.1 Industrial

- 6.2.2 Healthcare

- 6.2.3 Environmental Monitoring

- 6.2.4 Defense

- 6.2.5 Oil and Gas Industry

- 6.2.6 Homeland Security

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Smiths Detection Inc.

- 7.1.2 General Electric Co.

- 7.1.3 Honeywell International Inc.

- 7.1.4 MSA Safety Incorporated

- 7.1.5 Pepperl+Fuchs Group

- 7.1.6 AirTest Technologies Inc.

- 7.1.7 Siemens AG

- 7.1.8 ABB Ltd

- 7.1.9 Halma plc.,

- 7.1.10 Delphi Automotive PLC.

- 7.1.11 Alpha MOS

- 7.1.12 Yokogawa Electric Corporation.

- 7.1.13 Denso Corporation