|

市場調查報告書

商品編碼

1636182

電動車電池:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)E-Rickshaw Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

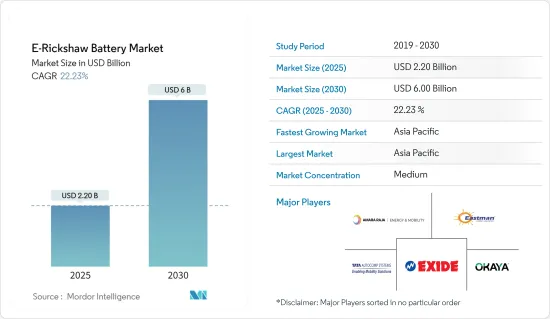

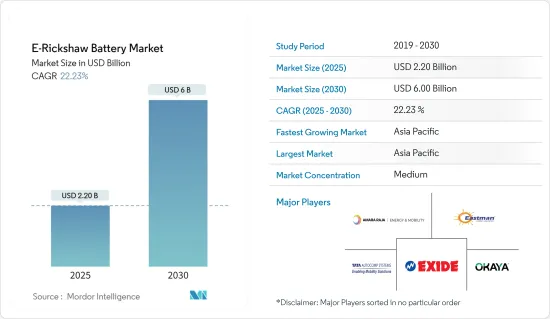

電動車電池市場規模預計到2025年為22億美元,預計到2030年將達到60億美元,預測期內(2025-2030年)複合年成長率為22.23%。

主要亮點

- 從中期來看,政府措施將擴大電動人力車的普及,並且由於其營運和維護成本比傳統石化燃料驅動的電動人力車更低,因此在預測期內,電動人力車電池預計將變得更受歡迎。市場為驅動。

- 另一方面,充電基礎設施的可用性差和電動人力車的行駛範圍有限可能會阻礙預測期內電動人力車電池市場的成長。

- 電池技術的不斷進步,例如能量密度的提高和電動人力車電池更換基礎設施的引入,預計將為電動人力車電池市場提供重大機會。

- 由於擴大採用電池驅動車輛,亞太地區預計將成為電動人力車市場的主導區域。

人力車電池市場趨勢

鋰離子電池成長迅速

- 在各種類型的電池技術中,鋰離子電池(LIB)預計將成為預測期內成長最快的電動車電池市場之一。由於其良好的容量重量比,鋰離子電池比其他電池類型更受歡迎。推動鋰離子電池普及的其他因素包括改進的性能(更長的使用壽命、更少的維護)、更長的保存期限和更低的價格。

- 與鉛酸電池等其他技術相比,鋰離子 (Li-ion) 電池具有多種技術優勢。平均而言,鋰離子電池的循環壽命超過5000次循環,而鉛酸電池的壽命約為400-500次循環。鋰離子電池不像鉛酸電池需要經常維護或更換。此外,這些電池在整個放電週期中保持電壓,使電氣元件更有效率、使用壽命更長。

- 近年來,幾大鋰離子電池製造商一直在投資以獲得規模經濟,並進行研發活動以提高性能,導致競爭加劇和鋰離子電池價格下降。例如,由於技術創新、製造改進和原料成本降低,鋰離子電池的體積加權平均價格已從2013年的780美元/千瓦時大幅下降至2023年的139美元/kWh。 2025 年可能達到約 113 美元/千瓦時,2030 年達到約 80 美元/kWh。這種電池成本下降的趨勢很可能使鋰離子電池成為未來幾年電動車電池市場所有電池中的有利選擇。

- 鋰離子電池傳統上用於行動電話和筆記型電腦等家用電子電器。然而,近年來,由於對環境的影響較小,越來越多的電池被重新設計為電動車(BEV)(包括電動人力車)的動力來源。

- 2023年12月,韓國財政部宣布計畫未來5年向鋰電池產業提供38兆韓元的政策貸款。該措施將於2024年正式實施。韓國也計劃設立1兆韓元的鋰電池產業促進基金,並投資736億韓元用於相關技術的研發。同時,政府決定增加國內鋰電池製造所需的關鍵礦物蘊藏量,並培育電池再利用和回收的生態系統。所有這些預計將提振鋰離子電池產業,進而支持電動車電池市場的成長。

- 亞太地區的鋰離子電池製造業正在崛起。例如,松下集團於2024年3月宣布,將與印度石油公司(IOCL)組成合資企業,生產圓柱形鋰離子電池。集團公司松下能源公司已簽署了一份具有約束力的條款清單,並開始與 IOCL 進行討論,概述建立一家合資企業生產圓柱形鋰離子電池的框架。這個概念是基於印度市場對兩輪和三輪汽車電池需求的預期成長。

- 2023 年 5 月,Stellantis 與 TotalEnergies 和梅賽德斯-奔馳一起為 Automotive Cells Company (ACC) 位於法國 Billie-Bercleau-Deverin 的電池超級工廠舉行了落成儀式。初始產能為 13 吉瓦時 (GWh),預計到 2030 年將增加至 40 吉瓦時 (GWh),提供二氧化碳排放最小的高性能鋰離子電池。 Gigafactory 將為 Stellantis 的目標做出貢獻,即在 2030 年將歐洲電池產能提高到 250GWh。

- 此外,據能源效率和可再生能源辦公室稱,政府已宣布將於 2023 年在北美建立電動車電池工廠。該地區的製造能力預計將從 2021 年的 55 吉瓦/年增加到 2030 年的 1,000 GWh/年。大多數籌備中的計劃預計將在 2025 年至 2030 年間開始生產。這顯示汽車電池市場發展穩健,預計在未來幾年支撐電動車電池市場。

- 2024 年 1 月,松下能源宣布更新位於堪薩斯州德索托、耗資 40 億美元正在興建的電動車電池工廠。據該公司稱,該製造工廠在運作時每秒將生產 66 塊鋰離子電池。這座佔地 470 萬平方英尺的電池工廠正在原向日葵陸軍彈藥廠的舊址上建設,預計將於 2025 年 3 月開始生產。此類鋰離子電池的開發預計將在全球範圍內繼續發展,並支持電動人力車電池市場。

- 由於重量更輕、充電時間更短、充電次數更多、成本更低以及鋰離子電池的進步等特點,鋰離子電池將成為成長最快的電動車市場,包括電動車電池市場、在預測期內,這可能是一種不斷成長的電池類型。

亞太地區預計將主導市場

- 由於幾個有吸引力的因素,預計亞太地區將在預測期內主導電動人力車電池市場。例如,在印度、中國和孟加拉等國家,高人口密度和快速都市化增加了對高效且負擔得起的交通的需求,而電動人力車近距離一個合適的選擇。這種高需求直接轉化為電動車電池的強勁市場。

- 該地區各個新興國家政府對引進電動人力車的支持顯而易見。特別是印度等國家已經實施了支持性法規、補貼和獎勵,以鼓勵使用包括電動人力車在內的電動車,作為對抗污染和減少對石化燃料依賴的更廣泛努力的一部分。例如,印度的 FAME(混合動力和電動車的更快採用和製造)計劃為包括電動人力車在內的電動車的採用提供了重大獎勵。

- 2024年3月,印度重工業部(MHI)宣布了一項計劃,旨在促進兩輪和三輪電動車用於商業用途,並為印度電動車的開發和製造提供必要的支持。 (EMPS)已經啟動。

- EMPS-2024將於2024年4月1日至2024年7月31日實施,為期四個月。預算為 500 億印度盧比,用於補貼電動車。兩輪電動車最高補助10,000印度盧比,小型三輪電動車最高補貼25,000印度盧比,大型三輪電動車最高補貼50,000印度盧比。三菱重工在銷售電動車時向電動車製造商補償補貼和需求激勵,但補貼從最終發票價格中扣除,降低了電動車的購買價格,也讓消費者受益。預計此類措施將促進電動人力車及其相關電池在日本的引進。

- 印度道路運輸及公路部預計,2023年印度電動三輪車年銷售量將超過58.1萬輛。國際能源總署(IEA)資料顯示,2023年中國和印度合計將佔全球電動三輪車銷售量的66%。這凸顯這些國家可能會在預測期內持續並確認大規模成長。

- 此外,該地區重要的電池製造商正在推動市場成長。 Exide Industries、Amara Raja Batteries 和 Okaya Power 等公司可以輕鬆獲得最新的電池技術和創新成果。這些公司也持續投資研發,以提高電池性能、降低成本、延長電動車電池的使用壽命,使其產品對消費者更具吸引力。

- 由於廉價的勞動力和原料,亞太地區的生產成本較低,因此電動人力車電池的定價具有競爭力。這種成本優勢支持了它在不同社會經濟階層的普及,使電動人力車成為許多人經濟上可行的解決方案。

- 此外,環保意識的增強和對永續城市交通解決方案的需求將推動市場向前發展。電動人力車為傳統自動化電動人力車提供了更環保的替代方案,並滿足許多亞太國家的環境目標。因此,在可預見的未來,該地區預計將保持在全球電動車電池市場的主導地位。

- 因此,由於上述因素,預計亞太地區將在預測期內主導電動人力車市場。

電動車電池產業概況

電動車電池市場適度細分。市場上的主要企業(排名不分先後)包括 Exide Industries Ltd、Eastman Auto & Power Ltd、Amara Raja Energy &Mobility Limited、Okaya Power Private Limited 和 TATA AutoComp GY Batteries Pvt.

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 透過政府措施擴大電動人力車的普及

- 營運和維修成本低於傳統石化燃料人力車

- 抑制因素

- 充電基礎設施不普及且難以接入

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他電池

- 車型

- 客車

- 貨車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 印尼

- 越南

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 卡達

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略及SWOT分析

- 公司簡介

- Exide Industries Ltd

- Eastman Auto & Power Ltd

- Amara Raja Energy & Mobility Limited

- Okaya EV Pvt. Ltd

- TATA AutoComp GY Batteries Pvt. Ltd

- Microtex Energy Private Limited

- Sparco Batteries Pvt. Ltd

- Gem Batteries Pvt. Ltd

- Alsym Energy Inc.

- 其他知名公司名單(公司名稱、總部地點、相關產品及服務、聯絡等)

- 市場排名分析

第7章 市場機會及未來趨勢

- 推出電動三輪車電池更換基礎設施

簡介目錄

Product Code: 50002591

The E-Rickshaw Battery Market size is estimated at USD 2.20 billion in 2025, and is expected to reach USD 6.00 billion by 2030, at a CAGR of 22.23% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of e-rickshaws aided by government initiatives and the lower operational and maintenance costs compared to traditional fossil fuel-powered rickshaws are expected to drive the e-rickshaw battery market during the forecast period.

- On the other hand, the lack of widespread and accessible charging infrastructure and the limited range of e-rickshaws can hinder the growth of the e-rickshaw battery market during the forecast period.

- Ongoing advancements in battery technologies, such as increased energy density and the implementation of battery-swapping infrastructure for e-rickshaw, are likely to create vast opportunities for the e-rickshaw battery market.

- Asia-Pacific is expected to be a dominant region in the e-rickshaw market due to the increasing adoption of battery-powered vehicles.

E-Rickshaw Battery Market Trends

Lithium-ion Battery to be the Fastest Growing

- Among different types of battery technologies, lithium-ion batteries (LIB) are expected to be among the fastest-growing e-rickshaw battery markets during the forecast period. Lithium-ion batteries are gaining more popularity than other battery types due to their favorable capacity-to-weight ratio. Other factors boosting their adoption include better performance (long and low maintenance), better shelf life, and decreasing price.

- Lithium-ion (Li-ion) batteries offer various technical advantages over other technologies, such as lead-acid batteries. On average, Li-ion batteries offer cycles over 5,000 times compared to lead-acid batteries that last around 400-500 times. Li-ion batteries do not require as frequent maintenance and replacement as lead-acid batteries. Furthermore, these batteries maintain their voltage throughout the discharge cycle, allowing more significant and longer-lasting efficiency of electrical components.

- In recent years, several major lithium-ion battery players have been investing to gain economies of scale and R&D activities to enhance their performance, increasing the competition and declining lithium-ion battery prices. For example, due to the improving technological innovations, manufacturing improvements, and declining raw material costs, the volume-weighted average price of lithium-ion batteries decreased considerably from USD 780/kWh in 2013 to USD 139/kWh in 2023. It is likely to reach around USD 113/kWh in 2025 and USD 80/kWh in 2030. Such declining trends in battery costs are likely to make it a lucrative choice among all batteries for the e-rickshaw battery market in the coming years.

- Lithium-ion batteries have traditionally been used in consumer electronic devices like mobile phones, laptops, and others. However, in recent years, they have increasingly been redesigned for use as the power source of choice in electric vehicles (BEVs), including e-rickshaws, in various countries, owing to factors such as low environmental impact.

- In December 2023, South Korea's Ministry of Finance announced plans to provide KRW 38 trillion in policy financing to the lithium battery industry over the next five years. This policy will be formally implemented in 2024. South Korea also plans to establish a KRW 1 trillion lithium battery industry promotion fund and invest KRW 73.6 billion in research and development of related technologies. At the same time, the government decided to increase the critical mineral reserves required for domestic lithium battery manufacturing and cultivate a battery reuse and recycling ecosystem. All these are anticipated to boost the lithium-ion battery industry and, in turn, support the growth of the e-rickshaw batteries market.

- There has been an increasing trend in lithium-ion battery manufacturing in the Asia-Pacific region. For example, in March 2024, Panasonic Group announced it would form a joint venture with Indian Oil Corporation Ltd (IOCL) to manufacture cylindrical lithium-ion batteries. Panasonic Energy, a group firm, signed a binding term sheet and initiated discussions with IOCL to draw a framework for forming a joint venture to manufacture cylindrical lithium-ion batteries. This initiative is driven by the expected expansion of demand for batteries for two and three-wheel vehicles in the Indian market.

- In May 2023, Stellantis, together with TotalEnergies and Mercedes-Benz, celebrated the inauguration of Automotive Cells Company's (ACC) battery gigafactory in Billy-Berclau Douvrin, France, the first of three planned in Europe. With an initial production line capacity of 13 gigawatt-hours (GWh), rising to 40 GWh by 2030, the facility is expected to deliver high-performance lithium-ion batteries with a minimal CO2 footprint. The gigafactory will contribute to Stellantis' goal of increasing battery manufacturing capacity to 250 GWh in Europe by 2030.

- Furthermore, as per the Office of Energy Efficiency and Renewable Energy, in 2023, the government announced the development of electric vehicle battery plants in North America. The region is expected to ramp up manufacturing capacity from 55 gigawatts per year (GWh/year) in 2021 to 1000 GWh/year by 2030. Most of the projects in the pipeline are expected to initiate production between the years 2025 to 2030. This indicates a robust battery market development for automotive applications, which is expected to support the e-rickshaw battery market in the coming years.

- In January 2024, Panasonic Energy announced an update on their USD 4 billion electric vehicle battery plant, still under construction, in De Soto, Kansas. According to the company, the manufacturing facility will produce 66 lithium-ion batteries per second when operating at full capacity. The 4.7 million-square-foot battery plant is still under construction on the former Sunflower Army Ammunition Plant site, and it is expected to begin production in March 2025. Such developments in lithium-ion batteries are anticipated to continue across the globe and support the e-rickshaw battery market.

- Due to properties such as less weight, low charging time, a higher number of charging cycles, declining cost, and the growing progress in lithium-ion batteries, they are likely to be the fastest-growing battery type among electric vehicles, including the e-rickshaw battery market, during the forecast period.

Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region is anticipated to dominate the e-rickshaw battery market during the forecast period due to several compelling factors. For example, the high population density and rapid urbanization in countries such as India, China, and Bangladesh are driving the need for efficient and affordable transportation solutions, positioning e-rickshaws as a preferred option for short-distance travel. This high demand directly translates to a robust market for e-rickshaw batteries.

- Various emerging countries in the region are experiencing notable government support for the adoption of e-rickshaws. In particular, countries such as India are implementing supportive regulations, subsidies, and incentives to promote the adoption of electric vehicles, including e-rickshaws, as part of broader efforts to combat pollution and reduce dependency on fossil fuels. For instance, India's Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme significantly incentivized the adoption of electric vehicles, including e-rickshaws.

- In March 2024, the Ministry of Heavy Industries (MHI) in India launched the Electric Mobility Promotion Scheme (EMPS) that aims to boost the adoption of two-wheeler and three-wheeler electric vehicles for commercial purposes and provide the necessary support for developing and manufacturing EVs in India.

- The EMPS-2024 is being implemented for four months, from 1 April 2024 to 31 July 2024. It has a budget of INR 500 crore and provides subsidies to EVs. Subsidies of up to INR 10,000 will be provided for each two-wheeler EV, up to INR 25,000 for each small three-wheeler EV, and up to INR 50,000 for each large three-wheeler EV. The MHI will reimburse the subsidies or demand incentives to the EV manufacturers upon the sale of a vehicle, which will also benefit the consumers as the subsidy amount will be deducted from the final invoice price, thus reducing the purchase price of the EVs. Such initiatives are anticipated to boost the country's adoption of e-rickshaws and their relevant batteries.

- As per the Ministry of Road Transport and Highways in India, the annual sales of electric three-wheelers in India stood at over 581 thousand units in 2023. The data from the International Energy Agency (IEA) revealed that together, China and India accounted for 66% of the world's electric three-wheeler sales share in 2023. This highlights that these countries are likely to continue and witness vast growth during the forecast period.

- Moreover, crucial battery manufacturers in the region enhance the market's growth. Companies like Exide Industries, Amara Raja Batteries, and Okaya Power offer easy access to the latest battery technologies and innovations. Besides, these players continuously invest in research and development to improve battery performance, reduce costs, and extend the lifespan of e-rickshaw batteries, making them more attractive to consumers.

- The Asia-Pacific region benefits from lower production costs due to cheaper labor and raw materials, enabling competitive pricing of e-rickshaw batteries. This cost advantage helps drive widespread adoption across different socioeconomic segments, making e-rickshaws an economically viable solution for many.

- Furthermore, the rising environmental awareness and the need for sustainable urban transport solutions propel the market forward. E-rickshaws offer a greener alternative to traditional auto-rickshaws, aligning with the environmental goals of many Asia-Pacific nations. As a result, the region is expected to maintain its leading position in the global e-rickshaw battery market for the foreseeable future.

- Therefore, due to the abovementioned factors, the Asia-Pacific region is expected to dominate the e-rickshaw market during the forecast period.

E-Rickshaw Battery Industry Overview

The e-rickshaw battery market is moderately fragmented. Some key players in the market (not in any particular order) include Exide Industries Ltd, Eastman Auto & Power Ltd, Amara Raja Energy & Mobility Limited, Okaya Power Private Limited, and TATA AutoComp GY Batteries Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of E-Rickshaws Aided By Government Initiatives

- 4.5.1.2 Lower Operational and Maintenance Costs Compared to Traditional Fossil Fuel-powered Rickshaws

- 4.5.2 Restraints

- 4.5.2.1 Lack of Widespread and Accessible Charging Infrastructure and Limited Range of E-rickshaws

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-acid Battery

- 5.1.2 Lithium-ion Battery

- 5.1.3 Other Batteries

- 5.2 Vehicle Type

- 5.2.1 Passenger Carrier

- 5.2.2 Goods Carrier

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Nordic

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Thailand

- 5.3.3.6 Malaysia

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Egypt

- 5.3.4.5 Nigeria

- 5.3.4.6 Qatar

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Chile

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Exide Industries Ltd

- 6.3.2 Eastman Auto & Power Ltd

- 6.3.3 Amara Raja Energy & Mobility Limited

- 6.3.4 Okaya EV Pvt. Ltd

- 6.3.5 TATA AutoComp GY Batteries Pvt. Ltd

- 6.3.6 Microtex Energy Private Limited

- 6.3.7 Sparco Batteries Pvt. Ltd

- 6.3.8 Gem Batteries Pvt. Ltd

- 6.3.9 Alsym Energy Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Implementation of Battery-swapping Infrastructure for E-rickshaws

02-2729-4219

+886-2-2729-4219