|

市場調查報告書

商品編碼

1637891

清潔劑:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Detergents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

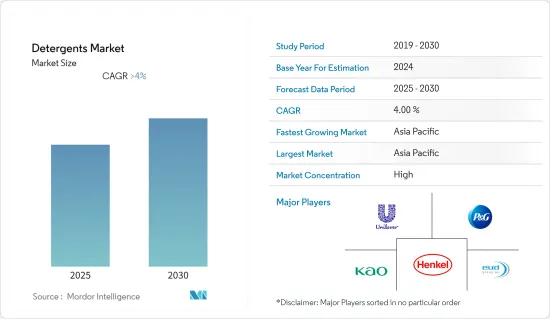

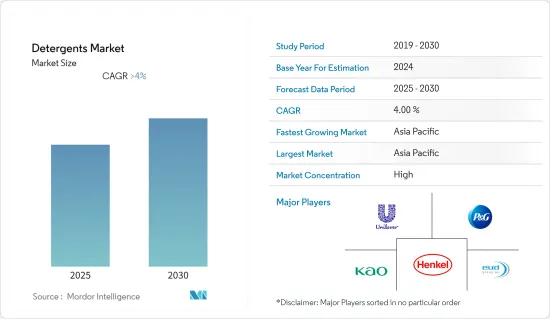

預計清潔劑市場在預測期內將維持4%以上的複合年成長率。

COVID-19 對 2020 年市場產生了負面影響。 COVID-19 暫時停止了洗衣精的生產並擾亂了供應鏈。然而,在當前情況下,人們對個人衛生和清潔環境的意識不斷增強,刺激了對洗衣和家用清潔劑的需求,並增加了2021年清潔劑市場的成長。

主要亮點

- 短期來看,個人護理和衣物洗護領域清潔劑使用量的增加是推動市場成長的關鍵因素。

- 然而,嚴格的環境法規預計是預測期內抑制所涉及行業成長的主要因素。

- 有機洗衣精的採用以及清潔劑作為整理加工劑的廣泛使用將很快為全球市場創造利潤豐厚的成長機會。

- 預計亞太地區將主導全球市場,其中消費量最高的國家是中國和印度等。

清潔劑市場趨勢

清洗應用可能具有更高的成長潛力

- 洗衣液是一種強效洗衣清洗,可在洗滌前塗抹到頑固污漬上。這些流體採用特定的界面活性劑系統配製而成,例如天然衍生的烷基、羥烷基硫酸鹽、磺酸鹽界面活性劑和中鏈支化氧化胺界面活性劑。

- 2021年,衣物洗護領域的以收益為準全球家庭和衣物洗護市場的50%以上,由於消費者衛生意識的提高,洗衣護理領域可能會在預測期內成長,從而預計將提振市場需求。完成。

- 隨著技術的進步,洗衣液製造商現在使用一種稱為菜籽油(非基因改造)的新成分,它具有低發泡特性的優點。

- 泡沫會對洗滌過程產生負面影響,使洗滌能力降低約 50%。洗衣液專為預先噴灑衣服上的頑固污漬而配製。它具有出色的清洗效果,即使是頑固的污垢也能去除。

- 液體清潔劑主要用於清洗衣物,有兩個主要的最終用戶部分:住宅和商業。

- 根據美國勞工統計局的數據,2020 年美國每位消費者在肥皂和清潔劑上的平均年支出為 75.53 美元,2021 年將增加至 80.49 美元。

- 根據俄羅斯聯邦統計局統計,俄羅斯清潔劑產量每年都在穩定成長。清潔劑產量在2021年達到高峰,清洗產品產量達213.9萬噸。

- 由於這些因素,清潔劑市場在預測期內可能會在全球範圍內成長。

亞太地區預計將主導市場

- 亞太地區是目前家用和工業清潔劑消費成長最快的市場。從供給和需求來看,印度和中國是亞太地區的市場領導。

- 這些新興國家液體清潔劑市場意識的提高和工業進步預計將推動亞太地區的市場成長。

- 中國在全球旅遊業中前景廣闊,正在吸引海外遊客。因此,各大連鎖飯店都被吸引來利用其在中國奢侈品市場的主導地位。因此,對保持酒店場地清潔的紡織品和洗衣產品的需求不斷成長。

- 根據中國國家統計局的數據,中國的酒店企業正在經歷快速成長。與2020年的25,281家公司相比,2021年公司數量增加了近2,500家,達到27,766家公司。

- 對方便、易於使用和易於塗抹的清潔劑產品的需求不斷成長,推動了印度清潔劑的發展。政府的措施和印度農村地區健康生活方式意識的提高,促進了該國清潔劑銷售的成長。

- 根據 IBEF 報導,2021 年 5 月,Indo Count Industries Ltd. (ICIL) 宣布投資擴大印度清潔劑銷售。 2021年5月,ICIL宣布投資20億印度盧比(2,690萬美元)擴大床上用品清潔劑產能。

- 清潔劑產業正在快速成長,透過廣告影響消費者的能力不斷增強。例如,Rohit Surfactants 已將其 Ghari清潔劑分銷網路擴展到印度更多邦,以擴大其客戶群。此外,在過去三年中,該公司已將其分銷網路擴展到另外 10 個州,並透過 3,500 多個銷售點銷售 Ghari清潔劑。此外,Gari 始終保持實惠的價格。

- 由於這些因素,預計該地區的清潔劑市場在預測期內將穩定成長。

清潔劑產業概況

清潔劑市場已部分整合。主要企業包括(排名不分先後)Henkel AG & Co.KGaA、Procter & Gamble、Unilever、Kao Corporation 和 EUDGROUP 等。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 個人護理和衣物洗護領域清潔劑使用量的增加

- 其他司機

- 抑制因素

- 嚴格的環境法規

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 類型

- 陰離子清潔劑

- 陽離子清潔劑

- 非離子清潔劑

- 兩性離子清潔劑

- 目的

- 洗衣精

- 家用清潔劑

- 洗碗產品

- 燃料添加劑

- 生物試劑

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Church & Dwight Co. Inc.

- EUDGROUP AS

- Guangzhou Liby Group Co. Ltd

- Henkel AG & Co. KGaA

- Johnson & Johnson Private Limited

- Kao Corporation

- Lion Corporation

- Nice Group

- Procter & Gamble

- Unilever

第7章 市場機會及未來趨勢

- 採用有機清潔劑

- 越來越多使用清潔劑作為整理加工劑

The Detergents Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. It paused the production of laundry detergents and disrupted the supply chain. However, the consciousness regarding personal hygiene and clean surroundings increased in the current situation, stimulating the demand for laundry and household cleaning products and enhancing the market growth of detergents in 2021.

Key Highlights

- Over the short term, increasing usage of detergents in the personal and laundry care segment is the major factor driving the market's growth.

- However, stringent environmental regulations are a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, adopting organic laundry detergent and increasing the application of detergents as cloth softeners will likely create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region is expected to dominate the market across the world, with the largest consumption from countries such as China and India.

Detergent Market Trends

The Laundry Cleaning Products Application is Expected to Witness Higher Potential Growth

- Laundry liquids are powerful laundry cleaning products applied to stubborn stains before washing. These liquids are formulated using a specified surfactant system of naturally derived alkyl, hydroxyalkyl sulfate, sulphonate surfactant, and mid-chain branched amine oxide surfactants.

- In 2021, the laundry care segment accounted for more than 50% of the home and laundry care market globally in terms of revenue, and it is likely to grow during the forecast period, owing to increasing hygiene consciousness among consumers, which, in turn, is expected to boost the market demand.

- With technological advancements, laundry-liquid manufacturers now use a new ingredient known as rapeseed oil (non-GMO) that offers benefits with its low foaming properties.

- Foam is detrimental to the washing process and may result in about 50% loss of the washing strength. Laundry liquid is formulated for the pre-spraying of stubborn stains on garments. It helps in removing even the toughest stains and offers exceptional cleaning results.

- Liquid laundry detergent is primarily used in cleaning laundry and has two main end-user segments, such as residential and commercial.

- According to the Bureau of Labor Statistics, in the United States, the average annual expenditure on soaps and detergents in 2020 accounted for USD 75.53, which increased to USD 80.49 per consumer unit in 2021.

- According to the Russian Federal State Statistics Service, Russia's output of detergents has been steadily rising yearly. The volume of detergent production peaked in 2021 when 2,139 thousand metric tonnes of cleaning supplies were produced.

- Owing to all these factors, the detergent market will likely grow globally during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is currently the fastest-growing market both for household and industrial detergent consumption. In terms of demand and supply, India and China are the market leaders in the Asia-Pacific region.

- The increasing awareness about the liquid laundry detergent market and the growth in industrial advancements in these emerging economies are expected to drive the growth of the market in Asia-Pacific.

- China has a promising global tourism future, attracting tourists from abroad. Major hotel chains have been drawn to develop dominance in the Chinese luxury market as a result. As a result, there is an increasing need for textiles and washing products to keep hotel grounds neat.

- According to the National Bureau of Statistics of China, there has been significant growth in hotel enterprises in China. In 2021 there was a total of 27,766 enterprises an increase of nearly 2,500 enterprises compared to 25,281 in 2020.

- The increasing demand for convenient and easy-to-use/apply detergent products contributed to the evolution of detergents in India. The increase in government initiatives and awareness to lead a healthy life among the rural Indian population are contributing to the increased sales of detergents in the country.

- According to IBEF, in May 2021, Indo Count Industries Ltd. (ICIL) announced an investment of Rs. 200 crore (USD 26.9 million) to expand its production capacity of bedding solutions.

- The detergent sector, with its increasing ability to influence consumers through advertisements, is rapidly growing. For instance, to increase its customer base, Rohit Surfactants spread its distribution network for Ghari detergent to more states in India. Moreover, in the last three years, the company increased its reach to 10 more states, and it sells Ghari detergent through more than 3,500 dealers. Additionally, Ghari has always maintained affordable pricing.

- Due to all such factors, the market for detergents in the region is expected to have steady growth during the forecast period.

Detergent Industry Overview

The detergents market is partially consolidated in nature. The major players include Henkel AG & Co. KGaA, Procter & Gamble, Unilever, Kao Corporation, and E.U.D.GROUP, a.s., among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Detergents in the Personal and Laundry Care Segment

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Anionic Detergents

- 5.1.2 Cationic Detergents

- 5.1.3 Non-ionic Detergents

- 5.1.4 Zwitterionic (Amphoteric) Detergents

- 5.2 Application

- 5.2.1 Laundry Cleaning Products

- 5.2.2 Household Cleaning Products

- 5.2.3 Dishwashing Products

- 5.2.4 Fuel Additives

- 5.2.5 Biological Reagent

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Church & Dwight Co. Inc.

- 6.4.2 E.U.D.GROUP AS

- 6.4.3 Guangzhou Liby Group Co. Ltd

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Johnson & Johnson Private Limited

- 6.4.6 Kao Corporation

- 6.4.7 Lion Corporation

- 6.4.8 Nice Group

- 6.4.9 Procter & Gamble

- 6.4.10 Unilever

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Organic Laundry Detergent

- 7.2 Increasing Application of Detergents as Cloth Softener