|

市場調查報告書

商品編碼

1694034

全球電池製造混合設備市場:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Global Mixing Equipment For Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

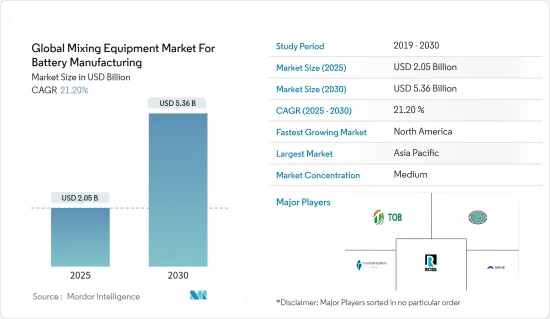

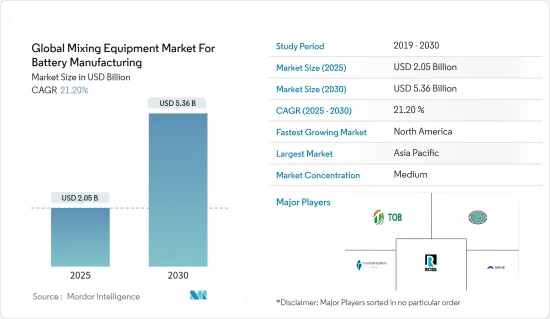

預計全球電池製造混合設備市場規模將從 2025 年的 20.5 億美元成長到 2030 年的 53.6 億美元,預測期間(2025-2030 年)的複合年成長率為 21.2%。

關鍵亮點

- 從中期來看,預計在預測期內,擴大電池生產能力的投資增加和電動車的普及將推動市場發展。

- 然而,預計高昂的物流成本將在預測期內阻礙市場成長。

- 先進電池解決方案的日益普及正在推動電池製造業的擴張。預計這一趨勢與電池製造設備的技術發展一起將在預測期內為市場帶來巨大的成長機會。

- 在北美,由於眾多終端產業對電池的使用日益增多,預計市場將顯著成長。

混合設備市場的全球趨勢

擴大電池產能的投資預計將推動市場成長

- 隨著汽車、電子、可再生能源等各行業對電池的使用日益增多,電池製造能力已成為世界各國關注的重點。為了滿足這項需求,許多國家正在投資擴建電池製造廠。公司正專注於採購混合設備。

- 例如,根據永續能源商業委員會的數據,美國鋰離子電池製造能力到 2022 年將達到 108 吉瓦時,而 2021 年為 59 吉瓦時。由於電動車和電池能源儲存等各類終端用戶的需求不斷成長,預計製造能力將會增加。

- 混合設備需求的增加是新電池製造廠投資增加的直接結果。這些工廠需要專門的設備來有效率、大規模地生產電池。混合設備對於確保電池品質、性能和安全起著至關重要的作用。

- 例如,2023年10月,寧德時代新能源科技有限公司宣布啟用新的電池生產基地,該基地擁有一條高度自動化的生產線,每秒可生產一個電芯。該工廠將分兩期建設,預計年總合生產能力為 60GWh。

- 因此,預計在預測期內增加投資以提高電池生產能力將推動市場發展。

預計北美市場將大幅成長

- 受政府支持發展鋰離子電池工廠、電動車使用增加以及美國電池機械製造商的成立等因素影響,北美預計將出現強勁成長。

- 鼓勵企業在美國建立電池製造廠可能會對電池製造設備,尤其是混合設備的需求產生重大影響。電池製造設備,包括混合設備,在生產過程中起著至關重要的作用。隨著對電池的需求不斷成長,對高效、可靠的混合設備的需求也在不斷成長,以確保高品質的電池生產。

- 例如,庫柏州長於 2023 年 12 月宣布將在莫里斯維爾建造一座新的鋰離子電池工廠,代表著對北卡羅來納州清潔能源技術和創造就業機會的重大投資。 Forge Nano 及其投資者計劃投資超過 1.65 億美元在莫里斯維爾建立一個鋰離子電池製造工廠。 Forge 電池廠預計將於 2026 年開始營運,為該州的經濟成長和永續發展做出貢獻。

- 在美國,電動車的普及度和銷量不斷增加,因此,電動車(EV)電池的產量也在增加。電動車電池產量的激增推動了對高效生產這些電池的混合設備的需求。

- 例如,豐田汽車公司於2023年10月宣布,將在北卡羅來納州的電動車電池製造廠額外投資80億美元。此舉是這家日本汽車製造商加速推進其汽車產品線電氣化的努力的一部分。豐田的目標是到2025年為其所有車型提供電動選項,此次投資使其在北卡羅來納工廠的總投資達到約139億美元。

- 因此,隨著電池製造業的興起,對混合設備的需求預計會增加。因此,預計預測期內北美市場將顯著成長。

全球電池製造混合設備產業概況

全球電池製造混合設備市場規模減少了一半。市場的主要企業包括世赫集團、Charles Ross & Son Company、廈門天馬電池設備有限公司、SCM GROUP LIMITED.HK、廈門托博新能源科技等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2029 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 加大投資,擴大電池產能

- 電動車日益普及

- 限制因素

- 物流成本高

- 驅動程式

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章市場區隔

- 類型

- 濕攪拌機

- 乾攪拌機

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- SIEHE GROUP

- Charles Ross & Son Company

- Xiamen Tmax Battery Equipments Limited

- SCM GROUP LIMITED. HK

- XIAMEN TOB NEW ENERGY TECHNOLOGY Co. LTD

- Processall

- ONGOAL

- Jongia Mixing Technology

- IKA India Private Limited

- MIXACO

- 市場排名分析

第7章 市場機會與未來趨勢

- 擴大先進電池解決方案的引入

簡介目錄

Product Code: 50002203

The Global Mixing Equipment Market For Battery Manufacturing Industry is expected to grow from USD 2.05 billion in 2025 to USD 5.36 billion by 2030, at a CAGR of 21.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increase in investments to enhance the battery production capacity and rising adoption of electric vehicles are expected to drive the market over the forecast period.

- On the other hand, the high logistic costs are expected to hamper the market growth over the forecast period.

- The increasing deployment of advanced battery solutions is leading to the expansion of battery manufacturing. This, along with technology development in battery manufacturing equipment, is expected to create a significant growth opportunity for the market during the forecast period.

- The market is expected to witness significant growth in North America due to the increasing battery applications across numerous end-use industries in the region.

Global Mixing Equipment Market Trends

Investments To Enhance the Battery Production Capacity is expected to Drive the Market Growth

- Battery manufacturing capacity has become a crucial focus for countries worldwide due to the increasing usage of batteries in various industries such as automotive, electronics, and renewable energy. To meet this demand, many countries are investing in expanding their battery manufacturing plant. Companies are focused on procuring mixing equipment.

- For instance, according to the Business Council for Sustainable Energy, in 2022, the US lithium-ion battery manufacturing capacity reached 108 GWh, compared to 59 GWh in 2021. The manufacturing capacity is expected to increase with rising demand from various end users, such as electric vehicles, battery energy storage, etc.

- The increasing demand for mixing equipment is a direct result of the increasing investments in deploying new battery manufacturing plants. These plants require specialized equipment to produce batteries efficiently and at scale. Mixing equipment plays a crucial role in ensuring the quality, performance, and safety of batteries.

- For instance, in October 2023, CATL, Contemporary Amperex Technology Co. Limited, a leading Chinese manufacturer of lithium-ion batteries, announced the opening of a new battery production base that boasts highly automated production lines capable of producing one cell every second. The facility is being constructed in two phases and is expected to have a combined annual capacity of 60 GWh.

- Thus, the increase in investments to enhance the battery production capacity is expected to drive the market over the forecast period.

The Market is Expected to Witness Significant Growth in North America

- North America is expected to witness significant growth due to factors such as support from the government for lithium-ion battery plant development, rising electric vehicle usage, and the formation of US battery machine builders.

- Encouraging companies to establish battery manufacturing plants in the United States can have a significant impact on the demand for battery manufacturing equipment, particularly mixing equipment. Battery manufacturing equipment, including mixing equipment, plays a crucial role in the production process. As the demand for batteries grows, so does the need for efficient and reliable mixing equipment to ensure high-quality battery production.

- For instance, in December 2023, Governor Cooper's announcement of a new lithium-ion battery plant for Morrisville signified a significant investment in clean energy technology and job creation in North Carolina. Forge Nano Inc. and its investors are set to invest over USD 165 million to establish a lithium-ion battery manufacturing facility in Morrisville. The Forge Battery plant is projected to commence operations in 2026, contributing to the state's economic growth and sustainability efforts.

- The increase in the usage and sales of electric vehicles in the United States has led to a corresponding rise in the production of electric vehicle (EV) batteries. This surge in EV battery production has increased the demand for mixing equipment to manufacture these batteries efficiently.

- For instance, in October 2023, Toyota Motor Corporation announced a significant boost in investment, allocating an additional USD 8 billion to its electric vehicle battery manufacturing plant in North Carolina. This move was part of the Japanese automaker's accelerated efforts to electrify its vehicle lineup. Toyota aims to offer electrified options for all its models by 2025, and this investment would bring the total investment in the North Carolina plant to about USD 13.9 billion.

- Thus, owing to the increase in battery manufacturing, the demand for mixing equipment is expected to increase. Thus, the market is expected to witness significant growth in North America during the forecast period.

Global Mixing Equipment Industry Overview

The global mixing equipment market for battery manufacturing is semi-fragmented. The key players in the market include SIEHE GROUP, Charles Ross & Son Company, Xiamen Tmax Battery Equipments Limited, SCM GROUP LIMITED. HK, and XIAMEN TOB NEW ENERGY TECHNOLOGY Co. LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increase in Investments to Enhance the Battery Production Capacity

- 4.5.1.2 Rising Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 The High Logistic Cost

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Wet Mixers

- 5.1.2 Dry Mixers

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 Qatar

- 5.2.4.4 Egypt

- 5.2.4.5 Nigeria

- 5.2.4.6 South Africa

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Columbia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 SIEHE GROUP

- 6.3.2 Charles Ross & Son Company

- 6.3.3 Xiamen Tmax Battery Equipments Limited

- 6.3.4 SCM GROUP LIMITED. HK

- 6.3.5 XIAMEN TOB NEW ENERGY TECHNOLOGY Co. LTD

- 6.3.6 Processall

- 6.3.7 ONGOAL

- 6.3.8 Jongia Mixing Technology

- 6.3.9 IKA India Private Limited

- 6.3.10 MIXACO

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Deployment of Advanced Battery Solutions

02-2729-4219

+886-2-2729-4219