|

市場調查報告書

商品編碼

1626883

亞太地區安全驅動和馬達:市場佔有率分析、行業趨勢和成長預測(2025-2030)Asia Pacific Safety Drives and Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

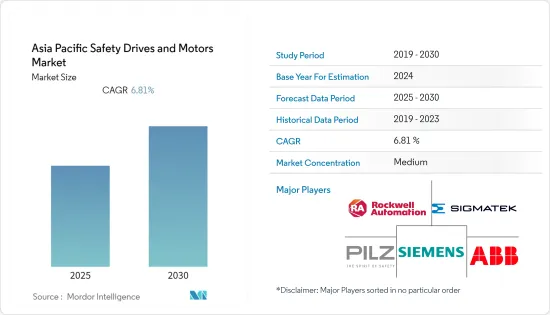

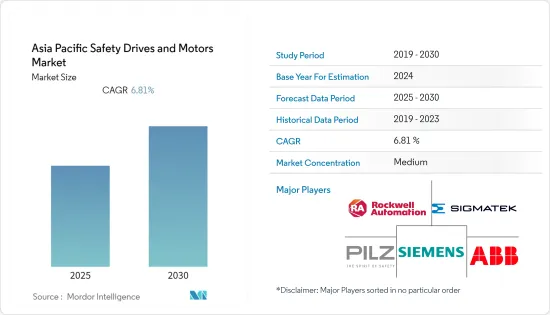

亞太安全驅動和馬達市場預計在預測期內複合年成長率為 6.81%

主要亮點

- 驅動器和馬達是所有工業領域機器的關鍵部件。主要工業部門存在多個危險區域,這使得對安全驅動器和馬達的需求變得極為重要。 IEC和EN標準用於馬達認證,並符合ATEX指令和其他國際標準。

- 安全驅動器有助於減少機器運作並提高生產率,同時保護人員和設備免受損壞。因此,這些安全設備具有可實現系統速度和扭力控制、最佳製程控制和顯著節能的功能。

- 工業機械和工廠變得更加靈活和高效,從而促進了安全整合設備的發展。這些整合的安全功能可以經濟高效地引入新的安全概念。此外,汽車銷量的增加和經濟的穩定,特別是在中國和日本,正在推動該地區安全驅動器和馬達的銷售和需求。例如,根據國際汽車製造商組織(OICA)的數據,2020年亞太地區乘用車銷售量為3,200萬輛,其中中國佔2,017萬輛,日本佔380萬輛。

- 此外,隨著該地區頁岩氣/天然氣行業的發展以及國內消費增加導致製造業前景改善,預計對安全驅動器和馬達的需求將會增加。例如,根據美國能源資訊署(EIA)的數據,2015年中國頁岩氣產量為每天5億立方英尺,預計到2040年將達到每天220億立方英尺。

- 另一方面,該標準的複雜性給市場帶來了挑戰,因為它同時適用於安全驅動器和馬達。安全馬達的缺點包括應用有限以及在不同區域缺乏靈活性。

亞太安全驅動馬達市場趨勢

工業和製造業對安全設備的需求不斷成長正在推動市場成長

- 採用 IEC 標準提高安全性以及對無火花馬達進行風險評估的需要是提高危險區域中使用的電子機械安全水平的最新趨勢之一。

- 如果風險等級超過可接受的限度,這些要求將幫助製造商透過檢查證明其設計或為其產品配備獨特的配件。低電壓 (LV) 電機控制中心 (MCC) 也廣泛應用於工業配電系統。由於 MCC 與操作員和維護人員的密切互動,它們常常引起操作員和維護人員的注意。

- 此外,人們認知到電弧是一種明顯的電氣危險,這對保護工人免受燒傷和爆炸風險的電路保護裝置產生了新的期望。

- 此外,過去幾年,製造業對安全驅動器和馬達的需求不斷增加。自2020年9月以來,隨著國內疫情趨穩、多國放鬆封鎖措施,亞太多個經濟體製造業強勁復甦。

- 例如,根據中國國家統計局的數據,2021年10月中國製造業生產量較去年同月增加2.50%。

石油和天然氣產業預計將佔據最大的市場佔有率

- 安全驅動器和馬達在石油和天然氣生產和分配、油泵系統以及天然氣基礎設施的壓縮傳動系統中發揮重要作用。

- 此外,VFD(變頻驅動器)經常用於石油和天然氣行業,透過調節速度來控制流量,避免在節流閥中浪費能量。更新、更先進的驅動器包括內建網路和診斷功能,以提高效能。智慧馬達控制和降低尖峰電流是推動石油和天然氣產業採用 VFD 的因素。

- 大多數 VSD 應用程式控制通過管道的流量或大型製程單元的輸入。此外,還可以保護馬達免受啟動期間湧入電流,並降低控制閥維護成本,從而減少停機時間。

- 國際能源總署(IEA)表示,由於能源需求的預期成長,亞洲,特別是東南亞地區,將成為未來二十年全球能源趨勢的主要推動者和推動者。

- 此外,根據《2019年國際能源展望》報告,2018年至2050年間,亞洲煉油廠數量將增加60%。 IEA預測,到2040年,該地區的石油需求將從目前的每天650萬桶增加到每天900萬桶。

亞太安全驅動馬達產業概況

亞太地區安全驅動馬達市場競爭適中,主要參與者包括 ABB Ltd.、西門子、羅克韋爾自動化有限公司等。從市場佔有率來看,目前該市場由少數大公司主導。這些擁有大量市場佔有率的大公司正致力於擴大海外基本客群。這些公司利用策略合作計劃來增加市場佔有率和盈利。競爭、快速的技術進步和消費者偏好的頻繁變化預計將對預測期內每家公司的市場成長構成威脅。

- 2021 年 10 月 - 羅克韋爾自動化有限公司推出 PowerFlex 6,000T 變頻器,以緊湊的設計提供高效的性能。此驅動器的佔地面積為 2,310 至 3,010 毫米(7.58 至 9.87 英尺),可承受高達 13.8 kV 的初級電壓。由於其緊湊的設計,該驅動器非常適合新建和改造工業應用,特別是在空間寶貴的 IEC 市場。該驅動器允許直接從主配電線路連接高電壓電源,無需降壓變壓器或變電站設備,從而降低了成本。

- 2021 年 8 月 - 西門子宣布推出 SINAMICS G120XE 封閉式驅動系統。 G120XE 專為廣泛市場中的工業泵浦、風扇和壓縮機應用而設計。這種新型密封系統基於流行的 SINAMICS G120X 基礎設施驅動器,專為快速設計和使用而設計,是石油和天然氣/石化、用水和污水、發電廠、工業氣候控制、製冷和冷卻器等惡劣環境的理想試運行。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 嚴格的工業安全標準

- 安全設備的需求

- 性價比高

- 市場限制因素

- 標準複雜度

第6章 市場細分

- 按類型

- 駕駛

- 交流變頻器

- 直流驅動

- 馬達

- AC馬達

- DC馬達

- 駕駛

- 按最終用戶產業

- 能源/電力

- 礦業

- 石油和天然氣

- 製造業

- 石油/化工

- 其他

- 按國家/地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他

第7章 競爭格局

- 公司簡介

- Rockwell Automation, Inc.

- ABB Limited

- Pilz GmbH & Co. KG

- SIGMATEK GmbH & Co KG

- Siemens

- Beckhoff Automation GmbH & Co. KG.

- B&R Industrial Automation GmbH

- Kollmorgen

- Hoerbiger India Precision Technology Private Ltd.

第8章投資分析

第9章 市場的未來

The Asia Pacific Safety Drives and Motors Market is expected to register a CAGR of 6.81% during the forecast period.

Key Highlights

- Drives and motors are critical components of any industrial sector's machinery. Since several hazardous zones exist in the core industrial sectors, the need for safety drives and motors has become pivotal. The IEC and EN standards are used to certify motors and meet ATEX directives and other international standards.

- The safety drives help to reduce machine time and increase productivity while protecting both personnel and equipment from damage. As a result, these safety devices have features that allow for system speed and torque control, optimal process control, and significant energy savings.

- Industry machines and plants are becoming more flexible and productive, which has resulted in the development of safety-integrated devices. These integrated safety functions allow for the cost-effective implementation of new safety concepts. Moreover, the increasing vehicle sales rate, especially in the Chinese and Japanese regions, and stabilizing economy boost the region's sales and demand for safety drives and motors. For instance, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2020, the number of passenger cars sold in the Asia Pacific region was 32 million, of which 20.17 million was from China, and 3.80 million was from Japan.

- Additionally, the region's growing shale/natural gas industry and improving manufacturing outlook due to rising domestic consumption are expected to boost demand for safety drives and motors. For instance, according to Energy Information Administration (EIA), the shale gas production in China in 2015 was 0.5 billion cubic feet per day and is estimated to reach 22 billion cubic feet per day by 2040.

- On the other hand, the complexity of standards poses a challenge to the market because it applies to both safety drives and motors. One disadvantage of safety motors is that they have limited applications or a lack of flexibility in different zones.

APAC Safety Drives Motors Market Trends

The Increasing Need of Safe Equipment in Industrial and Manufacturing Sector is Driving the Market Growth

- The adoption of risk assessment necessities for increased safety and non-sparking motors by IEC standards is one of the recent developments to improve the safety level of electrical machines used in hazardous areas.

- If the risk levels surpass the acceptable limits, these requirements assist manufacturers in proving their designs through testing or equipping their products with unique accessories. Low-voltage (LV) motor control centers (MCCs) are also widely used in industrial power distribution systems. MCC is frequently a source of concern for operators and maintenance personnel due to their close interactions with the MCC.

- Also, the recognition of arc flash as a distinct electrical hazard has resulted in a new expectation for circuit protection devices, which protect personnel from the dangers of thermal burns and explosive detonation.

- Further, the demand for safety drives and motors in the manufacturing sector increased in the last couple of years. Since September 2020, the manufacturing sector in many Asia Pacific economies has shown a significant rebound, as lockdown measures in many countries have been eased as domestic pandemics have been stabilized.

- For Instance, according to the National Bureau of Statistics of China, the manufacturing production in China increased by 2.50 percent in October of 2021 over the same month in the previous year.

Oil and Gas Sector is Expected to Hold the Maximum Market Share

- Safety drives and motors play an essential role in producing and distributing oil and gas and pumping systems for oil and compression drive trains for gas infrastructure.

- Further, VFDs (Variable Frequency Drives) are frequently used in the oil & gas industry to control the flow by adjusting speed to avoid energy wastage in the throttling valves. Advanced and modern drives incorporate networking and diagnostic capabilities into improved performance. Intelligent motor control and reduced peak-current drawn are factors that boost the adoption of VFDs in the oil and gas industries.

- The majority of VSD applications control flow through pipelines and input flow to large process units. Besides that, the motor is protected against starting inrush currents and control valve maintenance costs, reducing downtime.

- Due to the expected increase in energy demand, Asia, particularly the Southeast region, will become a key driver and proxy for global energy trends over the next two decades, according to the International Energy Agency (IEA).

- Further, according to the International Energy Outlook 2019 report, the number of refineries in Asia will increase by 60% between 2018 and 2050. The IEA predicts that regional oil demand will increase to 9 million barrels per day by 2040, up from 6.5 million barrels per day today.

APAC Safety Drives Motors Industry Overview

The Asia Pacific Safety Drives and Motors Market is moderately competitive, with a number of major players such as ABB Ltd., Siemens, Rockwell Automation, Ltd., and others. In terms of market share, the market is currently dominated by a few major players. With a significant market share, these major players are focusing on expanding their customer base in foreign countries. These companies are utilizing strategic collaborative initiatives to increase their market share and profitability. The competition, rapid technological advancements, and frequent changes in consumer preferences are expected to pose a threat to the market's growth of the companies during the forecast period.

- October 2021 - Rockwell Automation Ltd. launched the PowerFlex 6000T drive that delivers efficient performance in a compact design. The drive can accept up to 13.8 kV primary voltage in a best-in-class footprint of 2,310 to 3,010 mm (7.58 to 9.87 feet). Because of its compact design, the drive is ideal for new and retrofit industrial applications in IEC markets, particularly those where space is limited. The drive can save money by allowing high-voltage feeds from the main distribution line to be connected directly without a step-down transformer or substation equipment.

- August 2021 - Siemens announced the availability of the SINAMICS G120XE enclosed drive system. It is specifically designed to meet the demands of industrial pump, fan, and compressor applications in a wide range of markets. This new enclosed system, based on the popular SINAMICS G120X infrastructure drive, is ideal for quick design and commissioning in industries such as oil-and-gas/petrochemical, water/wastewater, power plants, industrial climate control, refrigeration, and chillers in harsh environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Industry Safety Standards

- 5.1.2 Demand for Safe Equipment

- 5.1.3 High Degree of Cost-Effectiveness

- 5.2 Market Restraints

- 5.2.1 Complexity of Standards

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Drives

- 6.1.1.1 AC Drives

- 6.1.1.2 DC Drives

- 6.1.2 Motors

- 6.1.2.1 AC Motors

- 6.1.2.2 DC Motors

- 6.1.1 Drives

- 6.2 By End-User Industry

- 6.2.1 Energy & Power

- 6.2.2 Mining

- 6.2.3 Oil and gas

- 6.2.4 Manufacturing

- 6.2.5 Petrolium and Chemical

- 6.2.6 Other End-User Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 Australia

- 6.3.5 South Korea

- 6.3.6 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation, Inc.

- 7.1.2 ABB Limited

- 7.1.3 Pilz GmbH & Co. KG

- 7.1.4 SIGMATEK GmbH & Co KG

- 7.1.5 Siemens

- 7.1.6 Beckhoff Automation GmbH & Co. KG.

- 7.1.7 B&R Industrial Automation GmbH

- 7.1.8 Kollmorgen

- 7.1.9 Hoerbiger India Precision Technology Private Ltd.