|

市場調查報告書

商品編碼

1635464

法國精製石油產品市場:佔有率分析、產業趨勢、成長預測(2025-2030)France Refined Petroleum Product - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

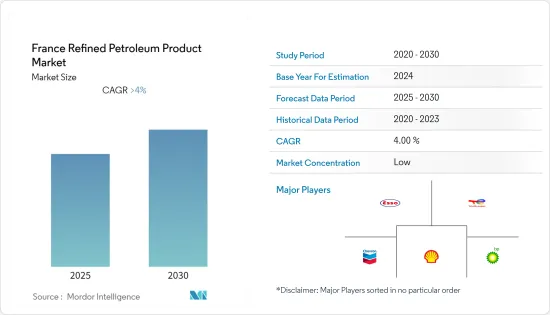

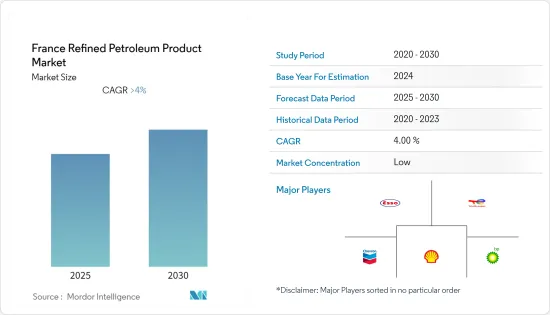

預計法國精製石油產品市場在預測期內複合年成長率將超過4%。

主要亮點

- 從中期來看,精製油市場主要由煉油廠建設和升級改造投資所驅動。

- 另一方面,油價上漲預計將減緩市場成長。

- 也就是說,石油精製產業的進步和擴張可能為精製產品應用創造有利的成長機會。

法國精製石油產品市場趨勢

柴油引擎產業顯著成長

- 由於方法的變化和海外領土資料的改進,自 2011 年以來,法國政府修訂了國內航行消耗的國際船用燃料、石油和柴油交付。

- 2022年10月份進口量超過59萬桶/日(BPD)。石油分析公司 Vortexa 的資料顯示,較 2021 年 10 月的水平成長了 37%,是 Vortexa 自 2016 年開始追蹤資料以來的最高水平。

- 此外,2022年4月,由於與COVID-19疫情相關的經濟原因,TotalEnergies關閉了其煉油廠,導致精製油價格需求下降,將原油轉化為產品的煉油廠利潤大幅下降。

- 2022 年 11 月,由於計畫內和計畫外煉油廠關閉以及需求增加,法國進口的百萬分之十 (ppm) 柴油創下歷史新高。此外,法國食品、飲料和菸草業也報告了麵包店的柴油消費量。

- 因此,鑑於以上幾點,柴油預計將在預測期內佔據市場主導地位。

私部門投資預計將推動市場

- 該國正在增加對現有精製基礎設施升級的投資,預計這將增加精製產品的供應並降低成本,從而在預測期內推動市場發展。

- 2021年10月,法國宣布了2030年300億歐元的投資計畫。該計畫針對法國能源、汽車和航太領域的工業發展,在氫能和小型模組化反應器上投資80億歐元以實現產業脫碳,並在電動車和插混合動力汽車。

- 此外,法國石油巨擘道達爾能源公司打算增加液化天然氣(LNG)的投資和產能。 Total Energy計畫在2027年將液化天然氣銷售量每年增加3%,並從2021年開始到2030年將液化天然氣產量增加40%。

- 2021年,由於COVID-19疫情的影響,法國乘用車銷量將比2019年下降25%,並有可能恢復到疫情前的水平,從而在預測期內創造對成品油的需求。

- 因此,鑑於上述幾點,預計法國在預測期內將出現顯著成長。

法國精製石油產品產業概況

法國精製石油產品市場適度分散。該市場的主要企業包括(排名不分先後)TotalEnergies、Esso、Royal Dutch Shell、BP PLC 和 Chevron Corporation。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 價值鏈/供應鏈分析

- PESTLE分析

第5章市場區隔

- 按用途

- 燃料

- 化學品

- 其他細分市場

- 依組件類型

- 柴油引擎

- 汽油

- 燃料油

- 煤油

- 其他精製石油產品

- 依產品類型

- 輕餾分

- 中間餾分

- 重油

第6章 競爭狀況

- 供應商市場佔有率

- 併購

- 公司簡介

- TotalEnergies

- BP PLC

- Royal Dutch Shell

- Petroineos

- ExxonMobil

- Chevron Corporation

- Ponticelli

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92774

The France Refined Petroleum Product Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- Over the medium period, the refined petroleum product market is primarily driven by investment in the construction and upgradation of refineries.

- On the other hand, the growing price of crude oil is expected to depreciate the market growth.

- Nevertheless, the advancements and expansion in the refined petroleum sectors will likely create lucrative growth opportunities for the applications of refinery products.

France Refined Petroleum Product Market Trends

The diesel segment to grow significantly

- The French administration revised the deliveries of gas/diesel oil and fuel oil for international marine bunkers and consumption in domestic navigation from 2011 onwards due to a change in methodology and improved data for the overseas territories.

- In 2022, imports in the October period reached over 590,000 barrels per day (BPD). Data from oil analytics firm Vortexa showed up 37% from October 2021 levels, and also, it was the highest since Vortexa started tracking data in 2016.

- Moreover, in April 2022, TotalEnergies halted the refinery for economic reasons related to the COVID-19 pandemic, which caused demand for the prices of oil products to fall and for refineries that turn crude oil into products to experience a substantial decline in profits.

- In November 2022, 10 parts per million (ppm) diesel imports into France reached a new record, driven by both planned and unplanned refinery outages as well as rising demand. Also, diesel consumption in bakeries is reported in France's food, beverage, and tobacco.

- Therefore, owing to the above points, diesel oil is expected to dominate the market during the forecast period.

Investments by Private Sector Expected to Drive the Market

- Due to increasing investments in the upgradation of the current refining infrastructure in the country, the supply of refined products is expected to increase, reducing costs and driving the market during the forecast period.

- In October 2021, France announced a EUR 30 billion investment plan for 2030, which targets French industrial development in the energy, automotive, and space sectors, including EUR 8 billion dedicated to energy technology investment in the decarbonization of industry, in hydrogen and small modular reactors, EUR 4 billion for electric and plug-in hybrid vehicles.

- Furthermore, French oil giant TotalEnergies intends to enhance investments and production capacity for liquefied natural gas (LNG). TotalEnergies plans to grow LNG sales by 3% a year through 2027 and boost LNG production by 40% to 2030, starting from 2021.

- In 2021, due to the COVID-19 pandemic, sales of passenger cars in France decreased by 25% as compared to 2019 and were likely to recover their pre-epidemic levels, creating demand for refined products in the forecast period.

- Therefore, owing to the above points, France is expected to witness significant growth during the forecast period.

France Refined Petroleum Product Industry Overview

The France refined petroleum product market is moderately fragmented. The key players in this market include ( in no particular order) TotalEnergies, Esso, Royal Dutch Shell, BP PLC, and Chevron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Fuel

- 5.1.2 Chemicals

- 5.1.3 Other Segmentations

- 5.2 Component Type

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Fuel Oil

- 5.2.4 Kerosene

- 5.2.5 Other Refined Petroleum Types

- 5.3 Product Type

- 5.3.1 Light Distillates

- 5.3.2 Middle Distillates

- 5.3.3 Heavy Oil

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers and Acquisitions

- 6.3 Company Profiles

- 6.3.1 TotalEnergies

- 6.3.2 BP PLC

- 6.3.3 Royal Dutch Shell

- 6.3.4 Petroineos

- 6.3.5 ExxonMobil

- 6.3.6 Chevron Corporation

- 6.3.7 Ponticelli

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219