|

市場調查報告書

商品編碼

1636538

電動汽車電池製造設備:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

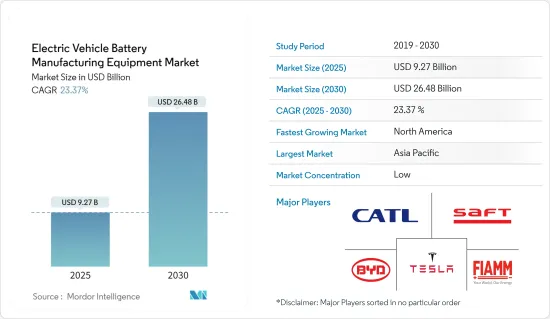

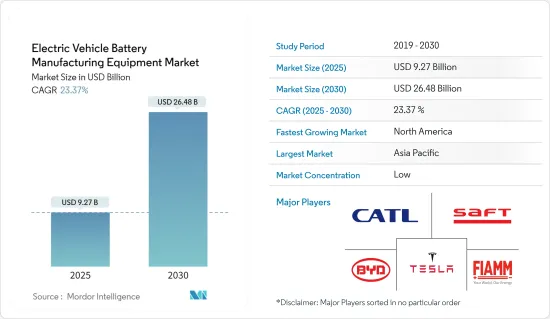

預計 2025 年電動車電池製造設備市場規模為 92.7 億美元,到 2030 年將達到 264.8 億美元,預測期內(2025-2030 年)的複合年成長率為 23.37%。

主要亮點

- 從長遠來看,電動車的普及和電池原料成本的下降預計將推動市場發展。

- 另一方面,長期依賴內燃機汽車可能會阻礙向電動車的快速轉型,從而限制市場成長。

- 然而,更高容量和更低放電率的技術進步使得電池設備更加可行和高效,為電動車電池製造設備市場創造了巨大的機會。

- 亞太地區佔據市場主導地位,其成長受到印度、中國和澳洲等國家不斷增加的投資和政府政策的推動。

電動車電池製造設備市場趨勢

電動車迅速普及,佔據市場主導地位

- 由於汽油和天然氣成本的劇烈波動以及各國對排放法規的要求日益嚴格,人們的注意力正從傳統汽車轉向電動車(EV)。電動車效率更高,電費更便宜,因此為電動車充電比加滿汽油或柴油更便宜。使用可再生能源使電動車更加環保。

- 此外,隨著對電動車的需求不斷成長,汽車製造商正在為所有汽車領域設計和銷售各種類型和設計的電動車。這種車輛設計的客製化為電池製造創造了巨大的成長機會,以滿足汽車製造商的需求。

- 2023年10月,BMW將在慕尼黑附近開設新的電池單元試點工廠,實現其「本地為本地」的電池供應鏈和生產策略。 BMW電池製造能力中心(CMCC)將生產圓柱形電池,預計將提高公司電池生產和供應的效率、品質和穩定性。

- 預計近年來電動車的湧入將在預測期內推動對電池製造設備的需求。根據國際能源總署(IEA)的數據,2023年全球電動車總銷量將達1,380萬輛,高於去年的1,020萬輛。

- 一些國家已決定在 2030 年增加電動車的佔有率。例如,中國的目標是到2030年,電動車佔汽車銷量的40%。隨著電動車保有量的增加,預計電池需求也將大幅成長。根據國際能源總署 (IEA) 的數據,到 2035 年電動車電池的需求預計將比 2023 年增加七倍。

- 考慮到這種情況,預計汽車產業將成為預測期內成長最快的產業。

預計亞太地區市場將大幅成長

- 隨著人們對環境問題的認知不斷提高,以及可以改善日益惡化的環境的技術,亞太地區的電動車電池製造設備市場正在不斷成長。亞太地區人口眾多,經濟成長迅速,其中中國、印度、東南亞國協等國家是市場推動力,預計該地區對電池的需求將穩定成長。

- 由於電動車產業的蓬勃發展、供應鏈中領先產業參與者的存在以及經濟的快速成長,中國在電池製造設備市場佔據主導地位。該地區擁有全球大部分的鋰離子蘊藏量。根據國際能源總署預測,2023年中國電動車銷量將達到約810萬輛,高於去年的590萬輛。這是亞太地區最高的。

- 預計亞太地區電動車電池製造超級工廠的成長將在未來幾年推動製造設備市場的發展。例如,2023年1月,Recharge Industries宣布,到2024年將在澳洲吉朗地區每年生產2GWh的電動車電池,到2026年生產6GWh的電動車電池。該大型工廠價值 3 億美元,預計將改善該國的電池供應價值鏈。

- 政府鼓勵發展電動車的目標和舉措可能會進一步推動亞太地區的市場成長。例如,在印度,政府的目標是到 2030 年使電動車 (EV) 佔個人汽車銷量的 30%、商用車銷量的 70% 以及二輪車和三輪車銷量的 80%。

- 因此,由於產量增加、技術進步以及政府對電動車電池製造設備市場的支持政策,預計亞太地區將在預測期內佔據市場主導地位。

電動汽車電池製造設備產業概況

電動車電池製造設備市場較為分散,參與者眾多。主要參與者(不分先後順序)包括 NEC、Duerr AG、Hitachi、Schuler AG 和 Buhler Holding AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 電動車日益普及

- 降低電池原物料成本

- 限制因素

- 長期依賴內燃機汽車

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場區隔

- 按工藝

- 混合物

- 塗層

- 日曆

- 狹縫/電極加工

- 其他流程

- 透過電池

- 鋰離子

- 鉛酸電池

- 鎳氫電池

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 馬來西亞

- 泰國

- 印尼

- 越南

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 奈及利亞

- 卡達

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- NEC Corporation

- Duerr AG

- Hitachi Ltd

- Schuler AG

- Buhler Holding AG

- Manz AG

- Sovema Group SpA

- Komatsu NTC Ltd

- KROENERT GmbH & Co. KG.

- List of Other Prominent Companies

- 市場排名分析

第7章 市場機會與未來趨勢

- 各種技術的進步日益

簡介目錄

Product Code: 50003971

The Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 9.27 billion in 2025, and is expected to reach USD 26.48 billion by 2030, at a CAGR of 23.37% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the increasing adoption of electric vehicles and the decline in the cost of raw battery materials are expected to drive the market.

- On the other hand, the long-term dependency on internal combustion engine vehicles could hinder the rapid transition to electric vehicles, which may restrain the growth of the market.

- However, the growing technological advancements in higher capacity and low discharge rates are expected to make battery equipment more feasible and efficient and create enormous opportunities for the electric vehicle battery manufacturing equipment market.

- Asia-Pacific dominates the market, and its growth will be linked to rising investments and conducive government policies in countries such as India, China, and Australia.

Electric Vehicle Battery Manufacturing Equipment Market Trends

Rapid Adoption of Electric Vehicles to Dominate the Market

- The increasing cost fluctuations of gasoline and natural gas and the growing demand for emission controls in various countries have shifted the focus from conventional vehicles to electric vehicles (EVs). Electric vehicles are more efficient, which, combined with the lower cost of electricity, makes charging an electric vehicle cheaper than filling up with petrol or diesel for your travel needs. Using renewable energy sources can make electric vehicles more eco-friendly.

- Moreover, as the demand for electric vehicles increases, automobile manufacturing companies are designing electric vehicles for all car segments in various types and designs to increase their sales. This customization in automobile design provides a significant growth opportunity for battery manufacturing to meet automobile manufacturers' demands.

- In October 2023, BMW established its new battery cell pilot plant near Munich to fulfill its 'local for local' battery supply chain and production strategy. BMW Cell Manufacturing Competence Center (CMCC) will manufacture cylindrical cells, which is expected to boost the company's efficiency, quality, and stability in battery production and supply.

- The influx of electric vehicles in recent years is expected to propel the demand for battery manufacturing equipment during the forecast period. According to the International Energy Agency (IEA), the total sales of electric vehicles worldwide were 13.8 million in 2023, an increase from 10.2 million the previous year.

- By 2030, several countries have decided to increase the share of electric vehicles. For instance, countries like China aim to have 40% of vehicles sold by 2030 to be electric. With the growth in the EV population, battery demand is expected to witness significant growth. According to the International Energy Agency, by 2035, EV battery demand is expected to increase by seven times compared to 2023.

- Considering such a scenario, the automotive industry is expected to be the fastest-growing segment during the forecast period.

Asia-Pacific is Expected to Witness Significant Growth in the Market

- The electric vehicle battery manufacturing equipment market is constantly rising in Asia-Pacific due to the rising public awareness of environmental issues and techniques to improve constantly deteriorating conditions. Due to the region's large population and fast-growing economy, the demand for batteries in Asia-Pacific is expected to grow steadily, with countries such as China, India, and the ASEAN countries driving the market.

- China dominates the battery manufacturing equipment market with a significant electric car industry, leading industry players across the supply chain, and a rapidly rising economy. The region has the majority of the world's lithium-ion reserves. As per the International Energy Agency, the sales of electric cars in China in 2023 were about 8.1 million, from 5.9 million in the previous year. This appeared to be the highest in Asia-Pacific.

- The growth of electric vehicle battery manufacturing gigafactors in Asia-Pacific is expected to push its manufacturing equipment market in the coming years. For instance, in January 2023, the Recharge Industries firm noted that it would construct close to 2 GWh of annual electric vehicle battery production by 2024 and 6 GWh by 2026 in Australia's Geelong region. The gigagactory worth USD 300 million is expected to improve the country's electric battery supply-value chain.

- Government targets and initiatives to expedite the development of electric vehicles could further drive market growth in Asia-Pacific. For instance, in India, by 2030, the government aims for electric vehicles (EVs) to make up 30% of private car sales, 70% of commercial vehicle sales, and 80% of sales of two- and three-wheelers.

- Hence, Asia-Pacific is expected to dominate the market during the forecast period due to increased production, technological advancements, and supportive government policies in the electric vehicle battery equipment manufacturing market.

Electric Vehicle Battery Manufacturing Equipment Industry Overview

The electric vehicle battery manufacturing equipment market is fragmented, with several players. Some of the major players (not in particular order) include NEC Corporation, Duerr AG, Hitachi Ltd, Schuler AG, and Buhler Holding AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing adoption of electric vehicles

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Long-term dependency on internal combustion engine vehicles

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and electrode making

- 5.1.5 Other Processes

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Spain

- 5.3.2.3 NORDIC Countries

- 5.3.2.4 Turkey

- 5.3.2.5 Russia

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Malaysia

- 5.3.3.4 Thailand

- 5.3.3.5 Indonesia

- 5.3.3.6 Vietnam

- 5.3.3.7 South Korea

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Egypt

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 NEC Corporation

- 6.3.2 Duerr AG

- 6.3.3 Hitachi Ltd

- 6.3.4 Schuler AG

- 6.3.5 Buhler Holding AG

- 6.3.6 Manz AG

- 6.3.7 Sovema Group S.p.A

- 6.3.8 Komatsu NTC Ltd

- 6.3.9 KROENERT GmbH & Co. KG.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing technological advancements in various technologies

02-2729-4219

+886-2-2729-4219