|

市場調查報告書

商品編碼

1637871

貨櫃型資料中心:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Containerized Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

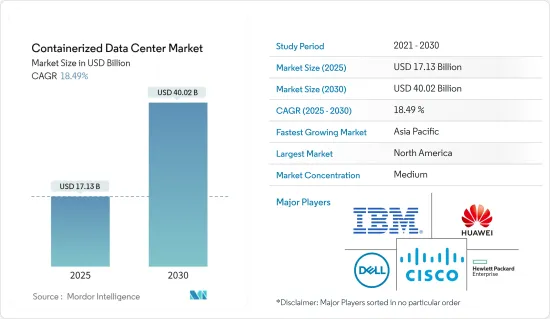

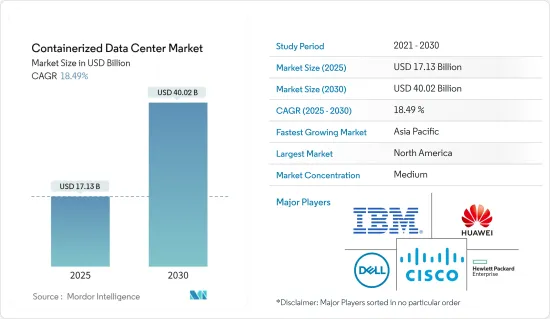

2025 年貨櫃型資料中心市場價值預計為 171.3 億美元,預計到 2030 年將達到 400.2 億美元,預測期內(2025-2030 年)的複合年成長率為 18.49%。

主要亮點

- 巨量資料和物聯網(IoT)技術將推動貨櫃型資料中心市場的投資。全球企業正在見證 IT 和電信、BFSI、醫療保健、政府和國防等產業的大量資料產生。雲端處理的擴張導致了外國雲端供應商的滲透、政府對本地資料安全的監管以及國內參與者的投資增加是推動貨櫃型資料中心需求的一些主要因素。

- 政府在貨櫃型資料中心市場的成長中發揮關鍵作用。各政府機構均致力於數位基礎設施,以增加就業機會並推動創新。例如,今年 6 月,英國政府公佈了期待已久的數位計劃,以支持該國的數位經濟。英國政府聲稱,新的英國數位策略到 2025 年將使英國科技業對經濟的貢獻增加 415 億美元。

- 近年來,雲端服務的普及增加了對資料中心的需求。根據《2021 年雲端基礎設施報告》發布的調查結果,57% 的受訪者表示,他們一半以上的基礎設施在雲端,64% 的受訪者預計未來五年將完全在公有雲上。這樣做。

- 在IT和通訊業,對每天處理和儲存海量資料的資料中心的需求很高,這是推動該行業資料中心建設市場成長的主要因素之一。此外,科技和服務型新興企業的出現促使這些中小企業將重點轉向具有成本效益的解決方案。這推動了向雲端運算的轉變,並增加了 IT 解決方案供應商在擴展基礎設施方面的支出。

- 新冠肺炎疫情對遠距辦公、線上學習、虛擬娛樂等的影響,以及巨量資料和物聯網的日益成長的影響力,促使世界各地的貨櫃型資料中心的部署力度。能力。因此,資料中心為全球經濟從 COVID-19 疫情中復甦提供了巨大的機會。此外,新南威爾斯州政府也對 COVID-19 疫情對國民經濟造成的財務影響進行了評估,並暫時允許在該州邊界建造資料資料. 宣布將把該產品重新歸類為重大發展。

- 在由眾多設備組成的大型網路中分發資料並從公司位置運行資料中心可能是一個巨大的挑戰,尤其是在物聯網網路中,其中每個設備都代表另一個潛在端點。和控制問題。其他使用 Edge 的裝置也有類似的問題。安全漏洞使駭客可以輕鬆存取核心網路,從而進一步限制資料中心的效能。隨著物聯網世界變得越來越普及,隨著網路節點數量的增加,安全問題也將隨之增加。此外,物聯網設備是最常受到攻擊的設備之一。

貨櫃型資料中心的市場趨勢

節能資料中心的需求不斷增加

- 綠色資料中心的主要目標是提高能源效率和最大限度地減少對環境的影響。綠色或永續資料中心是儲存、管理和傳輸資料的地方,其中的所有系統(包括機械和電氣)都節約能源。它具有更低的碳排放、降低成本並提高效率。

- 此外,這些綠色資料中心還能幫助現代企業節省電力並減少碳排放。在全球範圍內,無論是大企業還是小型企業,它的使用都在不斷成長。這樣的資料中心可以成功地滿足大量企業資料的需要,從收集到處理、審查和分發。

- 此外,政府也宣布了該地區實現碳中和的計畫。例如,今年6月,日本政府發布了《清潔能源戰略》快報。政府還計劃在 2050 年實現碳中和,到 2030 會計年度減少 46% 的溫室氣體排放,同時在未來保持可靠且負擔得起的能源供應,以實現成長。日本正在加大脫碳力度,以實現兩個雄心勃勃的目標:到2050年實現碳中和、2030會計年度減少46%的溫室氣體排放。

- 據荷蘭資料中心協會稱,80%的荷蘭資料中心使用綠色電力。這意味著至少 20% 的荷蘭資料中心仍然嚴重依賴石化燃料。所使用的綠色能源通常是「淺綠色」電力(「認證電力」),並非來自荷蘭的永續能源。在資料中心的電源供應器中,只有一小部分是荷蘭永續產生的「深綠色」電源。還有很多工作要做,特別是考慮到《氣候協議》和《荷蘭氣候法》的目標,到 2050 年幾乎消除溫室氣體並實現二氧化碳中性電力生產。

- 此外,據Cloud Scene稱,截至今年資料,美國共有2,701個資料中心,德國共有487個資料中心。英國擁有456個資料中心,僅次於中國(443個),位居第三。

預計北美將佔很大佔有率

- 預計未來幾年北美貨櫃型資料中心市場將快速成長。推動這種擴張的因素有幾個,包括巨量資料和雲端運算的興起,以及對主機託管服務的需求不斷增加。在這篇部落格中,我們探討北美貨櫃型資料中心市場及其擴張的關鍵因素。

- 據 Temenos AG 稱,美國BFSI 產業對雲端運算的採用正在增加。在美國,針對雲端技術的監管已連續數年收緊,81% 的相關人員認為多重雲端戰略將成為監管要求,77% 的相關人員認為 AI(人工智慧)將成為一項要求我們相信,從這些資產中提取價值將成為成功銀行與敗者銀行之間的差異。這是因為雲端、人工智慧和物聯網的廣泛應用將產生大量資料,增加對資料中心的需求,從而刺激研究市場的成長。

- 今年 4 月,美國合眾銀行表示正在擴大雲端基礎技術的使用,但暫時仍將繼續使用查斯卡資料中心。這家總部位於明尼阿波利斯的銀行表示,將關閉位於亞特蘭大和諾克斯維爾的兩個小型資料中心,並使用微軟的 Azure 提供雲端服務。該銀行於 2017 年在查斯卡開設了一個佔地 56,000 平方英尺的新資料中心。該資料中心由位於德克薩斯州的Stream Data Centers 建造,將獲得該市為期20 年的稅收減免(價值約548,000 美元)、明尼蘇達州就業和經濟發展部提供的287,000 美元補貼以及基礎設施資金。公共津貼和補貼總計已收到超過 100 萬美元的資金,其中包括 DEED 的 25 萬美元升級支援津貼。

- 此外,增加資料中心建設可能會為所研究的市場創造成長機會。例如,Facebook母公司Meta今年4月在密蘇裡州和德克薩斯州啟用了兩個新的資料中心計劃,使其在美國建造和營運資料中心的總投資達到約160億美元。位於德州坦普爾德克薩斯州價值 8 億美元的工廠面積約為 90 萬平方英尺,而位於密蘇裡州堪薩斯城價值 8 億美元的工廠面積約為 100 萬平方英尺。

- 此外,物聯網和互聯技術的興起迫使許多企業轉型為數位企業,這必然要求企業轉向提供可擴展性、快速部署、安全性、靈活性和可用性的先進資料中心生態系統。這些不斷變化的商業趨勢正在推動尖端、靈活且經濟高效的軟體定義解決方案的發展和創造。預計上述因素將推動市場的成長。

貨櫃型資料中心產業概況

主要參與者包括 IBM 公司、惠普企業、思科系統、戴爾公司、Rittal GmbH &Co.KG 和華為技術有限公司。這些公司擴大參與併購和產品發布,以開發和推出新技術和新產品。這導致市場集中度處於中等水平。

2022年5月,華為發布全新電源系統PowerPOD 3.0,定義新一代資料中心設備。這是華為資料中心設施團隊與業界專家智慧與共同努力的成果,也是華為致力於發展低碳智慧資料中心的舉措。下一代資料中心建築將完全綠色、節能,所有資料中心材料將盡可能回收。從而使整個資料中心生態系統變得更加綠色和永續。

2022 年 2 月,Vantage 位於德國法蘭克福的資料中心綜合體第二期工程正式動工。該公司宣布將在位於奧芬巴赫的 55MW 歐盟園區 (FRA1) 建造三棟建築中的第二棟。全部建成後,該電廠的容量將達到 16 兆瓦,佔地 13,000平方公尺(140,000 平方英尺)。預計 2024 年上半年開始向客戶交付。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 市場促進因素

- 對便攜性的需求以及對可擴展資料中心解決方案日益成長的需求

- 節能資料中心的需求不斷增加

- 市場限制

- 運算能力有限

第5章 市場區隔

- 依所有權類型

- 購買

- 租

- 按最終用戶

- BFSI

- 資訊科技/通訊

- 政府

- 教育機構

- 衛生保健

- 防禦

- 娛樂和媒體

- 其他最終用戶(工業、能源)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Hewlett Packard Enterprise Company

- IBM Corporation

- Dell Inc.

- Cisco Systems Inc.

- Huawei Technologies

- Emerson Network Power(Emerson Electric Co.)

- Schneider Electric SE(acquired AST Modular)

- Rittal Gmbh & Co. KG

- Baselayer Technology, LLC.

第7章投資分析

第 8 章:市場的未來

The Containerized Data Center Market size is estimated at USD 17.13 billion in 2025, and is expected to reach USD 40.02 billion by 2030, at a CAGR of 18.49% during the forecast period (2025-2030).

Key Highlights

- Big data and Internet-of-Things (IoT) technology will expand investments in the containerized data center market. Enterprises worldwide are witnessing high data generation across industries, such as IT and telecom, BFSI, healthcare, and government and defense. The growing cloud computing increasing penetration of foreign cloud vendors, government regulations for local data security, and increasing investment by domestic players are some of the major factors driving the demand for containerized data centers.

- The government plays a crucial role in the containerized data center market growth. Various government bodies focus on digital infrastructure to fuel job opportunities and drive innovation. For instance, in June this year, the UK government revealed its eagerly expected digital plan to support the nation's digital economy. By 2025, the government claimed that the new UK Digital Strategy could boost the economy's contribution from the UK tech sector by USD 41.5 billion.

- The need for data centers has increased in recent years due to the high adoption of cloud services. According to the survey results published in the Cloud Infrastructure Report 2021, 57% of the respondents reported that more than half of their infrastructure is in the cloud, while 64% expect that they will be fully in the public cloud in the next five years.

- The significant demand in the IT and telecommunication industries for data processing and storage of vast amounts of data daily has been one of the primary reasons for the growth of the data center construction market in this segment. Moreover, with the advent of more technology and service-based startups, these SMEs have shifted focus to cost-effective solutions. This has led to increased migration to the cloud, which, in turn, has increased spending on scaling up infrastructure by IT solution providers.

- Due to the COVID-19 pandemic's impact on the advent of remote work, online learning, and virtual entertainment, as well as the expanding influence of big data and the internet of things, global containerized data center operators are seeing a sharp rise in demand for their processing and storage capacity. As a result, data centers offer a great chance for the global economy to recover from the COVID-19 pandemic. Further, the New South Wales (NSW) state government announced the interim reclassification of data centers as State Significant Developments in reaction to the financial effects of the COVID-19 epidemic on the domestic economy and in appreciation of the economic benefits of data centers (SSDs).

- Distributing data across a large network containing numerous devices and data centers operating from enterprise locations can create problems with network visibility and control, with each device representing another potential endpoint, especially in the IoT network framework. Other devices that use edge have similar problems. Security loopholes can give hackers easy access to the core network, further creating performance constraints for data centers. With the global adoption of IoT, any increase in network node points increases security concerns further. Moreover, IoT devices are some of the frequently targeted devices.

Containerized Data Center Market Trends

Rising Demand for Energy Efficient Data Centers

- An environmentally friendly data center's primary goals are energy efficiency and minimal environmental effect. A green or sustainable data center is a location for storing, managing and transmitting data where all systems, including mechanical and electrical ones, conserve energy. It produces fewer carbon footprints, which reduces costs and improves efficiency.

- Further, these green data centers enable contemporary firms to conserve electricity and cut carbon emissions. Their use is expanding globally among both large corporations and SMBs. Such data centers can successfully serve the aims of a vast array of company data, from collection to processing and review to distribution.

- Moreover, the government has released plans to achieve carbon neutrality in the region. For example, in June this year, the Japanese government released a preliminary report on its "Clean Energy Strategy." Further, growth will be attained through maintaining a reliable and inexpensive energy supply for the future while striving to achieve carbon neutrality by 2050 and a 46% decrease in greenhouse gas emissions in fiscal 2030. To reach two ambitious goals-carbon neutrality by 2050 and a 46% decrease in greenhouse emissions (GHG) in fiscal 2030 Japan has intensified its decarbonization efforts.

- According to the Dutch Data Center Association, 80% of data centers in the Netherlands use green electricity. This means that at least 20% of Dutch data centers are still largely reliant on fossil fuels. The green energy used is often 'light green' electricity ('certified power') and does not come from sustainable electricity generation in the Netherlands. Only a small part of the power supply for data centers is 'dark green,' meaning that it is generated sustainably in the Netherlands. There is still a lot of work to be done, particularly considering the Climate Accord and the objectives of the Dutch Climate Act, namely the almost eradication of greenhouse gases and CO2- neutral electricity generation in this country by 2050.

- Further, according to Cloud scene, 2,701 data centers were located in the United States as of January this year, and 487 more were found in Germany. With 456, the United Kingdom came in third place among nations regarding the number of data centers behind China (443).

North America is Expected to Hold Major Share

- The North American containerized data center market is predicted to grow rapidly in the next few years. Several factors fuel this expansion, including the rise of big data and cloud computing and increased demand for colocation services. This blog post will examine the North American containerized data center market and some key drivers driving its expansion.

- According to Temenos AG, the adoption of cloud is increasing in the US BFSI industry as 81% of bankers believe that a multi-cloud strategy would become a regulatory prerequisite after several years of regulatory focus on cloud technologies in the United States, and 77% of bankers believed that unlocking value from artifiical intelligence (AI) will be the differentiator between winning and losing banks. This is because the proliferation of the cloud, AI, and the IoT has generated voluminous data that increases the need for data centers, thereby stimulating the growth of the market studied.

- In April this year, US Bancorp is expanding its use of cloud-based technologies, but for the time being, it will continue to use its Chaska data center. In addition to closing two minor data centers in the Atlanta and Knoxville regions, the Minneapolis-based bank said it would use Microsoft's Azure to offer cloud services. The bank occupied a new 56,000-square-foot data center in Chaska in 2017. The site, built by Texas-based Stream Data Centers, received more than USD 1 million in total public grants and subsidies, including a 20-year tax abatement from the city valued at approximately USD 548,000, a budget of USD 287,000 from the Minnesota Department of Employment and Economic Development, and a grant of USD 250,000 from DEED to support infrastructure upgrades.

- Further, the rise in data center construction would create an opportunity for the studied market to grow. For instance, in April this year, Meta, the parent company of Facebook, started two new data center projects in Missouri and Texas, bringing its total investment in US data center construction and operations to almost USD 16 billion. A USD 800 million facility in Temple, Texas, will total approximately 900,000 square feet, while another USD 800 million facility in Kansas City, Missouri, will total nearly 1 million square feet.

- Further, With the rise of IoT and connected technologies, many firms have been forced to change into digital enterprises, which has increased the need for an advanced data center ecosystem that provides scalability, rapid deployment, security, flexibility, and availability. This change in business trends enables the evolution and creation of cutting-edge, highly agile, cost-efficient, and software-defined solutions. The factors mentioned above are anticipated to propel market growth.

Containerized Data Center Industry Overview

The major players include - IBM Corporation, Hewlett Packard Enterprise, Cisco Systems Inc., Dell Inc., Rittal GmbH & Co. KG, and Huawei Technologies Co. Ltd, among others. These players increasingly undertake mergers, acquisitions, and product launches to develop and introduce new technologies and products. As a result of this, the market concentration will be Moderately consolidated.

In May 2022, Huawei unveiled PowerPOD 3.0, a brand-new power supply system, as well as the definition of the Next-Generation Data Center Facility. Based on the collective wisdom and joint efforts of the Huawei Data Center Facility Team and industry experts, the latest rollouts confirm Huawei's commitment to developing low-carbon smart data centers. Next-generation data center buildings will be completely green and energy-efficient, with all data center materials recycled to the greatest extent possible. As a result, the total data center ecosystem will be ecologically benign and sustainable.

In February 2022, the second stage of construction of one of Vantage's data center complexes in Frankfurt, Germany, was revealed. On its 55 MW EU campus (FRA1) in Offenbach, the business announced that it would erect the second of three buildings there. When fully constructed, the plant will have a 16 MW capacity and be 13,000 square meters (140,000 square feet) in size. It will begin serving customers in the first half of 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Market Drivers

- 4.4.1 Need for Portability and Increasing Demand for Scalable Data Center Solutions

- 4.4.2 Rising Demand for Energy Efficient Data Centers

- 4.5 Market Restraints

- 4.5.1 Limited Computing Performance

5 MARKET SEGMENTATION

- 5.1 By Ownership Type

- 5.1.1 Purchase

- 5.1.2 Lease

- 5.2 By End User

- 5.2.1 BFSI

- 5.2.2 IT and Telecommunications

- 5.2.3 Government

- 5.2.4 Education

- 5.2.5 Healthcare

- 5.2.6 Defense

- 5.2.7 Entertainment and Media

- 5.2.8 Other End Users (Industrial, Energy)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hewlett Packard Enterprise Company

- 6.1.2 IBM Corporation

- 6.1.3 Dell Inc.

- 6.1.4 Cisco Systems Inc.

- 6.1.5 Huawei Technologies

- 6.1.6 Emerson Network Power(Emerson Electric Co.)

- 6.1.7 Schneider Electric SE (acquired AST Modular)

- 6.1.8 Rittal Gmbh & Co. KG

- 6.1.9 Baselayer Technology, LLC.