|

市場調查報告書

商品編碼

1636466

印度電動汽車電池製造:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)India Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

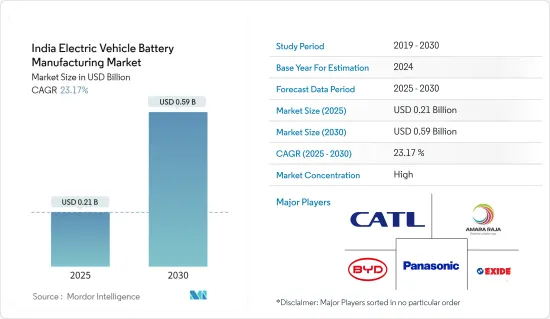

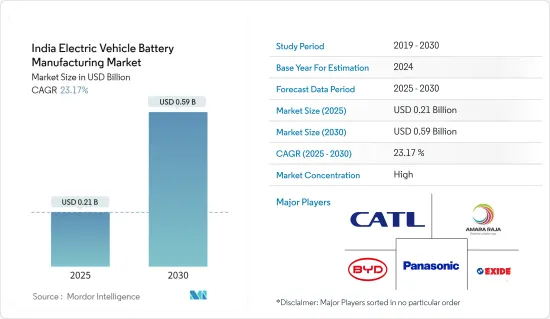

印度電動車電池製造市場規模預計到 2025 年為 2.1 億美元,到 2030 年將達到 5.9 億美元,預測期內(2025-2030 年)複合年成長率為 23.17%。

主要亮點

- 從長遠來看,增加電池產能的投資和電池原料成本下降等因素預計將成為預測期內印度電動車電池製造市場的最大驅動力之一。

- 另一方面,與原料供應鏈相關的挑戰預計將阻礙預測期內的市場成長。

- 電動車的長期雄心壯志預計將為未來的市場帶來機會。

印度電動車電池製造市場趨勢

鋰離子電池類型主導市場

- 印度電動車(EV)電池製造市場預計將大幅成長,這主要得益於鋰離子(Li-ion)電池的主導地位。鋰離子電池以其高能量密度、長壽命週期和高性能而聞名,使其成為專注於提供可靠、高效車輛的電動車製造商的最佳選擇。

- 印度政府正在推出一系列舉措,以促進電動車的採用並提高電動車電池的本地生產。混合動力汽車和電動車的快速採用和製造 (FAME) 計劃列出了針對電動車製造商和購買者的經濟獎勵。補充性的 PLI(生產掛鉤激勵)計劃針對先進化學電池(ACC)蓄電池,旨在在該國培育強大的製造生態系統。

- 印度對電動車的推動與減少碳排放和部署永續能源的更廣泛努力產生了共鳴。嚴格的政府排放法規和政策提倡從內燃機汽車過渡到電動車。在印度這個全球最大的電動車潛在市場,由於都市化、燃油價格飆升和環保意識不斷增強,對電動車的需求正在迅速增加。這種不斷成長的需求強調了對國產電池的需求並推動市場向前發展。

- 2024年7月,電池儲存巨頭Exide Industries宣布,其雄心勃勃的位於班加羅爾的12吉瓦鋰離子電池製造工廠的第一階段預計將在本會計年度結束時完工。同時,位於加爾各答的 Exide 子公司 Exide Energy Solutions (EESL) 的鋰離子電池製造計劃即將完成。認知到印度電動車市場的快速擴張,EESL已與汽車巨頭現代和起亞汽車簽署非約束性合作備忘錄(MOU),形成戰略合作關係。

- 為了鼓勵電動車的普及,全國各地正在大力投資充電基礎設施的建設。蓬勃發展的基礎設施不僅將支持電動車的普及,還將增加對國產電池的需求。印度企業正在加大研發投入,旨在提高電池技術並降低成本。與國際技術供應商和研究機構的合作是電池製造創新的催化劑。

- 2024 年 7 月,LICO 宣布擴張,在班加羅爾建造最先進的設施,使其成為印度最大的鋰離子電池回收工廠之一。 LICO 的工廠將於 2024 年 10 月投入營運,到 2026 年產能將達到每年 25,000 噸。策略上,我們將採取軸輻式營運模式,強調區域加工,降低運輸風險和成本。隨著電動車採用的加速,印度正準備有效管理廢棄電池並確保其基礎設施面向未來。

- 印度的鋰離子電池(LiB)製造業正在崛起,領先企業對新設備進行策略性投資,以滿足快速成長的電動車市場的需求。根據 PLI 計劃,Ola Electric、Reliance 和 Rajesh Export 等工業巨頭已獲得電池製造激勵,並計劃在 2024 年進行生產。此外,許多公司正在有計劃地擴建鋰電池工廠,並正在建立能夠應對國內外市場的系統。

- 由於這些發展,預計該地區電動車電池的產量將迅速增加,從而導致未來幾年對鋰離子電池的需求相應增加。

投資增加電池產能

- 印度正在提高其電池製造能力,以滿足快速成長的電動車(EV)需求。透過先進化學電池(ACC)電池的生產掛鉤激勵(PLI)計劃等舉措,政府正在尋求吸引投資並加強本地生產。這項戰略措施對於遏制進口依賴和培育強大的國內電池製造環境至關重要。

- 印度各地湧現新的電池生產工廠,以滿足快速成長的電動車市場的需求。 Exide Industries、Amara Raja 和 Tata Chemicals 等工業巨頭正在投資購買最先進的設備。這些工廠在滿足國內需求、促進創新、創造就業、推動印度電動車電池製造業的成長方面發揮關鍵作用。

- 為了增強其電池製造雄心,印度正在舉行先進設備競標,其中包括漿料攪拌機,這對於製造頂級鋰離子電池至關重要。這些競標針對的是提高效率和產量的最尖端科技。透過實現製造流程現代化,我們的目標是提高印度電動車電池生產的競爭基準化分析和質量,並使其與全球基準保持一致。

- 例如,2024 年 7 月,電動二輪車和智慧運輸領域的知名企業台灣 Ahamani EV Technology 將大力投資印度的電動車領域。該公司計劃在印度建立兆瓦級電池製造工廠,並正在尋求與印度領先汽車相關企業的戰略技術轉移合作夥伴關係。與三到四家主要電動車公司的談判已經在進行中。政府的支持措施和消費者對環保交通日益成長的需求正在推動印度對電動車的關注。計劃在現場建設的電池設施不僅旨在提高印度在電動車價值鏈中的自給自足,而且有望創造就業機會並重振經濟。

- 印度政府正在透過各種措施積極支持電動車產業,包括稅收優惠、對製造商和消費者的補貼以及對充電基礎設施的投資。這些措施旨在提高電動車的可負擔性和便利性,提高採用率,並最終增加對電池材料的需求。電池技術的創新也正在影響市場動態。例如,比亞迪正在開創磷酸鋰鐵(LFP)電池等新型電池化學材料,這種電池安全且具有成本效益,但能量密度比傳統鋰離子電池略低。此類突破對於讓更多人使用電動車發揮關鍵作用。

- 2024 年 8 月,Amara Raja Advanced Cell Technologies (ARACT) 與比亞喬汽車私人有限公司簽署了一份合作備忘錄,以在印度推廣電動車技術。該合作夥伴關係將專注於為比亞喬的電動三輪車和即將推出的二輪車製造和供應鋰離子電池、電池組和充電器。

- 根據全球趨勢,印度設定了 2029 年電動車 (EV) 的雄心勃勃的銷售目標。政府正在重點關注國內生產,尤其是電池生產,以推動印度的電動車雄心。根據30@30計劃和其他大膽預測,印度到2023年將需要42.5GWh的累積電池產能,到2029年將躍升至577.8GWh。這一激增意味著印度每年的電池需求量可能佔全球產量的 17% 至 26%。此外,擴大生產不僅對於滿足這一需求至關重要,而且對於降低成本並增加電動車的市場競爭也至關重要。建立穩固的國內生產基地將為日本帶來顯著的經濟效益。

- 總之,這些措施和投資將顯著提高印度的電池產能。

印度電動車電池製造業概況

印度的電動車電池製造市場是半集中的。該市場的主要企業(排名不分先後)包括比亞迪、寧德時代新能源科技有限公司、松下公司、Exide Industries 和 Amara Raja Batteries Ltd。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 投資增加電池產能

- 電池原物料成本下降

- 抑制因素

- 原料蘊藏量不足

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池

- 鋰離子

- 鉛酸

- 鎳氫電池

- 其他

- 電池形式

- 方形

- 袋型

- 圓柱形

- 車輛

- 客車

- 商用車

- 其他

- 晉升

- 電池電動車

- 油電混合車

- 插電式混合動力電動車

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- EnerSys

- GS Yuasa Corporation

- LG Chem Ltd

- Exide Industries

- Panasonic Corporation

- Amara Raja Batteries Ltd.

- Tata Chemicals

- HBL Power Systems Ltd.

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車的長期目標

簡介目錄

Product Code: 50003733

The India Electric Vehicle Battery Manufacturing Market size is estimated at USD 0.21 billion in 2025, and is expected to reach USD 0.59 billion by 2030, at a CAGR of 23.17% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as Investments to enhance battery production capacity and the decline in the cost of battery raw materials are expected to be among the most significant drivers for the India Electric Vehicle Battery Manufacturing Market during the forecast period.

- On the other hand, challenges associated with the raw material supply chain are expected to hinder market growth during the forecast period.

- Nevertheless, long-term ambitious targets for electric vehicles are expected to create opportunities for the market in the future.

India Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery Type to Dominate the Market

- India's electric vehicle (EV) battery manufacturing market is set for substantial growth, primarily fueled by the supremacy of lithium-ion (Li-ion) batteries. Li-ion batteries, known for their superior energy density, extended life cycles, and enhanced performance, have become the go-to choice for EV manufacturers focused on delivering reliable and efficient vehicles.

- To bolster EV adoption and stimulate local EV battery manufacturing, the Indian government has rolled out a series of initiatives. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme offers financial incentives to both EV manufacturers and buyers. Complementing this, the Production Linked Incentive (PLI) scheme targets advanced chemistry cell (ACC) battery storage, aiming to cultivate a robust manufacturing ecosystem within the country.

- India's push for EVs resonates with its broader commitment to curbing carbon emissions and embracing sustainable energy. The government's stringent emission norms and policies advocate a transition from internal combustion engines to electric vehicles. As the world's largest potential EV market, India's demand for EVs is surging, driven by urbanization, escalating fuel prices, and heightened environmental consciousness. This burgeoning demand underscores the necessity for domestically produced batteries, propelling the market forward.

- In July 2024, Exide Industries, a leading storage battery firm, announced that the first phase of its ambitious 12-gigawatt lithium-ion cell manufacturing plant in Bengaluru is on track for completion by the financial year's end. Meanwhile, Exide's Kolkata-based subsidiary, Exide Energy Solutions (EESL), is nearing the finish line with its lithium-ion cell manufacturing project. Recognizing the rapid expansion of India's EV market, EESL has inked a non-binding memorandum of understanding (MOU) with automotive giants Hyundai Motor and Kia Corporation, signaling a strategic collaboration.

- Massive investments are being funneled into the development of charging infrastructure nationwide, a move that bolsters EV adoption. This burgeoning infrastructure not only supports the widespread use of electric vehicles but also amplifies the demand for locally produced batteries. Indian firms are ramping up investments in research and development, aiming to refine battery technologies and curtail costs. Collaborations with international tech providers and research institutions are catalyzing innovations in battery manufacturing.

- In July 2024, LICO announced its operational expansion with a state-of-the-art facility in Bangalore, poised to be one of India's largest lithium-ion battery recyclers. Set to commence operations by October 2024, LICO's facility aims for an ambitious processing capacity of 25,000 tonnes annually by 2026. Strategically, the plant will emphasize regional processing to mitigate transportation risks and costs, adopting a hub-and-spoke operational model. As EV adoption accelerates, India is gearing up to efficiently manage end-of-life batteries, ensuring a future-ready infrastructure.

- India's Lithium-ion Battery (LiB) manufacturing sector is on an upward trajectory, with major players making strategic investments in new facilities to cater to the burgeoning EV market. Under the PLI scheme, industry stalwarts like Ola Electric, Reliance, and Rajesh Export have secured incentives for cell manufacturing, with production slated for 2024. In addition, numerous companies are methodically scaling up their LiB battery plants, positioning themselves to cater to both domestic and international markets.

- Given these developments, the region is poised for a surge in EV battery production, with a corresponding uptick in demand for lithium-ion batteries in the coming years.

Investments to Enhance the Battery Production Capacity

- India is ramping up its battery manufacturing capabilities to satisfy the surging demand for electric vehicles (EVs). Through initiatives like the Production Linked Incentive (PLI) scheme for advanced chemistry cell (ACC) battery storage, the government seeks to draw in investments and bolster local production. This strategic move is pivotal for curbing import reliance and nurturing a robust domestic battery manufacturing landscape.

- New battery production plants are emerging across India, catering to the burgeoning EV market. Industry giants such as Exide Industries, Amara Raja, and Tata Chemicals are channeling investments into cutting-edge facilities. These plants play a crucial role in satiating domestic demand, spurring innovation, and generating employment, thus propelling the growth of India's EV battery manufacturing sector.

- To bolster its battery manufacturing ambitions, India is issuing tenders for advanced equipment, including slurry mixers, vital for producing top-tier lithium-ion batteries. These tenders target state-of-the-art technology to boost efficiency and output. By modernizing its manufacturing processes, India aims to elevate the competitiveness and quality of its EV battery production, aligning it with global benchmarks.

- For example, in July 2024, Ahamani EV Technology Co., Ltd., a prominent Taiwanese player in electric two-wheelers and smart mobility, is set to make a substantial investment in India's EV landscape. The firm plans to set up a megawatt-scale battery manufacturing unit in India and is on the lookout for strategic technology transfer collaborations with major Indian automotive entities. Talks are already in progress with 3-4 leading EV firms. Given India's heightened emphasis on electric mobility, bolstered by supportive government policies and a surge in consumer demand for eco-friendly transport, Ahamani sees a golden opportunity. The envisioned local battery facility not only aims to bolster India's self-sufficiency in the EV value chain but also promises job creation and economic stimulation.

- India's government is actively backing the EV sector through a range of initiatives, including tax breaks, subsidies for manufacturers and consumers alike, and investments in charging infrastructure. These measures aim to enhance the affordability and convenience of EVs, driving up adoption rates and, in turn, boosting the demand for battery materials. Battery technology innovations are also influencing the market dynamics. For instance, BYD is pioneering new battery chemistries, like lithium iron phosphate (LFP) batteries, which, while being safer and more cost-effective, have a marginally lower energy density compared to conventional lithium-ion batteries. Such breakthroughs are instrumental in making EVs more accessible to the broader public.

- In August 2024, Amara Raja Advanced Cell Technologies (ARACT) inked a Memorandum of Understanding (MoU) with Piaggio Vehicles Private Limited, aiming to propel EV technology in India. This collaboration centers on crafting and supplying lithium-ion cells, battery packs, and chargers tailored for Piaggio's electric three-wheelers and upcoming two-wheelers.

- India is setting its sights on ambitious electric vehicle (EV) sales targets by 2029, in line with global trends. The government is emphasizing domestic manufacturing, especially in battery production, to fuel India's EV aspirations. Under the "30@30" initiative and other bold projections, India needed a cumulative battery capacity of 42.5 GWh in 2023, with expectations to skyrocket to 577.8 GWh by 2029. This surge means India's annual battery requirements could represent 17% to 26% of global production. Moreover, ramping up production is crucial not only to meet these demands but also to drive down costs, enhancing the market competitiveness of EVs. Establishing a solid domestic manufacturing foundation promises substantial economic advantages for the country.

- In conclusion, these initiatives and investments are set to significantly bolster India's battery production capabilities.

India Electric Vehicle Battery Manufacturing Industry Overview

The India Electric Vehicle Battery Manufacturing Market is semi-concentrated. Some of the key players in this market (in no particular order) are BYD Co. Ltd., Contemporary Amperex Technology Co. Limited, Panasonic Corporation, Exide Industries, and Amara Raja Batteries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 EnerSys

- 6.3.4 GS Yuasa Corporation

- 6.3.5 LG Chem Ltd

- 6.3.6 Exide Industries

- 6.3.7 Panasonic Corporation

- 6.3.8 Amara Raja Batteries Ltd.

- 6.3.9 Tata Chemicals

- 6.3.10 HBL Power Systems Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219