|

市場調查報告書

商品編碼

1636596

語音助理應用 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Voice Assistant Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

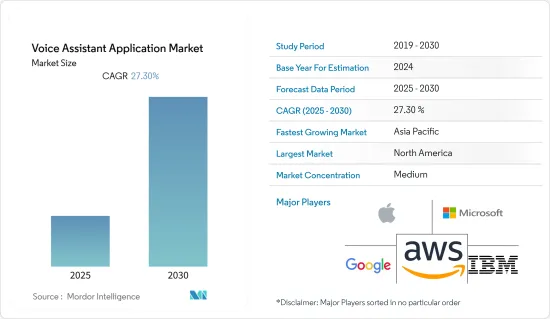

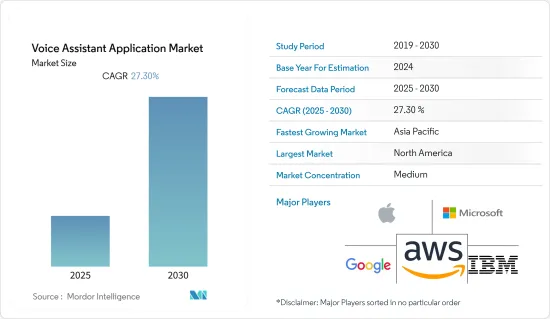

語音助理應用市場預計在預測期內複合年成長率為27.30%

主要亮點

- 根據思科年度網路報告,到今年,連接到網路的設備數量將是全球人口數量的三倍多。報告稱,人均連網設備數量將從2018年的2.4台增加到今年的約3.6台。它還預測,到今年,連網設備數量將達到 293 億台,高於 2018 年的 184 億台。每年,市場都會開發和採用各種外形規格、功能性和智慧化程度更高的新設備。隨著連接設備數量的增加,語音助理應用解決方案可能會被採用。

- 各個領域都認可的語音助理應用程式包括蘋果的 Siri、微軟的 Cortana 和Google的 Assistant。此外,中小企業也參與智慧語音助理技術的推廣,成為語音助理應用市場的重要參與企業。

- 允許用戶說出查詢的基於語音的系統在企業中越來越受歡迎。然而,眾所周知,基於語音的技術會佔用頻寬,並且可能會嚴重影響網路效能,尤其是在使用雲端基礎的基礎架構時。因此,對於陷入此類問題的公司來說,基於語音的技術的採用預計會受到負面影響。邊緣運算是一項有前途的技術,可以支援語音輔助設備。邊緣運算技術將高效能儲存和網路資源放置在盡可能靠近最終用戶和裝置的位置。

- 只有透過預先編程的查詢提供準確的資料,客戶才能獲得語音助理的幫助。因此,如果客戶提出語音助理無法理解的問題,語音助理將無法理解並回答該問題。在擁有多種區域語言的國家,例如印尼和印度,日常交流中區域語言比英語更受青睞。在印度,語音辨識的進步讓人們更能理解印度的地方語言。

- 在 COVID-19 大流行期間,流行的語音助理應用程式提供了來自世界衛生組織 (WHO)、疾病控制與預防中心 (CDC) 和美國國立衛生研究院 (NIH) 的安全說明,並且相當簡單- 提供對不斷上升的病例趨勢的見解。

語音助理應用市場趨勢

預計醫療領域在預測期內將大幅成長

- 醫療保健提供者正在分析語音助理應用程式在提高效率和改善患者體驗方面的優勢。這就是為什麼多個醫療保健品牌正在巧妙地利用語音助理技術,這讓他們有充分的理由相信其功能。

- 醫療保健中的語音助理應用可以幫助患者管理慢性病。例如,Sugarpod(一種 2 型糖尿病管理解決方案)根據糖尿病患者的偏好列出了自訂任務。 Sugarpod 與語音助理整合,使患者能夠有效管理治療程序並監控進展。

- 例如,亞馬遜的 Echo 裝置可讓您隨時存取亞馬遜的 Alexa 和遠端醫療服務 Teladoc Health。請求透過 Alexa 與醫生對話的客戶將收到 Teladoc 醫生的回電。在某些情況下,您的醫生可能會為您配製藥物。

- 技術提供者也專注於為醫療行業開發語音助理應用程式。例如,軟體公司 Nuance Communications 開發了一款專注於醫療領域的語音助手,名為 Dragon Medical Virtual Assistant。該解決方案提供複雜的對話對話和醫療技能,以自動執行從圖表搜尋到 CPOE 的高價值臨床業務。

- 只有在進行預先編程的查詢時,客戶才能透過準確的資料輸入獲得語音助理的幫助。因此,如果顧客問語音助理不認知的問題,語音助理將無法理解其意義,也無法回答問題。在擁有多種區域語言的國家,例如印尼和印度,日常交流中區域語言比英語更受青睞。在印度,語音辨識的進步使得人們更能理解印度的地方語言。

- 俄羅斯媒體公司 Group4Media 去年進行的一項調查顯示,十分之九的俄羅斯人知道 Yandex 的語音助理 Alisa。第二個最受認可的產品是 VK 的 Marusya,約有一半的受訪者提到。 12% 的俄羅斯人表示去年前三個月曾使用家庭語音助手,四分之一的人表示他們準備使用家庭語音助理。

預計北美在預測期內將佔據最大佔有率

- 技術提供者的大量存在以及醫療保健和零售等最終用途行業對語音助理應用程式的使用不斷增加正在推動北美地區的成長。該地區的供應商專注於建立夥伴關係、併購以及提供創新解決方案,以在地區和全球競爭格局中取得進展。

- 據惠普開發公司稱,三分之一的美國家庭擁有智慧揚聲器,其中 81% 的家庭在智慧型手機上配備了 Google 語音助理等語音助理。美國連網型設備的日益普及進一步推動了北美市場的成長。

- 由於不斷創新和採用新技術,美國市場已成為北美最大的市場貢獻者。語音助理應用程式廣泛應用於 BFSI、媒體和娛樂、醫療保健和零售領域。語音助理應用程式解決方案和服務預計將由北美的虛擬助理解決方案提供者整合並提供給企業。

- 去年,高達 95% 的語音助理用戶在行動裝置上使用它。根據全國消費者調查顯示,超過 45% 的用戶希望能夠在行動應用程式中進行對話。由於行動裝置有螢幕,因此它們是語音優先體驗的理想平台。 Apple Siri 和 Google Now 是行動優先的兩個例子。精心設計的語音優先軟體整合了視覺、語音和觸控介面,因為語音優先互動可以從語音開始,逐漸發展到圖形。

- 蘋果、Google、微軟、IBM、亞馬遜等在語音助理應用市場佔有最大市場佔有率的產業領導者的總部均位於美國。有利的技術環境、研發以及對新興市場的投資預計將推動該地區的市場。

語音助理應用行業概況

語音助理應用市場競爭適中,由大量全球和地區參與企業組成。這些參與企業佔據了很大的市場佔有率,並致力於擴大其全球基本客群。這些參與企業也專注於研發活動、策略聯盟以及其他有機和無機成長策略,以引入創新解決方案,從而在預測期內獲得競爭優勢。

2023年1月,亞馬遜和迪士尼將發表全球首款語音助理「Hey Disney」。根據亞馬遜的一篇部落格文章,「世界上第一個」語音助理將允許消費者透過家中的 Echo 設備和精選迪士尼度假酒店的免費服務獲得「廣泛的迪士尼樂趣」。迪士尼使用 Alexa Unique Assistant 創造了這種體驗,Alexa Unique Assistant 是一種人工語音智慧 (AI) 框架,可讓您快速建立與 Alexa 共存的自己的語音助理。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 工業吸引力-波特五力

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進因素

- 得益於最尖端科技,連網型設備的使用增加

- 市場問題

- 語音助理的準確性問題

第6章 市場細分

- 元件類型

- 解決方案

- 服務

- 技術類型

- 自然語言處理

- 語音辨識

- 其他技術(文字轉語音轉換、邊緣運算)

- 部署

- 本地

- 雲

- 公司規模

- 小型企業

- 主要企業

- 按最終用戶產業

- 資訊科技/通訊

- BFSI

- 醫療保健

- 零售

- 車

- 其他行業(媒體/娛樂、教育機構)

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Google LLC(Alphabet Inc.)

- IBM Corporation

- Nuance Communications Inc.

- Microsoft Corporation

- Amazon Web Services, Inc.

- Apple Inc.

- Salesforce.com, inc.

- Samsung Group

- Oracle Corporation

- Let's Nurture Infotech Pvt Ltd.

第8章投資分析

第9章 市場的未來

The Voice Assistant Application Market is expected to register a CAGR of 27.30% during the forecast period.

Key Highlights

- According to the "Cisco Annual Internet Report," the number of devices connected to internet networks will be more than three times the worldwide population by this year. As per the report, there will be approximately 3.6 networked devices per capita by this year, up from 2.4 devices per capita in 2018. Also, it further projects that there will be 29.3 billion networked devices by this year, up from 18.4 billion in 2018. Various new devices in different form factors with improved capabilities and intelligence are developed and adopted in the market every year. As the connected devices count increases, voice assistant application solutions will be adopted.

- Some voice assistant applications which have gained recognition across all sectors are Apple's Siri, Microsoft's Cortana, and Google's Assistant. Moreover, small and medium enterprises are also involved in driving intelligent voice assistant technology, thereby emerging as crucial participants in the voice assistant application market.

- Voice-based systems, which allow users to speak a query, have become increasingly common among businesses. However, voice-based technologies are known as bandwidth hogs and can efficiently overburden network performance, specifically if they use a cloud-based infrastructure. This is expected to harm voice-based technology adoption for businesses struggling with such issues. Edge computing is one of the promising technologies that can support voice-assisted devices. Edge computing technology places high-performance storage and network resources as close as possible to the end users and devices.

- Customers can only receive assistance from voice assistants fed with precise data when they ask inquiries that are preprogrammed to be answered. As a result, if a client asks a question about which the voice assistant is in the dark, it won't be able to understand what they mean and won't be able to respond to their question. People favor their regional languages above English for daily communications in nations with several regional languages, such as Indonesia and India. In India, improvements in speech recognition have made it possible to comprehend Indian regional languages better.

- At the time of the COVID-19 pandemic, popular voice assistant applications offered fairly straightforward insights on rising case trends, safety instructions from the World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), and National Institutes of Health (NIH).

Voice Assistant Application Market Trends

Healthcare Vertical is Expected to Grow Significantly Over the Forecast Period

- Healthcare providers are analyzing the benefits of voice assistant applications for increasing efficiency and improving patient experience. For this reason, several healthcare brands are smartly utilizing voice-assisted technology, giving some concrete reasons to believe in its competency.

- Voice assistant applications in healthcare can help in the chronic disease management of patients. For example, Sugarpod, a type 2 diabetes management solution with custom tasks for diabetes patients, is based on their preferences. Sugarpod, integrated with voice assistants, allows patients to manage their treatment procedures and monitor progress effectively.

- For instance, on Amazon's Echo devices, Alexa from Amazon and the telemedicine service Teladoc Health will always be accessible. Customers who have requested to speak with a doctor through Alexa will receive a call back from a Teladoc doctor. Doctors may be able to prescribe drugs in particular circumstances.

- Technology providers are also focusing on developing voice assistant applications for the healthcare industry. For example, Nuance Communications, which is a software company, developed a voice assistant specifically for the healthcare space called the Dragon Medical Virtual Assistant. The solution delivers sophisticated conversational dialogues and healthcare skills that automate highvalue clinical tasks from chart search to CPOE.

- Customers can only receive assistance from voice assistants fed with precise data when they ask inquiries that are preprogrammed to be answered. As a result, if a client asks a question about which the voice assistant is in the dark, it won't be able to understand what they mean and won't be able to respond to their question. People favor their regional languages above English for daily communications in nations with several regional languages, such as Indonesia and India. In India, improvements in speech recognition have made it possible to comprehend Indian regional languages better.

- According to a survey from last year by Group4Media, a Russian media company, nine out of ten Russians were familiar with Alisa, a voice assistant by Yandex. The second-highest level of awareness was found for Marusya, a product of VK, which was mentioned by around half of the respondents. Twelve percent of Russians reported using home voice assistants in the first three months of the last year, while one-fourth were prepared to do so.

North America is Expected to Hold Largest Share over the Forecast Period

- The significant presence of technology providers and increasing usage of voice assistant applications by end-use industries like healthcare and retail drive the growth of the North American geographic segment. The vendors in this region are focusing on entering into partnerships, merger acquisitions, and providing innovative solutions to stay in the regional and globally competitive landscape.

- According to HP Development Company, one in three United States homes has a smart speaker, and 81% of them have voice assistants like the Google voice assistant in their smartphones. The rising adoption of connected devices in the United States further drives the growth of the North American region segment of the market.

- As a result of ongoing innovation and the adoption of new technology, the US market has been the largest contributor to North America as a whole. The voice assistant application is heavily used in the BFSI, media & entertainment, healthcare, and retail sectors. It is anticipated that voice assistant application solutions and services will be integrated and made available to businesses by virtual assistant solution providers across North America.

- Up to 95% of voice assistant users in the last year will do it on mobile devices. More than 45% of users, according to the National Consumer Survey Reveals, would like to be able to speak with mobile applications. Since mobile devices include a screen, they are the ideal platform for voice-first experiences. Apple Siri and Google Now are two instances of mobile-first talents. A well-designed voice-first software integrates visual, speech, and touch interfaces because voice-first engagements begin with voice and may progress to graphics.

- The industry leaders with the most significant market shares in the voice assistant application market, like Apple, Google, Microsoft, IBM, and Amazon, have their headquarters in the United States; the favorable tech environment, Research and Development, and Investments in the studied market will drive the market in the region.

Voice Assistant Application Industry Overview

The voice assistant application market is moderately competitive and comprises a significant number of global and regional players. These players account for a considerable share of the market and focus on expanding their customer base globally. These players are also focusing on research and development activities to introduce innovative solutions, strategic alliances, and other organic & inorganic growth strategies to earn a competitive edge throughout the forecast period.

In January 2023, Amazon and Disney will release the first-of-its-kind voice assistant, "Hey Disney." According to an Amazon blog post, the "first-of-its-kind" voice assistant would give consumers access to "a wide spectrum of Disney enjoyment" through Echo devices at home and as a free service at some Disney Resort hotels. Disney created this experience using the Alexa Unique Assistant, an artificial speech intelligence (AI) framework that allowed the company to create its unique voice assistant that coexists with Alexa swiftly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Usage of Cutting-edge Technology-based Connected Devices

- 5.2 Market Challenges

- 5.2.1 Accuracy Problems Related to Voice Assistants

6 MARKET SEGMENTATION

- 6.1 Component Type

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 Type of Technology

- 6.2.1 Natural Language Processing

- 6.2.2 Speech Recognition

- 6.2.3 Other Technologies (Text to Speech Conversion, Edge Computing)

- 6.3 Deployment

- 6.3.1 On-Premise

- 6.3.2 Cloud

- 6.4 Enterprise Size

- 6.4.1 Small & Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 End-user Verticals

- 6.5.1 IT & Telecommunication

- 6.5.2 BFSI

- 6.5.3 Healthcare

- 6.5.4 Retail

- 6.5.5 Automotive

- 6.5.6 Other End-use Verticals (Media and Entertainment, Educational Institutions)

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia

- 6.6.4 Australia and New Zealand

- 6.6.5 Latin America

- 6.6.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC (Alphabet Inc.)

- 7.1.2 IBM Corporation

- 7.1.3 Nuance Communications Inc.

- 7.1.4 Microsoft Corporation

- 7.1.5 Amazon Web Services, Inc.

- 7.1.6 Apple Inc.

- 7.1.7 Salesforce.com, inc.

- 7.1.8 Samsung Group

- 7.1.9 Oracle Corporation

- 7.1.10 Let's Nurture Infotech Pvt Ltd.