|

市場調查報告書

商品編碼

1750576

住宅暖氣設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Residential Heating Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

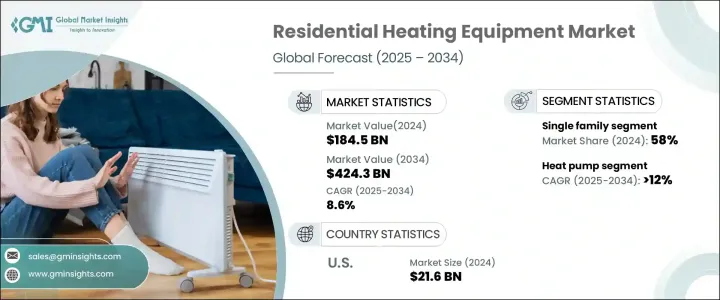

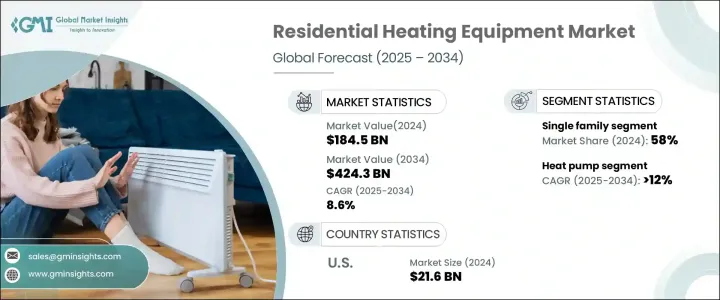

2024年,全球住宅暖氣設備市場規模達1,845億美元,預計到2034年將以8.6%的複合年成長率成長,達到4,243億美元。這得益於消費者對能源效率和環境永續性的認知不斷提高,促使他們採用先進環保的暖氣系統。世界各國政府正在設定碳中和目標,並實施政策鼓勵屋主投資節能解決方案,從而促進智慧永續家庭供暖的轉型。城市住房開發和對降低能源消耗的持續關注推動了高效供暖技術的採用。此外,將先進的電熱泵整合到混合加熱系統中,有助於住宅領域的永續減排。

美國各地極端寒流的頻率和強度不斷增加,使得可靠的住宅暖氣系統不再只是一種偏好,而成為一種必需品。為此,越來越多的屋主開始採用先進的暖氣技術,以確保無論外部條件如何,室內溫度都能保持恆定。同時,物聯網系統和智慧恆溫器等智慧控制系統的整合,使用戶能夠更精確地管理能源使用。這些創新技術幫助家庭減少不必要的供暖,不僅減少了每月的水電費,也符合更廣泛的永續發展目標。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1845億美元 |

| 預測值 | 4243億美元 |

| 複合年成長率 | 8.6% |

預計到2034年,熱泵住宅暖氣設備市場的複合年成長率將達到12%。對節能解決方案日益成長的需求,加上政府的利多政策,將推動住宅熱泵的普及。持續的技術發展將提高其運作效率,並促進環保實踐。市場細分為單戶住宅和多戶住宅應用。

預計到2034年,單戶住宅暖氣設備市場將以8%的複合年成長率推動業務成長,到2024年將佔據58%的市場佔有率。隨著客製化解決方案日益成長的需求,以滿足多樣化的供暖需求,產品的採用率也將不斷提升。此外,遠端監控系統的整合、預測性維護和流程最佳化也將推動產業前景。

2024年,美國住宅暖氣設備市場規模達216億美元,這得益於環保法規、消費者意識的提升以及政府支持的節能升級項目。此外,該市場也受益於廣泛的改造活動,老舊的暖氣系統正被符合新碳排放標準的高性能替代方案所取代。此外,住宅空間向電氣化的轉變也為熱泵和混合供暖系統創造了新的機會。

市場主要參與者包括惠而浦、威能集團、Bradford White Corporation、法羅利、克瑞、三星、松下、AO Smith、開利、大金工業、倫諾克斯國際、羅伯特·博世、Hoval、特靈科技、林內美國、Rheem Manufacturing Company、通用電器、LG電子、阿里斯頓控股、Havells India、Brm Fvs Manufacturing Company、通用電器、LG電子、阿里斯頓控股、Havells India、BrmWrovers、國際自控。為了鞏固市場地位,住宅暖氣設備產業的公司正在採取各種策略。這些策略包括推出創新產品、擴大分銷網路、建立策略合作夥伴關係和進行收購。例如,一些公司正在開發整合再生能源和智慧技術的先進暖氣系統,以滿足日益成長的節能解決方案需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 熱泵

- 鍋爐

- 爐

- 熱水器

- 其他

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 單戶住宅

- 多戶住宅

第7章:市場規模及預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- 線上

- 經銷商

- 零售

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 葡萄牙

- 羅馬尼亞

- 荷蘭

- 瑞士

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- AO Smith

- Ariston Holding

- Arovast Corporation

- BDR Thermea Group

- Bradford White Corporation

- Carrier Corporation

- Crane

- DAIKIN INDUSTRIES

- Ferroli

- GE Appliances

- Havells India

- Hoval

- Johnson Control International

- Lennox International

- LG Electronics

- Panasonic Corporation

- Rheem Manufacturing Company

- Rinnai America

- Robert Bosch

- SAMSUNG

- Trane Technologies

- Vaillant Group

- VIESSMANN

- Whirlpool

The Global Residential Heating Equipment Market was valued at USD 184.5 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 424.3 billion by 2034, driven by increasing awareness of energy efficiency and environmental sustainability, prompting consumers to adopt advanced and eco-friendly heating systems. Governments worldwide are setting carbon neutrality targets and implementing policies encouraging homeowners to invest in energy-efficient solutions, facilitating the transition toward smart and sustainable home heating. Urban housing development and the ongoing focus on reducing energy consumption fuel the adoption of efficient heating technologies. Additionally, the integration of advanced electric heat pumps into hybrid systems supports sustainable emission reduction within the residential sector.

The growing frequency and intensity of extreme cold spells across the U.S. have made dependable residential heating systems not just a preference but a necessity. In response, more homeowners are turning to advanced heating technologies that ensure consistent indoor temperatures regardless of external conditions. At the same time, the integration of intelligent controls, such as IoT-enabled systems and smart thermostats, is enabling users to manage energy usage with greater precision. These innovations help households cut down on unnecessary heating, which not only reduces monthly utility bills but also aligns with broader sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $184.5 Billion |

| Forecast Value | $424.3 Billion |

| CAGR | 8.6% |

The heat pump residential heating equipment market is expected to grow at a CAGR of 12% through 2034. The increasing need for energy-efficient solutions, coupled with favorable government policies, will boost the adoption of residential heat pumps. Ongoing technological developments will enhance their operational efficiency and promote environmentally friendly practices. The market is segmented into single-family and multi-family applications.

The single-family residential heating equipment segment is anticipated to drive business growth at a CAGR of 8% through 2034, holding a share of 58% in 2024. The growing demand for customized solutions to meet diverse heating needs will increase product adoption. Additionally, integrating remote monitoring systems, predictive maintenance, and process optimization will propel the industry outlook.

U.S. Residential Heating Equipment Market was valued at USD 21.6 billion in 2024, fueled by environmental mandates, rising consumer awareness, and government-backed programs that incentivize energy-efficient upgrades. The market is also benefiting from widespread retrofitting activities, where older heating systems are being replaced with high-performance alternatives that comply with newer carbon emission standards. Additionally, the shift toward electrification in residential spaces creates new opportunities for heat pumps and hybrid systems.

Key players in the market include Whirlpool, Vaillant Group, Bradford White Corporation, Ferroli, Crane, SAMSUNG, Panasonic Corporation, A.O. Smith, Carrier Corporation, DAIKIN INDUSTRIES, Lennox International, Robert Bosch, Hoval, Trane Technologies, Rinnai America, Rheem Manufacturing Company, GE Appliances, LG Electronics, Ariston Holding, Havells India, BDR Thermea Group, Arovast Corporation, Johnson Control International, VIESSMANN. To strengthen their market presence, companies in the residential heating equipment industry are adopting various strategies. These include launching innovative products, expanding distribution networks, and forming strategic partnerships and acquisitions. For instance, companies are developing advanced heating systems that integrate renewable energy sources and smart technologies to meet the growing demand for energy-efficient solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Heat pump

- 5.3 Boiler

- 5.4 Furnace

- 5.5 Water heater

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Single-family

- 6.3 Multi-family

Chapter 7 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Dealer

- 7.4 Retail

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Portugal

- 8.3.7 Romania

- 8.3.8 Netherlands

- 8.3.9 Switzerland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Egypt

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 A.O. Smith

- 9.2 Ariston Holding

- 9.3 Arovast Corporation

- 9.4 BDR Thermea Group

- 9.5 Bradford White Corporation

- 9.6 Carrier Corporation

- 9.7 Crane

- 9.8 DAIKIN INDUSTRIES

- 9.9 Ferroli

- 9.10 GE Appliances

- 9.11 Havells India

- 9.12 Hoval

- 9.13 Johnson Control International

- 9.14 Lennox International

- 9.15 LG Electronics

- 9.16 Panasonic Corporation

- 9.17 Rheem Manufacturing Company

- 9.18 Rinnai America

- 9.19 Robert Bosch

- 9.20 SAMSUNG

- 9.21 Trane Technologies

- 9.22 Vaillant Group

- 9.23 VIESSMANN

- 9.24 Whirlpool