|

市場調查報告書

商品編碼

1636482

美國電動汽車電池製造設備:市場佔有率分析、產業趨勢、成長預測(2025-2030)United States Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

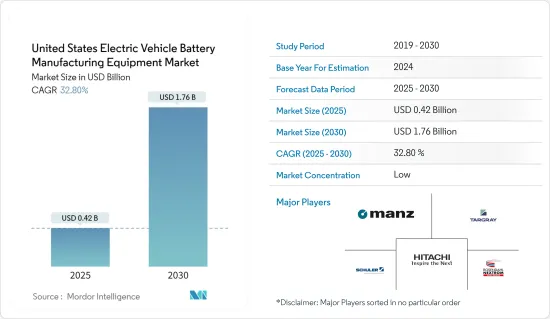

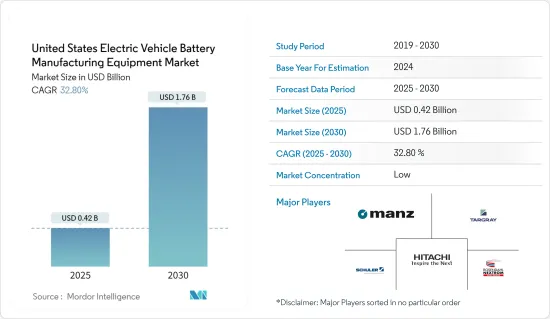

預計2025年美國電動車電池製造設備市場規模為4.2億美元,2030年將達17.6億美元,預測期間(2025-2030年)複合年成長率為32.8%。

主要亮點

- 從中期來看,政府對電池製造的措施和投資,以及電池原料(特別是鋰離子)成本的下降,預計將在預測期內推動市場發展。

- 另一方面,來自亞太地區其他現有市場的競爭預計將拖累市場的未來發展。

- 美國電動車的長期雄心壯志預計將在預測期內創造重大機會。

美國電動車電池製造設備市場趨勢

鋰離子電池預計將佔較大佔有率

- 鋰離子電池製造設備由專門用於製造鋰離子電池的專用機械和工具組成。在美國,它是生產電池芯、模組和電池組的必備設備。美國正專注於國內電池生產,旨在加強電動車(EV)市場和能源儲存解決方案。

- 此外,國內製造設備市場的進步正在大幅降低美國鋰離子電池價格。隨著電動車需求的飆升,規模經濟導致生產成本降低。因此,隨著鋰離子電池價格的下降,企業正在增加對電動車電池製造的投資,進一步拉動美國對鋰離子電池製造設備的需求。

- 2023年,鋰離子電池組價格將比前一年下降14%,穩定在139美元/kWh。除了這些價格優勢外,馬蘇正在進行的研發旨在開發更有效的電動車鋰電池材料,凸顯了馬蘇對先進電池製造設備的需求不斷成長。

- 此外,美國鋰礦石的新發現正促使電池製造商擴大電動車鋰電池的生產。這種需求表明,在可預見的未來,對電池製造設備的需求將會激增。

- 例如,2024年6月,埃克森美孚與全球領先的電動車電池開發商SK On簽署了一份不具約束力的合作備忘錄。這將使埃克森美孚能夠從其在阿肯色州的首計劃中獲取多達 10 萬噸 MobilTM 鋰。此外,埃克森美孚的目標是到 2030 年利用這種鋰每年生產約 100 萬個電動車電池。

- 此外,2023 年 11 月,美國政府承諾根據《兩黨基礎設施法案》投資約 35 億美元,以提高先進電池和材料的生產。這些舉措預計將在未來幾年加強國內鋰離子電池生產並有利於設備市場。

- 由於這些發展,預計該細分市場將在所研究的市場中佔據重要佔有率。

政府措施和電池製造投資將推動市場的前景

- 政府對電池製造的措施和投資是美國電動車電池製造設備市場的主要驅動力。聯邦和州政府的舉措,例如津貼、補貼和稅收優惠,鼓勵電池製造設施的發展和擴張。

- 例如,2024 年 1 月,美國能源局宣佈為計劃提供 1.31 億美元資金,以推進電動車電池和充電系統的研發。這筆資金支持將有助於電動車生態系統降低技術成本,延長電池車的續航里程,並建立安全、永續的國內電池供應鏈。

- 這種財政支持降低了公司投資先進設備的初始成本,使其更容易建立和擴大生產規模。這些研發舉措,例如能源部 (DOE) 的資助,促進了電池技術和製造流程的創新。

- 該國電動車銷售的成長預計將促使政府採取進一步措施,以提振該國對電池製造設備的需求。根據國際能源總署預測,2023年美國電動車總銷量將為139萬輛,高於2022年的99萬輛。

- 此外,在政府的支持下,電池製造公司正在投資開發新的電動車製造工廠,預計將大幅增加該國對電動車電池製造設備的需求。

- 例如,2023年5月,SK與現代汽車集團在喬治亞核准了合資產業計畫,展現了SK對塑造美國汽車技術未來的堅定承諾。這家價值 50 億美元的合資企業將在喬治亞巴托縣建立電動車電池工廠。

- 因此,隨著最近的趨勢和電動車銷售的增加,政府對電池製造的措施和投資預計將推動市場的發展。

美國電動汽車電池製造設備產業概況

美國電動車電池製造設備市場已縮減一半。市場主要企業包括(排名不分先後)Manz AG、Schuler AG、Hitachi、Rosendahl Nextrom GmbH 和 Targray Technology International Inc.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 政府對電池製造的措施和投資

- 電池原物料成本下降

- 抑制因素

- 與現有市場的競爭

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 過程

- 混合物

- 塗層

- 日曆

- 狹縫/電極加工

- 其他

- 電池

- 鋰離子

- 鉛酸

- 鎳氫電池

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Manz AG

- Rosendahl Nextrom GmbH

- Schuler AG

- Hitachi Ltd

- Targray Technology International Inc

- Targray Technology International Inc

- Xiamen TOB New Energy Technology Co.,Ltd.

- DAIICHI JITSUGYO (AMERICA), INC.

- Sovema Group

- 其他主要企業名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車的長期目標

The United States Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 0.42 billion in 2025, and is expected to reach USD 1.76 billion by 2030, at a CAGR of 32.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, government policies and investments towards battery manufacturing, and a decline in the cost of battery raw materials, especially lithium-ion, are expected to drive the market in the forecast period.

- On the other hand, competition from other established markets in Asia-Pacific region is expected to hamper the market in the future.

- Nevertheless, long-term ambitious targets for electric vehicles in the United States are expected to create a significant opportunity in the forecast period.

United States Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- Lithium-ion battery manufacturing equipment comprises specialized machines and tools tailored for lithium-ion battery production. In the United States, this equipment is pivotal for producing battery cells, modules, and packs. The United States is intensifying its focus on domestic battery production, aiming to bolster the electric vehicle (EV) market and energy storage solutions.

- Moreover, advancements in the domestic manufacturing equipment market are significantly driving down lithium-ion battery prices in the United States. As the demand for electric vehicles surges, achieving economies of scale has led to reduced production costs. Consequently, with decreasing lithium-ion battery prices, companies are ramping up investments in EV battery manufacturing, further fueling the demand for lithium-ion battery manufacturing equipment in the United States.

- In 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD139/kWh. Beyond these price advantages, ongoing research and development efforts aim to create more effective lithium battery materials for electric vehicles, underscoring the growing need for advanced battery manufacturing equipment.

- Furthermore, fresh discoveries of lithium ore within the United States are spurring battery manufacturers to ramp up production of lithium batteries for electric vehicles. Such ambitions signal a burgeoning demand for battery manufacturing equipment in the foreseeable future.

- For example, in June 2024, ExxonMobil and SK On, a leading global electric vehicle battery developer, signed a non-binding memorandum of understanding. This sets the stage for a potential multiyear offtake agreement, enabling ExxonMobil to acquire up to 100,000 metric tons of MobilTM Lithium from its debut project in Arkansas. Moreover, ExxonMobil targets this lithium for the production of approximately 1 million EV batteries annually by 2030.

- Additionally, in November 2023, the United States government, under the Bipartisan Infrastructure Law, committed an investment of around USD 3.5 billion to enhance the production of advanced batteries and their materials. Such initiatives are poised to bolster domestic lithium-ion battery production, subsequently benefiting the equipment market in the coming years.

- Given these developments, the segment is anticipated to command a substantial share in the market under study.

Government Policies and Investments Towards Battery Manufacturing is Expected to Drive the Market

- Government policy and investment in battery production are critical drivers of the U.S. EV battery manufacturing equipment market. Federal and state initiatives, such as grants, subsidies, and tax incentives, encourage the development and expansion of battery manufacturing facilities.

- For instance, in January 2024, the U.S. Department of Energy announced USD 131 million in funding for projects to advance research and development in EV batteries and charging systems. The funding will empower the EV ecosystem to lower technology costs, extend the driving range of battery vehicles, and establish a secure and sustainable domestic battery supply chain.

- These financial supports lower the initial costs for companies investing in advanced equipment, making it more feasible to establish and scale up production. Such policies promoting research and development, such as funding from the Department of Energy (DOE), spur innovation in battery technologies and manufacturing processes.

- Increasing electric vehicle sales in the country is expected to encourage the government to launch more policies that drive the demand for battery manufacturing equipment in the country. According to the International Energy Agency, in 2023, total EV car sales in the United States accounted for 1.39 million units, up from 0.99 million units in 2022.

- Further, with government support, battery manufacturing companies are investing in developing new EV manufacturing plants, which is expected to surge the demand for EV battery manufacturing equipment in the country.

- For instance, in May 2023, SK and Hyundai Motor Group greenlit plans for a joint venture in Georgia, signaling SK's deepening involvement in shaping the future of U.S. automotive technology. The venture, set to invest USD 5 billion, will establish an EV battery cell plant in Bartow County, Georgia.

- Thus, owing to the recent developments and increasing EV sales, government policies and investments in battery manufacturing are expected to drive the Market.

United States Electric Vehicle Battery Manufacturing Equipment Industry Overview

The United States electric vehicle battery manufacturing equipment market is semi-fragmented. Some of the major players in the market (in no particular order) include Manz AG, Schuler AG, Hitachi Ltd, Rosendahl Nextrom GmbH, and Targray Technology International Inc, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments Towards Battery Manufacturing

- 4.5.1.2 Decline in Cost of Battery Raw Materials

- 4.5.2 Restraints

- 4.5.2.1 Competition from Established Market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1

Manz AG

- 6.3.2 Rosendahl Nextrom GmbH

- 6.3.3 Schuler AG

- 6.3.4 Hitachi Ltd

- 6.3.5 Targray Technology International Inc

- 6.3.6 Xiamen Acey New Energy Technology Co

.,Ltd

- 6.3.7 Xiamen TOB New Energy Technology Co.,Ltd.

- 6.3.8 DAIICHI JITSUGYO (AMERICA), INC.

- 6.3.9 Sovema Group

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term Ambitious Targets for Electric Vehicles