|

市場調查報告書

商品編碼

1636172

美國商業乙烯基地板材料:市場佔有率分析、行業趨勢和成長預測(2025-2030)United States Commercial Vinyl Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

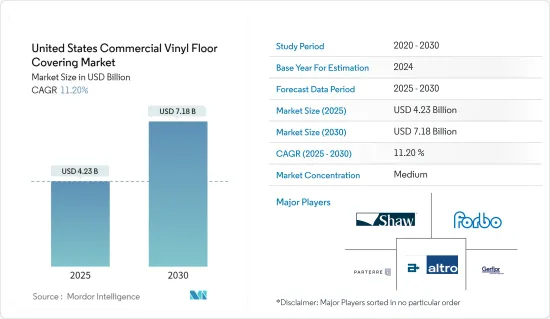

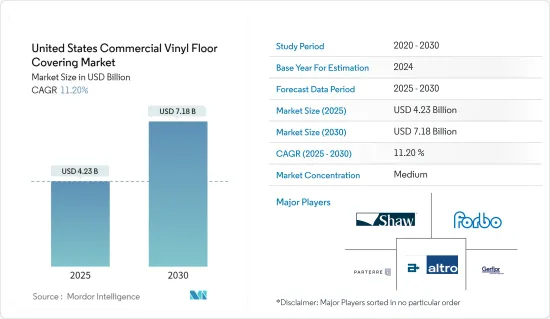

預計 2025 年美國商用乙烯基地板材料市場規模為 42.3 億美元,到 2030 年將成長至 71.8 億美元,預計在預測期內(2025-2030 年)複合年成長率為 11.2%。

乙烯基地板材料由合成材料製成,因其耐用性和多功能性而備受讚譽。這些地板材料有多種顏色和圖案,通常模仿木材、天然石材或瓷磚的外觀。由於其彈性和易於維護,乙烯基地板已成為商業領域許多人的最佳選擇。

由於其耐用性和美觀性,美國商業部門對乙烯基地板材料的採用顯著增加。醫院、零售店、健身房和交通樞紐等商業設施數量的不斷增加也刺激了需求。

在舒適性和美觀性至關重要的酒店業中,選擇合適的地板材料至關重要。乙烯基地板材料已成為最佳選擇。乙烯基地板材料可以處理人流和家具移動,而且其使用壽命長,無需頻繁更換。隨著美國酒店設施數量的增加,對乙烯基地板材料的需求也在增加。

乙烯基地板材料長期以來一直受到餐旅服務業的青睞,但現在它在汽車、航空和航運等交通領域迅速普及。由於其優異的耐用性和易於維護,也被用於電動車。在美國,電動車的產銷量預計將增加,汽車領域對乙烯基地板材料的需求預計將大幅增加。

美國商業乙烯基地板材料市場趨勢

彈性地板材料

商業計劃的設計師在彈性地板材料領域絕大多數選擇乙烯基複合瓷磚(VCT)、豪華乙烯基瓷磚(LVT)、油氈和橡膠。這些選擇因其多樣化的顏色和紋理選擇、環保功能和低維護要求而廣受歡迎。 VCT 通常是一種經濟實惠的選擇,它已經超越了傳統的 12x12 英寸格式,現在提供各種尺寸和圖案。另一方面,油氈強調其可再生和自然的品質,並為空間增添了溫暖的質感。隨著對彈性地板材料的需求迅速增加,橡膠、油氈和乙烯基等材料越來越受歡迎,特別是在高人流的商業環境中。這些瓷磚因其耐用性、防滑性能和承受繁忙人流的能力而廣受歡迎。這使得它們非常適合交通繁忙的場所,例如機場、醫院和學校,這些場所的安全性和使用壽命非常重要。

擴大高檔乙烯基瓷磚和板材的使用

豪華乙烯基瓷磚(LVT)和豪華乙烯基板(LVP)代表了豪華乙烯基地板材料的兩種不同形式。 LVT 反映了瓷磚的外觀,而 LVP 則模仿傳統的硬木板。 LVT 模仿這些材料,同時擁有經濟實惠、卓越的耐刮性和防水功能。 LVT 由實現逼真視覺效果的照片列印層和實現耐用性的耐磨層組成,有板材和瓷磚兩種形式。它是理想的商業地板解決方案,將精緻的美學與卓越的耐用性和易於維護相結合。

乙烯基地板材料具有高彈性,是商業設施的熱門材料。它是混凝土、陶瓷、大理石和木材等天然材料的經濟高效替代品,並且耐用且能夠承受繁忙的人流。

美國商用乙烯基地板材料產業概況

豪華乙烯基地板材料市場的特點是美國市場參與者眾多。因此,市場適度整合。

乙烯基地板材料行業的主要企業競爭激烈,每個人都力爭在市場上主導。這些公司的策略重點是提高製造能力、增加研發投資以及最佳化整個價值鏈的營運。這些舉措直接回應市場需求、促進創新並擴大我們的客戶群。

Shaw Industries Group Inc.、Forbo、Parterre、Gerflor Group、Altro 是市場上一些主要企業。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

- 研究框架

- 二次調查

- 初步調查

- 對資料進行三角測量並產生見解

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 商業建築計劃成長

- 健身設施需求增加

- 市場限制因素

- 施工後VOCS(揮發性有機化合物)排放

- 只能安裝在光滑的底層地板上

- 市場機會

- 美國地板材料市場參與者正在採用創新技術以保持領先地位

- 乙烯基地板材料印刷的創新

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 洞察最新的產業趨勢和創新

- 對市場近期趨勢的見解

- 深入了解美國汽車製造和工廠的主要地區和主要州/城市

- COVID-19 對市場的影響

第5章市場區隔

- 依產品類型

- 豪華乙烯基瓷磚和板材

- 乙烯基片材

- 乙烯基複合磚

- 按用途

- 運輸

- 汽車地板材料

- 航空地板材料

- 船用地板材料

- 其他交通

- 款待

- 健身房和健身

- 醫院

- 零售

- 公司

- 教育

- 其他商業用途

- 運輸

- 按分銷管道

- 廠商直銷

- 經銷商/零售店

第6章 競爭狀況

- 市場集中度概況

- 公司簡介

- Shaw Industries Group Inc.

- Forbo

- Parterre

- Gerflor Group

- Altro

- Karndean Designflooring

- Tarkett SA

- Mohawk Industries Inc.

- Armstrong Flooring

- Mannington Commercial

- Flexco Floors

- Interface Inc.

- Milliken

第7章 市場的未來

第 8 章 免責聲明與出版商訊息

The United States Commercial Vinyl Floor Covering Market size is estimated at USD 4.23 billion in 2025, and is expected to reach USD 7.18 billion by 2030, at a CAGR of 11.2% during the forecast period (2025-2030).

Vinyl floor coverings, prized for their durability and versatility, are crafted from synthetic materials. These coverings come in many colors and patterns, often replicating the look of wood, natural stone, or tiles. Their resilience and easy maintenance have cemented vinyl flooring as a top choice for many in the commercial realm.

The US commercial sector has seen a notable uptick in adopting vinyl floor coverings, largely due to their durability and aesthetic charm. The demand is further fueled by a growing number of commercial establishments, spanning hospitals, retail outlets, gyms, and transportation hubs.

In the hospitality industry, where comfort and aesthetics reign supreme, choosing the right flooring is paramount. Vinyl floor coverings have emerged as the go-to choice. They can handle heavy foot traffic and furniture movement, boasting a longer lifespan that reduces the need for frequent replacements. As the number of hospitality establishments in the United States grows, so does the demand for vinyl floor coverings.

While vinyl floor coverings have long been favored in hospitality, their popularity is now surging in transportation sectors, including automotive, aviation, and marine. Their durability and easy maintenance have made them a preferred choice in electric vehicles. With the projected rise in electric vehicle production and sales in the US, the demand for vinyl floor coverings in the automotive sector will significantly increase.

United States Commercial Vinyl Floor Covering Market Trends

Resilient Flooring

Commercial project designers overwhelmingly opt for vinyl composition tile (VCT), luxury vinyl tile (LVT), linoleum, and rubber in the realm of resilient flooring. These choices are favored for their diverse color and texture options, eco-friendly features, and low maintenance needs. VCT, typically the budget-friendly choice, has expanded beyond its traditional 12x12-inch format, now offering a range of sizes and patterns. On the other hand, linoleum highlights its renewable and natural qualities, adding a warm, textured feel to spaces. As the demand for resilient flooring surges, especially in high-traffic commercial settings, materials like rubber, linoleum, and vinyl are gaining traction. These tiles are popular due to their durability, slip resistance, and capacity to withstand heavy foot traffic. This makes them ideal for high-traffic settings such as airports, hospitals, and schools, where safety and longevity are crucial.

Growth in Luxury Vinyl Tiles and Planks Adoption

Luxury vinyl tile (LVT) and luxury vinyl plank (LVP) represent two distinct forms of luxury vinyl flooring. LVT mirrors the appearance of tiles, while LVP emulates traditional hardwood planks. LVT, while mimicking these materials, boasts affordability, superior scratch resistance, and waterproof features. Comprising a photographic print layer for realistic visuals and a wear layer for durability, LVT is available in both plank and tile formats. It embodies the ideal commercial flooring solution, blending sophisticated aesthetics with exceptional durability and easy maintenance.

Vinyl flooring, prized for its resilience, is a popular choice in commercial settings. It presents a cost-effective substitute for natural materials such as concrete, ceramic, marble, and wood, boasting durability and the capacity to endure high levels of foot traffic.

United States Commercial Vinyl Floor Covering Industry Overview

The luxury vinyl floor covering market is characterized by a large number of market players in the United States. Therefore, the market is moderately consolidated.

Key players in the vinyl flooring sector are engaged in intense competition, each striving for market leadership. Their strategies focus on increasing manufacturing capacity, bolstering R&D investments, and optimizing operations throughout the value chain. These initiatives directly address market demands, fostering innovation, and broadening their customer reach.

Shaw Industries Group Inc., Forbo, Parterre, Gerflor Group, and Altro are among the market's major players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Commercial Construction Projects

- 4.2.2 Increasing Demand from Fitness Facilities

- 4.3 Market Restraints

- 4.3.1 Emission of VOCS (Volatile Organic Compounds) Post Installation

- 4.3.2 Can only be Installed on Smooth Subfloor

- 4.4 Market Opportunities

- 4.4.1 US Flooring Market Players Embracing Innovative Technologies to Stay Ahead

- 4.4.2 Innovations in Vinyl Floor Covering Printing

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insight into the Latest Trends and Innovations in the Industry

- 4.8 Insights on Recent Developments in the Market

- 4.9 Insights on Major Regions and Key States/Cities in the United States with Automotive Manufacturing and Plants

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Luxury Vinyl Tiles and Planks

- 5.1.2 Vinyl Sheets

- 5.1.3 Vinyl Composite Tiles

- 5.2 By Application

- 5.2.1 Transport

- 5.2.1.1 Automotive Flooring

- 5.2.1.2 Aviation Flooring

- 5.2.1.3 Marine Flooring

- 5.2.1.4 Other Transport

- 5.2.2 Hospitality

- 5.2.3 Gym and Fitness

- 5.2.4 Hospitals

- 5.2.5 Retail

- 5.2.6 Corporate

- 5.2.7 Education

- 5.2.8 Other Commercial Applications

- 5.2.1 Transport

- 5.3 By Distribution Channel

- 5.3.1 Directly From the Manufacturers

- 5.3.2 Dealers/Retailers

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.3 Shaw Industries Group Inc.

- 6.4 Forbo

- 6.5 Parterre

- 6.6 Gerflor Group

- 6.7 Altro

- 6.8 Karndean Designflooring

- 6.9 Tarkett SA

- 6.10 Mohawk Industries Inc.

- 6.11 Armstrong Flooring

- 6.12 Mannington Commercial

- 6.13 Flexco Floors

- 6.14 Interface Inc.

- 6.15 Milliken