|

市場調查報告書

商品編碼

1626344

北美安全驅動器和馬達:市場佔有率分析、行業趨勢、統計和成長預測(2025-2030)NA Safety Drives and Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

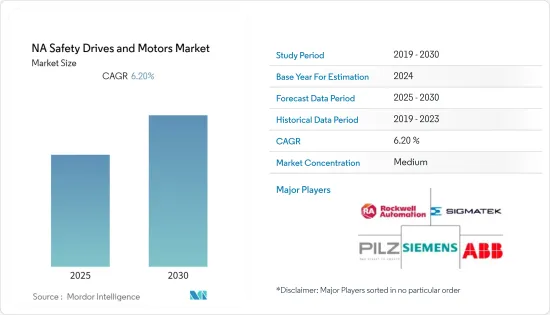

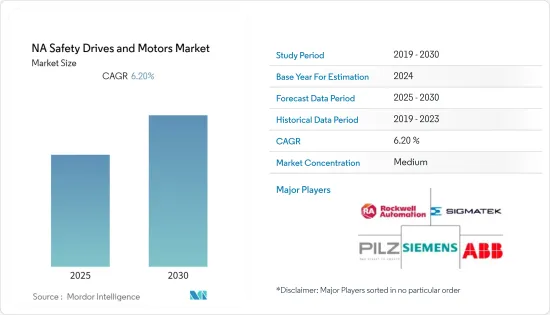

北美安全驅動和馬達市場預計在預測期內年複合成長率為 6.2%

主要亮點

- 驅動器和馬達是所有工業領域機器的重要組成部分。主要工業部門存在多個危險區域,因此對安全驅動器和馬達的需求極為重要。 IEC和EN標準用於馬達認證,並符合ATEX指令和其他國際標準。

- 安全驅動器有助於減少機器運作並提高生產率,同時保護人員和設備免受損壞。因此,這些安全設備具有能夠控制系統速度和扭力、最佳化製程控制以及顯著節能的功能。

- 工業機械和工廠變得更加靈活和高效,從而促進了安全整合設備的發展。這些整合的安全功能可以經濟高效地引入新的安全概念。此外,汽車銷售的增加和經濟的穩定,特別是在美國,正在推動該地區安全駕駛和馬達的銷售和需求。美國是僅次於中國的第二大乘用車市場。根據美國運輸部的數據,美國有 2.869 億輛汽車。

- COVID-19 的爆發對安全驅動器和馬達市場產生了前所未有的影響,一些部署驅動器的最終用戶產業面臨一些困難。該行業受到全國範圍內停工的打擊,陷入停滯。然而,在後COVID-19時代,隨著辦公室和工業重新開放,預計該行業對節能設備的需求以及對驅動器和馬達的輔助需求將會增加。

北美安全驅動和馬達市場趨勢

石油和天然氣產業預計將佔據最大的市場佔有率

- 安全驅動器和馬達在石油和天然氣生產和分配、抽油系統以及天然氣基礎設施的壓縮傳動系統中發揮關鍵作用。

- 隨著油氣上中游投資的不斷增加,交直流安全驅動和馬達的需求預計將大幅成長。上游油氣公司逐漸投資石油生產活動,導致傳統設備的更換率更高。反過來,預計將增強北美地區石油和天然氣生產市場的整體成長。

- 美國能源資訊署先前預測,2020年第二季美國液體燃料消費量平均為1,570萬桶/日,比去年同期下降23%。這一下降的結果反映了與 COVID-19 大流行緩解工作相關的旅行限制和經濟活動減少。美國能源情報署預測,美國石油消費已經經歷了最大幅度的下降之一,未來 18 個月需求將普遍增加。

預計美國將主導市場

- 美國對安全驅動器和馬達的需求受到工業革命的推動,包括該地區努力成為汽車、航太、國防以及石油和天然氣產品的重要出口國。

- 該地區的國內產業參與者也遵守能源效率標準。隨著美國開始受益於第四次工業革命,當地製造商正在利用大量資料來維持工業層面的能源消耗。這些因素都是工業馬達的驅動力。

- 對安全設備、產業安全標準以及對具有成本效益的系統的需求也促進了該地區全球安全驅動和馬達市場的成長。

- 汽車銷售的成長和經濟的穩定將增加該地區安全驅動器和馬達的銷售和需求。此外,在頁岩氣產業成長和製造業前景改善的推動下,國內消費的成長預計將推動該地區對安全驅動器和馬達的需求。

- 頁岩氣作為石油的替代品,為改變地區經濟和全球政治格局以及重新設計國內和國際能源政策提供了新的能力,以實現北美尤其是美國的創新和自給自足的發展。

- 此外,能源部 (DOE) 還提供研發資金(約 2500 萬美元)來開發節能馬達。新一代節能、高功率密度、高速、整合式中壓驅動系統預計將開發用於各種應用。

北美安全驅動和馬達產業概況

該市場集中在石油和天然氣、石化和化學、能源和公共事業行業的幾大需求參與者,佔據最大的市場佔有率。

- 2021 年 8 月 - 西門子宣布推出 SINAMICS G120XE 封閉式驅動系統。 G120XE 專為廣泛市場中的工業泵浦、風扇和壓縮機應用而設計。這種基於 SINAMICS G120X 基礎設施驅動器的新型密封系統對於石油和天然氣和石化、用水和污水和廢水、發電廠和工業空調、冷凍和冷卻器等惡劣環境中的快速設計和試運行來說是完美的。

- 2020 年 12 月 - Beckhoff 自動化推出了 ELM72xx EtherCAT伺服驅動器,以 I/O 端子模組的形式擴展了其緊湊型驅動技術產品組合,該驅動器採用 48V DC 電源可提供高達 16A 的輸出電流 (Irms)。與同類 EL 系列 I/O 設計相比,ELM72xx 提供當前技術特性,並具有更高的性能和功能。 ELM72xx 的金屬外殼即使在高功率下也能提供最佳的散熱效果,並提供最佳的電氣干擾屏蔽。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 研究範圍和調查方法

- 執行摘要

第2章 市場概況

- 介紹

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 產業政策

第3章市場動態

- 介紹

- 市場促進因素

- 業界安全標準

- 安全設備的需求

- 靈活的功能

- 性價比高

- 市場限制因素

- 標準複雜度

第 4 章 技術概覽

第5章市場區隔

- 按類型

- 駕駛

- 交流變頻器

- 直流驅動

- 馬達

- AC馬達

- DC馬達

- 駕駛

- 按最終用戶產業

- 能源和電力

- 礦業

- 石油和天然氣

- 製造業

- 石油/化工

- 其他最終用戶產業

- 按國家/地區

- 美國

- 加拿大

第6章 供應商市場佔有率

第7章 競爭格局

- 公司簡介

- Rockwell Automation

- SIGMATEK Safety Systems

- ABB Limited

- Beckhoff

- Siemens

- B&R

- KOLLMORGEN

- KEBA

- Hoerbiger

- Pilz

- WEG

- CG North America

第8章投資分析

- 投資場景及機會

第9章 市場的未來

簡介目錄

Product Code: 47980

The NA Safety Drives and Motors Market is expected to register a CAGR of 6.2% during the forecast period.

Key Highlights

- Drives and motors are critical components of any industrial sector's machinery. Since several hazardous zones exist in the core industrial sectors, the need for safety drives and motors has become pivotal. The IEC and EN standards are used to certify motors and meet ATEX directives and other international standards.

- The safety drives help to reduce machine time and increase productivity while protecting both personnel and equipment from damage. As a result, these safety devices have features that allow for system speed and torque control, optimal process control, and significant energy savings.

- Industry machines and plants are becoming more flexible and productive, which has resulted in the development of safety-integrated devices. These integrated safety functions allow for the cost-effective implementation of new safety concepts. Moreover, the increasing vehicle sales rate, especially in the United States, and stabilizing economy boost the region's sales and demand for safety drives and motors. The US is the second biggest passenger car market, after China. As per the US Dept. of Transportation and Federal Highway Administration, there were 286.9 million cars in the US.

- The COVID-19 outbreak had an unprecedented impact on the safety drives and motors market, with several end-user industries that deploy drives facing several difficulties. The industries were riddled with nationwide lockdowns, which brought them to a standstill. However, with the reopening of the offices and industries in the post-COVID-19 era, the industry is expected to witness an increasing need for energy-efficient devices creating an ancillary demand for drives and motors.

North America Safety Drives & Motors Market Trends

Oil and Gas Sector is Expected to Hold the Maximum Market Share

- Safety drives and motors play an essential role in producing and distributing oil and gas and pumping systems for oil and compression drive trains for gas infrastructure.

- With the increasing investment in oil and gas upstream and midstream sectors, the demand for AC/DC safety drives and motors is expected to witness significantly high growth. The oil and gas upstream companies are gradually investing in oil production activities, which, in turn, will boost the replacement rate of traditional appliances. In turn, this is expected to increase the growth across the oil and gas production market in the North American region

- U.S. Energy Information Administration has previously forecasted that the United States liquid fuels consumption will average 15.7 million barrels per day in the Q2 of 2020, down by 23% from the same period in the previous year. The declining result reflects travel restrictions and reduced economic activity related to the COVID-19 pandemic mitigation efforts. U.S. Energy Information Administration expects one of the most significant declines in the United States oil consumption that has already happened, and demand will generally rise in the next 18 months.

United States Expected to Dominate the Market

- Demand for safe drives and motors in the United States is driven by the industrial revolution across automobiles, aerospace, defense, and regional efforts to emerge as significant exporters of oil and gas products.

- Domestic industrial players in the region also follow energy efficiency standards. When the United States began to profit from the Fourth Industrial Revolution, local manufacturers were using large amounts of data to maintain energy consumption at the industrial level. These factors are the driving factors for industrial motors.

- The demand for safety equipment, industry safety standards, and the need for cost-effective systems also contribute to the growth of the region's global safe drive and motor market.

- Rising vehicle sales and economic stability will increase the region's sales and demand for safe drives and motors. In addition, rising domestic consumption is expected to drive demand for safe drives and motors in the region, driven by growth in the shale gas industry and an improved manufacturing outlook.

- Shale gas as an alternative to oil has the new ability to modify regional economic and global political scenarios and redesign domestic and foreign energy policies for innovative and self-sufficient development in North America, especially the United States.

- Moreover, the Department of Energy (DOE) is funding R&D (about USD 25 million) to develop energy-efficient electric motors. It expects to develop a new generation of energy-efficient, high power density, high speed, integrated medium voltage drive systems for diverse applications.

North America Safety Drives & Motors Industry Overview

The market is concentrated with some major players occupying maximum market share, which are in demand by Oil and Gas, Petrochemicals and Chemicals, and Energy utility industries.

- August 2021 - Siemens announced the availability of the SINAMICS G120XE enclosed drive system. It is specifically designed to meet the demands of industrial pump, fan, and compressor applications in a wide range of markets. Based on the SINAMICS G120X infrastructure drive, this new enclosed system is ideal for quick design and commissioning in oil-and-gas/petrochemical, water/wastewater, power plants, and industrial climate control, refrigeration, and chillers in harsh environments.

- December 2020 - Beckhoff Automation launched ELM72xx EtherCAT servo drives that deliver an output current (Irms) of up to 16 A at 48 V DC for the power supply, which expands its portfolio of compact drive technology in I/O terminal format. They offer the current technology features with increased performance and functionality compared with comparable EL series I/O designs. The ELM72xx metal housings render optimum heat dissipation even at high output power and optimal shielding against electrical interference.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study and Research Methodology

- 1.3 Executive Summary

2 MARKET OVERVIEW

- 2.1 Introduction

- 2.2 Industry Value-Chain Analysis

- 2.3 Industry Attractiveness - Porter's Five Forces Analysis

- 2.4 Industry Policies

3 MARKET DYNAMICS

- 3.1 Introduction

- 3.2 Market Drivers

- 3.2.1 Industry Safety Standards

- 3.2.2 Demand for Safe Equipment

- 3.2.3 Flexible Functionality

- 3.2.4 High Degree of Cost-Effectiveness

- 3.3 Market Restraints

- 3.3.1 Complexity of Standards

4 TECHNOLOGY SNAPSHOT

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Drives

- 5.1.1.1 AC Drives

- 5.1.1.2 DC Drives

- 5.1.2 Motors

- 5.1.2.1 AC Motors

- 5.1.2.2 DC Motors

- 5.1.1 Drives

- 5.2 By End-User Industry

- 5.2.1 Energy and Power

- 5.2.2 Mining

- 5.2.3 Oil and gas

- 5.2.4 Manufacturing

- 5.2.5 Petrolium and Chemical

- 5.2.6 Other End-User Industries

- 5.3 By Country

- 5.3.1 United Sates

- 5.3.2 Canada

6 VENDOR MARKET SHARE

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation

- 7.1.2 SIGMATEK Safety Systems

- 7.1.3 ABB Limited

- 7.1.4 Beckhoff

- 7.1.5 Siemens

- 7.1.6 B&R

- 7.1.7 KOLLMORGEN

- 7.1.8 KEBA

- 7.1.9 Hoerbiger

- 7.1.10 Pilz

- 7.1.11 WEG

- 7.1.12 CG North America

8 INVESTMENT ANALYSIS

- 8.1 Investment Scenario and Opportunities

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219