|

市場調查報告書

商品編碼

1636107

亞太地區直接甲醇燃料電池 -市場佔有率分析、產業趨勢、成長預測(2025-2030)Asia-Pacific Direct Methanol Fuel Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

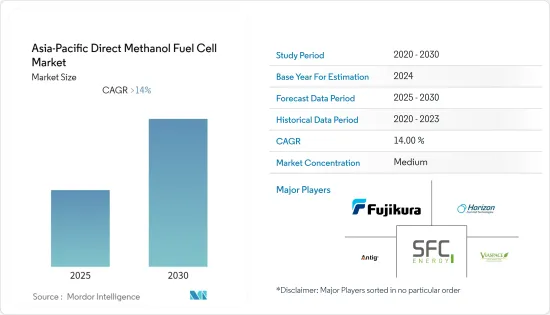

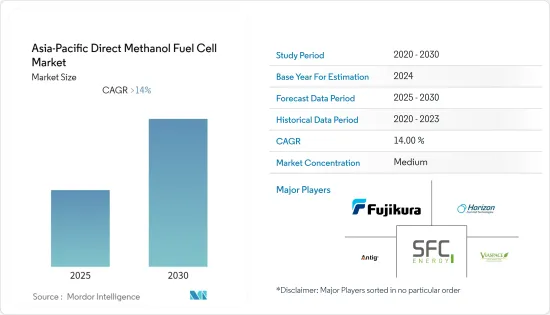

預計亞太地區直接甲醇燃料電池市場在預測期內的複合年成長率將超過14%。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,隨著人們越來越關注清潔能源的採用和提高燃料效率,燃料電池在各種應用中的使用,包括運輸、固定和攜帶式,預計將推動未來市場的成長。

- 另一方面,燃料電池技術多種多樣,包括固體氧化物燃料電池、固體電子膜燃料電池和鹼性燃料電池。預計這將阻礙市場成長。

- 直接甲醇燃料電池 (DMFC) 無需電池充電基礎設施。甲醇也相對便宜,具有相對較高的能量密度,並且易於運輸和儲存在倉庫中,這可能會支撐市場。因此,市場相關人員很快就會出現重大商機。

- 預計中國將主導直接甲醇燃料電池市場。由於電動車的普及以及都市化和購電均等化對家用電子電器需求的增加,電動車的採用正在增加。

亞太地區直接甲醇燃料電池市場趨勢

可攜式細分市場佔據主導地位

- 燃料電池是小型化的壯舉,重量輕,但強大且持久。這些燃料電池是離網電源和行動應用領域的領先領域,適用於關鍵任務通訊、資訊科技、光電、感測器和輔助電源。這種燃料電池依賴直接甲醇燃料電池(DMFC)技術,該技術將甲醇直接轉化為電流。液體甲醇盒可讓您輕鬆地將燃料從一個地方運送到另一個地方。

- 燃料電池是一種電化學裝置,可有效且清潔地將甲醇等燃料轉化為電能,而無需燃燒它們。燃料電池現在永久安裝在裝有電池的筆記型電腦中。燃料電池的燃料由插入電腦的一次性小型墨盒提供。

- 與可充電電池相比,燃料電池的優點是提供持久電力、可以透過更換一次性燃料盒立即充電、無害且可丟棄、重量輕。因此,許多公司正在開發甲醇燃料電池作為攜帶式電子設備的清潔替代電源。

- 燃料電池動力來源的筆記型電腦或行動電話預計在其使用壽命期間將使用約 100 個一次性燃料盒,從而創造定期且可能非常大的收益流。據預測,高達 22% 的筆記型電腦和 2.5% 的行動電話將由燃料電池供電,導致每年需要超過 30 億個電池盒。

- 由甲醇製成的燃料電池和燃料盒高效、清潔且安全。經國際民用航空組織核准安裝在飛機上。由於這些批准,用於攜帶式電子設備的燃料電池預計將得到更廣泛、更迅速的採用。

- 隨著越來越多的攜帶式家用電子電器(例如筆記型電腦、智慧型手機、數位相機和音樂參與企業)依賴電池,全球對可攜式電池的需求預計將增加。此外,隨著智慧型手錶、穿戴式健康監測設備和智慧眼鏡等家用電子電器出貨量的增加,可攜式電池預計在預測期內將出現巨大成長。

- 亞太地區是可攜式電池的主要熱點地區。這一成長背後的一個主要因素是智慧型手機和其他行動配件的高消費。該地區人口占世界人口的60%以上,且該地區國家高度發達,對智慧型手機、平板電腦和其他行動配件的需求不斷增加。

- 2021年,印度智慧型手機出貨量達到1.607億部,高於前一年的1.497億部。年與前一年同期比較成長率為7.3%。

- 因此,鑑於上述幾點,預計可攜式市場在預測期內將大幅成長。

中國預計將主導市場

- 在中國,市場主要受到電動車普及率的不斷提高以及都市化和購電平價上漲導致對家用電子電器產品的高需求推動。

- 未來,電動車將成為主流,還會有混合動力系統來延長行駛里程。直接甲醇燃料電池(DMFC)提供安全、輕巧的車載電池充電,讓車主免於電量耗盡的疑慮。混合動力系統使用電動車電池以及燃料電池盒和 DMFC 燃料電池。

- 中國是最大的電動車 (EV) 市場,2021 年電動車銷量超過 333 萬輛。預計仍將是全球最大的電動車市場。 2021年,中國電動車銷量將佔全球電動車銷量的近40%。

- 電動車的普及與該國的清潔能源計畫是一致的。中國政府計劃放寬汽車製造商的汽車進口管制,以縮小供需缺口。

- 措施制定還包括對新內燃機汽車(ICE)製造廠的投資限制。

- 因此,隨著電動車的日益普及和政府的有利措施,直接甲醇燃料電池的使用預計會增加,因為它們可以延長車輛的行駛里程。

- 直接甲醇燃料電池為行動電話基地台提供清潔、安靜的備用電源。通訊服務的不斷普及為中國通訊業電池需求的成長提供了機會。截至2022年6月,中國99.6%的網路網路用戶使用行動電話上網。截至2022年上半年末,中國行動網路用戶規模約10.5億人。

- 因此,隨著用戶的增加,該國對通訊鐵塔的需求預計也會增加。預計這將推動備用燃料電池的需求。

- 預計上述因素將在研究期間推動直接甲醇燃料電池市場的需求。

亞太直接甲醇燃料電池產業概況

亞太地區直接甲醇燃料電池市場適度細分。該市場的主要企業包括(排名不分先後)Fujikura Ltd.、Horizon Fuel Cell Technologies、SFC Energy AG、Antig Technology 和 Viaspace Inc。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 目的

- 固定式

- 可攜式的

- 運輸

- 地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Fujikura Ltd.

- Horizon Fuel Cell Technologies

- SFC Energy AG

- Antig Technology Co., Ltd

- Viaspace Inc.

- Oorja Protonics, Inc

- FC TecNrgy Pvt Ltd

- Ballard Power Systems Inc.

- Guangzhou Neerg Eco Technologies Co., Ltd.

- XNRGI, Inc.

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 5000022

The Asia-Pacific Direct Methanol Fuel Cell Market is expected to register a CAGR of greater than 14% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market now reached pre-pandemic levels.

Key Highlights

- Over the medium term, with the increasing focus on adopting clean energy and improving fuel efficiency, the use of fuel cells for various applications such as transportation, stationary, and portable applications is expected to drive market growth in the future.

- On the other hand, a wide variety of other fuel cell technologies are available, including solid oxide fuel cells, proton-electron membrane fuel cells, and alkaline fuel cells. It is expected to hamper the growth of the market.

- Nevertheless, the direct methanol fuel cell (DMFC) eliminates the need for charging infrastructure for the battery. In addition, methanol is relatively inexpensive, includes a relatively high energy density, and is easily transported and stored in warehouses, thus likely to support the market. In turn, this is likely to create huge opportunities for market players shortly.

- China is expected to dominate the direct methanol fuel cell market. Due to the growing use of electric vehicles and the increase in demand for consumer electronics caused by urbanization and power purchase parity, electric vehicle deployment is increasing.

Asia-Pacific Direct Methanol Fuel Cell Market Trends

Portable Segment to Dominate the Market

- A feat of miniaturization, the fuel cells are lightweight yet powerful and long-lasting. These fuel cells are leading the field in off-grid power & mobile applications for mission-critical communication, information technology, optronics, sensors, and auxiliary power. Fuel cells such as these rely on direct methanol fuel cell (DMFC) technology, which transforms methanol directly into electrical current. Cartridges of liquid methanol make transporting the fuel from one location to another easy.

- A fuel cell is an electrochemical device that converts a fuel like methanol into electricity efficiently and cleanly without burning. Fuel cells are permanently installed in notebook computers where batteries are now found. Fuel for the fuel cell is provided by a small disposable cartridge inserted into the computer.

- The advantages of a fuel cell are longer-lasting power compared to a rechargeable battery, instantaneous recharging by simply replacing the disposable fuel cartridge, nontoxic disposal, and lightweight. As a result, many companies are developing methanol fuel cells as a new, clean alternative power source for portable electronic devices.

- Notebook computers and mobile phones powered by fuel cells are projected to use approximately 100 disposable fuel cartridges during their useful lives, creating a recurring and potentially very large revenue stream. It was predicted that up to 22% of notebook computers and 2.5% of mobile phones would be powered by fuel cells, resulting in an annual demand for more than three billion cartridges.

- A fuel cell or cartridge made from methanol is efficient, clean, and safe. It is approved to carry on airplanes by the International Civil Aviation Organization. As a result of these approvals, portable electronic device fuel cells are expected to be adopted more widely and more rapidly.

- An increasing number of portable consumer electronic devices rely on batteries, such as laptops, smartphones, digital cameras, and music players, which is expected to increase the demand for portable batteries worldwide. Moreover, with the increased shipments of consumer electronics, such as smart watches, wearable health monitoring devices, and smart glasses, portable batteries are expected to grow tremendously during the forecast period.

- Asia-Pacific is the major hotspot for portable batteries. The significant factor of this growth is the high consumption of smartphones and other mobile accessories. The region accounts for over 60% of the global population, and the countries in the region are developing, thereby causing more demand for smartphones, tablets, and other portable accessories.

- In 2021, the number of smartphones shipped across India reached 160.7 million, up from 149.7 million in the previous year. The growth rate from year to year was 7.3%.

- Therefore, owing to the above points, the portable segment is expected to grow significantly during the forecast period.

China Expected to Dominate the Market

- In China, the market studied is mainly driven by the increasing deployment of electric vehicles and high demand for consumer electronics with urbanization and increasing power purchase parity.

- The future belongs to electric cars, and there is a hybrid system for extending their mileage. Direct methanol fuel cells (DMFCs) provide safe, lightweight, onboard battery charging, freeing car owners from worrying about running out of power. An electric vehicle battery is used in the hybrid system, along with a fuel cell cartridge and DMFC fuel cell.

- China is the largest market for electric vehicles (EVs), with over 3.33 million EVs sold in 2021. It is expected to remain the world's largest electric car market. China accounted for almost 40% of global electric car sales in 2021.

- The increasing adoption of EVs is in line with the country's clean energy policy. The Government of China is planning to ease restrictions on automakers importing cars into the country to reduce the demand-supply gap.

- Policy developments include restricting investment in new internal combustion engines (ICE) vehicle manufacturing plants.

- Hence, with the increasing adoption of EVs and favorable government policies in the country, the use of direct methanol fuel cells is expected to increase as these cells can increase the range of the vehicle.

- Direct methanol fuel cells provide clean, quiet backup power for cellular base stations. The increasing penetration of telecommunication services provides an opportunity for the growth of the battery demand in the telecommunication segment in China. As of June 2022, 99.6% of internet users in China used mobile phones to access the internet. By the end of the first half of 2022, the number of mobile internet users in China had reached approximately 1.05 billion.

- Thus, with the rise in subscribers, the requirement for telecommunication towers in the country is expected to increase. It would foster the demand for fuel cells required for backup purposes.

- The abovementioned factors are expected to drive the demand for the direct methanol fuel cell market over the study period.

Asia-Pacific Direct Methanol Fuel Cell Industry Overview

The Asia-Pacific direct methanol fuel cell market is moderately fragmented. Some of the major players in the market (in no particular order) include Fujikura Ltd., Horizon Fuel Cell Technologies, SFC Energy AG, Antig Technology Co., Ltd, and Viaspace Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Stationary

- 5.1.2 Portable

- 5.1.3 Transportation

- 5.2 Geography

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 South Korea

- 5.2.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fujikura Ltd.

- 6.3.2 Horizon Fuel Cell Technologies

- 6.3.3 SFC Energy AG

- 6.3.4 Antig Technology Co., Ltd

- 6.3.5 Viaspace Inc.

- 6.3.6 Oorja Protonics, Inc

- 6.3.7 FC TecNrgy Pvt Ltd

- 6.3.8 Ballard Power Systems Inc.

- 6.3.9 Guangzhou Neerg Eco Technologies Co., Ltd.

- 6.3.10 XNRGI, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219