|

市場調查報告書

商品編碼

1639414

石油和天然氣自動化:市場佔有率分析、產業趨勢、成長預測(2025-2030)Oil & Gas Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

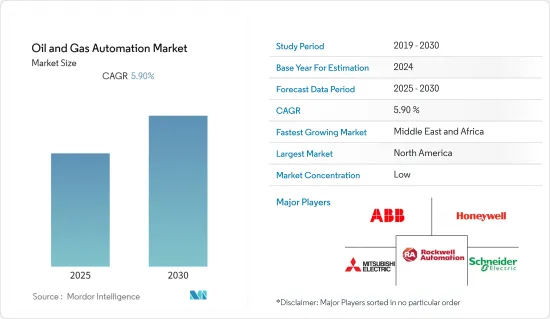

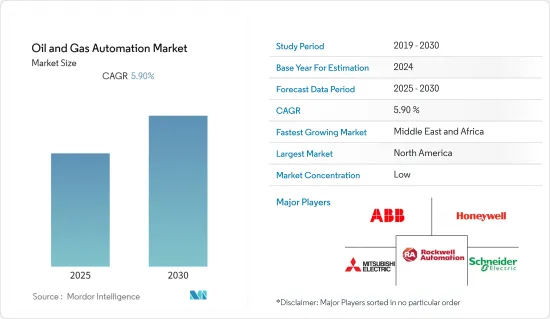

石油和天然氣自動化市場預計在預測期內複合年成長率為 5.9%

主要亮點

- 隨著越來越多的感測器累積來自世界各地鑽機的資料,石油和天然氣產業已經開始向數位化轉型。採用數位技術使工程團隊能夠與石油和天然氣公司更有效地協作,以管理資料和計劃要求,改善內部溝通並簡化規劃。石油和天然氣行業的自動化可以提高效率並降低成本。

- 石油業的自動化數位化正在迅速發展。機器監控現在是主動的而不是被動的。公司正在投資數位平台來建立尖端的虛擬工作空間,以做出資料驅動的決策並專注於出色的員工體驗。 AQI 是一家工業創新公司,貝克休斯和阿布達比國家石油公司(ADNOC) 與Group 42 (G42) 合作,將於2021 年11 月為全球石油和天然氣行業開發先進的分析服務。戰略夥伴關係協議。

- 全球石油和天然氣需求的增加預計將增加對自動化的需求,以在市場競爭中生存。根據國際能源總署(IEA)預測,到2040年,全球石油需求將成長21%,佔所有能源的35%,天然氣需求將增加31%,佔能源總量的17%。

- 石油和天然氣產業可以以低成本應用自動化技術來提高產量並消除經營模式中的潛在瓶頸。石油和天然氣產業正受益於物聯網 (IoT) 解決方案的採用。從井下監視器到地面控制閥,即時資訊被傳送到負責人進行分析。這加強了營運並使整個領域變得更加安全。

由於資源稀缺,COVID-19 的爆發增加了石油和天然氣產業對自動化的需求。後疫情時代,隨著政府限制的全面解除、生產和探勘的滿載進行,油氣自動化產業預計將受到嚴重影響。此外,石油和天然氣行業日益嚴格的政府法規也促進了自動化解決方案的採用。

石油和天然氣自動化市場趨勢

變頻驅動器佔據很大佔有率

- 例如,2022 年 10 月,羅克韋爾自動化對其中壓 PowerFlex 6,000T 變頻驅動器 (VFD) 進行了增強,以提高高速馬達的 VFD 輸出頻率。在電氣、石油和天然氣行業等要求苛刻的製造環境中,中壓電源用於驅動大型工業電機,通常每天 24 小時運作。採用 TotalFORCE 技術的 PowerFlex 6,000T 變頻器提供高效馬達馬達控制和即時作業系統資料,有助於提高生產率並節省能源。

- 此外,印度對石油和天然氣的需求不斷增加,工業投資不斷增加。據印度品牌資產基金會稱,政府實施了多項計劃來滿足對石油和天然氣不斷成長的需求。它允許多個行業類別 100% 的外國直接投資 (FDI),包括煉油廠、天然氣和石油產品。

- 公共部門精製計劃的外國直接投資限額已提高至 49%,但不會稀釋或撤回現有國內精製公司 (PSU) 所有者的投資。精製計劃的外國直接投資上限已提高至 49%,信實工業有限公司 (RIL) 和凱恩等公司的存在就證明了這一點。該行業預計將帶來250億美元的探勘和生產投資。

市場也關注流程最佳化。 VFD 減少了石油和天然氣行業的停機時間,因為燃氣渦輪機需要頻繁維護,而 VFD 和馬達幾乎不需要維護。這可以提高產量、降低維護成本並提高生產力。這導致多家石油和天然氣公司採用變頻器。

北美佔據主要市場佔有率

- 美國是北美最大的石油和天然氣市場。根據EIA的數據,2021年,美國向176個國家和美國四個領土運送石油,日運量約854萬桶。約296萬桶/天的原油佔2021年美國石油出口總量的35%。

- 北美石油和天然氣運作是流程主導的,需要連續運作和廣泛的監控技術。管理者難以監控和控制工業設備的使用狀態。北美的許多公司都在使用基於控制器的人機介面 (DCS),允許操作員監督操作。這些技術自動化了安全流程,例如機器維護和維修操作以及警報監控系統。

- 該地區石油和天然氣行業的自動化需求受到該地區穩定的經濟、油田營運和服務供應商對自動化技術的廣泛接受以及領先技術和系統供應商的強大影響力,預計這將受到以下因素的推動。對研究和開發活動的公私聯合投資。

- 美國EIA報告稱,2022年1月美國最大產油區二疊紀地區的石油產量約為500萬桶/日(Mbpd)。該聯邦機構還表示,與 2021 年同期相比,估值增加了約 13%。因此,預計全部區域石油產量的增加將為預測期內的市場成長創造機會。

石油和天然氣自動化產業概述

石油和天然氣自動化市場分散且競爭激烈。參與企業包括 ABB Ltd、霍尼韋爾國際公司、羅克韋爾自動化公司、三菱公司和施耐德電氣。這些參與企業不斷推出創新解決方案以在細分市場中競爭。

2022 年 9 月,ANYbotics 宣布商業銷售 ANYmal X,該產品為石油、天然氣和化學工業提供可擴展的自主評估解決方案。 ANYmal X 引入的影響促使公司提高機器人檢查的自動化程度。

2022 年 8 月,TWMA 宣布推出即時自動化和追蹤解決方案。 TWMA 的新 XLink 工具旨在為石油和天然氣生產商提供自動化、更深入的了解和即時資料監控,以提高井筒廢棄物管理系統的有效性。

Sensia 是羅克韋爾自動化和斯倫貝謝於 2022 年 7 月成立的合資企業,是石油和天然氣生產、運輸和加工自動化領域的領導者。該雲端原生系統描述了一個可擴展的捆綁平台,用於為石油和燃氣公司實施數位舉措。透過選擇和組合來自眾多供應商的解決方案,您可以節省時間、成本和精力,而不是建立客製化的數位平台。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 工業措施

- 技術簡介

第5章市場動態

- 市場促進因素

- 新興經濟體工業基礎設施活動的成長

- 石油消費量增加

- 技術純熟勞工日益短缺

- 石油和天然氣產業需求增加

- 市場問題

- 已開發國家工業成長停滯

- 油價不穩定

- 主要石油和天然氣活動

- IIoT 技術在石油和天然氣領域的推廣

- 評估 COVID-19 對產業的影響

第6章 市場細分

- 按流程

- 上游

- 中產階級

- 下游

- 依技術

- 感測器和發射器

- 集散控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 監控與資料採集系統(SCADA)

- 安全儀器系統 (SIS)

- 變頻驅動(VFD)

- 製造執行系統

- 工業資產管理

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 供應商市場佔有率分析

- 公司簡介

- ABB Ltd.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Mitsubishi Corporation

- Schneider Electric SE

- Emerson Electric Co.

- Eaton Corporation

- Dassault Systemes SE

- Yokogawa Electric Corporation

- Siemens Corporation

- Robert Bosch GmbH

- Texas Instruments Inc.

- Johnson Controls Inc.

第8章投資分析

第9章 市場未來展望

The Oil & Gas Automation Market is expected to register a CAGR of 5.9% during the forecast period.

Key Highlights

- The Oil & Gas industry began the move toward digitization with more sensors accumulating data from rigs worldwide. Adopting digital technologies can improve internal communication and simplify plans by allowing engineering teams to work more efficiently with Oil & Gas companies to manage data and project requirements. Automation in the Oil & Gas industry can improve efficiency and reduce costs.

- Automation and digitalization are advancing quickly in the oil industry. Instead of being reactive, machine monitoring is now proactive. Businesses are putting money into digital platforms, basing judgments on data, and building a cutting-edge virtual workspace focused on a good worker experience. Baker Hughes, an industrial innovation company, and AQI, the Abu Dhabi National Oil Company's (ADNOC) combined partnership with Group 42 (G42), signed a strategic partnership deal in November 2021 to develop advanced analytics services for the worldwide Oil & Gas sector.

- Increasing global Oil & Gas demand is expected to boost the demand for automation to compete in the market. The International Energy Agency said that by 2040, the world's demand for oil will go up by 21%, making it the source of 35% of all energy, and the demand for natural gas will go up by 31%, making it the source of 17% of all energy.

- The Oil & Gas sector may be able to apply automation technology at reduced prices in order to increase production and get rid of any potential bottlenecks in the business model. The Oil & Gas sector is benefiting from the deployment of Internet of Things (IoT) solutions, from downhole monitors to surface-control valves broadcasting real-time information into boardrooms for analysis. This enhances operations and makes the entire oilfield a safer place to work.

The COVID-19 outbreak boosted the demand for automation in the Oil & Gas industries due to a shortage of resources. The Oil & Gas automation industry was anticipated to be severely impacted in the post-COVID situation as the government's limitations were entirely abolished and output and explorations were conducted at maximum capacity. Furthermore, increasing government regulations in the Oil & Gas industry have also contributed to the adoption of automation solutions.

Oil & Gas Automation Market Trends

Variable Frequency Drives to Have Significant Share

- Vendors are increasingly introducing new products to meet the growing demand for energy efficiency.For instance, in October 2022, Rockwell Automation increased VFD Output Frequency for High-speed Motor Applications by introducing enhancements to medium-voltage PowerFlex 6000T variable frequency drives (VFDs). Demanding manufacturing environments like electric, oil, and gas operations rely on medium-voltage power to drive large industrial motors, often running 24 hours a day. The PowerFlex 6000T drives with TotalFORCE technology are claimed to deliver high-performance motor control and real-time operating system data that can help increase productivity and energy savings.

- Also, the increasing demand for oil and natural gas in India is boosting investments in the industry. According to the Indian Brand Equity Foundation, the government has implemented several programs to meet the rising demand for oil and gas. It has permitted 100 percent foreign direct investment (FDI) in several industry categories, including refineries, natural gas, and petroleum products.

- Without any disinvestment or diluting of domestic ownership in already-existing PSUs, the FDI limit for public sector refining projects has been increased to 49%. As seen by the existence of businesses like Reliance Industries Ltd. (RIL) and Cairn India, it now draws both domestic and global investment. By 2022, it is anticipated that the industry will bring in USD 25 billion in exploration and production investments.

The market is also witnessing an increased focus on process optimization. A VFD reduces downtime in the oil and gas industry because gas turbines require frequent maintenance, while VFDs and motors require very little maintenance. This enables more production, lower maintenance expenses, and improved productivity. This has encouraged various oil and gas companies to incorporate VFDs.

North America Holds a Significant Market Share

- The U.S. is North America's largest oil and gas market. According to EIA, in 2021, the U.S. shipped petroleum to 176 nations and 4 U.S. territories at a rate of around 8.54 million b/d. About 2.96 million barrels per day (b/d) of crude oil made up 35% of all gross petroleum exports from the United States in 2021.

- The oil and gas business in North America is process-driven, with continuing operations and extensive surveillance techniques. It is difficult for administrators to monitor and control the utilization of the equipment in the industry. Numerous North American enterprises have adopted the use of an HMI with a controller, or DCS, that allows operators to oversee operations. These technologies automate upkeep and repair operations for machinery and safety processes, such as alarm monitoring systems.

- The region's need for automation in the oil and gas industry is anticipated to be driven by elements including the region's stable economy, widespread acceptance of automated technology among oilfield operations and services providers, a significant presence of leading technology and systems vendors, and joint investments by public and private entities in R&D activities.

- The U.S. EIA reported that the Permian Region, the country's largest oil-producing region, produced around five million barrels per day (Mbpd) of oil in January 2022. The federal agency also stated that when contrasted to the same period in 2021, the valuation grew by almost 13%. Thus, increasing oil production across the region is expected to create opportunities for market growth over the forecast period.

Oil & Gas Automation Industry Overview

The Oil & Gas automation market is fragmented and competitive in nature. Some of the players are ABB Ltd, Honeywell International Inc, Rockwell Automation Inc, Mitsubishi Corporation, and Schneider Electric, among others. These players are continuously introducing innovative solutions in order to compete in the fragmented market.

In September 2022, ANYbotics announced commercial sales for ANYmal X to supply the oil, gas, and chemical industries with scalable autonomous assessment solutions. The impact of installing ANYmal X is causing businesses to increase robotic inspection automation.

In August 2022, TWMA introduced a real-time automation and tracking solution. The new XLink tool from TWMA is intended to give oil and gas producers more automation, more in-depth understanding, and real-time data monitoring to increase the effectiveness of their wellsite drill cuttings management system.

In July 2022, Sensia, a Rockwell Automation and Schlumberger combined venture, is the premier automation expert in oil and gas production, transportation, and processing. The cloud-native system provides a scalable, bundled platform for implementing digital initiatives for oil and gas enterprises. Choosing and combining solutions from many suppliers can reduce time, money, and effort instead of establishing a customized digital platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Policies

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Industrial & Infrastructural Activities in Developing Economies

- 5.1.2 Increasing Oil Consumption

- 5.1.3 Increasing Scarcity of Skilled Workers

- 5.1.4 Increase in Demand from the Oil & Gas Industry

- 5.2 Market Challenges

- 5.2.1 Stagnant Industrial Growth in Developed Countries

- 5.2.2 Volatile Oil Price Situation

- 5.2.3 Key Oil & Gas Activities

- 5.2.4 Proliferation of IIoT Technology in Oil & Gas

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Process

- 6.1.1 Upstream

- 6.1.2 Midstream

- 6.1.3 Downstream

- 6.2 By Technology

- 6.2.1 Sensors & Transmitters

- 6.2.2 Distributed Control Systems (DCS)

- 6.2.3 Programmable Logic Controllers (PLC)

- 6.2.4 Supervisory Control and Data Acquisition System (SCADA)

- 6.2.5 Safety Instrumented Systems (SIS)

- 6.2.6 Variable Frequency Drive (VFD)

- 6.2.7 Manufacturing Execution System

- 6.2.8 Industrial Asset Management

- 6.2.9 Other Technologies

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share Analysis

- 7.2 Company Profiles

- 7.2.1 ABB Ltd.

- 7.2.2 Honeywell International Inc.

- 7.2.3 Rockwell Automation Inc.

- 7.2.4 Mitsubishi Corporation

- 7.2.5 Schneider Electric SE

- 7.2.6 Emerson Electric Co.

- 7.2.7 Eaton Corporation

- 7.2.8 Dassault Systemes SE

- 7.2.9 Yokogawa Electric Corporation

- 7.2.10 Siemens Corporation

- 7.2.11 Robert Bosch GmbH

- 7.2.12 Texas Instruments Inc.

- 7.2.13 Johnson Controls Inc.