|

市場調查報告書

商品編碼

1627112

生物聚合物包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Biopolymer Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

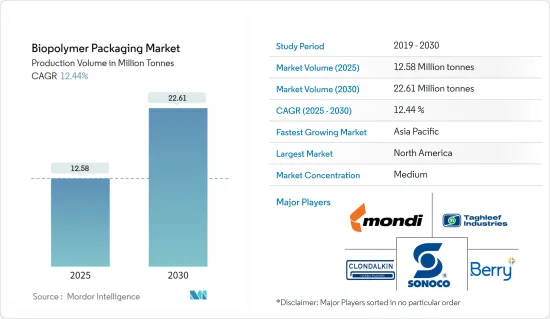

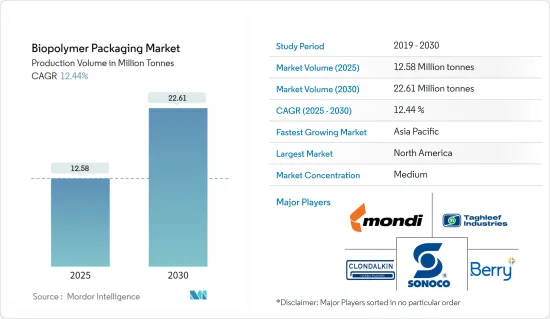

以產量為基礎的生物聚合物包裝市場規模預計將從2025年的1,258萬噸擴大到2030年的2,261萬噸,預測期內(2025-2030年)複合年成長率為12.44%。

由於合成聚合物的使用和對塑膠包裝日益嚴格的監管而引起的環境問題日益嚴重,是促進生物聚合物包裝市場成長的關鍵因素之一。

各種農產品是食品包裝的原料,具有成本效益、可再生、生物分解性特性。生物分解性聚合物的化學結構的特徵是由生物分解性官能基產生的酯鍵和醯胺鍵。

隨著塑膠購物袋使用法規的收緊,批發商和零售商擴大採用環保包裝。這種永續包裝的成長趨勢有望加強生物聚合物包裝市場。此外,與化石基、非生物分解的塑膠相比,生物基、生物分解性和可堆肥塑膠等替代品是更永續的選擇。

生物聚合物包裝材料不僅提供了環保的解決方案,而且還受益於其原料的價格實惠和豐富。在食品和製藥產業需求的推動下,生物聚合物包裝市場可望強勁成長。在永續性議題和生物分解性塑膠包裝潛力的推動下,亞太國家,特別是印度、中國和日本,以及幾個歐洲國家正在增加對生物聚合物包裝的採用。

近年來,生物複合材料已成為活性食品包裝、與食品直接接觸的增強材料的主要焦點。這些先進的生物複合材料為具有卓越機械、阻隔、抗氧化和抗菌性能的創新食品包裝材料鋪平了道路。

採用生物基生物分解性合成生物聚合物存在障礙。與傳統石油基非生物分解材料相比,成本較高,加上某些局限性,使其無法與傳統塑膠競爭。因此,將生物基可生物生物分解性生物聚合物定位為傳統塑膠的直接替代品仍然是一個巨大的障礙。

生物聚合物包裝市場趨勢

最大的最終用戶是食品和飲料行業

- 在環境意識不斷提高、監管需求以及消費者轉向永續包裝的推動下,生物聚合物包裝市場的食品和飲料領域正在經歷強勁成長。由於生物聚合物是生物分解性的並且較少依賴石化燃料,因此它們正在成為傳統塑膠的環保替代品。

- 生物聚合物不僅環保,而且在食品工業中發揮至關重要的作用。特別是,保持肉類的新鮮度和品質可以延長保存期限並減少食物廢棄物。為了因應這些趨勢,世界各地的政府和監管機構正在採取措施支持永續包裝,進一步推動生物聚合物包裝市場的發展。

- 隨著消費者越來越喜歡環保產品,食品和飲料公司開始轉向生物聚合物,不僅是為了滿足這些偏好,也是為了提升其品牌形象。

- 從新鮮農產品和肉類到乳製品、零嘴零食和其他生鮮食品食品,生物聚合物正成為包裝的首選。其有效的阻隔性能可保護食品免受濕氣、氧氣和污染物的影響。

- 根據經合組織和糧農組織的資料,全球肉類產量正在迅速成長,預計將從2016年的3.17億噸增加到2024年的3.5075億噸。肉類產量的增加自然增加了對包裝解決方案的需求,而生物聚合物作為肉類包裝的永續選擇脫穎而出。

- 在一次性應用領域,基於生物聚合物的瓶子、杯子和容器正在迅速普及,特別是在可回收性至關重要的地方。食品服務業也正在擁抱生物聚合物,將其用於一次性刀叉餐具、盤子和外帶容器。

亞太地區預計將出現顯著成長

- 亞太地區是世界領先的生物聚合物消費國和生產國。人們對食物浪費(尤其是過期產品造成的食物浪費)的日益關注正促使該地區的企業尋求創新解決方案。此外,針對食品浪費的政府法規進一步推動了向永續包裝的轉變,增強了生物聚合物包裝市場。

- 印度、中國、巴基斯坦和印尼等人口稠密的國家正逐步轉向生物基塑膠。這種轉變是由日益嚴格的環境法規、政府意識提升計畫和對傳統塑膠的禁令所推動的。

- 根據國際健身健美聯合會報告,2023年全球生質塑膠產能將達202萬噸,其中亞洲佔超過50%。

- 此外,隨著消費者意識的提高以及印度等新興國家為綠色解決方案提供稅收優惠,預計亞太地區的投資將會增加。這一趨勢可望推動生物聚合物包裝市場的發展。

- 根據工業和內貿促進部 (DPIIT) 統計,2000 年 4 月至 2024 年 3 月期間,印度作為全球食品和飲料製造領域的領先者,已在食品加工業投資約 125.8 億美元。此流入量佔所有領域 FDI 總額的 1.85%。 2023-24會計年度,加工蔬菜價值6.5242億美元,雜項加工產品價值16.5222億美元,加工水果和果汁價值9.7093億美元。

- 此外,印度政府正在透過食品加工工業部積極努力增加對食品加工產業的投資。政府繼續履行承諾,將全面的 PMKSY 計畫延長至 2026 年 3 月,並撥款 460 億印度盧比(5.594 億美元)。這些舉措預計將顯著促進該地區研究市場的成長。

生物聚合物包裝產業概述

生物聚合物包裝市場正變得半固體,主要企業包括 Mondi Group、Taghleef Industries Inc.、Clondalkin Group Holdings BV、Sonoco Products Company 和 Berry Plastics Group Inc.。這些公司比其他公司具有競爭優勢,因為它們有能力不斷增強產品線以滿足消費者需求。這些公司投資於研發活動、併購以及與其他公司和機構的策略夥伴關係,以保持競爭力。

- 2023 年 8 月 - CJ Biomaterials Inc. 是主要企業的聚羥基烷酯(PHA) 生物聚合物公司,也是韓國 CJ CheilJedang 的子公司,已與韓國 Riman 合作。此次合作將把 CJ Biomaterials Inc. 的 PHA 專利技術與聚乳酸 (PLA) 結合,為 Riman 優質的 Inselderm 產品線開發包裝。這種先進的包裝不僅與 Riman 對永續性的承諾產生共鳴,而且還顯著減少了護膚品對傳統石化燃料包裝的依賴。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進因素

- 政府加強對生物基包裝的監管

- 人類健康和環保產品意識不斷增強

- 市場限制因素

- 生物基材料的性能問題

- 生物包裝材料高成本

第6章 市場細分

- 依材料類型

- 非生物分解

- PET

- PA

- PTT

- 其他非生物分解材料

- 生物分解性

- PLA

- 澱粉混合物

- PBAT

- 其他生物分解性材料

- 非生物分解

- 依產品

- 包包

- 小袋

- 電影

- 按最終用戶

- 飲食

- 零售

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 北美洲

第7章 競爭格局

- 公司簡介

- Mondi Group

- Taghleef Industries Inc.

- Clondalkin Group Holdings BV

- Sonoco Products Company

- Berry Plastics Group Inc.

- Constantia Flexibles Group GmbH

- Sealed Air Corporation

- Tetra Pak International SA

- United Biopolymers SA

- Amcor PLC

- NatureWorks LLC

- CJ Biomaterials Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Biopolymer Packaging Market size in terms of production volume is expected to grow from 12.58 million tonnes in 2025 to 22.61 million tonnes by 2030, at a CAGR of 12.44% during the forecast period (2025-2030).

Increasing environmental concerns owing to the use of synthetic polymers, coupled with rising strict regulations on plastic packaging, are some of the crucial factors contributing to the growth of the biopolymers packaging market.

A variety of agricultural by-products serve as raw materials for cost-effective, renewable, and biodegradable food packaging. The chemical structure of biodegradable polymers features ester and amide bonds attributed to their biodegradable functional groups.

As regulations tighten on plastic bag usage, wholesalers and retailers are increasingly adopting eco-friendly packaging. This rising inclination toward sustainable packaging is poised to bolster the biopolymers packaging market. Furthermore, alternatives like bio-based, biodegradable, and compostable plastics present a more sustainable choice compared to their fossil-based, non-biodegradable counterparts.

Biopolymer packaging materials not only offer an eco-friendly solution but also benefit from the affordability and abundance of their raw materials. The bio-polymers packaging market is set for robust growth, driven largely by demand from the food and pharmaceutical industries. In response to sustainability concerns and the potential of biodegradable plastic packaging, countries in Asia-Pacific, notably India, China, and Japan, alongside several European nations, are increasingly adopting bio-polymer packaging.

In recent years, biocomposites have emerged as a leading focus for active food packaging, enhancing materials in direct contact with food. These advanced biocomposites are paving the way for innovative food packaging materials boasting superior mechanical, barrier, antioxidant, and antimicrobial attributes.

Nonetheless, the adoption of bio-based biodegradable synthetic biopolymers faces hurdles. Their higher costs, surpassing those of conventional petroleum-derived non-biodegradable materials, coupled with certain limitations, challenge their competitiveness against traditional plastics. As a result, positioning bio-based biodegradable synthetic biopolymers as direct replacements for conventional plastics remains a formidable obstacle.

Biopolymer Packaging Market Trends

The Food and Beverages Industry to be the Largest End User

- The food and beverage segment of the biopolymers packaging market is witnessing robust growth fueled by heightened environmental awareness, regulatory imperatives, and a consumer shift toward sustainable packaging. Biopolymers, with their biodegradable properties and diminished dependence on fossil fuels, are emerging as a greener alternative to traditional plastics.

- Beyond their eco-friendliness, biopolymers play a pivotal role in the food industry, notably in preserving the freshness and quality of meat products, thereby extending shelf life and curbing food waste. In response to these trends, governments and regulatory entities worldwide are rolling out policies to champion sustainable packaging, further energizing the biopolymers packaging market.

- As consumers increasingly gravitate toward eco-friendly products, food and beverage companies are turning to biopolymers, not just to align with these preferences but also to bolster their brand image.

- From fresh produce and meat to dairy, snacks, and other perishables, biopolymers are becoming the go-to choice for packaging. Their effective barrier properties shield food from moisture, oxygen, and contaminants.

- Data from the OECD and FAO highlights a surge in global meat production, climbing from 317 million metric tons in 2016 to an anticipated 350.75 million metric tons in 2024. This uptick in meat production naturally escalates the demand for packaging solutions, with biopolymers standing out as a sustainable choice for meat packaging.

- In the realm of single-use applications, biopolymer-based bottles, cups, and containers are witnessing a surge in popularity, especially where recyclability is paramount. The foodservice industry is also embracing biopolymers, utilizing them for disposable cutlery, plates, and takeaway containers.

Asia-Pacific Expected to Witness Significant Growth

- Asia-Pacific stands out as the world's leading consumer and producer of biopolymers. Heightened concerns over food wastage, particularly due to product expiry, have driven companies in the region to seek innovative solutions. Additionally, government regulations addressing food wastage have further propelled the shift toward sustainable packaging, bolstering the biopolymers packaging market.

- Countries like India, China, Pakistan, and Indonesia, with their dense populations, are witnessing a gradual shift toward bio-based plastics. This shift is fueled by rising environmental regulations, government awareness programs, and an increasing number of bans on conventional plastics.

- As reported by the International Fitness and Bodybuilding Federation, global bioplastics production capacity hit 2.02 million metric tons in 2023, with Asia accounting for over 50% of this capacity.

- Furthermore, as consumer awareness rises and emerging economies like India offer tax incentives for eco-friendly solutions, investments in Asia-Pacific are expected to increase. This trend is poised to boost the biopolymers packaging market.

- As per the Department for Promotion of Industry and Internal Trade (DPIIT), India, a global leader in food and beverage manufacturing, attracted approximately USD 12.58 billion in foreign direct investment (FDI) equity inflow in its food processing industry from April 2000 to March 2024. This inflow represented 1.85% of the total FDI across sectors. In the fiscal year 2023-24, the industry saw processed vegetables earning USD 652.42 million, miscellaneous processed items at USD 1,652.22 million, and processed fruits and juices reaching USD 970.93 million.

- Moreover, the Indian government, through its Ministry of Food Processing Industries, is actively working to bolster investments in the food processing industry. Continuing its commitment, the government extended the umbrella PMKSY scheme with a substantial allocation of INR 4,600 crore (USD 559.4 million) until March 2026. Such initiatives are expected to significantly drive the growth of the market studied in the region.

Biopolymer Packaging Industry Overview

The biopolymers packaging market is semi-consolidated, with the presence of prominent players, such as Mondi Group, Taghleef Industries Inc., Clondalkin Group Holdings BV, Sonoco Products Company, and Berry Plastics Group Inc. These firms hold a competitive advantage over other players due to their ability to continually enhance their product lines as per consumers' demands. These companies are investing in research and development activities, mergers and acquisitions, and strategic partnerships with other firms or institutions to maintain their competitive position.

- August 2023 - CJ Biomaterials Inc., a prominent player in polyhydroxyalkanoate (PHA) biopolymers and a subsidiary of South Korea's CJ CheilJedang, forged a partnership with Riman Korea. The collaboration displays the fusion of CJ Biomaterials' patented PHA technology with polylactic acid (PLA) to develop packaging for Riman's premium IncellDerm product line. This forward-thinking packaging not only resonates with Riman's commitment to sustainability but also drastically reduces the brand's dependence on traditional fossil-fuel-derived packaging for its skincare products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Growing Government Regulations for Bio-based Packaging

- 5.1.2 Increasing Awareness of Human Well-being and Eco-friendly Products

- 5.2 Market Restraints

- 5.2.1 Performance Issues with Bio-based Materials

- 5.2.2 High Cost of Bio-packaging Materials

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Non-biodegradable

- 6.1.1.1 PET

- 6.1.1.2 PA

- 6.1.1.3 PTT

- 6.1.1.4 Other Non-biodegradable Materials

- 6.1.2 Biodegradable

- 6.1.2.1 PLA

- 6.1.2.2 Starch Blends

- 6.1.2.3 PBAT

- 6.1.2.4 Other Biodegradable Materials

- 6.1.1 Non-biodegradable

- 6.2 By Products

- 6.2.1 Bags

- 6.2.2 Pouches

- 6.2.3 Films

- 6.3 By End User

- 6.3.1 Food and Beverages

- 6.3.2 Retail

- 6.3.3 Other End User

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 Saudi Arabia

- 6.4.6.2 South Africa

- 6.4.6.3 Egypt

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mondi Group

- 7.1.2 Taghleef Industries Inc.

- 7.1.3 Clondalkin Group Holdings BV

- 7.1.4 Sonoco Products Company

- 7.1.5 Berry Plastics Group Inc.

- 7.1.6 Constantia Flexibles Group GmbH

- 7.1.7 Sealed Air Corporation

- 7.1.8 Tetra Pak International SA

- 7.1.9 United Biopolymers SA

- 7.1.10 Amcor PLC

- 7.1.11 NatureWorks LLC

- 7.1.12 CJ Biomaterials Inc.