|

市場調查報告書

商品編碼

1729703

藝術基金市場:按基金類型、用途和地區分類Art Funds Market, By Fund Type (Public and Private), By Application (Financial Investment and Art Development), By Geography (North America, Latin America, Asia Pacific, Europe, Middle East, and Africa) |

||||||

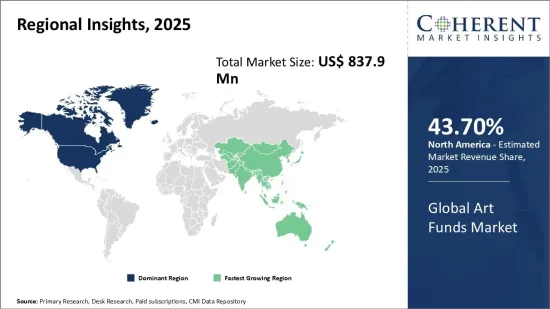

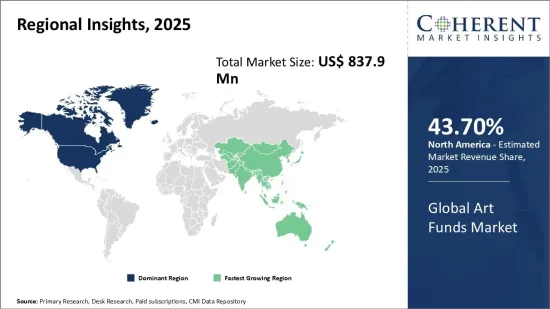

2025 年全球藝術基金市場規模估計為 8.379 億美元,預計 2032 年將達到 12.433 億美元,2025 年至 2032 年的年複合成長率(CAGR)為 5.8%。

| 報告範圍 | 報告詳細資訊 | ||

|---|---|---|---|

| 基準年 | 2024 | 2025年的市場規模 | 8.379億美元 |

| 效能數據 | 從2020年到2024年 | 預測期 | 2025年至2032年 |

| 預測期:2025-2032年複合年成長率: | 5.80% | 2032年價值預測 | 12.433億美元 |

近年來,受富人參與度增加和私人藝術投資成長的推動,全球藝術基金市場顯著成長。藝術基金允許私人和機構投資者建立多元化的著名藝術品投資組合,並透過基金結構對其進行投資。這些基金從成熟和新興藝術家那裡購買作品,然後管理和轉售它們,為投資者創造回報。該基金的目標是為流動性較差的藝術品產業帶來透明度和流動性。隨著全球富人數量的增加以及更多個人尋求替代投資,藝術品基金市場預計將繼續上漲。

市場動態:

由於富人數量的增加和私人對藝術品投資的增加,全球藝術基金市場正在經歷顯著成長。此外,消費者模式的改變以及藝術品作為投資資產類別的日益被接受,正在推動對藝術品基金的需求。然而,管理藝術品投資組合的高營運成本以及缺乏標準化的估值方法對市場的可行性構成了挑戰。此外,個別藝術品的表現和回報普遍存在的不確定性也限制了該行業的發展。從積極的一面來看,對藝術品收藏感興趣的千禧世代的人口基礎不斷擴大,以及富裕家庭藝術品捐贈的增加,可能會在未來幾年為市場相關人員創造重大機會。

本研究的主要特點

本報告對全球藝術基金市場進行了詳細分析,並以 2024 年為基準年,展示了預測期(2025-2032 年)的市場規模和年複合成長率(CAGR%)。

它還強調了各個領域的潛在商機,並說明了該市場的有吸引力的投資提案矩陣。

它還提供了有關市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景和主要企業採用的競爭策略的重要見解。

全球藝術基金市場的主要企業簡介是根據公司亮點、產品系列、主要亮點、績效和策略等參數列出的。

研究涵蓋的主要企業包括 Anthea-Contemporary Art Investment Fund SICAV FIS、The Fine Art Group、Artemundi Global Fund、Liquid Rarity Exchange、Saatchi Art、Dejia Art Fund、Arthena、Masterworks、The Arts Fund、Castlestone Management、Deloitte Art &Finance、Art Fund Group、Ascribe Capital、Arty Capital Partners 和 RArtt Capital。

本報告的見解將使負責人和企業經營團隊能夠就未來的產品發布、新興趨勢、市場擴張和行銷策略做出明智的決策。

本研究報告針對該產業的各個相關人員,包括投資者、供應商、產品製造商、經銷商、新進業者和財務分析師。

透過使用各種策略矩陣來分析全球藝術基金市場,相關人員將能夠更輕鬆地做出決策。

目錄

第1章 調查目的與前提條件

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告描述

- 市場定義和範圍

- 執行摘要

第3章市場動態、法規與趨勢分析

- 市場動態

- 影響分析

- 主要亮點

- 監管情景

- 產品發布/核准

- PEST分析

- 波特分析

- 市場機會

- 監管情景

- 主要進展

- 產業趨勢

第4章:2020-2032 年全球藝術基金市場(按基金類型分類)

- 公共

- 私人的

第5章 全球藝術基金市場(按應用分類),2020-2032

- 金融投資

- 藝術發展

第6章 2020-2032年全球藝術基金市場(按地區)

- 北美洲

- 美國

- 加拿大

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 歐洲

- 德國

- 英國

- 西班牙

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- ASEAN

- 其他亞太地區

- 中東

- 海灣合作理事會國家

- 以色列

- 其他中東地區

- 非洲

- 南非

- 北非

- 中部非洲

第7章 競爭態勢

- Anthea-Contemporary Art Investment Fund SICAV FIS

- The Fine Art Group

- Artemundi Global Fund

- Liquid Rarity Exchange

- Saatchi Art

- Dejia Art Fund

- Arthena

- Masterworks

- The Arts Fund

- Castlestone Management

- Deloitte Art & Finance

- Art Fund Group

- Ascribe Capital

- Arte Collectum

- RIT Capital Partners

第 8 章分析師建議

- 命運之輪

- 分析師觀點

- 一致的機會圖

第9章參考文獻與調查方法

- 參考

- 調查方法

- 關於出版商

Global Art Funds Market is estimated to be valued at USD 837.9 Mn in 2025 and is expected to reach USD 1,243.3 Mn by 2032, growing at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 837.9 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 5.80% | 2032 Value Projection: | USD 1,243.3 Mn |

The global art funds market has seen significant growth over the past few years driven by increasing participation of high-net-worth individuals and growth in private investments in art. Art funds allow individual and institutional investors to build diversified portfolios of famous artworks and investing in them through a fund structure. These funds purchase artworks from established and emerging artists and manage and resell them to generate returns for investors. They aim to bring transparency and liquidity to the largely illiquid fine arts industry. As wealth around the world increases and more individuals seek alternative investments, the art funds market is expected to continue its upward trajectory in the coming years.

Market Dynamics:

The global art funds market has been witnessing considerable growth driven by the growing affluence of high-net-worth individuals and increasing private capital investments in fine arts. Additionally, changing consumer patterns and growing acceptance of artwork as an investment asset class have augmented the demand for art funds. However, high operating costs associated with managing artwork portfolios and the lack of standardized valuation methods pose challenges to the market's continuity. Furthermore, the predominance of uncertainty associated with the performance and returns of individual artworks restrains the industry growth. On the positive side, expanding millennials' population base interested in art collection and rising art endowments by wealthy families are likely to present significant opportunities for market players over the next few years.

Key Features of the Study:

This report provides in-depth analysis of the global art funds market, and provides market size (US$ Million) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global art funds market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Anthea - Contemporary Art Investment Fund SICAV FIS, The Fine Art Group, Artemundi Global Fund, Liquid Rarity Exchange, Saatchi Art, Dejia Art Fund, Arthena, Masterworks, The Arts Fund, Castlestone Management, Deloitte Art & Finance, Art Fund Group, Ascribe Capital, Arte Collectum, and RIT Capital Partners

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global art funds market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global art funds market

Market Segmentation

- Fund Type Insights (Revenue, US$ Mn, 2020 - 2032)

- Public

- Private

- Application Insights (Revenue, US$ Mn, 2020 - 2032)

- Financial Investment

- Art Development

- Regional Insights (Revenue, US$ Mn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Company Profiles:

- Anthea - Contemporary Art Investment Fund SICAV FIS

- The Fine Art Group

- Artemundi Global Fund

- Liquid Rarity Exchange

- Saatchi Art

- Dejia Art Fund

- Arthena

- Masterworks

- The Arts Fund

- Castlestone Management

- Deloitte Art & Finance

- Art Fund Group

- Ascribe Capital

- Arte Collectum

- RIT Capital Partners

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Art Funds Market, By Fund Type

- Global Art Funds Market, By Application

- Global Art Funds Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trends

4. Global Art Funds Market, By Fund Type, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Public

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Private

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

5. Global Art Funds Market, By Application, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Financial Investment

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Art Development

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

6. Global Art Funds Market, By Region, 2020 - 2032, Value (US$ Mn)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, Value (US$ Mn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (US$ Mn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Fund Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Application, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (US$ Mn)

- South Africa

- North Africa

- Central Africa

7. Competitive Landscape

- Anthea - Contemporary Art Investment Fund SICAV FIS

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- The Fine Art Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Artemundi Global Fund

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Liquid Rarity Exchange

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Saatchi Art

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Dejia Art Fund

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Arthena

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Masterworks

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- The Arts Fund

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Castlestone Management

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Deloitte Art & Finance

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Art Fund Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Ascribe Capital

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Arte Collectum

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- RIT Capital Partners

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us