|

市場調查報告書

商品編碼

1635348

美國住宅暖氣設備:市場佔有率分析、產業趨勢、成長預測(2025-2030)United States Residential Heating Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

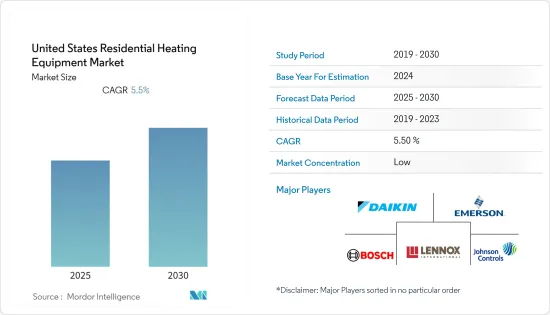

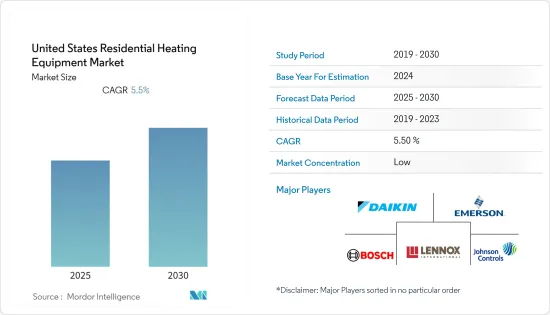

美國住宅暖氣設備市場預計在預測期內複合年成長率為 5.5%。

主要亮點

- 住宅建設支出的增加以及重組和更換活動的活性化預計將支持暖氣設備的成長。該國的建築業專注於開發永續和節能的結構。

- 該國政策制定者正在推出有利於在住宅安裝暖氣設備和系統的住宅的監管政策和回扣,增加對暖氣設備的需求。此外,住宅領域能源消耗的增加預計將推動人們對技術先進的住宅暖氣設備的偏好,從而降低整體營運成本並提高節能效果。

- 例如,根據國際能源總署的數據,大多數熱泵都安裝在新建築中。在美國,熱泵在新建築中的銷售佔有率(單戶住宅超過 40%),新建多用戶住宅接近 50%。

- 在預測期內,遏制對石化燃料的依賴和尋找爐子的節能替代品的需求日益成長,這正在推動對住宅供暖設備的需求。然而,替代品的可用性和該設備的安裝成本阻礙了市場的成長。

- COVID-19 的爆發正在對美國經濟產生負面影響。各州的封鎖導致該國的一些商業活動和基礎設施開發計劃停止。因此,對住宅供暖設備的需求正在減少。

美國住宅暖氣設備市場趨勢

熱泵顯著成長

- 熱泵不僅廣泛用於供暖,還廣泛用於冷氣。熱泵是一種機械傳熱設備,可從任何熱源收集低品位熱量,並將其升級以在高溫下分配。對節能家用電器日益成長的偏好主要推動了日本對熱泵的需求。

- 美國是空氣源熱泵安裝的主要市場之一,自2015年以來每年持續成長5%以上,2021年將成長15%。此外,在美國,由於家庭電氣化的推動和石化燃料供暖的禁止,對熱泵的需求預計將進一步增加。

- 此外,美國能源局推出了「更好的能源、排放和公平舉措」 ,重點是加快創新、清潔、高效的建築供暖和製冷系統的研究、開發和全國部署,並承諾投入1000 萬美元來加速研究。

- 此外,美國最近將新建住宅地源熱泵 26% 的聯邦稅額扣抵延長至 2022年終。美國政府的此類措施預計將增加該國住宅熱泵的銷售量。

- 2021年,美國環保署取消了瓦斯熱水器在能源之星計畫中最高排名的資格。其他政策訊號,例如暖氣設備的碳強度預期,預計將推動熱泵的採用。

新建住宅的增加帶動了住宅暖氣設備的需求

- 2021 年 8 月,加州能源委員會發布了新的《建築能源規範》,鼓勵在新建建築中安裝空間供暖和熱水熱泵(或作為核准的更嚴格的建築能源效率要求的替代方案)。 2023 年能源標準的實施將透過在預測期內增加需求,將熱泵設定為基準加熱技術。

- 在房屋抵押貸款利率逐步上升、對更多生活空間的強勁需求以及市場上的住宅存量有限的推動下,住宅建築行業實現了兩位數的成長率,為經濟和整個建設產業的復甦做出了重大貢獻。住宅的成長可能會在預測期內增加對暖氣設備的需求。

- 此外,根據 IEA 的數據,由於建築重建活動的增加和新房銷量的增加,新建築的單戶住宅熱泵銷量成長了 40%,新建多用戶住宅住宅了 50%。

- 此外,爐子是美國住宅領域最常用的暖氣設備。大多數爐子都是由燃氣驅動的,但隨著天然氣價格上漲以及紐約市議會禁止在新建築中使用天然氣,預計市場對電爐的需求將會增加。

美國住宅暖氣設備產業概況

由於美國對暖氣設備的需求不斷增加,美國住宅暖氣設備市場高度分散。Daikin Industries Ltd.、艾默生電氣、羅伯特博世等市場主要企業不斷創新新產品,並活性化併購和產能擴張等活動,進一步加劇競爭。

- 2021 年 12 月 - 三菱電機推出 Ecodan Hydrodan,這是一款針對多用戶住宅市場的新型高效水對水熱泵。這款熱泵專為多用戶住宅的供暖和熱水而設計,充分利用下一代熱網提供的永續能源效率。我們也使用少量低 GWP R32 冷媒,以盡量減少對環境的影響。

- 2021 年 8 月 - Gradient 是一家總部位於加州舊金山的新興企業,提供全年供暖和製冷服務,使用丙烷(R290)(一種潛在的氣候友善製冷劑),與傳統系統相比,我們宣布排放更低的暖氣和冷氣成本。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 對節能解決方案的需求不斷成長

- 嚴格措施減少碳足跡

- 市場挑戰

- 安裝成本高

第 6 章 細分

- 按類型

- 爐

- 空氣能熱水器

- 熱泵

- 鍋爐

- 其他類型

第7章 競爭格局

- 公司簡介

- Daikin Industries Ltd.

- Emerson Electric Co.

- Robert Bosch LLC

- Lennox International Inc.

- Johnson Controls

- Honeywell International

- Carrier Global Corporation

- Burnham Holdings, Inc.

- Rheem Manufacturing Company

- Bradford White Corporation

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 91464

The United States Residential Heating Equipment Market is expected to register a CAGR of 5.5% during the forecast period.

Key Highlights

- Growing residential construction expenditure with increasing restructuring & replacement activities are predicted to boost heating equipment growth. The construction sector in the country is focused on developing sustainable and energy-efficient structures.

- The introduction of favorable regulatory policies and rebates for homeowners by policymakers in the country to integrate heating equipment and systems in their new houses are augmenting the demand for heating equipment. In addition, the rising energy consumption in the residential sectors is projected to drive the preference for technologically advanced residential heating equipment that reduces overall operational costs and improves energy savings.

- For instance, according to IEA, most heat pumps are installed in new buildings. In the United States, the share of heat pump sales for newly constructed buildings exceeds 40% for single-family dwellings and is near 50% for new multi-family buildings.

- The increasing need to curb dependence on fossil fuels and look for an energy-efficient alternative to the furnace is driving the demand for residential heating equipment over the forecast period. However, the availability of substitutes for this equipment and the cost of installation is hindering the growth of the market.

- The COVID- 19 pandemic has adversely affected the United States economy. Lockdowns across various states have resulted in the closure of multiple business activities and infrastructure development projects across the country. This has resulted in a decrease in demand for residential heating equipment.

US Residential Heating Equipment Market Trends

Heat Pumps to Grow Significantly

- The heat pumps are widely used not only for heating purposes but also for cooling. They are mechanical heat transfer devices that collect low-grade heat from any source and then upgrade it to distribute it at a high temperature. The growing inclination toward energy-efficient appliances is primarily driving the demand for heat pumps in the country.

- The United States is one of the major market in the installation of air source heat pumps which registered 15% growth in 2021 with consistent yearly growth of above 5% since 2015. Further, in the United States, a drive to electrify homes and ban on fossil fuel heating is expected to further boost the need for heat pumps.

- Furthermore, the United States Department of Energy launched the initiative for Better Energy, Emissions, and Equity, focused on advancing the research, development, and national deployment of innovating clean and efficient building heating and cooling systems, putting USD 10 million toward accelerating the research and adoption of heat pump technologies through Nationwide Advanced Water Heating Deployment Initiative to increase market adoption of high-efficiency, grid-connected Heat Pump Water Heaters in residential and commercial buildings.

- Moreover, the United States recently extended the 26% federal tax credit for new residential ground source heat pumps until the end of 2022. Such initiatives by the US government are projected to increase the sales of residential heat pumps in the country.

- In 2021, The United States Environmental Protection Agency removed eligibility to top rating for gas heaters in the Energy Star Programme. Other policy signals, like carbon intensity expectations for heating equipment, are projected to encourage heat pump adoption.

Growth in New Homes to Fuel the Demand for Residential Heating Equipments

- In August 2021, the California Energy Commission approved a new building energy code that encourages the installation of heat pumps for space and water heating in new buildings (or as an alternative to meet more stringent building energy efficiency requirements). The implementation of the energy code in 2023 will set heat pumps as the baseline heating technology by boosting the demand during the forecast period.

- The residential construction sector has become the key performer in the US economic recovery from the COVID-19 crisis, generating double-digit growth rates and making significant contributions to the economy and overall construction industry's recovery owing to moderate mortgage rates, robust demand for larger living spaces, and limited housing inventory in the market. This growth in residential buildings will boost the demand for heating equipment in the forecast period.

- Furthermore, the increasing renovation activities of buildings and growth in the sales of new homes resulted in an increase in the sales of heat pumps for newly constructed buildings by 40% for single-family dwellings and 50% for new multi-family buildings according to IEA.

- Moreover, furnaces are the most common heating equipment used in the residential sector of the United States. Most of the furnaces are gas based and the increasing prices of gases and the ban on the use of natural gas in new buildings by the New York City Council are expected to create the demand for electric furnaces in the market.

US Residential Heating Equipment Industry Overview

The United States residential heating equipment market is highly fragmented as the demand for heating equipment is increasing in the country. The key players in the market like Daikin Industries Ltd., Emerson Electric Co., Robert Bosch LLC, and others, are continuously innovating new products and rising activities such as mergers and acquisitions and capacity expansion, further increasing the competition.

- December 2021 - Mitsubishi Electric launched Ecodan Hydrodan, a new highly efficient, water-to-water heat pump for the multi-residential market. It is specifically designed to provide heating and hot water in residential apartments, and to capitalize on the significant sustainable energy efficiency that the next generation of heat networks offer. It also operates with a low quantity of low-GWP R32 refrigerant, to help keep environmental impact to a minimum.

- August 2021 - Gradient, a San Francisco, California based startup, announced the development of a home window heat pump that will provide cooling and heating year-round, make use of a climate-friendly refrigerant possibly propane (R290) and reduce greenhouse gas emissions by 75% compared to conventional systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy-Efficient Solutions

- 5.1.2 Stringent Measures to Reduce Carbon Footprints

- 5.2 Market Challenges

- 5.2.1 High Cost of Installation

6 SEGMENTATION

- 6.1 By Type

- 6.1.1 Furnace

- 6.1.2 Air & Water Heaters

- 6.1.3 Heat Pumps

- 6.1.4 Boilers

- 6.1.5 Other Types

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Ltd.

- 7.1.2 Emerson Electric Co.

- 7.1.3 Robert Bosch LLC

- 7.1.4 Lennox International Inc.

- 7.1.5 Johnson Controls

- 7.1.6 Honeywell International

- 7.1.7 Carrier Global Corporation

- 7.1.8 Burnham Holdings, Inc.

- 7.1.9 Rheem Manufacturing Company

- 7.1.10 Bradford White Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219