|

市場調查報告書

商品編碼

1755384

充電燈市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Rechargeable Light Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

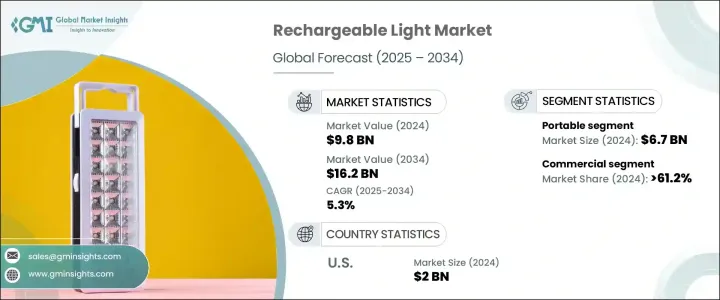

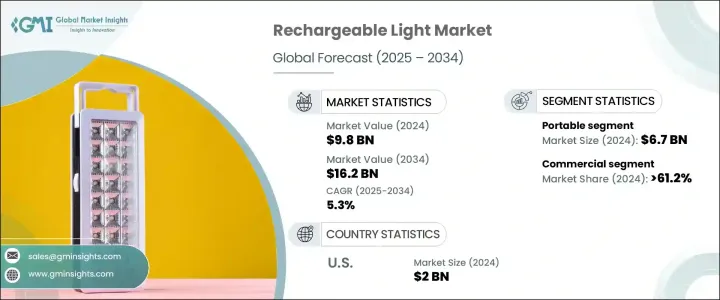

2024年,全球可充電照明市場規模達98億美元,預計到2034年將以5.3%的複合年成長率成長,達到162億美元。鋰離子電池技術的進步推動了這一成長。如今,鋰離子電池充電速度更快、使用壽命更長、效能更佳,讓充電式照明更普及,更適合日常使用。政府在城鄉電氣化計畫中大力支持綠色能源,也促進了該產業的擴張。健行、釣魚和露營等戶外休閒活動的顯著成長,也刺激了對可充電照明解決方案的需求。

由於這些燈具在停電期間的可靠性,它們越來越被視為必不可少的照明設備,尤其是在緊急準備中。隨著氣候相關災害和電網不穩定的日益頻繁,可靠的可充電照明已成為緊急應變工具包的核心組成部分。它們便攜、易用且電池壽命長,在颶風、暴風雨和其他自然災害期間必不可少。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 98億美元 |

| 預測值 | 162億美元 |

| 複合年成長率 | 5.3% |

對環保技術的推動,包括LED整合、智慧控制、運動偵測和節能功能,大大重塑了市場的技術格局。製造商正致力於開發不僅能降低能耗,還能支援太陽能板和USB-C介面等再生能源充電選項的產品。這些進步與消費者對永續性和長期成本節約日益成長的需求相契合。諸如應用程式控制亮度、定時器設定和自適應照明等智慧功能,將可充電燈轉變為適用於家庭、戶外活動和工業用途的多功能工具。

2024年,攜帶式充電燈市場規模達67億美元,預計到2034年,由於戶外、工業和緊急用途的普及,該市場將以5.4%的複合年成長率成長。隨著消費者對輕便、耐用和多功能照明選項的追求,諸如提燈、頭燈和緊湊型手電筒等產品的需求量很大,尤其是在農村和城市地區的用戶中。這些燈具擁有出色的便攜性和設計靈活性,可根據不同的用戶偏好進行客製化。

商業領域在2024年佔據了61.2%的市場佔有率,預計到2034年將以5.3%的複合年成長率成長。這種主導地位源自於飯店、畫廊、辦公空間和商業展覽對高性能、節能LED系統日益成長的需求。這些環境需要先進的照明來滿足合規性、展示效果和營造氛圍。可充電LED解決方案兼具亮度、安全性和靈活性。自動化功能、易於安裝和便攜性進一步增強了它們在通常需要臨時或可重新配置照明裝置的商業應用中的吸引力。

2024年,美國可充電照明市場規模達20億美元,預計2034年將以5.3%的複合年成長率成長。美國市場受益於強大的環保意識消費者群體、完善的產品開發基礎設施以及政府支持的節能解決方案激勵措施。此外,戶外生活方式的普及以及積極主動的緊急準備措施將繼續支撐該地區的持續成長。

全球可充電照明市場的主要活躍公司包括 Petzl、松下、飛利浦照明、SureFire、勁量、密爾瓦基工具、Black Diamond Equipment、Streamlight、Maglite、傲光、Coleman、Fenix Lighting、Goal Zero、Nitecore 和金霸王。為了在市場上站穩腳跟,應重點關注太陽能相容性、USB 充電和智慧連接等功能。許多公司正在與戶外裝備品牌和緊急準備組織建立策略聯盟,以擴大其影響力。產品線多元化,涵蓋消費級和商用級照明解決方案,有助於品牌吸引更廣泛的受眾。此外,對環保材料的投資和對能源標準的遵守,使公司能夠與永續發展目標保持一致,並在全球市場上獲得競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對節能和永續照明解決方案的需求不斷成長。

- 電池技術的進步,尤其是鋰離子電池。

- 增加戶外休閒活動和探險旅遊。

- 擴大可充電燈在工業和緊急應用中的使用。

- 產業陷阱與挑戰

- 與一次性替代品相比,初始成本較高。

- 依賴電池效能和充電基礎設施

- 成長動力

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 首選價格範圍

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 固定的

- 便攜的

第6章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 手持式手電筒

- 露營燈

- 頭燈

- 應急燈

- 其他(工業工作燈、安全照明系統)

第7章:市場估計與預測:按電源,2021 - 2034 年

- 主要趨勢

- 電池供電(鋰離子、鎳氫)

- 太陽能

- 混合動力系統

第8章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務平台

- 公司網站

- 離線

- 專賣店

- 超市和大賣場

- 其他(個人、部門等)

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Black Diamond Equipment

- Coleman

- Duracell

- Energizer

- Fenix Lighting

- Goal Zero

- Maglite

- Milwaukee Tool

- Nitecore

- Olight

- Panasonic

- Petzl

- Philips Lighting

- Streamlight

- SureFire

The Global Rechargeable Light Market was valued at USD 9.8 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 16.2 billion by 2034. The growth is fueled by technological progress in lithium-ion batteries, which now offer faster charging, longer use, and improved performance, making rechargeable lights more accessible and practical for everyday use. Government initiatives supporting green energy in urban and rural electrification programs contribute to industry expansion. A noticeable rise in outdoor recreational activities such as hiking, fishing, and camping amplifies the demand for rechargeable lighting solutions.

These lights are increasingly viewed as essential, especially in emergency preparedness due to their reliability during power outages. As climate-related disasters and grid instability become more frequent prioritizing dependable, rechargeable lighting as a core component of their emergency response kits. Their portability, ease of use, and long battery life make them indispensable during hurricanes, storms, and other natural disruptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 Billion |

| Forecast Value | $16.2 Billion |

| CAGR | 5.3% |

The push for eco-friendly technology, including LED integration, smart controls, motion detection, and energy-efficient features, has significantly reshaped the market's technological landscape. Manufacturers are focusing on developing products that not only reduce energy consumption but also support renewable energy charging options such as solar panels and USB-C interfaces. These advancements align with growing consumer demand for sustainability and long-term cost savings. Smart features like app-controlled brightness, timer settings, and adaptive lighting transform rechargeable lights into multifunctional tools for homes, outdoor activities, and industrial use.

In 2024, the portable rechargeable lights segment generated USD 6.7 billion and is projected to grow at a CAGR of 5.4% through 2034 due to rising adoption across outdoor, industrial, and emergency-use cases. With consumers seeking lightweight, durable, and multifunctional lighting options, products like lanterns, headlamps, and compact flashlights are in high demand, especially among users in both rural and urban locations. These lights offer impressive mobility and design flexibility tailored to diverse user preferences.

The commercial segment captured a 61.2% share in 2024 and is expected to grow at 5.3% CAGR through 2034. This dominance stems from the growing demand for high-performance, energy-efficient LED systems across hotels, galleries, office spaces, and commercial exhibitions. These environments require advanced lighting for compliance, presentation, and ambiance. Rechargeable LED solutions offer a combination of brightness, safety, and flexibility. Automated features, ease of setup, and portability further enhance their appeal in commercial applications that often require temporary or reconfigurable lighting installations.

U.S. Rechargeable Light Market was valued at USD 2 billion in 2024 and is poised to grow at 5.3% CAGR through 2034. The U.S. market benefits from a strong base of environmentally conscious consumers, an established infrastructure for product development, and government-backed incentives promoting energy-saving solutions. Additionally, the popularity of outdoor lifestyles and a proactive approach to emergency preparedness continue to support sustained growth in the region.

Key companies active in the Global Rechargeable Light Market include Petzl, Panasonic, Philips Lighting, SureFire, Energizer, Milwaukee Tool, Black Diamond Equipment, Streamlight, Maglite, Olight, Coleman, Fenix Lighting, Goal Zero, Nitecore, and Duracell. To gain a stronger foothold in the market, focus on features such as solar compatibility, USB charging, and smart connectivity. Many are forming strategic alliances with outdoor gear brands and emergency preparedness organizations to broaden their reach. Diversifying product lines to include both consumer-grade and commercial-grade lighting solutions helps brands appeal to a wider demographic. Additionally, investments in eco-friendly materials and compliance with energy standards allow companies to align with sustainability goals and secure a competitive edge in global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Pricing analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for energy-efficient and sustainable lighting solutions.

- 3.8.1.2 Advancements in battery technology, especially lithium-ion batteries.

- 3.8.1.3 Increasing outdoor recreational activities and adventure tourism.

- 3.8.1.4 Expanding the use of rechargeable lights in industrial and emergency applications.

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial cost compared to disposable alternatives.

- 3.8.2.2 Dependence on battery performance and recharging infrastructure

- 3.8.1 Growth drivers

- 3.9 Consumer buying behavior analysis

- 3.9.1 Demographic trends

- 3.9.2 Factors affecting buying decision

- 3.9.3 Consumer product adoption

- 3.9.4 Preferred distribution channel

- 3.9.5 Preferred price range

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Fixed

- 5.3 Portable

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Handheld flashlights

- 6.3 Camping lanterns

- 6.4 Headlamps

- 6.5 Emergency lights

- 6.6 Others (industrial work lights, security lighting systems)

Chapter 7 Market Estimates and Forecast, By Power Source, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Battery-powered (lithium-ion, NiMH)

- 7.3 Solar-powered

- 7.4 Hybrid power systems

Chapter 8 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce platforms

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Specialty stores

- 10.3.2 Supermarkets and hypermarkets

- 10.3.3 Others (individual, departmental, etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Black Diamond Equipment

- 12.2 Coleman

- 12.3 Duracell

- 12.4 Energizer

- 12.5 Fenix Lighting

- 12.6 Goal Zero

- 12.7 Maglite

- 12.8 Milwaukee Tool

- 12.9 Nitecore

- 12.10 Olight

- 12.11 Panasonic

- 12.12 Petzl

- 12.13 Philips Lighting

- 12.14 Streamlight

- 12.15 SureFire