|

市場調查報告書

商品編碼

1740844

生物聚合物包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biopolymer Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

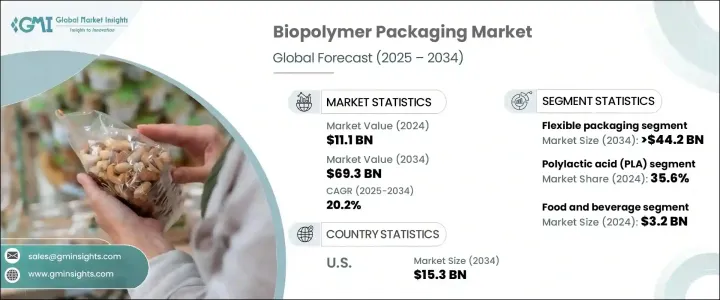

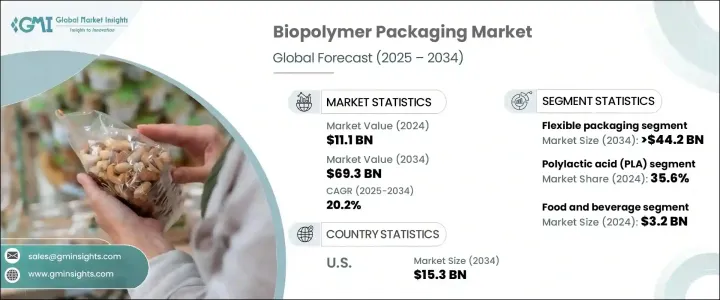

2024年,全球生物聚合物包裝市場規模達111億美元,預計到2034年將以20.2%的複合年成長率成長,達到693億美元,這得益於對永續包裝解決方案需求的激增。隨著各行各業環保意識的增強,企業面臨越來越大的減少生態足跡的壓力,而生物聚合物包裝正成為首選解決方案。與傳統塑膠包裝不同,生物聚合物提供可堆肥和可回收的替代品,符合全球永續發展目標。隨著消費者越來越重視環保選擇,監管機構也越來越嚴格地控制塑膠使用,企業正迅速整合更環保的包裝選擇。

技術進步也發揮關鍵作用,使生物聚合物材料更具成本效益、用途更廣泛、更易於取得。這些發展正在打破長期的應用障礙,即使是價格敏感的行業也能擁抱永續包裝。隨著市場參與者加大研發投入,他們專注於提升材料強度、阻隔性和客製化能力,以便與傳統包裝解決方案直接競爭。生物聚合物包裝已不再只是一個利基市場,它正迅速成為主流需求,重塑食品飲料、醫療保健、個人護理等行業的包裝策略。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 111億美元 |

| 預測值 | 693億美元 |

| 複合年成長率 | 20.2% |

隨著企業擴大將永續性與品牌形象和消費者偏好聯繫起來,生物聚合物包裝正日益受到關注。許多製造商正積極轉向生物聚合物解決方案,這體現了他們對環境責任的更廣泛承諾。隨著這些材料背後的技術日益成熟,生產流程也變得更加精簡,從而降低了成本,並使生物聚合物成為傳統塑膠更可行的替代品。

市場也正在見證採購策略的轉變。大型品牌如今願意為永續包裝支付溢價,而小型企業儘管選擇範圍縮小,也正在利用本地原料。製造商與生物聚合物材料供應商之間的合作正在成為一項關鍵的成長策略,幫助企業提供客製化的環保包裝解決方案。這些合作也推動了成本效率和可擴展性的創新,進而提升了各行各業的採用率。

預計軟包裝形式(例如包裝袋、薄膜和包裝膜)將主導生物聚合物包裝領域,到2034年預計將創造442億美元的市場價值。這一成長主要得益於食品飲料、個人護理和製藥等行業的強勁需求。高阻隔性生物聚合物材料正擴大被使用,以確保產品保護,同時最大限度地減少環境影響。數位印刷技術的創新正在增強包裝客製化,減少材料浪費,並進一步增強生物聚合物包裝的市場吸引力。

聚丁二酸丁二醇酯 (PBS) 細分市場在 2024 年佔據了 13.3% 的市場。 PBS 以其卓越的生物分解性、熱穩定性和柔韌性脫穎而出,成為食品包裝和農業薄膜等應用的首選材料。由於其在工業和家庭堆肥環境中均可分解,因此在永續性至關重要的領域,PBS 是傳統塑膠的理想替代品。

預計2025年至2034年,德國生物聚合物包裝市場的複合年成長率將達到20.3%。德國強力的環境政策和對循環經濟的承諾正在推動對可生物分解替代品的需求。鼓勵企業採用環保包裝的政策以及歐盟層面雄心勃勃的碳足跡削減目標,進一步推動了市場從化石基塑膠轉向再生材料的轉變。

全球生物聚合物包裝產業的主要參與者包括利樂國際公司 (Tetra Pak International SA)、聯合生物聚合物公司 (United Biopolymers SA)、NatureWorks, LLC、Genpak、Greendot Biopak、Sphere Group、CJ Biomaterials Inc.、Danimer Scientific、Vegware Global、Accredo Packaging 和 Mondi 集團。領先的公司正在透過與生物聚合物材料供應商建立策略合作夥伴關係來鞏固其市場地位,從而能夠提供量身定做且具有競爭力的解決方案。這些公司高度重視研發投入,旨在提高生產效率、成本效益和產品性能,以在快速發展的市場中保持領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(銷售價格)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 不斷發展的永續包裝產業

- 政府對一次性塑膠的法規和禁令

- 生物聚合物技術的進展

- 循環經濟與廢棄物管理政策

- 電子商務與永續包裝需求的擴大

- 產業陷阱與挑戰

- 生產成本高且規模經濟有限

- 廢棄物管理和回收基礎設施面臨的挑戰

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 澱粉混合物

- 聚乳酸(PLA)

- 聚丁二酸丁二醇酯(PBS)

- 聚己二酸對苯二甲酸丁二醇酯(PBAT)

- 聚羥基脂肪酸酯(PHA)

- 其他

第6章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 硬質包裝

- 瓶子和罐子

- 托盤和容器

- 蛤殼

- 軟包裝

- 小袋和小袋

- 袋子和包裝

- 電影

- 其他

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 食物

- 新鮮食品

- 加工食品

- 乳製品

- 烘焙和糖果

- 飲料

- 水和軟性飲料

- 酒精飲料

- 果汁和乳製品飲料

- 食物

- 消費品

- 電子產品

- 家居用品

- 製藥

- 製藥

- 醫療器材

- 個人護理和化妝品

- 保養品

- 護髮

- 化妝品

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Accredo Packaging

- CJ Biomaterials Inc.

- Danimer Scientific

- Genpak

- Greendot Biopak

- Mondi Group

- NatureWorks, LLC

- Sphere Group

- Tetra Pak International SA

- United Biopolymers SA

- Vegware Global

The Global Biopolymer Packaging Market was valued at USD 11.1 billion in 2024 and is estimated to grow at a CAGR of 20.2% to reach USD 69.3 billion by 2034, driven by the surging demand for sustainable packaging solutions. As environmental consciousness intensifies across industries, companies are under growing pressure to minimize their ecological footprint, and biopolymer packaging is emerging as a go-to solution. Unlike conventional plastic packaging, biopolymers offer compostable and recyclable alternatives that align with global sustainability goals. With consumers prioritizing eco-friendly choices and regulatory bodies tightening rules around plastic usage, businesses are moving fast to integrate greener packaging options.

Technological advancements are also playing a critical role by making biopolymer materials more cost-effective, versatile, and accessible. These developments are breaking long-standing barriers to adoption, enabling even price-sensitive industries to embrace sustainable packaging. As market players step up investments in R&D, they are focusing on enhancing material strength, barrier properties, and customization capabilities to compete directly with traditional packaging solutions. Biopolymer packaging is no longer just a niche market-it is fast becoming a mainstream requirement, reshaping packaging strategies across sectors like food and beverages, healthcare, personal care, and beyond.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.1 Billion |

| Forecast Value | $69.3 Billion |

| CAGR | 20.2% |

Biopolymer packaging is gaining traction as companies increasingly tie sustainability to brand identity and consumer preference. Many manufacturers are actively shifting toward biopolymer solutions, reflecting their broader commitment to environmental responsibility. As the technology behind these materials matures, production processes are becoming more streamlined, reducing costs and making biopolymers an even more viable alternative to conventional plastics.

The market is also witnessing a shift in sourcing strategies. Larger brands are now willing to pay a premium for sustainable packaging, while smaller businesses are tapping into locally sourced raw materials despite facing a narrower selection. Partnerships between manufacturers and biopolymer material suppliers are emerging as a critical growth strategy, helping companies offer customized, eco-friendly packaging solutions. These collaborations are also fueling innovations that drive cost-efficiency and scalability, which in turn are boosting adoption rates across industries.

Flexible packaging formats such as pouches, films, and wraps are expected to dominate the biopolymer packaging space, projected to generate USD 44.2 billion by 2034. This growth is largely fueled by strong demand from industries like food and beverages, personal care, and pharmaceuticals. High-barrier biopolymer materials are increasingly being used to ensure product protection while minimizing environmental impact. Innovations in digital printing are enhancing packaging customization, reducing material waste, and further strengthening the market appeal of biopolymer packaging.

The polybutylene succinate (PBS) segment captured a 13.3% market share in 2024. PBS stands out for its exceptional biodegradability, thermal stability, and flexibility, making it a preferred material for applications like food packaging and agricultural films. Its ability to decompose in both industrial and home composting environments positions PBS as an ideal alternative to traditional plastics where sustainability is non-negotiable.

The Germany Biopolymer Packaging Market is projected to grow at a CAGR of 20.3% from 2025 to 2034. Germany's strong environmental policies and commitment to a circular economy are propelling demand for biodegradable alternatives. Incentives for businesses adopting eco-friendly packaging and ambitious EU-level targets for carbon footprint reduction are further driving the market shift from fossil-based plastics to renewable materials.

Key players in the global biopolymer packaging industry include Tetra Pak International SA, United Biopolymers SA, NatureWorks, LLC, Genpak, Greendot Biopak, Sphere Group, CJ Biomaterials Inc., Danimer Scientific, Vegware Global, Accredo Packaging, and Mondi Group. Leading companies are strengthening their market positions through strategic partnerships with biopolymer material providers, allowing them to deliver tailored and competitive solutions. With a strong focus on R&D investments, these players aim to enhance production efficiency, cost-effectiveness, and product performance to stay ahead in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-Side impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing sustainable packaging industry

- 3.3.1.2 Government regulations & bans on single-use plastics

- 3.3.1.3 Advancements in biopolymer technology

- 3.3.1.4 Circular economy & waste management policies

- 3.3.1.5 Expansion in e-commerce & sustainable packaging needs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High production costs & limited economies of scale

- 3.3.2.2 Challenges in waste management & recycling infrastructure

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Starch blends

- 5.3 Polylactic acid (PLA)

- 5.4 Polybutylene succinate (PBS)

- 5.5 Polybutylene adipate terephthalate (PBAT)

- 5.6 Polyhydroxyalkanoates (PHA)

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.2.1 Bottles & jars

- 6.2.2 Trays & containers

- 6.2.3 Clamshells

- 6.3 Flexible packaging

- 6.3.1 Pouches & sachets

- 6.3.2 Bags & wraps

- 6.3.3 Films

- 6.3.4 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Mn & Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverage

- 7.2.1 Food

- 7.2.1.1 Fresh food

- 7.2.1.2 Processed food

- 7.2.1.3 Dairy products

- 7.2.1.4 Bakery & confectionery

- 7.2.2 Beverage

- 7.2.2.1 Water & soft drinks

- 7.2.2.2 Alcoholic beverages

- 7.2.2.3 Juices & dairy drinks

- 7.2.1 Food

- 7.3 Consumer goods

- 7.3.1 Electronics

- 7.3.2 Household products

- 7.4 Pharmaceuticals

- 7.4.1 Pharmaceuticals

- 7.4.2 Medical devices

- 7.5 Personal care & cosmetics

- 7.5.1 Skincare

- 7.5.2 Haircare

- 7.5.3 Makeup

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accredo Packaging

- 9.2 CJ Biomaterials Inc.

- 9.3 Danimer Scientific

- 9.4 Genpak

- 9.5 Greendot Biopak

- 9.6 Mondi Group

- 9.7 NatureWorks, LLC

- 9.8 Sphere Group

- 9.9 Tetra Pak International SA

- 9.10 United Biopolymers SA

- 9.11 Vegware Global