|

市場調查報告書

商品編碼

1626294

保護性包裝:市場佔有率分析、產業趨勢、統計和成長預測(2025-2030)Protective Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

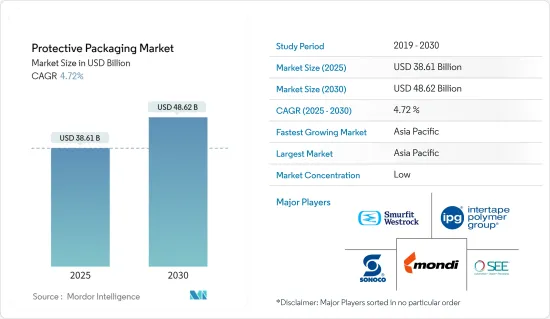

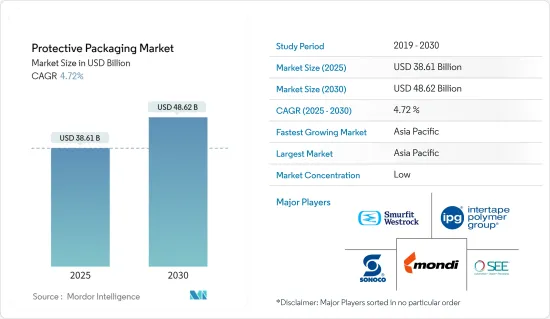

預計2025年保護性包裝市場規模為386.1億美元,預計2030年將達486.2億美元,預測期內(2025-2030年)年複合成長率為4.72%。

主要亮點

- 物流和物料輸送技術的不斷發展和創新正在顯著發展,新一代的包裝產品正在被採用。保護性包裝可確保產品在交付時保持與新產品相同的狀態。包裝不當會嚴重影響產品的形式和功能。

- 網路購物在消費者中的普及負責產品設計、包裝、挑選、履約和運輸。因此,產品保護被認為是最重要的問題之一。包裝材料的技術發展和電子商務的快速崛起正在主要改變大多數企業選擇保護性包裝的方式。關鍵點是性能、先進材料造成的成本問題、包裝要求、按需包裹遞送系統和永續性。

- 使用軟保護包裝代替硬包裝可顯著降低運輸成本和重量。據軟包裝協會(FPA)稱,透過製造方法和材料的創新,某些軟包裝的重量已減輕約50%。

- 軟包裝還可以節省空間,使得運輸大量貨物成為可能,同時減少燃料和能源消耗。消費者在決策流程中必須考慮運輸成本。與零售應用程式不同,電子商務減少了對單個單位而不是批量單位的運輸。

- 對保護性包裝不斷成長的需求正在吸引企業投資該市場。包裝產業併購很常見,成長空間不大。由於包裝行業高度依賴終端市場,企業必須尋找併購機會來發展業務並保持競爭力。

- 2023 年 10 月,MacFarlane 以 385 萬歐元收購了位於南安普敦的防護包裝企業 B&D Group。該公司表示,此次收購是其透過有機和收購成長建立保護性包裝業務策略的一部分。 B&D 為英國越來越多的航太、國防和太空產業客戶提供服務。 B&D 有大量機會為現有客戶提供進一步的包裝解決方案,並在 B&D 擅長的領域吸引新客戶。

- 然而,食品服務業禁止使用發泡聚苯乙烯(EPS)包裝預計將阻礙市場成長。根據新的州法律,紐約居民和企業禁止使用發泡聚苯乙烯 (EPS) 包裝。紐約州的禁令禁止銷售或分銷含有 EPS 泡沫的一次性食品服務容器。

防護包裝市場趨勢

軟保護包裝實現穩定成長

- 塑膠軟包裝是保護性包裝的理想選擇,因為它能可靠地吸收衝擊,提供出色的絕緣包裝,並保持清潔度,這在運輸食品和藥品時極為重要。塑膠也可以回收。此外,其重量輕可讓您在運輸過程中節省資源。也可用於製作空氣枕等超輕包裝材料。行業公司正在轉向使用可回收材料進行保護性包裝。

- 例如,據透露,亞馬遜計劃在 2023 年 11 月將多項全球創新技術引入印度,生產堅固、耐用且可回收的紙質包裝,同時繼續努力消除交付中的塑膠包裝。

- 近年來,亞馬遜一直在探索將產品交付改為紙本交付的方法。履約中心是美國第一個使用可回收紙包裝並不再使用塑膠的履行中心。這項轉變是透過改造現有的用紙設備、開發堅固且靈活的紙包裝、推進客製化技術以及用紙填充材取代塑膠氣墊來實現的。

- 此外,產業參與者正在使用可回收塑膠為眾多產業生產軟性保護包裝。聚丙烯和可回收材料等先進包裝材料的更多使用可以提供更高的污染和溫度屏障,保護包裝產品免受損壞。對可回收性的日益關注迫使製造商回收塑膠廢棄物。為此,Sealed Air 使用 30% 或 50% 的回收塑膠廢棄物開發了新型氣泡膜保護包裝。

- 此外,不斷擴大的電子商務市場將增強對軟性保護包裝解決方案的需求。電子商務公司越來越重視永續包裝材料,進一步推動了該市場的成長。美國商務部下屬的美國人口普查局的資料顯示,2024年第二季電子商務將占美國零售總額的16%,高於上一季的15.80%。

亞太地區預計將佔據主要市場佔有率

- 印度品牌股權基金會(IBEF)的資料顯示,消費性電子產業正在推動該地區的主要需求。 2022年,印度家電及消費性電子產業產值達90.9億美元。預計到2025年將超過211.8億美元。

- 耐用品通常會使用很多年,因此必須精心包裝,以確保它們以原始狀態到達消費者手中。這些產品在運輸過程中存在處理不當的風險,並且容易受到壓力和振動的影響。因此,儘管包裝面臨挑戰,但保護性包裝的使用至關重要。

- 印度製造業正在經歷重大變革時期。 「印度製造」等舉措加強了印度的本土製造業,並將該國定位為電子和消費性電子產品製造的重要中心。這些行業越來越依賴保護性包裝來保護運輸過程中的產品,並且對這些解決方案的需求正在迅速增加。這些動態正在推動該地區保護性包裝市場的成長。

- 市場的主要趨勢之一是增加研發投資,以開發環保和永續的包裝材料。供應商正在投資創新技術來開發可回收和再利用的包裝材料。

- 例如,2023年6月,陶氏化學與寶潔中國推出用於電商包裝的單PE空氣膠囊。與傳統紙板小包裹箱相比,這項創新減少了材料使用量並減輕了 40% 以上的重量。包裝採用來自陶氏的精英 AT PE 樹脂,以提高可回收性並取代傳統的多材料選擇。其設計注重可靠性和易用性,開口是砸道機的,以增加安全性。

防護包裝產業概況

保護性包裝市場的競爭格局較為分散,主要企業參與者包括 Intertape Polymer Group Inc.、Sonoco Products Company、Smurfit Westrock、Sealed Air Corporation 和 DS Smith PLC。這些供應商正在積極推出新產品、擴大業務、合併和收購公司以增加市場佔有率。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 對電子商務產品的需求不斷成長

- 軟保護包裝產品的需求

- 市場限制因素

- 關於可分解性的嚴格規定

第6章 市場細分

- 依產品類型

- 難的

- 紙板保護器

- 紙漿模塑

- 隔熱運輸貨櫃

- 其他硬質產品類型

- 柔軟的

- 保護郵件

- 氣泡膜

- 空氣枕/氣囊

- 紙填充

- 其他軟性產品類型(鋁箔袋/袋、拉伸膜、收縮膜等)

- 形式

- 發泡成型製品

- 就地表格 (FIP)

- 鬆散填充

- 發泡卷材/片材

- 其他泡沫類型(角塊等)

- 難的

- 按最終用戶產業

- 飲食

- 工業的

- 藥品

- 家電

- 美容/家庭護理

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Intertape Polymer Group Inc.

- Pregis Corporation

- Riverside Paper Co.

- Sealed Air Corporation

- Signode Industrial Group LLC

- Sonoco Products Company

- Smurfit Westrock

- Huhtamaki Group

- DS Smith PLC

- International Paper Company

- Pro-Pac Packaging Limited

- Storopack Hans Reichenecker GmbH

- Mondi Group

第8章投資分析

第9章 市場未來展望

The Protective Packaging Market size is estimated at USD 38.61 billion in 2025, and is expected to reach USD 48.62 billion by 2030, at a CAGR of 4.72% during the forecast period (2025-2030).

Key Highlights

- The ongoing development and innovation in logistics and material handling technology have significantly evolved, and new-generation packaging products have been adopted. Protective packaging ensures that a product remains as intact as new upon delivery. The lack of proper packaging can seriously affect a product's shape and function.

- The popularity of online shopping among consumers is responsible for product design, packaging, picking, fulfillment, and shipping. Therefore, product protection is regarded as one of the most critical issues. The technological developments in packaging material and the exponential rise of e-commerce are primarily altering how most businesses choose protective packaging. The primary points are performance, cost issues brought on by material advancements, packaging requirements, on-demand package delivery systems, and sustainability.

- Transport costs and weight are significantly lower when flexible protective packaging is used instead of rigid packaging. According to the Flexible Packaging Association (FPA), specific flexible packaging has seen a weight reduction of about 50% due to innovations in production methods and materials.

- Also, flexible packaging allows space-saving opportunities, which enables the shipping of large quantities of goods while using less fuel and energy. Consumers must take into account the cost of delivery during the decision-making process. Unlike retail applications, e-commerce scales down shipping into individual units rather than bulk units.

- The growing demand for protective packaging attracts players to invest in the market. M&A is common in the packaging industry, as there is little room for growth. The packaging industry is highly dependent on end markets, so players must look for M&A opportunities to grow their business and remain competitive.

- In October 2023, Macfarlane acquired a Southampton-based protective packaging business, B&D Group, for EUR 3.85 million. The company stated that the acquisition was part of its strategy to build its protective packaging business through organic and acquisition growth. B&D serves customers in the expanding aerospace, defense, and space industries across the United Kingdom and internationally. There are considerable opportunities to deliver further packaging solutions to existing customers and grow new customers in sectors where B&D excels.

- However, a ban on the use of expanded polystyrene foam (EPS) packaging for food service is expected to hinder market growth. New York State residents and businesses are prohibited from using expanded polystyrene foam (EPS) packaging under the new state law. New York's ban will prohibit anyone from selling or distributing disposable food service containers containing EPS foam.

Protective Packaging Market Trends

Flexible Protective Packaging to Execute a Steady Growth Rate

- Plastic-based flexible packaging material is excellent for protective packing because it reliably absorbs shocks, insulates well, and is incredibly clean, which is crucial when sending food and medications. Plastic can also be recycled. Additionally, it is lightweight, saving resources during transportation. It can also be used to create ultralightweight packaging materials such as air pillows. Industry players are focusing on recyclable materials for protective packaging.

- For instance, in November 2023, Amazon disclosed its intention to bring several global innovations into India for manufacturing strong, durable, recyclable paper packaging as Amazon continues its efforts to eliminate plastic packaging from its deliveries.

- In recent years, Amazon has sought ways to transition its product deliveries to paper. The fulfillment center in Euclid, Ohio, became the first in the United States to adopt curbside-recyclable paper packaging, moving away from plastic. This shift was achieved by retrofitting existing paper-use equipment, developing robust and flexible paper packaging, advancing made-to-fit technology, and replacing plastic air cushions with paper fillers.

- Additionally, players are using recyclable plastic to produce flexible protective packaging across numerous industries. Advanced packaging materials, such as polypropylene and increased use of recyclable material, can provide a high barrier against contamination and temperatures, protecting the packaged product from damage. The growing recyclability concerns are forcing manufacturers to recycle plastic waste. In line with this, Sealed Air has developed a range of new bubble wrap protective packaging that uses 30% or 50% recycled plastic waste.

- Also, the expanding e-commerce market is poised to bolster the demand for flexible protective packaging solutions. E-commerce companies increasingly prioritize sustainable packaging materials, further fueling this market's growth. Data from the US Census Bureau, part of the US Department of Commerce, reveals that in the second quarter of 2024, e-commerce accounted for 16% of total retail sales in the United States, marking an increase from the prior quarter's 15.80%.

Asia-Pacific is Expected to Occupy Significant Market Share

- The consumer electronics segment is driving significant demand in the region as per data from the India Brand Equity Foundation (IBEF). The Indian appliances and consumer electronics industry was valued at USD 9.09 billion in 2022. Projections indicate a robust growth trajectory, expected to exceed USD 21.18 billion by 2025.

- Consumer durables, typically used for years, require meticulous packaging to ensure they reach consumers in pristine condition. These items are at risk of improper handling during transport and are vulnerable to stress and vibration. Consequently, while packaging poses challenges, the use of protective packaging becomes paramount.

- India's manufacturing industry is undergoing a significant transformation. Initiatives like 'Make in India' bolstered indigenous production, positioning India as a key hub for electronics and home appliance manufacturing. As these industries increasingly rely on protective packaging to safeguard their products during transit, the demand for such solutions is surging. Collectively, these dynamics are fueling the growth of the protective packaging market in the region.

- One significant trend in the market is the increased investment in research and development to develop environmentally friendly and sustainable packaging materials. Vendors are investing in innovative technologies to develop packaging materials that can be recycled and reused.

- For instance, in June 2023, Dow and Procter & Gamble China introduced a mono-PE air capsule for e-commerce packaging. This innovation reduces material usage and achieves a weight reduction exceeding 40% compared to conventional corrugated parcel boxes. The packaging utilizes ELITE AT PE resins sourced from Dow, enhancing recyclability and replacing traditional multi-material options. Emphasizing reliability and user-friendliness, the design features a tamper-free opening to enhance security.

Protective Packaging Industry Overview

The protective packaging market features a fragmented competitive landscape with a diverse array of vendors such as Intertape Polymer Group Inc., Sonoco Products Company, Smurfit Westrock, Sealed Air Corporation, and DS Smith PLC are key players. These vendors actively pursue new product launches, expansions, mergers, and acquisitions to bolster their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for E-commerce-based Products

- 5.1.2 Demand for Flexible Protective Packaging Products

- 5.2 Market Restraints

- 5.2.1 Stringent Regulations Related to Degradability

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Rigid

- 6.1.1.1 Corrugated Paperboard Protectors

- 6.1.1.2 Molded Pulp

- 6.1.1.3 Insulated Shipping Containers

- 6.1.1.4 Other Rigid Product Types

- 6.1.2 Flexible

- 6.1.2.1 Protective Mailers

- 6.1.2.2 Bubble Wraps

- 6.1.2.3 Air Pillows/Air Bags

- 6.1.2.4 Paper Fill

- 6.1.2.5 Other Flexible Product Types (Foil Pouches/Bags, Stretch and Shrink Films, etc.)

- 6.1.3 Foam

- 6.1.3.1 Molded Foam

- 6.1.3.2 Foam in Place (FIP)

- 6.1.3.3 Loose Fill

- 6.1.3.4 Foam Rolls/Sheets

- 6.1.3.5 Other Foam Types (Corner Blocks, etc.)

- 6.1.1 Rigid

- 6.2 By End-user Industry

- 6.2.1 Food and Beverage

- 6.2.2 Industrial

- 6.2.3 Pharmaceuticals

- 6.2.4 Consumer Electronics

- 6.2.5 Beauty and Home Care

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Mexico

- 6.3.6 Middle East and Africa

- 6.3.6.1 Saudi Arabia

- 6.3.6.2 United Arab Emirates

- 6.3.6.3 Egypt

- 6.3.6.4 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intertape Polymer Group Inc.

- 7.1.2 Pregis Corporation

- 7.1.3 Riverside Paper Co.

- 7.1.4 Sealed Air Corporation

- 7.1.5 Signode Industrial Group LLC

- 7.1.6 Sonoco Products Company

- 7.1.7 Smurfit Westrock

- 7.1.8 Huhtamaki Group

- 7.1.9 DS Smith PLC

- 7.1.10 International Paper Company

- 7.1.11 Pro-Pac Packaging Limited

- 7.1.12 Storopack Hans Reichenecker GmbH

- 7.1.13 Mondi Group