|

市場調查報告書

商品編碼

1635450

美國EHR 雲端運算:市場佔有率分析、產業趨勢、統計和成長預測(2025-2030)United States EHR Cloud Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

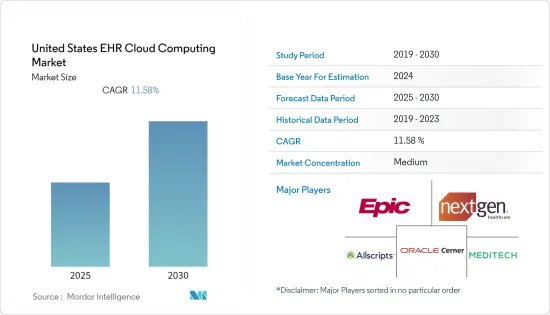

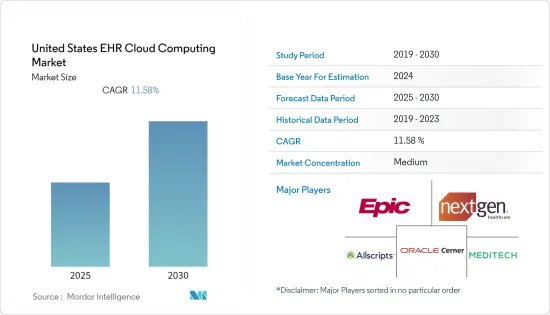

美國EHR雲端運算市場預計在預測期內複合年成長率為11.58%。

主要亮點

- COVID-19 的爆發預計將對整體市場產生積極影響。人們越來越認知到雲端技術在提供由外部服務供應商管理的資料儲存和運算資源以提高電子病歷的安全性、品質和效率方面的潛力。

- 醫療保健領域的雲端運算徹底改變了醫療資料的創建、儲存、使用和共用方式。醫療保健雲端運算市場的發展主要受到以下因素的推動:由於 COVID-19,EHR、電子處方、遠端保健、行動醫療和其他醫療保健 IT 解決方案的採用增加。

- 電子病歷採用率的提高正在增加雲端基礎的電子病歷軟體的使用,而人口老化的迅速激增以及隨之而來的慢性病數量的增加正在推動美國市場的成長。此外,巨量資料分析、物聯網、穿戴式裝置的採用增加,以及雲端的資料擴充性、靈活性、增加儲存和成本效率等優勢也推動了醫療保健產業的雲端採用,引領了雲端基礎的EHR 。

- 然而,電子病歷的高成本以及對患者資料安全和保障的日益擔憂預計將阻礙市場成長。此外,美國巨大的市場潛力預計將為預測期內的市場成長提供進一步的機會。

- 加強併購力度,推動市場成長 2021年12月,Oracle宣布收購EHR供應商Cerner。此次收購將為醫療保健專業人員提供新一代易於使用的雲端基礎的工具,使他們能夠透過安全雲端應用程式中的免持語音介面存取資訊。

美國EHR雲端運算市場趨勢

政府推動醫療保健資訊科技使用的舉措

- 美國政府已採取舉措,在該國投資開發雲端基礎的醫療保健系統。 2021 年 6 月,美國衛生與公眾服務部 (HHS) 國家衛生資訊科技協調員辦公室 (ONC) 宣布了一項 8000 萬美元的公共衛生資訊學和技術計劃,以加強美國公共衛生資訊學和資料科學。

- 在預測期內,對基於雲端基礎的EHR 解決方案支援健康和保健的技術的需求預計將增加,除此之外,消費者的消費能力不斷增強,對此類解決方案的需求不斷成長,並且隨著服務變得越來越普遍,預計對它們的需求將迅速增加。

- 此外,2021 年 3 月,企業主動歸檔和轉換解決方案的醫療保健提供資料MediQuant 宣布,將在 2024 年之前轉向新的美國電子健康記錄 (EHR) 平台。整個軍隊衛生系統。該公司透過雲端基礎的軟體平台管理患者記錄和相關資訊。

- 此外,2022 年 1 月,國防部向德克薩斯州100 個不同地點的 19,000 名新用戶部署了新的電子健康記錄系統 Military Health System Genesis。此類案例預計將推動美國EHR 雲端運算市場的成長。

醫療保健產業雲端採用率的提高

- 雲端基礎的EHR 有潛力促進患者健康資訊的捕獲、組織和在參與患者護理的所有經過認證的醫療保健提供者之間立即分發。例如,EHR 警報可以通知醫療保健提供者患者已入院,使他們能夠主動跟進患者。此外,EHR 雲端運算可以減少醫療保健專業人員花在文書工作上的時間。

- 美國EHR 雲端運算市場正在出現聯盟和合併,以支援 EHR 雲端軟體資料安全的進步。例如,2022年1月,美國基於雲端基礎的EHR供應商MEDITECH宣布與關鍵存取管理供應商SecureLink建立合作關係,以提高醫療資料的安全性。此次合作預計將增強使用 MEDITECH 的 2,300 家醫療機構的資料安全性。

- 此外,2021 年 7 月 16 日,Amazon Web Services 宣布推出 AWS for Health。 AWS for Health 提供經過驗證、易於使用的功能,可協助組織加快創新步伐、釋放健康資料的潛力並開發治療方法和更個人化的護理方法。亞馬遜的 AWS 解決方案使用戶能夠將電子健康記錄工作負載轉移到雲端、提高效能並自動執行許多傳統 IT 任務。此類發展可能會推動美國EHR 雲端運算市場。

- 然而,雲端 API 和介面已成為嘗試與雲端運算互通的組織面臨的主要挑戰。雲端服務供應商之間缺乏標準化限制了不同雲端工具之間的資料共用,導致可攜性問題。

美國EHR雲端運算產業概況

美國EHR雲端運算市場企業之間的競爭日益激烈。該市場由 Epic Systems Corporation、NextGen Healthcare, Inc 和 Cerner Corporation (Oracle) 等主要企業組成。目前,這些大公司主導著市場。然而,隨著技術創新的不斷增加,許多公司正在透過贏得新合約和開闢新市場來擴大其市場佔有率。

- 2022 年 3 月 - 微軟宣布收購對話式人工智慧和環境智慧專家 Nuance Communications。該公司以安全為中心的雲端基礎的解決方案利用強大的、垂直最佳化的人工智慧來幫助公司加速實現業務目標。客戶透過改善消費者、患者、臨床醫生和員工的體驗以及提高生產力和財務績效而受益。

- 2021 年 10 月 - NOVO Health 透過其子公司 NOVO Health Technology Group 宣布與 Epic Systems 合作,在整個醫療保健提供者社群部署由 Microsoft Azure Health IT 提供支援的雲端基礎的Epic EHR。此外,這種雲端基礎的部署將使醫療保健提供者能夠利用其他 Microsoft 工具來改善護理服務和質量,包括用於高級醫療保健分析的 Microsoft Power BI。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 工業自動化軟體全球市場分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 雲端運算改善了 EHR 雲端運算的資料儲存、靈活性、可擴充性和協作。

- COVID-19 增加了 EHR、電子處方、遠端醫療、行動醫療和其他醫療保健 IT 系統的使用

- 將醫療保健管理集中到雲端系統的需求不斷增加

- 市場挑戰

- 日益嚴重的隱私問題和資料安全問題

- 雲端 EHR 實施相關的高成本

第6章 COVID-19 對工業自動化產業的影響

第7章 市場區隔

- 按類型

- 急性期電子病歷

- 門診電子病歷

- 急性後電子病歷

- 按發展

- 雲端基礎的軟體

- 基於伺服器/本機部署的軟體

- 按服務

- Software-as-a-Service(SaaS)

- Infrastructure-as-a-Service(IaaS)

- Platform-as-a-Service(PaaS)

- 按最終用戶使用情況

- 醫院

- 診所

- 專業中心

- 其他最終用戶

第8章 競爭格局

- 公司簡介

- Epic Systems Corporation

- NextGen Healthcare, Inc.

- Cerner Corporation(Oracle)

- Allscripts Healthcare, LLC

- Medical Information Technology, Inc.

- Computer Programs and Systems, Inc

- eClinicalWorks

- CureMD Healthcare

- Greenway Health, LLC

- McKesson Corporation

- GE Healthcare

第9章投資分析

第10章市場的未來

The United States EHR Cloud Computing Market is expected to register a CAGR of 11.58% during the forecast period.

Key Highlights

- The COVID-19 pandemic is expected to have an overall positive effect on the market. It has driven an increased understanding of the potential of cloud technologies, which provide data storage and computing resources managed by external service providers to help enhance EHR's safety, quality, and efficiency.

- Cloud computing in healthcare has carried a huge shift in the creation, storage, consumption, and sharing of medical data. The development of the healthcare cloud computing market is mainly driven by factors such as the growing adoption of EHR, e-prescribing, telehealth, mHealth, and other healthcare IT solutions due to COVID-19.

- The rise in the adoption of EHR increased the use of cloud-based EHR software, the rapid surge in the aging population, and the subsequent rise in the number of chronic diseases drive the market growth in the United States. Moreover, the increase in adoption of big data analytics, IoT, and wearable devices, and increased cloud deployment in the healthcare sector due to the benefits such as scalability of data, flexibility, increased storage, and cost efficiency of cloud is driving the cloud-based EHR market.

- However, the high cost of EHR and increased concerns regarding patient data safety & security are expected to impede the market growth. Moreover, the huge market potential in the United States is expected to offer further opportunities for market growth during the forecast period.

- Increasing number of mergers and acquisitions to boost the market growth. In December 2021, Oracle announced the acquisition of EHR vendor Cerner. The acquisition will help medical professionals with a new generation of easier-to-use cloud-based tools that enable access to information via a hands-free voice interface to secure cloud applications.

US EHR Cloud Computing Market Trends

Government initiatives to boost healthcare IT usage

- The United States government is taking initiatives by investing in developing a cloud-based healthcare system in the country. In June 2021, the U.S. Department of Health and Human Services (HHS) Office of the National Coordinator for Health Information Technology (ONC) announced the establishment of the USD 80 million Public Health Informatics & Technology Workforce Development Program (PHIT Workforce Program) to strengthen U.S. public health informatics and data science.

- Health and wellness supporting technology demand in terms of cloud-based EHR solutions is expected to increase during the forecasted period, and beyond that, the need for services is expected to surge owing to the increased consumer spending capabilities and normalization of such solutions and services over time.

- Moreover, In March 2021, MediQuant, a healthcare provider of enterprise active archiving and conversion solutions, announced that it had been selected by the U.S. Defense Health Agency (DHA) to help consolidate all clinical data across the Military Health System as it transitions to a new enterprise electronic health records (EHR) platform by 2024. The company maintains the patient record and relevant information through a cloud-based software platform.

- Furthermore, In January 2022, the Defense Department deployed its new electronic health records system, the Military Health System GENESIS, to 19,000 new users in 100 different locations in Texas. Such instances are expected to promote the growth of the EHR cloud computing market in the United States.

Increasing cloud deployment in healthcare industry

- The cloud-based EHRs have the potential to incorporate and organize patient health information and encourage its instant distribution among all authorized providers involved in a patient's care. For example, EHR alerts can be used to notify providers when a patient has been in the hospital, allowing them to proactively follow up with the patient. Additionally, EHR cloud computing can reduce the time providers spend doing paperwork.

- The US EHR cloud computing market is witnessing partnerships and mergers to help develop data security in EHR cloud software. For instance, In January 2022, MEDITECH, a cloud-based EHR vendor based in the United States, announced a partnership with critical access management provider SecureLink to improve health data security. The partnership is expected to enhance data security across the 2,300 healthcare institutions that use MEDITECH.

- Furthermore, On July 16, 2021, Amazon Web Services announced the launch of AWS for Health. AWS for Health will provide proven and easily accessible capabilities that will help organizations increase the pace of innovation, unlock the potential of health data, and develop more personalized approaches to therapeutic development and care. Amazon's AWS solution allows users to migrate electronic health record workloads to the cloud to increase performance and automate many traditional IT tasks. Such developments will drive the EHR cloud computing market in the United States.

- However, Cloud APIs and interfaces constitute the primary challenge to organizations attempting cloud computing interoperability. The lack of standardization in the cloud service providers restricts the data sharing between different cloud tools leading to portability issues.

US EHR Cloud Computing Industry Overview

The United States EHR Cloud Computing Market is witnessing a rise in competitiveness among companies. The market consists of major players, such as Epic Systems Corporation, NextGen Healthcare, Inc., and Cerner Corporation (Oracle). These significant players currently dominate the market. However, with increasing technology innovations, many companies are increasing their market presence by securing new contracts and tapping new markets.

- March 2022 - Microsoft Corp announced the acquisition of Nuance Communications Inc, a company that specializes in conversational AI and ambient intelligence. With their security-focused, cloud-based solutions infused with powerful, vertically optimized AI, the acquisition will enable organizations to accelerate their business goals. Customers will benefit from the improved consumer, patient, clinician, and employee experiences, as well as increased productivity and financial performance.

- October 2021 - NOVO Health, through its subsidiary NOVO Health Technology Group, announced a collaboration with Epic Systems to launch a cloud-based Epic EHR implementation across its community of healthcare providers using Microsoft Azure health IT. Furthermore, the cloud-based implementation allows providers to leverage additional Microsoft tools to improve care delivery and quality, such as Microsoft Power BI for advanced healthcare analytics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Global Industrial Automation Software Market Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cloud computing improves data storage, flexibility, scalability, and collaboration for the EHR cloud computing

- 5.1.2 COVID-19 has led to an increase in the use of EHR, e-prescribing, telemedicine, mobile health, and other healthcare IT systems

- 5.1.3 Rising demand for centralization of healthcare administration on cloud system

- 5.2 Market Challenges

- 5.2.1 Growing privacy concerns and Data Security Issues

- 5.2.2 High costs associated with cloud EHR implementation

6 IMPACT OF COVID-19 ON THE INDUSTRIAL AUTOMATION INDUSTRY

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Acute EHR

- 7.1.2 Ambulatory EHR

- 7.1.3 Post-acute EHR

- 7.2 By Deployment

- 7.2.1 Cloud-Based Software

- 7.2.2 Server-Based/ On-Premise Software

- 7.3 By Service

- 7.3.1 Software-as-a-Service (SaaS)

- 7.3.2 Infrastructure-as-a-Service (IaaS)

- 7.3.3 Platform-as-a-Service (PaaS)

- 7.4 By End-User Applications

- 7.4.1 Hospital

- 7.4.2 Clinics

- 7.4.3 Specialty Centers

- 7.4.4 Other End Users

8 Competitive Landscape

- 8.1 Company Profiles

- 8.1.1 Epic Systems Corporation

- 8.1.2 NextGen Healthcare, Inc.

- 8.1.3 Cerner Corporation (Oracle)

- 8.1.4 Allscripts Healthcare, LLC

- 8.1.5 Medical Information Technology, Inc.

- 8.1.6 Computer Programs and Systems, Inc

- 8.1.7 eClinicalWorks

- 8.1.8 CureMD Healthcare

- 8.1.9 Greenway Health, LLC

- 8.1.10 McKesson Corporation

- 8.1.11 GE Healthcare