|

市場調查報告書

商品編碼

1636193

藝術品物流:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Art Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

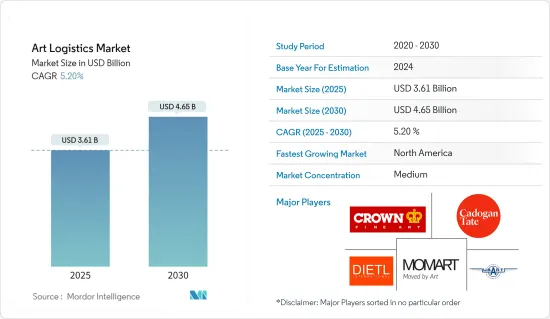

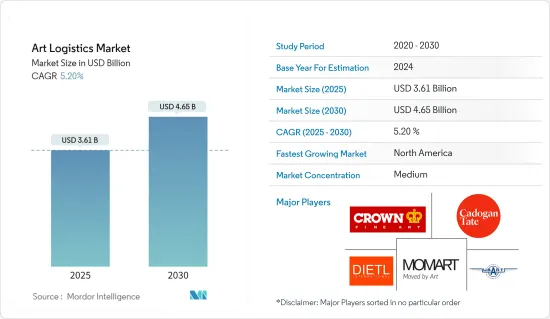

藝術品物流市場規模預計到 2025 年為 36.1 億美元,預計到 2030 年將達到 46.5 億美元,預測期內(2025-2030 年)複合年成長率為 5.2%。

藝術品物流市場主要受到高價值藝術品投資增加等因素的推動。

面對全球動盪,藝術市場展現了非凡的韌性。儘管遭受 2008 年金融危機和新冠肺炎 (COVID-19) 等重大經濟挑戰的挫折,我們仍持續反彈。儘管疫情期間下降了22%,但隔年迅速恢復,並於2022年成為全球第二大市場。儘管成長在 2023 年趨於穩定,但全球藝術品銷售額仍超過 2019 年的水平,達到驚人的 650 億美元。

過去十年,美國一直主導全球藝術市場,緊隨其後的是中國和英國。到 2023 年,這三個國家總合將佔市場銷售額的近 80%。具體檢驗全球藝術品和NFT公開競標銷售情況,美國和中國已成為主要競爭對手,在藝術品競標領域的差距正在縮小。

佳士得和蘇富比這兩家總部位於倫敦的競標行都可以追溯到 18 世紀,是市場中的佼佼者。繼2022年創下歷史新高後,佳士得2023年全球銷售額下降26%至60億美元左右。相較之下,蘇富比則小幅下滑,不到 1.5%,2023 年銷售額略低於 80 億美元。 2023年,Heritage 競標、Bonhams和Phillips是銷售額最高的競標行,銷售額均低於20億美元。

藝術品物流市場趨勢

藝術價值的上升推動了對專業運輸服務的需求

隨著藝術品價值的增加,對專業物流服務的需求也隨之增加,以確保其安全運輸和儲存。藝術收藏家正在認知到他們作品的價值,並且越來越願意為這些服務付費。隨著收藏家和畫廊參與全球藝術品貿易,對精通複雜的國際藝術品運輸的物流提供者的需求正在迅速增加。由於收藏家經常需要為展覽或新環境重新安置他們的藏品,因此這項需求進一步增加。 2023 年 2 月,印度藝術博覽會總監強調了這一趨勢,指出印度和南亞藝術品範圍和多樣性的擴大支撐了當代藝術品物流市場的成長。

私人收藏家要求對他們的作品格外小心,尤其是在氣候控制環境中的運輸過程中。對一流服務不斷成長的需求推動了專業藝術品物流公司的崛起。

亞太地區成為領先的藝術品物流服務中心

在成熟的展覽業的推動下,亞太藝術品物流市場正經歷顯著成長。這種演變正在推動藝術品物流公司的整合和標準化,使他們能夠滿足對可靠和專業的藝術品運輸服務不斷成長的需求。隨著亞太藝術市場在藝術品收購和轉售興趣日益濃厚的推動下不斷擴大,高效的藝術品運輸、儲存和處理變得至關重要。

為了滿足這項需求,藝術品物流公司根據珍貴藝術品的獨特需求提供專業的運輸和倉儲服務。 2023 年印度藝術博覽會 85 家參展和 71 家畫廊展示了這種成長,展示了來自印度和南亞的各種當代、現代和數位藝術。除了參展和畫廊外,各種機構也參加了展會,凸顯了藝術品物流市場的區域重要性。值得注意的是,印度及海外畫廊的積極參與進一步提升了市場關注。

隨著線上畫廊的興起和電子商務的擴張,該地區對藝術品物流服務的需求預計將激增。亞太地區正在大力投資建造新的博物館和畫廊,幫助創造新的商機。因此,亞太地區預計將在未來幾年主導藝術品物流市場。

藝術品物流行業概況

藝術品物流市場較為分散。少數大公司的集中是顯而易見的。 Crown Fine Art、Cadogan Tate、 美國 Art Company、Momart 和 Dietl International 等知名公司因其在處理和運輸稀有藝術品方面的專業知識而脫穎而出。多年的行業經驗和良好的業績記錄鞏固了主導地位。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場動態與洞察

- 目前的市場狀況

- 市場動態

- 促進因素

- 藝術產品的需求不斷成長推動市場

- 永續實踐推動市場

- 抑制因素

- 影響市場的複雜運輸挑戰

- 氣候條件如何影響市場

- 機會

- 藝術市場的全球化

- 促進因素

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 廢棄物回收服務市場的技術開發

- COVID-19 對市場的影響

第5章市場區隔

- 按類型

- 運輸

- 倉儲及其他服務

- 按用途

- 藝術品經銷商和畫廊

- 競標行

- 美術館/博物館

- 藝術博覽會

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 市場集中度概況

- 公司簡介

- Crown Fine Art

- Cadogan Tate

- US Art Company

- Momart

- Dietl International

- Gander & White

- Atelier4

- Helutrans Artmove

- Constantine

- 其他公司

第7章 市場的未來

第8章附錄

- 總體經濟指標

- 按部門分類的 GDP 分佈

The Art Logistics Market size is estimated at USD 3.61 billion in 2025, and is expected to reach USD 4.65 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

The art logistics market is mainly driven by factors such as an increase in investment in high-value art pieces.

The art market has showcased remarkable resilience in the face of global disruptions. Despite setbacks from major economic challenges, such as the 2008 financial crisis and the COVID-19 pandemic, it has consistently bounced back. Following a 22% decline at the onset of the pandemic, the global art market swiftly rebounded the next year, culminating in its second-highest value in 2022. Although the growth plateaued in 2023, global art sales still surpassed 2019 levels, reaching a notable USD 65 billion.

For the past decade, the United States has consistently dominated the global art market, with China and the United Kingdom following closely behind. In 2023, these three nations collectively accounted for nearly 80% of the market's sales. When specifically examining public auction revenues for fine art and NFTs worldwide, the United States and China emerged as the primary contenders, with a narrower gap separating them in the fine art auction arena.

Two London-based auction houses, Christie's and Sotheby's, both established in the 18th century, stand out as the market leaders. Christie's, after achieving a record high in 2022, saw a notable 26% decline in its global sales in 2023, settling at approximately USD 6 billion. In contrast, Sotheby's experienced a marginal drop of less than 1.5%, with its 2023 sales just shy of USD 8 billion. Following closely in 2023, Heritage Auctions, Bonhams, and Phillips emerged as the top revenue-generating auction houses, each with sales below USD 2 billion.

Art Logistics Market Trends

Rising Art Values Propel Demand for Specialized Transportation Services

As the value of art rises, so does the need for specialized logistics services to ensure its safe transport and storage. Art collectors, recognizing the value of their pieces, are increasingly willing to pay for these services. With collectors and galleries engaging in global art transactions, there is a surging demand for logistics providers adept at navigating the complexities of international art transport. This demand is further fueled by collectors often needing to relocate their collections for exhibitions or new environments. Highlighting this trend, in February 2023, the Director of the Indian Art Fair noted how the expanding scope and diversity of art in India and South Asia underscore the growth of the modern art logistics market.

Private collectors, particularly during transport in climate-controlled settings, demand meticulous care for their artworks. This heightened demand for top-tier service has spurred the rise of specialized fine art logistics firms.

Asia-Pacific Emerges as a Lucrative Hub for Art Logistics Services

The art logistics market in Asia-Pacific is witnessing substantial growth, driven by a maturing exhibition sector. This evolution has prompted art logistics companies to consolidate and standardize, enabling them to cater to the rising demand for reliable and professional art transport services. As the Asia-Pacific art market expands, fueled by a heightened interest in art acquisition and resale, the importance of efficient art transport, storage, and handling is paramount.

To address these demands, art logistics firms offer specialized transport and safekeeping services tailored to the unique needs of valuable artworks. Illustrating this growth, the India Art Fair 2023 featured 85 exhibitors and 71 galleries, showcasing a diverse array of contemporary, modern, and digital art from India and South Asia. The fair attracted not only exhibitors and galleries but also various institutions, underscoring the regional significance of the art logistics market. Notably, the event saw the active participation of Indian and international galleries, further emphasizing the market's prominence.

With the rise of online galleries and expanding e-commerce in the region, the demand for art logistics services is poised to surge. Asia-Pacific is witnessing substantial investments in the construction of new museums and art galleries, signaling a push to create fresh business avenues. Consequently, Asia-Pacific is anticipated to dominate the art logistics market in the coming years.

Art Logistics Industry Overview

The art logistics market is fragmented. It is marked by a notable concentration, largely steered by a handful of major players. Notable names such as Crown Fine Art, Cadogan Tate, U.S. Art Company, Momart, and Dietl International stand out for their expertise in handling and transporting valuable artworks. Their industry tenure and stellar track record have cemented their leading positions in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increased Demand for Art Driving the Market

- 4.2.1.2 Sustainable Practices Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Complex Transportation Challenges Affecting the Market

- 4.2.2.2 Climatic Conditions Might Affect the Market

- 4.2.3 Opportunities

- 4.2.3.1 Globalization of Art Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Developments in the Waste Recycling Services Market

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Transportation

- 5.1.2 Storage and Other Services

- 5.2 By Application

- 5.2.1 Art Dealers and Galleries

- 5.2.2 Auction Houses

- 5.2.3 Museums

- 5.2.4 Art Fairs

- 5.2.5 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Crown Fine Art

- 6.2.2 Cadogan Tate

- 6.2.3 U.S. Art Company

- 6.2.4 Momart

- 6.2.5 Dietl International

- 6.2.6 Gander & White

- 6.2.7 Atelier4

- 6.2.8 Helutrans Artmove

- 6.2.9 Constantine

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 GDP Distribution by Sector