|

市場調查報告書

商品編碼

1627178

美國化學感測器:市場佔有率分析、行業趨勢和成長預測(2025-2030)United States Chemical Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

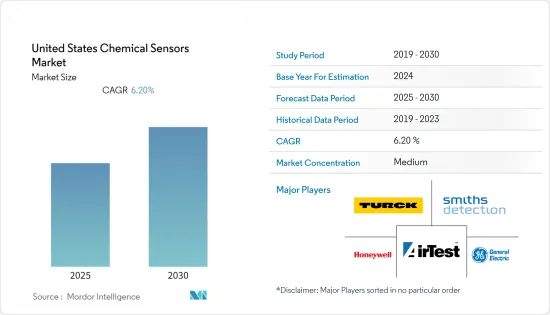

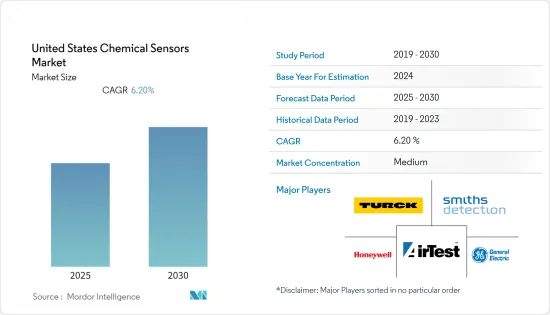

美國化學感測器市場預計在預測期內複合年成長率為 6.2%

主要亮點

- 隨著 MEMS 和奈米技術的出現,化學感測器在技術上得到了發展。小型化已被證明可以引入新的電氣、機械、化學、催化和光學特性。

- 不同類型的感測元件,例如奈米碳管、氧化鋅奈米線和鈀奈米顆粒,已用於基於奈米技術的化學感測器。

- 化學感測器在醫學領域的應用日益增多。這些感測器用於診斷氣體問題,例如人體內化學物質的濃度。 MEMS 感測器對生物技術的發展產生了重大影響,使研究人員能夠搜尋和影響人體及其各種複雜子系統內的化學物質和生物化合物。這催生了多種識別和預防疾病的方法。

- 美國佔有很大佔有率。根據美國人口普查局的數據,65 歲及以上的人口預計將從 2018 年的 5,200 萬增加到 2060 年的 9,500 萬。老年人口比例預計將從 16% 上升至 23%。因此,該國是癌症、呼吸道疾病、糖尿病等疾病的高發生率。

- 因此,由於醫療保健支出的增加和疾病發病率的增加,預計美國將對化學感測器市場做出重大貢獻。此外,美國政府也推出了法規,要求每個家庭都配備一氧化碳氣體洩漏偵測器。

美國化學感測器市場趨勢

醫療領域顯著成長

- 生物醫學和醫療保健領域是化學感測器的重要市場之一。這主要是由於對小型、快速、準確和攜帶式診斷感測系統的需求不斷成長。

- 原料成本低廉以及製造過程中奈米微加工技術的出現顯著提高了醫療保健應用化學感測器的商業化程度。

- 此外,隨著奈米技術的出現,化學感測器的操作特性發生了巨大變化,在市場上變得越來越重要。體外診斷感測器已經取得了許多進步,並且一些發展即將到來。使用化學奈米感測器進行照護現場診斷也是可能的。

- 使用電化學感測器的分子POC(即時護理)診斷可提高現有近距離患者的靈敏度,進行快速測試,廣泛應用於世界各地醫生辦公室和醫院的重症監護室、門診診所等因其擴展照護端診斷能力的能力而受到關注。

- 此外,在開發用於糖尿病治療的植入式葡萄糖感測器以及用於血管內和皮下應用的下一代醫療和診斷電化學生物感測器的設計方面,精密印刷和加工技術的進步正在開發中。

電化學感測器逐漸成長

- 旨在識別特定生物分子的電化學感測器可以使多重 POC 診斷成為現實。呼吸分析儀、呼吸二氧化碳感測器和一氧化碳感測器等電化學感測器已用於檢測空氣中的有害氣體、氧氣和其他分子。當氣體撞擊感測器的一個電極(稱為工作電極)時,會發生化學氧化或還原過程。例如,當氧氣被還原成水時,電子會從對電極(或參考電極)流向工作電極,並測量與氣體中的氧氣量成比例的電流。

- 電化學系統目前在世界各地的多家公司中使用。電化學系統經常用於環境監控、控制和其他設備。電化學氣體感測器在廢氣控制、室內空氣品質、具有有效多氣體感測能力的填充氣體感測以及成本效益等方面的需求很高。此外,由於各國政府實施嚴格的安全標準,預計該產業將在未來幾年內發展。

- 由於有毒和可燃性氣體的存在,在製造和化學工業的極端環境中發生的爆炸事故越來越多,這些最終用戶行業的整個危險區域正在開發,以實現更安全的工作環境。監測來預防爆炸越來越受到關注。

- 此外,管理海上石油和天然氣探勘、生產和儲存活動的政府法規,例如 COSHH 法規和 OSHA 法規,嚴格限制一氧化碳和其他有害氣體的排放。這是採用基於電化學技術的氣體感測器的主要推動力。

- 由於車內空氣品質和燃油排放氣體偵測器等新應用,汽車產業正經歷快速成長。基於電化學的氣體感測器產業的一個顯著驅動力是燃料效率提高和空氣品管等趨勢的協調。

美國化學感測器產業概況

美國化學感測器市場適度整合,許多市場公司所佔佔有率可忽略不計。區域市場的發展和當地企業在外國直接投資中所佔佔有率的不斷增加是推動市場分散化的主要因素。

- 2021 年 3 月 Ouster Inc. 是一家為工業自動化、智慧基礎設施、機器人和汽車行業提供高解析度數位LiDAR感測器的供應商,與戰略委託製造Benchmark Electronics 合作,擴大關鍵汽車里程,宣布將擴大生產規模在達成目標的同時該公司強調,與 Benchmark 的合作將滿足四個細分市場的當前需求,並加快其滿足汽車客戶預期的大量需求的能力。同時,博世也推出了高性能加速計、IMU和壓力感測器,供貨期為10年。

- 2021 年 1 月:Petasense 推出首款集振動、溫度和速度於一體的三合一工業感測器。 VSx 中整合的速度偵測功能可讓使用者僅在指定的速度範圍內或在裝置運作時進行測量。內建智慧感測允許感測器相互通訊,並向資產列車上的多個感測器提供同步測量。新的無晶圓廠半導體公司 Flusso 隨後將與連網型設備服務供應商Pelion 建立聯合開發夥伴關係,以加速跨工業領域互聯流量感測產品和系統的開發和部署。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- COVID-19 對產業的影響

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

第5章市場動態

- 市場促進因素

- 擴大小型化、攜帶式電化學感測器的開發

- 汽車和醫療保健行業的招聘增加

- 市場挑戰

- 先進感測器應用的嚴格性能要求挑戰市場成長

第6章 市場細分

- 依產品類型

- 電化學

- 光學的

- 帕利斯特/觸媒珠

- 其他產品類型

- 按用途

- 工業的

- 醫療用途

- 環境監測

- 國防/國防安全保障

- 其他用途

第7章 競爭格局

- 公司簡介

- AirTest Technologies Inc.

- Smiths Detection Inc.

- General Electric

- Hans Turck GmbH & Co. KG

- Honeywell International Inc.

- MSA Safety Incorporated

- Pepperl+Fuchs Group

- SenseAir AB

- SICK AG

- Siemens AG

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 50331

The United States Chemical Sensors Market is expected to register a CAGR of 6.2% during the forecast period.

Key Highlights

- Chemical sensors have evolved technically with the advent of MEMS and nanotechnology. It has been found that with the reduction in size, novel electrical, mechanical, chemical, and catalytic, optical properties can be introduced.

- Various types of detecting elements, such as carbon nanotubes, zinc oxide nanowires, or palladium nanoparticles, have already been used in nanotechnology-based chemical sensors.

- The applications of chemical sensors have witnessed a rise in the medical sector. These sensors are used for the diagnostics of gaseous issues, such as the concentration of chemicals in human bodies. The MEMS sensors have a massive impact on the development of biotechnology, offering researchers the ability to search for and influence chemical and biological compounds in the body and its various complex subsystems. This has led to multiple ways of identifying and preventing illnesses conditions.

- The United States accounts for a significant share. According to the United States Census Bureau, the number of people aged 65 years and above is anticipated to augment from 52 million in 2018 to 95 million by 2060. The share of people of the older age group share is expected to rise from 16% to 23%. Hence, the country is prone to diseases, such as cancer, respiratory diseases, and diabetes.

- Thus, due to rising healthcare expenditure and increasing incidence of diseases, the United States is expected to contribute to the chemical sensors market significantly. Additionally, the government of the United States has introduced mandatory regulations to compel the adoption of CO gas leak detectors in every home.

US Chemical Sensors Market Trends

Medical Segment will Witness a Significant Growth

- The biomedical and healthcare sector is one of the significant markets for chemical sensors, primarily owing to the increasing demand for compact, rapid, accurate, and portable diagnostic sensing systems.

- The low cost of raw materials and the advent of nano and microfabrication techniques within the manufacturing process have led to a significant increase in the commercialization of chemical sensors for healthcare applications.

- Moreover, with the advent of nanotechnology, the operating characteristics of chemical sensors have dramatically changed and are gaining importance in the market. There have been different advances in in-vitro sensors for diagnostics, with a few developments about to be launched shortly. Also, point-of-care diagnostics are possible with chemical nanosensors.

- Molecular point-of-care (POC) diagnostics using electrochemical sensors have gained traction owing to their ability to improve the sensitivity of existing near-patients, perform rapid tests, and expand the diagnostic capabilities at point-of-care, such as physician offices and hospitals critical care units, and outpatient clinics across the world.

- Further, advancements in precise printing and processing technology and next-generation medical and diagnostic electrochemical biosensor product designs in developing implantable glucose sensors for treating diabetes have been developed for intravascular and subcutaneous applications.

Electrochemical Sensor will Observe Gradual Growth

- Multiplexed POC diagnostics could become a reality due to electrochemical sensors designed to identify specific biomolecules. Electrochemical sensors, such as breathalyzers, respiratory carbon dioxide sensors, and carbon monoxide sensors, are already used to detect harmful gases, oxygen, and other airborne molecules. The chemical oxidation or reduction process occurs when gas hits one of the sensor's electrodes, known as the working electrode, depending on the gas to be examined. For example, when oxygen is reduced to water, electrons flow from the counter (or reference) electrode to the working electrode, resulting in an electric current that can be measured and is proportional to the amount of oxygen in the gas.

- Electrochemical systems are now used in a variety of enterprises across the world. They are frequently used for environmental monitoring and management, as well as other appliances. Electrochemical gas sensors are in high demand for emission control, indoor air quality, fill gas detection with effective multiple gas detection capability, and cost efficiency, to name a few applications. Furthermore, the industry is expected to develop in the approaching years as a result of severe safety standards imposed by various governments.

- Due to an increase in the number of explosions occurring in the extreme environment of the manufacturing and chemical industries due to the presence of toxic and combustible gases, an increased focus on explosion prevention through implicit monitoring across the hazardous zones of these end-user industries has prompted an increased focus on explosion prevention through implicit monitoring across the hazardous zones of these end-user industries to achieve a safer working environment.

- Furthermore, government rules governing offshore oil and gas exploration, production, and storage activities, such as COSHH and OSHA regulations, place rigorous limitations on exposure to carbon monoxide and other dangerous gas emissions. This has been a major driver in the adoption of gas sensors based on electrochemical technology.

- The automotive industry has seen positive growth, owing to new applications such as cabin air quality and fuel emission detectors. A prominent driver for the electrochemical-based gas sensor industry has been aligning trends such as improved fuel efficiency and air quality control.

US Chemical Sensors Industry Overview

The United States Chemical Sensor market is Moderately Consolidated, with many market players cornering a very minimal share in the market. The development of regional markets and increasing shares of local players in foreign direct investments are the major factors promoting the fragmented nature of the market.

- March 2021: Ouster Inc., a provider of high-resolution digital lidar sensors for the industrial automation, smart infrastructure, robotics, and automotive industries, announced scaling of production while achieving major automotive milestones through its partnership with Benchmark Electronics a strategic contract manufacturer. The company highlighted that the partnership with Benchmark is to meet current needs across four market segments and accelerate the capacity to meet the anticipated high volume demands of automotive customers. Bosch, on the other hand, launched a high-performance accelerometer, IMU, and pressure sensor with 10-year availability.

- January 2021: Petasense launched its first 3-in-1 industrial sensor with vibration, temperature, and speed. Integrated speed detection within the VSx allows users to take measurements only during the specified speed ranges or when the asset is operating. Embedded smart sensing allows the sensors to communicate with each other, providing synchronized readings across multiple sensors on the asset train. Subsequently, Flusso, a new fabless semiconductor company, signed a joint development partnership with Pelion, a connected device service provider, to accelerate the development and roll-out of connected flow sensing products and systems across the industrial domain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 on the Industry

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Developments in Miniaturised and Portable Electrochemical Sensors

- 5.1.2 Increased Adoption from Automotive and Healthcare Sector

- 5.2 Market Challenges

- 5.2.1 Stringent Performance Requirements for Advanced Sensor Application challenge the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Electrochemical

- 6.1.2 Optical

- 6.1.3 Pallister/Catalytic Bead

- 6.1.4 Other Product Types

- 6.2 By Application

- 6.2.1 Industrial

- 6.2.2 Medical

- 6.2.3 Environmental Monitoring

- 6.2.4 Defense and Homeland Security

- 6.2.5 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AirTest Technologies Inc.

- 7.1.2 Smiths Detection Inc.

- 7.1.3 General Electric

- 7.1.4 Hans Turck GmbH & Co. KG

- 7.1.5 Honeywell International Inc.

- 7.1.6 MSA Safety Incorporated

- 7.1.7 Pepperl+Fuchs Group

- 7.1.8 SenseAir AB

- 7.1.9 SICK AG

- 7.1.10 Siemens AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219