|

市場調查報告書

商品編碼

1628791

LCoS 顯示器 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)LCoS Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

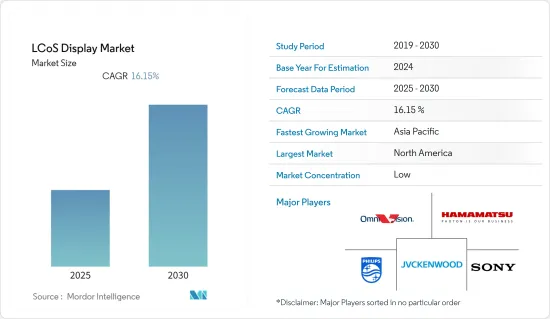

LCoS顯示器市場預計在預測期內複合年成長率為16.15%

主要亮點

- LCoS 面板長期以來一直被用作投影顯示器應用的光學幅度調變。由於適當的液晶模式和入射光的偏振排列,LCoS 面板也可以用作純相位調變。它還具有動態衍射元件的功能。

- 對攜帶式電子產品的需求逐年增加。但由於螢幕大小較小,其使用受到了限制。因此,可攜式或微型投影儀,讓您可以在智慧型手機、筆記型電腦、數位媒體參與企業、遊戲機和相機等可攜式電子設備上享受大螢幕體驗。

- 因此,各公司正在開發簡單的平行處理來提供LCoS面板和顯示器,並實現微型投影機和微型投影機中使用的最小和最高解析度的光調變晶片,這導致我們正在推動LCoS與投影機技術的結合。

- 微型投影機用於各個行業。例如,在國防和航太工業中,微型投影機可以與設備整合,透過投影敵方部署位置、掩體位置以及海上或陸地上的敵方地塊的即時 3D 影像來支援軍事。

- VDCDS 是全球領先的創新顯示系統供應商之一,也是多個聯邦合約的承包商,為美國空軍、海軍陸戰隊、國民警衛隊、海軍和商業企業提供支持,擁有超過5,000 個模擬顯示系統和訓練顯示器。

- 然而,與 LCD 和 LED 等競爭技術相比,技術成本阻礙了市場的發展。此外,LCoS 微型元件很難製造,英特爾等幾家公司由於製造產量比率持續較低而放棄了這項努力。

矽基液晶 (LCoS) 顯示器市場趨勢

頭戴式顯示器證實了對 LCoS 系統的巨大需求

- 用於 AR/VR 應用的頭戴式裝置是使用 LCoS 顯示器的重要部分。這些 AR/ VR頭戴裝置用於消費者和企業/工業用途。 Ominivison 和 Himax Technologies 等公司是 LCoS 技術的最大供應商,為 Magic Leap、Google和微軟等公司的產品提供服務。

- 市場上充滿了不同的 HMD,從最小的 HMD 到完全身臨其境型的HMD。 LCoS 在這一領域與 DLP、AMOLED 和 LCD 等其他技術競爭。 LCoS 已成為提供半身臨其境型體驗的 HMD 提供者的首選。

- HMD 在最近的趨勢中取得了顯著的進步。 Apple 正在開發新的擴增實境(AR) 產品,並投入大量資源。例如,2022 年 6 月,蘋果獲得了多模態音訊系統以及未來 HMD 和智慧眼鏡的專利。

- 由於 HMD 仍處於起步階段,因此各個供應商正在共同開發可供設備製造商使用的平台。然而,隨著影片和遊戲等 AR/VR 內容的激增,這種趨勢正在逐漸轉向完全沉浸式體驗。此外,5G 的推出將使企業能夠傳輸真正身臨其境的 AR/VR 體驗所需的高解析度內容。

- 此外,該公司正在尋求將 LCoS 顯示器整合到熱像儀等頭戴式裝置中。例如,2022 年 1 月,蔡司發布了第二款紅外線相機 DTI 3/25,該相機主要是為狩獵而開發的。它將高解析度高清 LCOS 顯示器與 0.5 倍變焦增量相結合,確保提供清晰的影像,從而實現自信的發現。

北美佔據主要市場佔有率

- 北美預計將佔據很大的市場佔有率,因為它是各種汽車品牌的主要生產中心以及軍事和國防創新趨勢的所在地。

- 北美新興市場的政府法規擴大支持汽車創新和技術,這將有助於發展 LCoS 顯示器市場。

- 此外,在預測期內,軍事和國防領域的不斷發展進一步增加了對 LCoS 顯示器市場的需求。例如,2022年5月,BAE Systems推出了LiteWave輕量抬頭顯示器。它旨在輕鬆安裝在各種民航機和軍用飛機的駕駛座內。

- 此外,軍事預算是美國聯邦政府分配給國防部以及更廣泛地說所有軍事相關支出的可自由支配預算的最大部分。國防部要求2023會計年度預算為7,730億美元,比2022會計年度預算增加4.1%。

- 美國是世界上最大的航太、國防和太空市場之一。 SIPRI預計,2021年美國仍將是全球最大國防費用,軍事支出達8,010億美元,佔全球軍費總額的38%。

矽基液晶 (LCo) 顯示器產業概述

市場高度集中,大公司控制大部分市場。市場上有多家LCoS技術供應商,例如OmniVision Technologies Inc.、Hamamatsu Photonics KK和HOLOEYE Photonics AG,以及LCoS顯示設備製造商,例如JVC Kenwood USA Corporation、Sony Corporation和Microsoft Corporation。這些公司採取的策略如下:

- 2022 年 6 月 - Kopin Corporation 是一家領先的國防、工業、消費、企業和醫療產品高解析度微顯示器和顯示器次組件開發商和製造商,有機發光二極體顯示器和矽背板產品。收到了訂單。

- 2022 年 1 月 - 蔡司推出第二款紅外線相機 DTI 3/25,主要為狩獵而開發。配備高解析度高清 LCOS 顯示器和 0.5 倍變焦,您可以透過詳細影像可靠地定位敵人。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 將 AR&VR 部署到 HMD 等支援市場成長的產品中

- 對高解析度顯示器產品的需求不斷成長推動市場成長

- 市場限制因素

- 技術開發成本阻礙市場發展

第6章 市場細分

- 依產品

- 頭戴式顯示器 (HMD)

- 投影儀

- 抬頭顯示器(HUD)

- 依技術

- 鐵電 LCoS (FLCoS)

- 向列型 LCoS (NLCoS)

- 波長選擇性開關 (WSS)

- 按最終用戶

- 消費性電子產品

- 車

- 航空

- 光學3D測量

- 醫療保健

- 軍隊

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 韓國

- 台灣

- 其他亞太地區

- 其他

- 北美洲

第7章 競爭格局

- 公司簡介

- OmniVision Technologies Inc.

- Hamamatsu Photonics KK

- Meadowlark Optics Inc.

- Syndiant Inc.

- HOLOEYE Photonics AG

- Himax Technologies Inc.

- JVC KENWOOD USA Corporation

- Sony Corporation

- Koninklijke Philips NV

- Google Inc.

- Microsoft Corporation

- Magic Leap Inc.

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 54367

The LCoS Display Market is expected to register a CAGR of 16.15% during the forecast period.

Key Highlights

- The liquid crystal on silicon (LCoS) panels has long been used as a light amplitude modulator for projection display applications. The LCoS panel can also be used as a pure phase modulator with proper liquid crystal mode and arrangement of incident light polarization. It also functions as a dynamic diffractive element.

- The demand for hand-held consumer electronics has increased over the years. However, the small size of the screen limited their usage. This resulted in using ultra-portable or pico projectors that allowed consumers to enjoy a large-screen experience in portable electronics, such as smartphones, notebook computers, digital media players, game consoles, and cameras.

- Therefore, the companies are offering LCoS panels and displays and are developing simple parallel processing to enable the most minor and highest resolution light modulating chips used in ultra-portable or pico projectors, which is driving the incorporation of LCoS technology in projectors.

- Pico projectors have applications in various industries. For instance, in the defense and aerospace industries, a pico projector can assist the armed forces with a 3D projection of the real-time location of enemy deployments, bunker locations, and plot charts of the sea or land-based enemies when integrated with devices.

- VDCDS, one of the world's leading providers of innovative display systems, has provided more than 5,000 simulation and training display systems (which primarily include ruggedized and motion-capable LCoS) as a contractor on multiple Federal contracts to support the Air Force, Marines, National Guard, Navy, and commercial businesses in the United States.

- However, compared to competitive technologies like LCD and LED, the cost of technology is hindering the market. In addition, LCoS microdevices are challenging to manufacture, because of which several companies, including Intel, have abandoned their efforts after consistently low yields in manufacturing.

Liquid Crystal on Silicon (LCos) Display Market Trends

Head-mounted Displays to Witness Huge Demand for LCoS Systems

- Head-mounted devices for AR/VR applications are a significant segment that uses LCoS displays. These AR/VR headsets are used for consumer and enterprise/industrial purposes. Companies like Ominivison and Himax Technologies were the two major suppliers of LCoS Technology for products of companies like Magic Leap, Google, and Microsoft.

- The market is flooded with several HMDs that provide minimal to fully immersive HMDs. LCoS competes with other technologies in this segment, like DLP, AMOLED, and LCD. LCoS has been the preferred choice for HMD providers who provide a semi-immersive experience.

- HMDs have seen significant development in recent years. Apple has been developing new augmented reality products and is significantly investing resources. For instance, in June 2022, Apple won a patent for a multimodal audio system and future HMD and smart glasses.

- HMDs are still in their early stages; thus, various suppliers are coming together to develop platforms that device manufacturers can use. However, trends are slowly moving toward a fully immersive experience, as there has been a surge in AR/VR content in the form of videos and games. Moreover, with the availability of 5G, companies are likely to be able to stream high-resolution content, which is required for a truly immersive AR/VR experience.

- Further, companies are integrating LCoS Displays in head-mounted equipment such as Infrared Cameras. For instance, in January 2022, Zeiss released DTI 3/25, the company's second thermal imaging camera developed primarily for hunting. This integrates a high-resolution HD LCOS display combined with 0.5 zoom increments for detailed images for reliable spotting.

North America to Hold Significant Market Share

- North America is expected to cater to a significant market share with its major production sites of various automotive brands and innovation trends in military and defense.

- The government regulations in the developed regions of North America are increasingly favoring automotive innovations and technologies that support the development of the LCoS display market.

- Additionally, the increasing development in the military and defense segment is further creating a demand for the LCoS display market over the forecast period. For instance, in May 2022, BAE Systems launched the LiteWave lightweight head-up display, designed to be easy to install in the cockpits of a wide variety of commercial and military aircraft.

- Further, the military budget is the largest portion of the discretionary United States federal budget allocated to the Department of Defense, or more broadly, the portion of the budget that goes to any military-related expenditures. For FY 2023, the Department of Defense has requested a budget of USD 773 billion, which is 4.1% more than the budget requested in FY2022.

- The United States (US) is one of the world's biggest aerospace, defense, and space markets. According to SIPRI, the US remains the highest spender on defense capability globally in 2021, with USD 801 billion dedicated to the military, constituting 38 percent of the total military spending worldwide.

Liquid Crystal on Silicon (LCos) Display Industry Overview

The market is highly concentrated, with significant players dominating most of the market. There are a few LCoS technology providers in the market, like OmniVision Technologies Inc., Hamamatsu Photonics KK, HOLOEYE Photonics AG, and a few LCoS display devices manufacturers JVC Kenwood USA Corporation, Sony Corporation, and Microsoft Corporation. The strategies adopted by them include,

- June 2022 - Kopin Corporation, a leading developer and high-resolution microdisplays and display subassemblies provider for defense, industrial, consumer, enterprise, and medical products, announced that it had received new orders for Organic Light Emitting Diode (OLED) displays and silicon backplane products for a new customers applications.

- January 2022 - Zeiss released DTI 3/25, the company's second thermal imaging camera developed primarily for hunting. This integrates a high-resolution HD LCOS display combined with 0.5 zoom increments for detailed images for reliable spotting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Deployment of AR & VR in Products such as HMDs to Support the Market Growth

- 5.1.2 Increasing Demand for High-Resolution Display Products to Drive Market Growth

- 5.2 Market Restraints

- 5.2.1 Cost of Technology Development to Hinder the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Head-mounted Display (HMD)

- 6.1.2 Projector

- 6.1.3 Head Up Display (HUD)

- 6.2 By Technology

- 6.2.1 Felloelectrics LCoS (FLCoS)

- 6.2.2 Nematics LCoS (NLCoS)

- 6.2.3 Wave length Selective Switching (WSS).

- 6.3 By End User

- 6.3.1 Consumer Electronics

- 6.3.2 Automotive

- 6.3.3 Aviation

- 6.3.4 Optical 3D Measurement

- 6.3.5 Medical

- 6.3.6 Military

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 Taiwan

- 6.4.3.5 Rest of Asia Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 OmniVision Technologies Inc.

- 7.1.2 Hamamatsu Photonics KK

- 7.1.3 Meadowlark Optics Inc.

- 7.1.4 Syndiant Inc.

- 7.1.5 HOLOEYE Photonics AG

- 7.1.6 Himax Technologies Inc.

- 7.1.7 JVC KENWOOD USA Corporation

- 7.1.8 Sony Corporation

- 7.1.9 Koninklijke Philips NV

- 7.1.10 Google Inc.

- 7.1.11 Microsoft Corporation

- 7.1.12 Magic Leap Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219