|

市場調查報告書

商品編碼

1636532

美國二次電池:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)United States Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

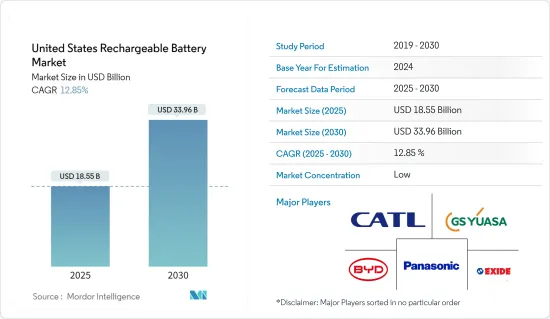

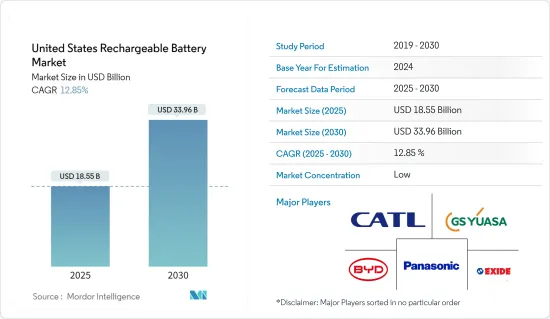

美國二次電池市場規模預計到2025年為185.5億美元,預計2030年將達到339.6億美元,預測期內(2025-2030年)複合年成長率為12.85%。

主要亮點

- 從中期來看,電動車需求增加和消費性電子產品銷售擴大等因素預計將成為預測期內美國充電電池市場的最大推動力之一。

- 相反,美國在電池採購方面面臨嚴重的供應鏈限制,在預測期內對該國的二次電池市場構成潛在威脅。

- 然而,能量密度、充電週期和能量保留方面的持續進步正在催生更有效率的二次電池,為未來市場的許多機會鋪平道路。

美國二次電池市場趨勢

鋰離子電池預計將成長

- 鋰離子電池有望在所考慮的市場中經歷顯著成長。鋰離子電池由於其良好的容量重量比而變得越來越受歡迎,特別是與其他類型的電池相比。推動鋰離子電池採用的其他因素包括卓越的性能(特別是長壽命和最少的維護)、更長的保存期限和更低的價格。儘管鋰離子電池的成本通常高於同類電池,但其優勢正在推動需求。

- 消費性電子產品擴大採用鋰離子電池。該領域包括智慧型手機、筆記型電腦、平板電腦和穿戴式裝置。這些設備選擇鋰離子電池是因為它們需要輕質組件、高效的充電週期和更長的電池壽命。隨著先進電子設備需求的增加,對鋰離子電池的需求也將增加,推動市場擴張。

- 此外,世界向太陽能和風能等再生能源來源的轉變正在擴大對能源儲存解決方案的需求。鋰離子電池在這一方面表現出色,可以巧妙地儲存來自可再生能源的多餘能量,並在需要時釋放。這項功能不僅提高了電網穩定性,也減少了對石化燃料的依賴。

- 近年來,鋰離子電池和電池組的價格有所下降,這使得它們對最終用戶產業更具吸引力。繼2022年價格小幅上漲後,2023年價格又恢復下降趨勢。值得注意的是,鋰離子電池組的價格暴跌14%至139美元/kWh的歷史低點。價格下降主要是由於整個電池價值鏈產能的增加以及原料和零件成本的降低。

- 鋰離子技術的持續研究和開發正在提高能量密度、安全性和成本效益。鋰鎳錳鈷氧化物 (NMC) 和磷酸鐵鋰 (LFP) 等電池化學方面的創新延長了電池壽命、增加了能源儲存並提高了熱穩定性,並擴大了其在電池領域的吸引力。種應用。

- 例如,2023年3月,美國能源局宣布突破性鋰電池技術,擁有卓越的能量密度和效率。這些先進的電池預計將在動力車輛、家用飛機和遠距卡車上有潛在的應用。此外,該電池的電化學特性使其更安全,適用於工作條件惡劣和溫度變化的行業。

- 鑑於這些見解,鋰離子電池在未來幾年可能會顯著成長。

電動車需求不斷成長推動市場發展

- 美國是全球汽車市場的主要企業,不僅在汽車生產方面,也是二次電池的頂級市場。在石化燃料價格飆升的背景下,電動車(EV)的銷量不斷增加,電動車可能在未來幾年主導美國汽車產業。

- 為了促進電動車的普及,美國設定了2035年結束內燃機汽車(ICE)銷售的最後期限。此外,美國承諾在未來幾十年內實現整個經濟的淨零排放。這些前瞻性政策正在活性化電動車製造商的研發投資。

- 諸如此類的努力正在迅速提高電動車在美國的普及度。國際能源總署資料顯示,2022年至2023年美國電動車銷量將成長37.5%。 2019 年至 2023 年複合年成長率高達 71.6%,證實了電動車的成長動能。

- 隨著電動車需求的快速增加,對電池的需求也在增加,因此美國的電池生產設施數量正在迅速增加,二次電池領域的研發活動也不斷增加。

- 例如,根據環保基金 2024 年 1 月的分析,美國預計將宣佈到 2028 年電動車電池年產能將超過 1,000 吉瓦時。這項產能足以生產1000萬輛電動車,超過了美國環保署設定的2030年銷售預測。

- 鑑於這些動態,很明顯電動車銷售將成為未來幾年美國二次電池市場的主要驅動力。

美國二次電池產業概況

美國二次電池市場較為分散。該市場的主要企業(排名不分先後)包括比亞迪、Contemporary Amperex Technology、Exide Industries、Panasonic Corporation 和 GS Yuasa Corporation。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車需求不斷擴大

- 家電需求擴大

- 抑制因素

- 供應鏈限制

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 依技術

- 鉛酸

- 鋰離子

- 其他(鎳氫、鎳鎘等)

- 按用途

- 車

- 工業電池

- 可攜式電池

- 其他用途

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Co. Ltd.

- LG Chem Ltd.

- Contemporary Amperex Technology Co Ltd

- Exide Industries

- Saft Groupe SA

- Samsung SDI Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- GS Yuasa Corporation

- Tesla, Inc.

- 其他知名企業名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 技術創新進展

簡介目錄

Product Code: 50003927

The United States Rechargeable Battery Market size is estimated at USD 18.55 billion in 2025, and is expected to reach USD 33.96 billion by 2030, at a CAGR of 12.85% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing demand for electric vehicles and growing sales of consumer electronics are expected to be among the most significant drivers for the United States rechargeable battery market during the forecast period.

- Conversely, the United States faces significant supply chain constraints in procuring batteries, posing a potential threat to its rechargeable battery market during the forecast period.

- However, ongoing advancements in energy density, charging cycles, and energy retention have resulted in more efficient rechargeable batteries, paving the way for numerous future opportunities in the market.

United States Rechargeable Battery Market Trends

Lithium-Ion Batteries Expected to Witness Growth

- Lithium-ion batteries are poised for substantial growth in the market under consideration. Their rising popularity, especially when compared to other battery types, can be attributed to their favorable capacity-to-weight ratio. Additional factors fueling their adoption include superior performance (notably, a long lifespan and minimal maintenance), an extended shelf life, and decreasing prices. While lithium-ion batteries typically command a higher price than their counterparts, their advantages are driving demand.

- Consumer electronics are increasingly turning to lithium-ion batteries. This sector encompasses smartphones, laptops, tablets, and wearables. These devices demand lightweight components, efficient charging cycles, and prolonged battery life, making lithium-ion batteries the preferred choice. As the appetite for advanced electronics grows, so too will the demand for lithium-ion batteries, propelling market expansion.

- Moreover, the global shift towards renewable energy sources, like solar and wind, is amplifying the demand for energy storage solutions. Lithium-ion batteries excel in this role, adeptly storing excess energy from renewables and releasing it as needed. This capability not only bolsters grid stability but also curtails dependence on fossil fuels.

- In recent years, declining prices of lithium-ion batteries and cell packs have made them increasingly appealing to end-user industries. Following minor price increases in 2022, a downward trend resumed in 2023. Notably, the cost of lithium-ion battery packs plummeted by 14%, hitting a historic low of USD 139/kWh. This price drop is largely due to reductions in raw material and component costs, alongside expanded production capacities throughout the battery value chain.

- Ongoing research and development in lithium-ion technology are yielding enhancements in energy density, safety, and cost-effectiveness. Innovations in battery chemistries, such as lithium-nickel-manganese-cobalt-oxide (NMC) and lithium-iron-phosphate (LFP), are resulting in extended battery life, increased energy storage, and enhanced thermal stability, broadening their appeal across various applications.

- For example, in March 2023, the U.S. Department of Energy unveiled a groundbreaking lithium battery technology boasting superior energy density and efficiency. These advanced batteries are touted for potential use in power cars, domestic airplanes, and long-haul trucks. Furthermore, the battery's electrochemical chemistry enhances safety, making them suitable for industries with demanding operational conditions and temperature variations.

- Given these insights, lithium-ion batteries are set to experience notable growth in the coming years.

Growing Demand for Electric Vehicles to Drive The Market

- The United States stands as a key player in the global automobile market, leading not only in automobile production but also ranking among the top markets for rechargeable batteries. With rising electric vehicle (EV) sales, driven by escalating fossil fuel prices, the United States automobile industry is set to be dominated by EVs in the coming years.

- In a bid to boost EV adoption, the United States has set a 2035 deadline to halt sales of internal combustion engine (ICE) vehicles. Additionally, the United States has committed to achieving economy-wide net-zero emissions in the coming decades. Such forward-looking policies have spurred EV manufacturers to ramp up their R&D investments.

- These initiatives have catalyzed a swift embrace of electric vehicles across the nation. Data from the International Energy Agency highlights a 37.5% surge in United States electric vehicle sales from 2022 to 2023. This comes on the heels of a remarkable 71.6% annual average growth rate from 2019 to 2023, underscoring the escalating momentum towards EVs.

- As EV demand surges, so too does the need for batteries, prompting a proliferation of battery production facilities and heightened R&D activities in the United States rechargeable battery sector.

- For example, a January 2024 analysis by the Environmental Defense Fund revealed that the United States is set to unveil over 1,000 gigawatt hours per year of electric vehicle battery production capacity by 2028. This capacity, sufficient to power 10 million electric cars, exceeds the sales projections for 2030 set by the United States Environmental Protection Agency.

- Given these dynamics, it's clear that electric vehicle sales will be a primary driver of the rechargeable battery market in the United States in the years to come.

United States Rechargeable Battery Industry Overview

The United States Rechargeable Battery Market is fragmented. Some of the key players in this market (in no particular order) are BYD Co. Ltd., Contemporary Amperex Technology Co. Ltd., Exide Industries, Panasonic Corporation, and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Electric Vehicles

- 4.5.1.2 Growing Demand for Consumer Electronics

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Others (NiMh, NiCd, etc.)

- 5.2 Applications

- 5.2.1 Automobiles

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd.

- 6.3.2 LG Chem Ltd.

- 6.3.3 Contemporary Amperex Technology Co Ltd

- 6.3.4 Exide Industries

- 6.3.5 Saft Groupe SA

- 6.3.6 Samsung SDI Co., Ltd.

- 6.3.7 Murata Manufacturing Co., Ltd.

- 6.3.8 Panasonic Corporation

- 6.3.9 GS Yuasa Corporation

- 6.3.10 Tesla, Inc.

- 6.4 List of other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Innovation

02-2729-4219

+886-2-2729-4219