|

市場調查報告書

商品編碼

1630373

無源光纖網路(PON) 設備 -市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Passive Optical Network (PON) Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

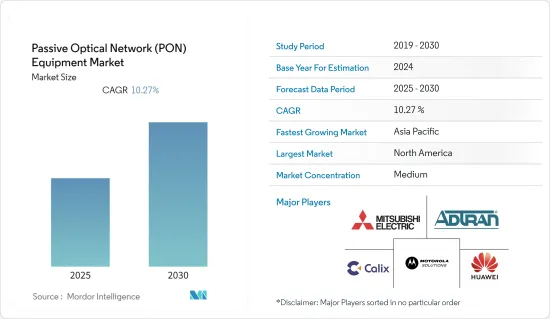

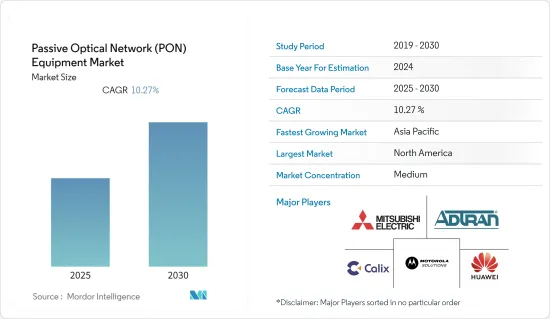

無源光纖網路(PON) 設備市場預計在預測期間內複合年成長率為 10.27%

主要亮點

- 此外,政府正在採取諸如採用光纖豐富網路的智慧城市計畫等舉措,以實現物聯網基礎設施的順暢流動。光纖網路支援為水、電、污水、污水管理、安全和通訊等公共產業提供動力的技術。據聯合國預計,到2050年,全球超過68%的人口將居住在都市區,智慧城市計劃預計在全球範圍內活性化。

- 隨著資料流量持續呈指數級成長,對更高容量網路的需求也不斷增加。無源光纖網路(PON)是這個問題的有效解決方案,因為它們可以遠距提供高頻寬。對頻寬的需求不斷成長是推動無源光纖網路市場成長的關鍵因素。隨著視訊串流和其他頻寬密集型程式變得越來越普遍,消費者需要更快、更可靠的網路。 PON 非常適合滿足這些需求,因為它可以在很長的距離內提供Gigabit速度,而無需使用主動元件或昂貴的光纖。

- 由於COVID-19的爆發,世界各國都採取了預防措施。雖然學校關閉,社區被要求留在家裡,但許多組織正在尋找允許員工在家工作的方法。電訊公司已積極建置全光纖基礎設施,以提供超高速、超可靠且面向未來的寬頻網路。

- 例如,根據世界5G大會上公佈的資料,在5G的推動下,過去三年,中國行動用戶的平均每月線上流量從7.8GB增加到14.9GB。這為COVID-19大流行期間的遠距工作、線上教育、數位生活、科學研究和疫情防治提供了便利。這些因素對預測期內的市場成長率做出了重大貢獻。

無源光纖網路(PON)市場趨勢

GPON設備預計將大幅成長

- 增強型行動寬頻(eMBB) 描述了 5G NR 和 4G LTE 更高的資料頻寬以及改進的延遲。 eMBB 透過直接向客戶提供行動寬頻服務,為許多營運商帶來了 5G 的新使用案例。隨著已開發國家和開發中國家智慧型手機資料使用量的增加,這提高了頻譜效率和功率,補充了數位服務的充足容量。

- VIAVI Solutions Inc. 是一家測試、測量和保障解決方案以及先進精密光學解決方案提供商,最近推出了 Fusion JMEP 10,這是一款外形規格可插拔 (SFP+)Gigabit乙太網路收發器,用於網路測試、開通和效能監控宣佈到 10GbE。 Fusion JMEP 10 是VIAVI NITRO 生命週期管理平台的一部分,支援5G xHaul、商業乙太網路服務、電纜DAA(分散式存取架構)以及光纖存取網路GPON/XGSPON(千兆位元被動光網路)等應用。

- 5G 和光纖相容性將帶來互惠互利的夥伴關係。在光纖入戶難度高、成本高、耗時長的地區,5G固定無線存取可以填補FTTH部署的空白,擴大覆蓋範圍。客戶將從蜂巢式網路遷移到 Wi-Fi,並將 5G 流量卸載到 Wi-Fi 和 FTTH。這有助於有效管理 RAN 容量和定價,為關鍵任務應用釋放 5G 容量,並改善客戶的家庭體驗。行動裝置用戶期望 5G 顯著提高速度並實現全球覆蓋,這需要高效能的行動傳輸網路。此外,現有的基於被動光纖網路(PON) 技術的 FTTH 網路將用於提供此傳輸。

- 隨著GPON在全球的部署加速,通訊業者也積極邁向光纖部署的下一步。未來5年,光纖接入網路將迅速進入千兆位元組時代。 10G PON無源光纖網路技術具有廣覆蓋、寬頻寬的特性。世界各地的營運商在安裝高速光纖接入網路時更喜歡這種技術,因為單一系統可以為30至40個家庭提供千兆位元組的存取。

亞太地區成長迅速

- 近年來,高速網路和5G網路越來越受到關注。該地區以中國、日本、台灣、印度和澳洲等新興國家為主導。中國擁有完善的5G生態系統,預計預測期內將進一步發展。然而,由於 5G 技術預計將成為目前行動寬頻的熱點技術,因此預期成長將較為溫和。

- 我國正邁向以10G PON技術為代表的Gigabit超寬頻新階段,光纖網路基礎優勢領先全球。各大通訊供應商紛紛制定了簡潔的Gigabit光纖網路發展規劃。至2021年,全國300多個城市將建成Gigabit寬頻接取網路,服務超過8,000萬戶家庭。全國超過270萬Gigabit上網用戶獲得了大部分通訊營運商的Gigabit商用套餐。僅僅五個月的時間,新增用戶數量就超過了去年的總量。

- 北京移動將在全市建設數百個雙Gigabit精品社區,並加速F5G建設。廣州電信聯合華為發表首個FTTR白皮書,以全光住宅網路技術實現Gigabit寬頻全戶覆蓋。為夯實數位經濟的堅實基礎,杭州移動發布了「雙5G」數位城市白皮書。中國的Gigabit寬頻旨在連接眾多設備和終端,實現家庭、企業、商業、工業製造等多場景應用,為消費者提供可靠的高速頻寬存取能力,預計將持續擴大。

- 中國電信業者在5G方面的投資超過594億美元,預計產生1.25兆美元的經濟影響。這表明新型網路基礎設施正在為經濟成長做出重大貢獻。科技部副部長項立斌指出,5G商用已進入正回饋循環,經過三年多的發展,工業5G應用數量已從零增加到一個。我們分析這些因素對預測期內市場成長率的影響。

無源光纖網路(PON) 產業概覽

無源光纖網路設備市場適度整合,因為市場上只有少數公司存在。這些公司也進行了大量投資,為客戶提供廣泛的技術。此外,這些公司持續投資於策略夥伴關係、收購和產品開發,以增加市場佔有率。以下是這些公司目前的一些進展。

- 2022年5月-在奧地利維也納舉行的2022年FTTH大會上,全球重要的行動網際網路通訊、企業與消費科技解決方案供應商中興通訊(0763.HK/000063.SZ)宣布推出業界首款光纖網路單元(ONU) 原型,提供50 Gigabit無源光纖網路連結(50G PON) 和 Wi-Fi 7 技術。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 網路運作安全可靠的需求

- 與傳統網路相比的環保替代方案

- 總擁有成本低,投資收益率高

- 市場限制因素

- 操作員介面的組件成本高

第6章 市場細分

- 按結構分

- 乙太網路光纖網路(EPON)設備

- Gigabit被動光纖網路(GPON)設備

- 按成分

- 波分複用多工器/解多工器

- 濾光片

- 光功率分配器

- 光纜

- 光線路終端(OLT)

- 光纖網路終端(ONT)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- ADTRAN, Inc.

- Calix, Inc.

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Motorola Solutions, Inc.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Tellabs, Inc.

- Verizon Communications, Inc.

- ZTE Corporation

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 70276

The Passive Optical Network Equipment Market is expected to register a CAGR of 10.27% during the forecast period.

Key Highlights

- Additionally, governments are taking initiatives like smart city programs with fiber optic-rich networks to enable the smooth flow of IoT infrastructure. Fiber optic network allows the technology to drive utilities like water, electricity, wastewater, sewerage management, security, and communication. According to the UN, over 68% of the global population is estimated to live in urban areas by 2050, which will fuel more smart city projects globally.

- The demand for networks with greater capacity is increasing as data traffic keeps growing exponentially. Because they can deliver high bandwidths across great distances, passive optical networks (PONs) present a viable solution to this issue. The rising need for bandwidth is the primary factor driving the passive optical network market growth. Consumers demand faster and more dependable networks as video streaming and other bandwidth-intensive apps proliferate. Due to their ability to deliver gigabit speeds over considerable distances without the use of active components or pricey optical fiber, PONs are uniquely suited to meet this demand.

- Due to the COVID-19 outbreak, countries worldwide implemented preventive measures. While schools were closed and communities were asked to stay at home, many organizations were finding ways to enable employees to work from their homes. Telecom companies actively made efforts to build full-fiber infrastructure to deliver an ultrafast, ultra-reliable, and futureproof broadband network.

- For instance, the average monthly mobile user in China's online traffic increased from 7.8 GB to 14.9 GB over the past three years, driven by 5G, according to data released at the global 5g convention. It facilitated remote work, online education, digital life, scientific research, and epidemic prevention and control during the COVID-19 pandemic. These factors significantly contribute to the market growth rate during the forecast period.

Passive Optical Network (PON) Market Trends

GPON Equipments is Expected to Grow Significantly

- Enhanced mobile broadband (eMBB) provides greater data bandwidth due to latency improvements on 5G NR and 4G LTE. It led most operators towards new use cases for 5G by delivering mobile broadband services directly to customers. It, thus, complements ample capacity for digital services, owing to better spectral efficiency, power, and increasing smartphone data usage in developed & developing countries.

- Recently, VIAVI Solutions Inc., a test, measurement, assurance solutions, and advanced precision optical solutions provider, announced Fusion JMEP 10, a small form-factor pluggable (SFP+) Gigabit Ethernet transceiver for network test, turn-up, and performance monitoring up to 10 GbE. The Fusion JMEP 10, which is part of the VIAVI NITRO lifecycle management platform, addresses10 GbE emergence as the dominant Ethernet bandwidth for applications such as 5G xHaul, Business Ethernet Services, Distributed Access Architecture (DAA) for Cable and Gigabit Passive Optical Networks (GPON/XGSPON) for Fiber Access Networks.

- The compatibility of 5G and fiber results in a reciprocal partnership. In areas where connecting fiber to the home is challenging, expensive, or takes too long, 5G fixed wireless access can fill in the gaps in FTTH deployments and expand coverage. Customers leave the cellular network for Wi-Fi, offloading 5G traffic to Wi-Fi and FTTH. It facilitates managing RAN capacity and prices effectively, freeing up 5G capacity for mission-critical applications and improving the customer experience at home. Users of mobile devices anticipate substantially faster speeds and global coverage from 5G, which requires a high-performance mobile transport network. Further, to offer that transport, a passive optical network (PON) technology-based FTTH networks already in existence are used.

- With the accelerating rollout of GPON worldwide, telecom operators are also actively moving toward the next step in fiber rollouts. The Gigabyte era will rapidly enter optical access networks during the next five years. The 10G PON passive optical network technology is distinguished by its broad coverage and high bandwidth. When installing high-speed optical access networks, operators around the world favor this technology since it can give Gigabyte access to 30-40 households on a single system.

Asia-Pacific Region to Witness the Fastest Growth

- Recently, there is an increased emphasis on high-speed internet and 5G network. The major driving countries in the region for the same are emerging countries, including China, Japan, Taiwan, India, and Australia. China includes an established ecosystem for 5G and is expected to grow further in the forecast period. However, the 5G technology is expected to serve as a hotspot technology with the current mobile broadband; the growth is expected to be gradual.

- China is advancing towards a new Gigabit ultra-wide stage, represented by 10G PON technology, and leading the global in terms of optical networks' fundamental advantages. Primary telecom providers effectively put up concise development plans for a gigabit optical network. Over 300 cities nationwide had a gigabit broadband access network in 2021, serving more than 80 million households. More than 2.7 million National Gigabit internet access consumers have received gigabit commercial packages from most provincial telecommunications providers. The number of new users surpassed the total number from the previous year in just five months.

- In addition to building hundreds of double Gigabyte boutique communities throughout the city, Beijing Mobile will hasten the construction of F5G. The first FTTR White Paper, published by Guangzhou Telecom and Huawei, ensures Gigabit broadband full house coverage through an all-optical residential network technology. To strengthen the firm foundation of the digital economy, Hangzhou Mobile published the "Double 5G" Digital City White Paper. China's Gigabit Broadband will continue to broaden its coverage to connect many devices and terminals, achieve multi-scenario applications such as home, enterprise, business, and industrial manufacturing, and give consumers reliable, high-speed bandwidth access capacity.

- Chinese telecom companies have invested more than USD 59.4 billion in 5G, generating more than USD 59.4 billion in 5G, generating an estimated USD 1.25 trillion in economic output. It shows the significant contribution new network infrastructure makes to economic growth. The commercial use of 5G entered a positive feedback loop, according to Xiang Libin, vice-minister of science and technology, and noted that after more than three years of development, industry-oriented 5G applications have increased from zero to one. These factors are analyzed to contribute to the market growth rate during the forecast period.

Passive Optical Network (PON) Industry Overview

The market for passive optical network equipment is moderately consolidated due to the presence of a few companies in the market. Also, these companies are investing extensively in offering customers a wide range of technologies. Moreover, these companies continuously invest in strategic partnerships, acquisitions, and product development to gain market share. Some of the current advancements by the companies are listed below.

- May 2022 - At the FTTH Conference 2022 in Vienna, Austria, ZTE Corporation (0763. HK / 000063.SZ), a significant global supplier of telecoms, enterprise, and consumer technology solutions for the mobile internet, declared that it had unveiled the prototype of the first Optical Network Unit (ONU) in the industry to offer both 50-Gigabit-Capable Passive Optical Networking (50G PON) and Wi-Fi 7 technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment on the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for secure and reliable network operation

- 5.1.2 Eco-friendly substitute as compared to traditional networks

- 5.1.3 Low total cost of ownership and high return on investment

- 5.2 Market Restraints

- 5.2.1 High component cost at operator interface

6 MARKET SEGMENTATION

- 6.1 By Structure

- 6.1.1 Ethernet Passive Optical Network (EPON) Equipment

- 6.1.2 Gigabit Passive Optical Network (GPON) Equipment

- 6.2 By component

- 6.2.1 Wavelength Division Multiplexer/De-Multiplexer

- 6.2.2 Optical filters

- 6.2.3 Optical power splitters

- 6.2.4 Optical cables

- 6.2.5 Optical Line Terminal (OLT)

- 6.2.6 Optical Network Terminal (ONT)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ADTRAN, Inc.

- 7.1.2 Calix, Inc.

- 7.1.3 Huawei Technologies Co., Ltd.

- 7.1.4 Mitsubishi Electric Corporation

- 7.1.5 Motorola Solutions, Inc.

- 7.1.6 Nokia Corporation

- 7.1.7 Telefonaktiebolaget LM Ericsson

- 7.1.8 Tellabs, Inc.

- 7.1.9 Verizon Communications, Inc.

- 7.1.10 ZTE Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219