|

市場調查報告書

商品編碼

1636254

醫療設備/設備物流-市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Medical Devices And Equipment Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

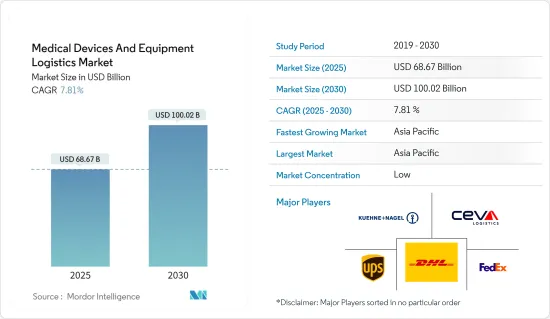

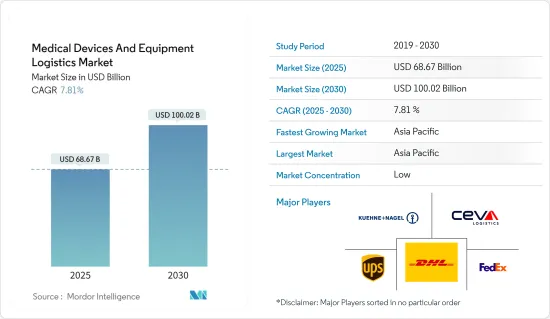

醫療器材與設備物流市場規模預計到2025年為686.7億美元,預計到2030年將達到1000.2億美元,預測期內(2025-2030年)複合年成長率為7.81%。

在先進醫療服務需求快速成長和醫療設備技術進步的推動下,醫療設備及器械物流市場正在迅速擴大。製造商和醫療保健提供者日益簡化其供應鏈業務,以確保關鍵設備及時在全球交付。自動化、即時追蹤系統和先進的庫存管理技術進一步增強了這種效率驅動力,以提高透明度並降低成本。

2024 年 2 月,GobalMed Logistix (GMLx) 宣布將把亞特蘭大園區擴大 200%,新建一座 65,000 平方英尺的設施,成為頭條新聞。此舉是對醫療設備物流和第三方服務日益成長的需求的直接回應,代表了行業物流能力的重大進步。

與 Wing 合作,美敦力 (Medtronic) 無人機交付檢查等突破性舉措正在徹底改變最後一英里的醫療物流,預計將提供更快、更具適應性的供應鏈解決方案。此外,隨著醫療基礎設施領域不斷擴大,特別是在新興國家,物流供應商正在建立強大的物流網路來滿足不斷成長的需求。

例如,總部位於英國的 Apian 於 2023 年 12 月與 Zipline 合作,以加強 NHS 的醫療保健供應交付,突顯醫療保健物流領域的持續創新浪潮。

醫療設備物流市場趨勢

醫療設備製造商整合尖端物流解決方案

Medtronic)是一家醫療設備和治療產品的跨國製造商,產品包括胰島素幫浦、心律調節器和糖尿病治療產品。從2022年開始,美敦力將對其物流和供應鏈業務進行重大改革,預計2024年取得成果。該公司專注於三個主要領域:全球營運和供應鏈(GOSC)、核心技術以及針對大型企業客戶的商業策略。這代表著方向的重大轉變。

2024 年 7 月,美敦力成為愛爾蘭首批使用無人機送貨公司 Wing 向醫院運送醫療用品和醫療設備的公司之一。這些公司正在與 Blackrock Health 和都柏林聖文森特私人醫院合作啟動無人機送貨試驗,以展示無人機如何在醫療保健領域使用。

美敦力 (Medtronic) 和 Wing 的努力突顯了在醫療設備市場中整合尖端物流解決方案日益成長的重要性。競爭對手和產業相關人員可能會效仿,加速採用旨在簡化供應鏈和改善客戶服務的創新技術。

英國醫療設備製造業引領物流業

2022 年,英國國家統計局報告稱,英國醫療設備和牙科產品製造業的附加價值毛額(GVA) 升至約 29.8 億英鎊(38.1 億美元)。這種持續成長凸顯了該行業的經濟重要性,並反映了英國國內醫療設備生產和需求的成長。

隨著產業的擴張,強大的供應鏈和分銷網路變得至關重要。這些網路對於醫療產品的高效全球運輸至關重要,確保快速到達醫療機構並遵守嚴格的法規。該行業產量的增加也刺激了對尖端物流技術的投資,例如溫控倉庫、自動化庫存系統和專業運輸解決方案。

最近的人道主義努力,例如透過 UK-Med 向受俄羅斯入侵烏克蘭影響的平民提供藥品,進一步凸顯了工業世界在醫療援助中的作用。

總而言之,英國醫療和牙科用品製造業的 GVA 的成長凸顯了物流在擴大國內外關鍵醫療設備的可用性和可近性方面所發揮的重要作用。

醫療設備及器材物流行業概況

醫療器材與設備物流市場競爭激烈,參與企業眾多,從全球物流巨頭到小眾服務供應商。處於領先地位的是 UPS Healthcare、DHL Supply Chain、FedEx Healthcare Solutions、Kuehne+Nagel 和 Ceva Logistics 等物流巨頭。這些工業巨頭利用廣泛的全球網路、最尖端科技和全套服務。相反,也有一些專業的參與企業,例如 Cardinal Health、Owens & Minor 和 DB Schenker。 這些公司透過為醫療保健行業量身定做物流解決方案(包括倉儲、配送、庫存管理等)而處於獨特的地位。

物流營運商和醫療保健相關人員之間的合作不斷加強,以擴大市場滲透率並豐富服務組合。物聯網、人工智慧和區塊鏈等技術的採用至關重要,因為它提高了物流鏈的效率和透明度。此外,鑑於對醫療設備物流的嚴格監控,對法規遵循和品質保證的堅定承諾仍然至關重要。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 科技趨勢

- 洞察供應鏈/價值鏈分析

- 產業監管洞察

- 洞察產業技術進步

- 地緣政治與疫情如何影響市場

第5章市場動態

- 市場促進因素

- 醫療服務全球擴張

- 技術進步

- 市場限制因素

- 營運成本高

- 監理複雜性

- 市場機會

- 拓展新興市場

- 與醫療保健提供者建立策略夥伴關係和合作

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 依產品類型

- 醫療設備

- 醫療設備

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- 海灣合作理事會國家

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- UPS Healthcare

- DHL Supply Chain

- FedEx Healthcare Solutions

- Kuehne+Nagel

- Ceva Logistics

- Cardinal Health

- Owens & Minor

- DB Schenker

- DSV

- World Courier*

- 其他公司

第8章 市場機會及未來趨勢

第9章 附錄

- 總體經濟指標

- 資金流向洞察(運輸和倉儲領域的投資)

- 電子商務及消費統計

- 對外貿易統計

The Medical Devices And Equipment Logistics Market size is estimated at USD 68.67 billion in 2025, and is expected to reach USD 100.02 billion by 2030, at a CAGR of 7.81% during the forecast period (2025-2030).

The medical devices and equipment logistics market is rapidly expanding, fueled by surging demand for advanced healthcare services and technological advancements in medical devices. Manufacturers and healthcare providers are increasingly streamlining their supply chain operations to ensure the timely global delivery of critical equipment. This efficiency drive is further empowered by automation, real-time tracking systems, and advanced inventory management techniques to boost transparency and cut costs.

In February 2024, GobalMed Logistix (GMLx) made headlines by unveiling a 200% expansion of its Atlanta campus, introducing a new 65,000-sq. ft facility. This move directly responds to the escalating need for medical device logistics and third-party services, marking a significant stride in the industry's logistics capabilities.

In collaboration with Wing, groundbreaking initiatives like Medtronic's drone delivery trials are revolutionizing last-mile healthcare logistics and promising swifter and more adaptable supply chain solutions. Moreover, the ongoing global expansion of healthcare infrastructure, especially in emerging economies, is creating a ripe environment for logistics providers to establish robust distribution networks and cater to mounting demands.

For instance, UK-based Apian partnered with Zipline in December 2023 to enhance NHS medical supply deliveries, underscoring the continuous wave of innovation in healthcare logistics.

Medical Devices and Equipment Logistics Market Trends

Medical Devices Manufacturer Integrate Cutting-edge Logistics Solutions

Medtronic is a multinational producer of medical devices and therapies, such as insulin pumps, pacemakers, and diabetes therapies. Since 2022, Medtronic has embarked on a massive overhaul of its logistics and supply chain operations that will culminate in 2024. The company has focused on three key areas: global operations and supply chain (GOSC), core technology, and commercial strategies targeting large enterprise customers. It represents a significant shift in direction.

In July 2024, Medtronic was among the first companies in Ireland to use the drone delivery company Wing to deliver medical supplies and devices to hospitals. The two companies are teaming up with Blackrock Health and St. Vincent's Private Hospital in Dublin to launch a drone delivery trial to demonstrate how drones can be used in healthcare.

Medtronic's initiative with Wing underscores the growing importance of integrating cutting-edge logistics solutions in the medical devices market. Competitors and industry stakeholders may follow suit, accelerating the adoption of innovative technologies to enhance supply chain efficiency and customer service.

UK Medical Devices Manufacturing Propels the Logistics Industry

In 2022, the Office for National Statistics reported that the UK manufacturing industry for medical and dental instruments and supplies saw its gross value added (GVA) climb to around GBP 2.98 billion (USD 3.81 billion). This consistent growth highlights the industry's economic significance and mirrors the escalating production and demand for medical instruments within the United Kingdom.

With the industry's expansion, robust supply chains and distribution networks become paramount. These networks are vital for the efficient global transportation of medical products, ensuring they reach healthcare facilities promptly and comply with stringent regulations. The industry's heightened manufacturing output also spurs investments in cutting-edge logistics technologies, including temperature-controlled storage, automated inventory systems, and specialized transportation solutions.

Recent humanitarian endeavors, like the country's provision of medical supplies to civilians affected by the Russian invasion of Ukraine through UK-Med, further underscore the industry's global healthcare support role.

In essence, the escalating GVA in the UK medical and dental supplies manufacturing industry accentuates the indispensable role of logistics in broadening the accessibility and availability of crucial healthcare equipment, both domestically and internationally.

Medical Devices and Equipment Logistics Industry Overview

The medical devices and equipment logistics market boasts a competitive landscape, hosting a diverse array of players, from global logistics powerhouses to niche service providers. Logistics giants like UPS Healthcare, DHL Supply Chain, FedEx Healthcare Solutions, Kuehne + Nagel, and Ceva Logistics lead the charge. These industry giants leverage their expansive global networks, cutting-edge technology, and a robust suite of services. Conversely, specialized players such as Cardinal Health, Owens & Minor, and DB Schenker carve their niche by tailoring logistics solutions for the healthcare sector, encompassing warehousing, distribution, and inventory management.

Collaborations between logistics entities and healthcare stakeholders are rising to broaden market penetration and enrich service portfolios. Embracing technologies like IoT, AI, and blockchain is pivotal, as they bolster efficiency and transparency in the logistics chain. Moreover, given the stringent oversight in medical device logistics, a steadfast commitment to regulatory compliance and quality assurance remains paramount.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

- 4.6 Impact of Geopolitics and Pandemics on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Global Expansion of Healthcare Services

- 5.1.2 Technological Advancements

- 5.2 Market Restraints

- 5.2.1 High Operational Costs

- 5.2.2 Regulatory Complexity

- 5.3 Market Opportunities

- 5.3.1 Expansion into Emerging Markets

- 5.3.2 Forging Strategic Partnerships and Collaborations With Healthcare Providers

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Medical Devices

- 6.1.2 Medical Equipment

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia

- 6.2.3.5 South Korea

- 6.2.3.6 Rest of Asia-Pacific

- 6.2.4 Middle East and Africa

- 6.2.4.1 GCC

- 6.2.4.2 South Africa

- 6.2.4.3 Rest of Middle East and Africa

- 6.2.5 South America

- 6.2.5.1 Brazil

- 6.2.5.2 Argentina

- 6.2.5.3 Rest of South America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 UPS Healthcare

- 7.2.2 DHL Supply Chain

- 7.2.3 FedEx Healthcare Solutions

- 7.2.4 Kuehne + Nagel

- 7.2.5 Ceva Logistics

- 7.2.6 Cardinal Health

- 7.2.7 Owens & Minor

- 7.2.8 DB Schenker

- 7.2.9 DSV

- 7.2.10 World Courier*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Macroeconomic Indicators

- 9.2 Insight Into Capital Flows (Investments In Transport and Storage Sector)

- 9.3 E-commerce and Consumer Spending-related Statistics

- 9.4 External Trade Statistics