|

市場調查報告書

商品編碼

1639509

生物有機酸 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Bio-Organic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

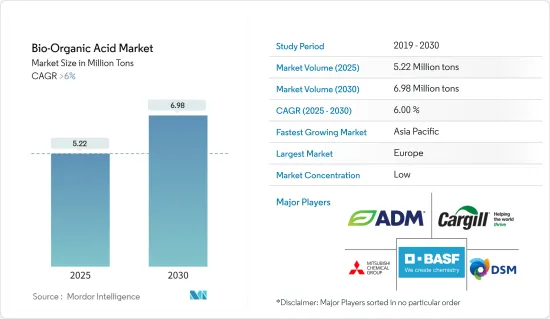

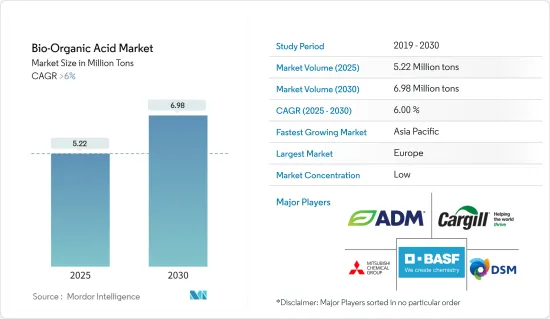

預計2025年生物有機酸的市場規模為522萬噸,預計2030年將達到698萬噸,預測期間(2025-2030年)複合年成長率將超過6%。

由於全國範圍內的封鎖、嚴格的社交距離措施和供應鏈中斷,COVID-19 大流行對市場產生了負面影響。這些因素對食品飲料、紡織品和塗料市場產生了負面影響,進而影響了生物有機酸市場。不過,限購解除後,市場穩定復甦。由於食品和飲料、紡織品和塗料等終端用戶行業生物有機酸消費量的增加,市場已顯著復甦。

對傳統有機酸的嚴格監管以及醫療應用中對生物基聚合物不斷成長的需求預計將推動生物有機酸市場的發展。

生物基化學品的高製造成本預計將阻礙市場成長。

轉向環保產品預計將在預測期內創造市場機會。

預計亞太地區將主導市場。由於製藥、紡織品、被覆劑和食品應用中對生物有機酸的需求不斷增加,預計在預測期內複合年成長率將達到最高。

生物有機酸市場趨勢

食品飲料產業主導市場

- 預計食品和飲料最終用戶產業將在預測期內主導生物有機酸市場。生物有機酸及其衍生物經常用於飲料、食品和飼料的生產。酸性添加劑可以充當調節酸度的緩衝劑、抗氧化劑、防腐劑、增味劑和螯合劑。

- 北美和歐洲是世界上最大的食品和飲料市場。根據美國人口普查局的數據,2023 年 11 月美國零售和食品服務業的月度零售額約為 7,057 億美元,而 9 月為 7,049 億美元。這樣,食品飲料市場的擴張將帶動該國生物有機酸市場的發展。

- 此外,根據美國農業部的數據,墨西哥擁有美洲第三大食品加工業,僅次於美國和巴西。根據農業市場諮詢小組 (GCMA) 的資料,該國糧食產量預計將從 2022 年的 2.87 億噸增至 2023 年的 2.9 億噸。

- 食品和飲料產業是歐洲最大的製造業之一。根據FoodDrinkEurope統計,2022年第四季食品飲料產業銷售額較上季成長2.3%,2021年第四季較去年同期成長19.2%。因此,食品和飲料市場的銷售成長預計將推動該地區的生物有機酸市場。

- 德國是歐洲最大的食品和飲料市場。食品工業是該國第四大工業部門。德國食品飲料工業聯合會(BVE)資料顯示,2022年,該國食品飲料加工總收入達207億美元,與前一年同期比較去年同期成長17.9%。因此,食品和飲料行業的成長預計將推動該地區生物有機酸市場的發展。

- 因此,食品和飲料最終用戶產業預計將在預測期內主導生物有機酸市場。

亞太地區主導市場成長

- 由於該地區製藥、紡織、塗料以及食品和飲料終端用戶行業的需求不斷成長,預計亞太地區將主導生物有機酸市場。

- 中國和印度是該地區最大的食品和飲料市場。根據中國國家輕工業委員會統計,2022年年銷售額超過280萬美元的主要食品生產企業收益累計超過1.53兆美元。與2021年與前一年同期比較,總收入年增5.6%,顯示食品業成長強勁。

- 同樣,在印度,食品和飲料行業預計將顯著成長。 IBEF預計,2022年印度食品加工市場規模預計將達到307.2兆美元,2028年將達到547.3兆美元。因此,食品加工市場的成長預計將增加該國生物基有機酸的使用量。

- 製藥業對生物有機酸的需求不斷增加。印度是世界製藥中心,向 200 多個國家出口藥品。 2022-2023年上半年,流入醫藥產業的外商直接投資成長25%。根據IBEF預測,到2024年,製藥業的收益預計將達到650億美元。因此,醫藥市場的擴大將帶動目前的研究市場。

- 此外,在中國,紡織業的市場成長顯著。根據中國國家統計局數據,2022年中國紡織品產量達382億米,去年同期為235億米。 12月份,我國服飾布料產量約34.7億公尺。每月紡織品產量始終超過30億公尺。

- 由於上述因素,亞太生物有機酸市場預計在預測期內將顯著成長。

生物有機酸產業概況

生物有機酸市場分散。市場的主要企業包括(排名不分先後)BASF、帝斯曼、三菱化學公司、嘉吉公司和 ADM。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 常規有機酸的嚴格規定

- 醫療應用對生物基聚合物的需求不斷成長

- 其他司機

- 抑制因素

- 生物基化學品的製造成本上升

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 原料

- 生物量

- 玉米

- 玉米

- 糖

- 其他原料

- 產品類型

- 生物乳酸

- 生物醋酸

- 生物己二酸

- 生物丙烯酸

- 生物琥珀酸

- 其他產品種類(生物檸檬酸、生物富馬酸等)

- 應用領域

- 聚合物

- 藥品

- 紡織產品

- 塗層

- 飲食

- 其他用途(個人護理、化學等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ADM

- Abengoa

- BASF SE

- BioAmber Inc

- Braskem

- Cargill, Incorporated

- Corbion

- Cosun

- DSM

- Genomatica

- Gfbio

- Mitsubishi Chemical Corporation

- NatureWorks LLC

- Novozymes

- PTT Global Chemical Public Company Limited

第7章 市場機會及未來趨勢

- 轉向環保產品

- 其他機會

The Bio-Organic Acid Market size is estimated at 5.22 million tons in 2025, and is expected to reach 6.98 million tons by 2030, at a CAGR of greater than 6% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market due to nationwide lockdowns, strict social distancing measures, and disruption in supply chains. These factors negatively affected the food and beverage, textile, and coating markets, thereby affecting the market for bio-organic acids. However, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in consumption of bio-organic acids in food and beverage, textile, and coating end-user industries.

The stringent regulations over conventional organic acids and the growing demand for bio-based polymers in healthcare applications are expected to drive the market for bio-organic acids.

The higher production cost of bio-based chemicals is expected to hinder the growth of the market.

The shifting focus towards eco-friendly products is expected to create opportunities for the market during the forecast period.

The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to rising demand for bio-organic acids in pharmaceuticals, textiles, coatings, and food products applications.

Bio-Organic Acid Market Trends

Food and Beverage Industry to Dominate The Market

- The food and Beverage end-user industry is expected to dominate the market for bio-organic acid during the forecast period. Bio-organic acids and their derivatives are frequently used in beverage, food, and feed production. Acidic additives may act as buffers to regulate acidity, antioxidants, preservatives, flavor enhancers, and sequestrants.

- North America and Europe are the largest markets for food and beverages across the globe. According to the U.S. Census Bureau, monthly retail sales from U.S. retail and food services were valued at around USD 705.7 billion in November 2023, as compared to USD 704.9 billion in September. Thus, the increasing market for food and beverage products will drive the market for bio-organic acids in the country.

- Furthermore, according to the USDA, Mexico is the third-largest food processing industry in the Americas, after the United States and Brazil. According to data from the Agricultural Markets Advisory Group (GCMA), the country's food production is anticipated to reach 290 million tons in 2023, growing from 287 million tons in 2022.

- The food and beverage sector is one of the largest manufacturing industries in Europe. According to FoodDrinkEurope, the food and beverage industry turnover increased by 2.3% in Q4 2022, compared to the previous quarter, and increased by 19.2% Y-o-Y compared to Q4 2021. Thus, the growth in food and beverage market turnover is expected to drive the market for bio-organic acid in the region.

- Germany is the largest market for food and beverage products in Europe. The food industry represents the fourth-largest industrial sector in the country. According to data from the Federation of German Food and Drink Industries (BVE), in 2022, the total revenue of food and beverage processing in the country reached USD 20.7 billion, at a growth rate of 17.9% as compared to the previous year. Thus, the growth in the food and beverage sector is expected to drive the market for bio-organic acids in the region.

- Thus, the food and beverage end-user industry is expected to dominate the market for bio-organic acid during the forecast period.

Asia-Pacific Region to Dominate the Market Growth

- The Asia-Pacific region is expected to dominate the market for bio-organic acid due to rising demand from pharmaceuticals, textiles, coatings, food and beverage end-user industries in the region.

- China and India are the largest food and beverage markets in the region. According to the China National Light Industry Council, major food manufacturing companies with an annual turnover of over USD 2.8 million reported revenues of over USD 1.53 trillion in 2022. Compared to 2021, the total revenue registered a year-on-year growth of 5.6%, indicating strong growth in the food industry.

- Similarly, in India, the food and beverage sector is expected to register a significant growth rate. According to IBEF, Indian food processing market size reached USD 307.2 trillion in 2022 and is expected to reach USD 547.3 trillion by 2028. Thus, the growth in food processing markets will increase the usage of bio-based organic acids in the country.

- The demand for bio-organic acids is increasing in the pharmaceutical sector. India is a global pharmaceutical hub, exporting pharmaceuticals to over 200 countries. In the first half of 2022-2023, foreign direct investment inflows into the pharmaceutical industry increased by 25%. According to IBEF, the pharmaceutical industry revenue is expected to reach USD 65 billion by 2024. Thus, the increasing market for pharmaceuticals will drive the current studied market.

- Furthermore, in China, the textile industry registered significant market growth. According to the National Bureau of Statistics of China, China's textile production volume accounted for 38.2 billion meters in 2022, compared to 23.5 billion meters during the same period in the previous year. In December, approximately 3.47 billion meters of clothing fabric were produced in China. Monthly textile production volume was consistently above three billion meters.

- Owing to the above-mentioned factors, the market for bio-organic acid in the Asia-Pacific region is projected to grow significantly during the forecast period.

Bio-Organic Acid Industry Overview

The bio-organic acid market is fragmented in nature. Some of the major players in the market (not in any particular order) include BASF SE, DSM, Mitsubishi Chemical Corporation, Cargill, Incorporated, and ADM, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Stringent Regulations Over Conventional Organic Acids

- 4.1.2 Growing Demand for Bio-based Polymer in Healthcare Applications

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Production Cost of Bio-based Chemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material

- 5.1.1 Biomass

- 5.1.2 Corn

- 5.1.3 Maize

- 5.1.4 Sugar

- 5.1.5 Other Raw Materials

- 5.2 Product Type

- 5.2.1 Bio Lactic Acid

- 5.2.2 Bio Acetic Acid

- 5.2.3 Bio Adipic Acid

- 5.2.4 Bio Acrylic Acid

- 5.2.5 Bio Succinic Acid

- 5.2.6 Other Product Types (Bio Citric Acid, Bio Fumaric Acid, etc.)

- 5.3 Application

- 5.3.1 Polymers

- 5.3.2 Pharmaceuticals

- 5.3.3 Textile

- 5.3.4 Coatings

- 5.3.5 Food and Beverage

- 5.3.6 Other Applications (Personal Care, Chemicals, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Abengoa

- 6.4.3 BASF SE

- 6.4.4 BioAmber Inc

- 6.4.5 Braskem

- 6.4.6 Cargill, Incorporated

- 6.4.7 Corbion

- 6.4.8 Cosun

- 6.4.9 DSM

- 6.4.10 Genomatica

- 6.4.11 Gfbio

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 NatureWorks LLC

- 6.4.14 Novozymes

- 6.4.15 PTT Global Chemical Public Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Towards Eco-Friendly Products

- 7.2 Other Opportunities